Regulatory regulation

Depending on the terms of the agreement (clauses 1-2 of article 624 of the Civil Code of the Russian Federation, clause 1 of article 19, clause 1 of article 28 of the Federal Law of October 29, 1998 N 164-FZ):

- the leased property becomes the property of the tenant upon expiration of the lease term or before its expiration, subject to the tenant paying the entire redemption price stipulated by the agreement (if this is expressly stated in the agreement);

- The parties have the right to enter into an additional agreement, establishing in it the conditions for early redemption.

The redemption price of the leased asset is determined by agreement of the parties (Article 421 of the Civil Code of the Russian Federation, clause 1 of Article 424 of the Civil Code of the Russian Federation, clause 1 of Article 485 of the Civil Code of the Russian Federation).

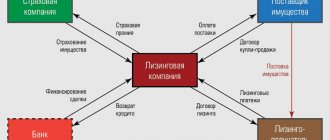

Let's define the concepts

A special type of lease, in which a special agreement is concluded, under the terms of which the first party undertakes to purchase an asset that meets specific characteristics, and then transfer this property asset for use to the lessee company, that is, the second party, is called leasing.

Under the terms of this agreement, the key aspects of the relationship between the parties must be determined, including the possibility of purchasing the asset into the ownership of the recipient company. In addition to the procedure for transferring ownership of a property asset, the agreement should determine the redemption price of the lease (the entries are given below), as well as methods for its early purchase - redemption.

Currently, two methods are used to purchase leased property assets:

- A lump sum, in the amount of the full value of the asset, upon expiration of the leasing agreement. Moreover, the recipient company has the right to pay the cost of the leased property ahead of schedule, without waiting for the completion of the contract.

- Periodic advances. That is, the cost of the object will be distributed in proportion to the period of validity of the rental agreement. In other words, the lessee company, as part of the periodic payments under the current agreement, will also pay part of the initial price of the leased property.

Depending on the method of payment for the redemption value of the leased asset, the transactions and the procedure for their preparation vary. For more information on how to reflect transactions under similar agreements, read the article “An example of a leasing entry on the lessee’s balance sheet.”

Step-by-step instruction

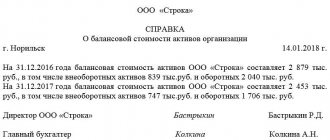

The organization is a lessee under a lease agreement for a BMW 520d car. The leased object is recorded on its balance sheet:

- total cost under the contract (initial cost in the used book) - RUB 3,513,600. (including VAT 20%);

- cost according to the acceptance certificate (cost of the lessor's expenses) - 2,040,000 rubles;

- The useful life of used and used units is 60 months.

On April 20 (12 months later) the Organization entered into an additional agreement with the lessor on early repurchase:

- the contract amount was reduced by 600,000 rubles. (including VAT 20%);

- the redemption price was RUB 2,210,880. (including VAT 20%).

On April 20, the Organization transferred the final payment under the leasing agreement in the amount of the redemption value of RUB 2,210,880. (including VAT 20%).

On April 21, the lessor provided documents for redemption.

The lease payment for April was not paid before the buyout.

Let's look at step-by-step instructions for creating an example. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Adjustment of settlements with the lessor | |||||||

| 20 April | 76.07.1 | 76.07.9 | 100 000 | Reducing calculations for input VAT by the difference under the agreement | Debt Adjustment - Other Adjustments | ||

| 76.07.1 | 91.01 | 500 000 | Write off the difference in the value of the contract in accounting | Debt Adjustment - Other Adjustments | |||

| Transfer of advance payment to the lessor | |||||||

| 20 April | 60.02 | 51 | 2 210 880 | 2 210 880 | Transfer of payment to the supplier | Debiting from the current account - Payment to the supplier | |

| Adjustment of the value of leased property in NU | |||||||

| 20 April | 000 | 01.K | 500 000 | Reducing the difference in cost in NU and BU by the amount of reduction in liabilities | Manual entry - Operation | ||

| Redemption of leased property, acceptance of own fixed assets for accounting | |||||||

| April 21 | 60.01 | 60.02 | 2 210 880 | 2 210 880 | 2 210 880 | Advance offset | Redemption of leased items |

| 76.07.1 | 60.01 | 1 842 400 | 1 842 400 | Redemption of leased property | |||

| 19.01 | 60.01 | 368 480 | 368 480 | Acceptance for VAT accounting | |||

| 76.07.1 | 76.07.9 | 368 480 | Reducing calculations for vehicle input VAT | ||||

