Violation of tax laws leads to fines and penalties. You can receive a sanction for underestimating the taxable base or late submission of declarations. If payment is not made, penalties will be calculated automatically. Fines and penalties according to 1C 8.3 are calculated manually. There are no separate templates created for them. You can make them yourself. It is important to correctly select the account to which fines and penalties will be transferred and make entries in the process of accruing them. Thus, a fine for violating the provisions of tax legislation can be classified as tax sanctions. They do not reduce the amount of taxable profit.

Calculation of entries when calculating fines/penalties

In the 1C 8.2 program, you can create wiring using two methods - manually or through a standard operation.

How to create a wiring manually?

Step 1. You need to create a new manual operation in version 1C 8.3. The user moves on. Go to the “Operations” section and click on the inscription “Operations entered manually”. After a few seconds, a window for manual operations will open to the user.

In the form that opens, select the “Create” item and select the “Operation” link. The program will open a window for creating the necessary transactions for calculating fines and penalties.

Step 2. It is important to post the penalty calculation manually in the “Operation (Creation)” window. At this stage, the client fills out several fields indicating personal data. Confirm the procedure by clicking on the “Add” button. Next, a form for creating accounting entries will open.

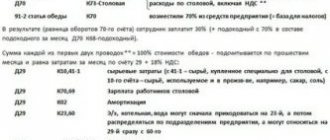

In the “Debit” field, the user indicates the name of the account 99.01.1 “Profits and losses”. Next, a directory opens with several items. Among them, you must select “Tax Penalties Due”. The “Credit” field indicates the accounting account against which current tax calculations are taken into account. It was for this reason that penalties were assessed.

Example:

For 68.01 “Personal Income Tax” you need to select from the directory the item “Fine: accrued / paid”. In the field that opens with the amount, the amount of the fine or penalty in rubles is indicated. Below you need to write the contents of the posting, for example, “Calculation of a fine upon request No. 256.”

The last step is to confirm the procedure. The user clicks on the “Record” inscription. In 1C 8.3 you can create an unlimited number of wires for penalties and fines.

Reflection of an administrative fine in the program

A fine can be entered into the 1C program as follows. Go to the “Operations” menu and select the “Operations entered manually” view. Click on the “Create” button and a form will open for you to fill out. You need to enter information about the name, date of the document, correspondence of accounts (debit and credit of accounts), the amount of the transaction and subaccount. Debit subconto is the counterparty, credit subconto is an item of other income and expenses from the directory “Directory of Items of Income and Expenses”. In this directory, select the article “Fines, penalties and penalties for receipt (payment)”. The amount of the fine is indicated in the document “Receipt to the current account” indicating the type of transaction “Other receipt”. Now you can post the document and the 1C program will display the transactions.

The operation for accounting for a fine is carried out through the operation “Operation entered manually”, but when filling out changes in the corresponding account and analytics appear. The changes occur due to the fact that fines and penalties are accepted for tax accounting. Therefore, the amount when posting a document will be reflected in both accounting and tax accounting.

Finished works on a similar topic

Course work Posting fines in 1C 490 ₽ Abstract Posting fines in 1C 220 ₽ Test paper Posting fines in 1C 220 ₽

Receive completed work or specialist advice on your educational project Find out the cost

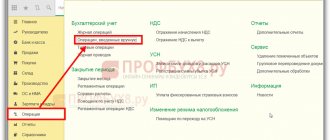

Typical operation in the 1C 8.3 program

Step 1. You need to create a new standard operation for the options “Calculation of fines in 1s 8.3 transactions” and “Calculation of penalties for taxes transactions in 1s 8.3”. To simplify the procedure for further use of the program, you can create templates. They will allow you to avoid entering data and company details manually each time. All subsequent payments will be able to be created based on the data saved in the storage. To create a current template, you need to go to the “Operations” section and click on the “Typical operations” link. After a few seconds, a window will open for creating standard operations.

In the “Typical Operations” window, select the “Create” function. A form for opening an operation will become available in a new tab.

To implement the task, the user will have to perform a list of actions in a new tab:

- in the “Contents” paragraph, information such as the name of the typical operation is indicated (example);

- The second step is to deliver a standard posting (click on the “Add” sign)

- the current account 99.01.1 is entered in the “Debit” field;

- in the directory field for account 99.01.1, select the value “Tax sanctions due”;

- in the “Credit” field, indicate the tax account for which it is planned to create a template, for example 68.02 “VAT”;

- in the directory field for account 68.02 (you need to determine the value in the item “Fine: accrued / paid.”

To confirm all applied data, click on the inscription “Record and close”. After confirmation, the template will be saved automatically. You can find it the next time you start the program in the list of typical operations.

Step 2. The owner needs to create a transaction for calculating a fine in the 1C 8.3 program using a standard operation. To successfully calculate a fine using the functionality, you can go to the general list of operations (performed in step 1), and then click on the desired one and press the “Enter operation” button

A form for entering current standard information will open in a new tab. It is necessary to fill in a field with the name of the organization or enterprise and the date of completion. The user specifies the date on which the current posting for penalties/penalties will be created. The lowermost area indicates the amount of the fine to pay. It must coincide with the official requirement from the tax office. The last step is for the user to click on the “Fill” button. All valid transactions are recorded in the program.

The transition to “Accounting and tax accounting” will allow you to see the newly created transactions. It is important to check them for errors and typos. If there are none, then the entrepreneur clicks on the “Record and close” item to save the accounting entry in the 1C 8.3 program.

Using a similar method, it is possible to create standard transactions when calculating state duties in order to save your personal time working in the 1C 8.3 program.