| 26 | 02.03 | 48 000 | Calculation of the latest depreciation | ||||

| 01.01 | 01.03 | 2 928 000 | 2 040 000 | 2 040 000 | Moving the OS to your own | ||

| 02.03 | 02.01 | 585 600 | Transfer of depreciation | ||||

| 02.03 | 01.01 | 374 000 | 374 000 | Transfer of depreciation to NU | |||

| 01.01 | 01.K | 176 400 | 176 400 | Transferring the non-depreciable part to the NU | |||

| Registration of SF supplier | |||||||

| April 21 | — | — | 368 480 | Registration of SF supplier | Invoice received for receipt | ||

| 68.02 | 19.04 | 368 480 | Acceptance of VAT for deduction | ||||

| — | — | 368 480 | Reflection of VAT deduction in the Purchase Book | Purchase Book report | |||

How to buy out a leased asset early

Although the procedure for early redemption of leased property often raises many questions among lessees, it is quite well developed and regulated in leasing companies. Managers do not refuse to help with such a procedure, and clients do not have any major problems.

Let's take a step-by-step look at how early redemption of leased property occurs:

- The client sends a request to calculate the amount of early repayment and informs the company about his desire and the planned date of payment. A sample letter for early repayment of leasing can be requested through the manager or found on the Internet.

- Company employees make calculations and also form an additional agreement to the leasing agreement. All mandatory conditions for early redemption must be recorded on paper so that there are no disputes between the parties in the future.

- The client makes a payment to the leasing company's account. It is very important to carry it out before the date agreed upon by the parties.

- The transfer of property to the lessee is formalized. All conditions and terms for the transfer of property rights must also be contained in the additional agreement or initial contract.

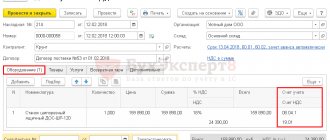

Transfer of payment to the lessor

Repayment of debt to the lessor is reflected in the document Write-off from the current account transaction type Payment to the supplier in the Bank and cash desk - Bank statements section.

Please indicate:

- Amount - the amount under the additional agreement on early repurchase (in our example - RUB 2,210,880);

- Expense item - Acquisition, creation, modernization and reconstruction of non-current assets (in our example, the entire amount is the redemption value of the fixed assets).

Postings according to the document

The document generates the posting:

- Dt 60.02 Kt - advance payment transferred to the lessor.

Adjustment of the value of leased property in NU

The initial cost in the NU of the OS that has become its own is the redemption price of the leased property. In the future, it is recognized as expenses through the calculation of depreciation (clause 1 of Article 256 of the Tax Code of the Russian Federation, clause 1 of Article 257 of the Tax Code of the Russian Federation).

Analyze the report Balance sheet for account 01 with selection by fixed asset - leasing object. Indicators - BU and NU.

In the program, account 01 in the accounting system reflects the initial cost of the fixed assets, taking into account all leasing (rental) payments. In connection with the decrease in the lease obligation, the difference between the cost of the used book and the standard for it decreases, accordingly. Therefore, you need to reduce the balance in account 01.K on the date of conclusion of the agreement using the Transaction document entered manually in the Transactions .

Please indicate:

- Debit - 000 “Sub account”;

- Loan - 01.K “Adjustment of the value of leased property”; Subconto 1 - leasing OS.

Redemption of leased property

Complete the redemption of property in the same way as redemption at the end of the contract with the document Redemption of leased items , from the section OS and intangible .

Specify the redemption date, Counterparty and Agreement . On the Lease Items , clicking the Fill will fill the tabular part automatically with the balances of lease obligations accounts as of the specified date.

On the Accounting , check the completion:

- Lease obligations : Accounting account - 76.07.1 “Rease obligations”.

- Accounting account - 01.01 “Fixed assets in the organization”;

On the Tax Accounting , specify:

- The procedure for including the redemption value in expenses - you can choose from 3 options: Depreciation - if the redemption value of the fixed asset is more than 100 thousand rubles. (in our example we choose this order);

- Inclusion in expenses upon acceptance for accounting - if the redemption value of the fixed asset is 100 thousand rubles. or less;

- The cost is not included in expenses - if the cost of the OS cannot be taken into account in the NU;

Postings according to the document

The document generates transactions:

- Dt 60.01 Kt 60.02 - offset of the advance payment to the supplier at the purchase price;

- Dt 76.07.1 Kt 60.01 - redemption of fixed assets;

- Dt 19.01 Kt 60.01 - acceptance of VAT for accounting;

- Dt 76.07.1 Kt 76.07.9 - write-off of lease liability in terms of VAT;

- Dt Kt 02.03 - accrual of depreciation for fixed assets in leasing for the last time;

- Dt Kt 02.03 - adjustment in NU of excessively accrued depreciation;

Under the conditions of our example, the lease payment was not paid in April, so there is no recognition of expenses in the NU.

- Dt 01.01 Kt 01.03 - transfer of fixed assets to the composition of our own;

- Dt 02.03 Kt 02.01 - transfer of depreciation accrued in accounting for the period of the leasing agreement;

- Dt 02.03 Kt 01.01 - adjustment of the cost of fixed assets in NU due to depreciation;

- Dt 01.01 Kt 01.K - adjustment of the cost of fixed assets in NU due to the non-depreciable part.

Check the balance sheet for account 01.

After adjustment, the cost of fixed assets in NU is equal to the redemption value (2,210,880 – 368,480 = 1,842,400 rubles).

Starting from the next month after the purchase of fixed assets, depreciation accrual in NU is reflected based on the new initial cost using the routine operation Depreciation and depreciation of fixed assets in the Month Closing procedure.

Let's check the calculation of depreciation at the new cost in NU:

- 1 842 400 / 48 = 38 383, 33

In accounting, the amount of depreciation continues to be accrued in the same order:

- 2 928 000 / 60 = 48 800

Accounting for early repurchase of the leased asset

The procedure for recording the redemption of property in accounting will depend on who has it on their balance sheet. If on the lessor’s balance sheet, the entries will be as follows:

| Business transaction | D | TO |

| Property written off balance sheet | 001 | |

| The property is recognized by the OS | 08 | 60 |

| The asset is classified as inventory | 10 | 60 |

| VAT reflected | 19 | 60 |

In case of early repurchase of the leased asset, the postings will be as follows:

| Business transaction | D | TO |

| Property at its original cost is included in the property | 01 “Leased fixed assets” | |

| The amount of accrued depreciation is transferred to the depreciation account accrued on assets | 02 “Depreciation on own fixed assets” | |

| VAT is included in other expenses | 91.2 | 19 |

| Unpaid amounts under the leasing agreement are written off as other expenses | 76 | 91.1 |

Registration of SF supplier

To register an incoming invoice, indicate its number and date at the bottom of the form of the document Redemption of leased items , click the Register .

If in the document Invoice received for receipt, the Reflect VAT deduction in the purchase book by date of receipt checkbox is selected , then when it is posted, a posting will be made to accept VAT for deduction Dt 68.02 Kt 19.04.

- Operation type code : “Receipt of goods, works, services.”

Reporting

Transactions on early redemption of fixed assets are not reflected in the income tax return.

The amount of income from writing off part of the lease payments will be reflected in the Financial Results Report:

- page 2340 “Other income”. PDF

See also:

- Is it possible to deduct VAT when purchasing a leased asset early?

- Step-by-step accounting of leasing in 1C 8.3 on the lessee’s balance sheet

- Accounting for leased property on the balance sheet of the lessee under PBU 18/02

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Early repurchase of the leased asset from the tenant until 2022 (PROF) The 1C: Accounting 8.3 PROF program has implemented opportunities for early use…

- Early repurchase of the leased asset from the lessee (KORP) In the 1C: Accounting 8.3 CORP program, opportunities for early use…

- On accounting for leasing payments and the redemption value of the leased asset, the Ministry of Finance explained the nuances of accounting for leasing payments for the purpose of calculating tax...

- Sales of products during the month of production at planned cost and in subsequent periods at actual cost Sales of finished products are the final stage of the turnover of funds spent on...

How to find out the redemption value of a property

One of the most difficult issues is calculating the redemption value of the leased asset in case of early repayment. Its size will significantly depend on the terms of the original agreement. Typically, the client is asked to make all remaining payments under the contract and then receive ownership of the property.

Even if the agreement provides for the recalculation of interest, the lessee is obliged to cover the lessor's expenses and pay him certain compensation.

Calculating the redemption value of a property on your own is not always easy. Some companies prepare a separate application with the schedule and conditions for early repurchase. If not, you will have to make a written settlement request indicating the date of full repayment. In the response letter, the leasing company must indicate the exact amount for the early purchase of the property.