You can purchase services that help you work as an accountant here.

Do you want to install, configure, modify or update 1C? Leave a request!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Traffic police fines - posting in 1C

Content:

1. Traffic police fines in 1C

2. How is the traffic police fine calculated in 1C?

3. Making official payment of the traffic police fine

4. Refund of the traffic police fine from the employee

Traffic police fines in 1C

This article will discuss how to enter, pay and post traffic police fines in 1C. This happens when the employee uses a company car - the employer is responsible for paying the fine, but can then collect the fine from the driver of the company car. Operations with traffic police fines occur through the 1C: Enterprise Accounting program.

It is worth noting that the verification of accrued fines is carried out through the portals mos.ru, State Services, the State Traffic Inspectorate website, as well as through SMS messages.

According to the 1st part of Article 32.2 of the Code of Administrative Offenses of the Russian Federation, official payment of traffic police fines must occur within 60 days from the moment the resolution on the offense came into effect. You can appeal a fine within the first 10 days, so the longest possible period during which the fine must be paid is 70 days.

Official payment of traffic police fines is also carried out through the State Services portals, mos.ru, the State Traffic Inspectorate website or in person.

Note: since January 1, 2016, a law has been in force that states that if payment of a fine occurs within 20 days from the date of issuance of the resolution, then you receive a 50% discount on the amount that was issued (but this does not apply to all types of fines ).

How is the traffic police fine calculated in 1C?

To calculate a fine from the traffic police in 1C, you need to go to 1C 8.3 Enterprise Accounting 3.0 along the path “Operations → Accounting → Operations entered manually.”

Fig. 1 The path to paying fines in the 1C: Enterprise Accounting program.

After this, click on “Create”, the document opens in 1C: Enterprise Accounting 3. We call it “Operation”, as shown below:

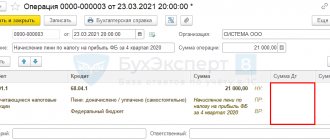

Rice. 2 Document “Operation” in the 1C: Enterprise Accounting program.

After this, you should enter the traffic fine entries in 1C 8.3.

Rice. 3 Posting a fine in 1C: Enterprise Accounting 3.

According to the debit, you need to indicate account 91.02 “Other expenses”. Next is the article “Other non-operating income and expenses”. After that, go to the article settings and there uncheck the “Accepted for tax accounting” checkbox, as can be seen in the screenshot below:

Rice. 4 Checkbox “Accepted for tax accounting” in the 1C: Enterprise Accounting program.

Next, in the loan you should indicate account number 76.02 “Settlements on claims” and select the traffic police as the counterparty, after which you need to indicate the amount of the fine.

Making official payment of a traffic fine

In order for the official payment of the traffic police fine to occur, you need to create in the 1C: Enterprise Accounting 3.0 configuration the document “Write-off from the current account” and specify the operation “Other settlements with contractors”, as shown in the screenshot below:

Rice. 5 Settlements with counterparties in the 1C: Enterprise Accounting program.

After this, we indicate the traffic police as the recipient, specify the amount of the fine, then, according to settlement account number 76.02, we enter this document in 1C 8.3 Enterprise Accounting.

Rice. 6 We carry out the document in the 1C: Enterprise Accounting program.

Refund of a traffic police fine from an employee

If the traffic police fine is returned, the following sequence will apply:

1. The employee acknowledges the fine.

If the fine is recognized, you must manually create the following process in the 1C: Enterprise Accounting program: indicate the posting Dt 73.02 “Calculations for compensation of material damage”, Kt 91.01 “Other income”, as shown in the screenshot below:

Rice. 7 Postings for a fine in the 1C: Enterprise Accounting program 3

We select an article with a check mark, which indicates what is accepted for tax accounting, as can be seen below:

Rice. 8 “Accepted for tax accounting” in the 1C: Enterprise Accounting program

After this, there are two options for the return of funds by an employee with a company car - payment through the cash register (point 2) or deduction from salary (point 3).

2. Payment through the cash register.

In order to make a payment through the cash register, in 1C: Enterprise Accounting 3 you need to make a new document “Cash Receipt” and carry out the “Other Receipt” operation, as shown below:

Rice. 9 Payment through the cash register in the 1C: Enterprise Accounting program

Next, you need to enter the payment amount and mark the loan account 73.02 and select the required employee from the list. The document postings will look like the screenshot below:

Rice. 10 Posting a document for payment through the cash register in 1C: Enterprise Accounting 3

3. Deduction of traffic police fines from wages

The traffic police fine can also be deducted from the employee’s salary. To perform this operation, you need to go to the list with holds, as can be seen below:

Rice. 11 List with deductions in the 1C: Enterprise Accounting program

This will be followed by the creation of a new deduction called “Retention for a traffic police fine”:

Rice. 12 Deduction for a traffic police fine from wages

The “Payroll” document will be filled in automatically when you select an employee. Click on “Withhold” and select the type of deduction from wages for the traffic police fine that you created before:

Rice. 13 Type of deduction in the 1C program: Enterprise Accounting

All you have to do is enter the amount and click “OK”:

Rice. 14 Amount of deduction in the 1C: Enterprise Accounting program 3

This deduction for a traffic police fine from wages will be reflected only in the calculation sheet, and will not be indicated in the “Payroll” document:

Rice. 15 Displaying retention in the 1C: Enterprise Accounting program

In order to complete the postings, you must enter the posting Dt 70 Kt 73.02 and indicate the amount of the fine, as shown below:

Rice. 16 Selecting a currency for accounting in the 1C: Accounting 3 program

The operation is completely completed. Thank you for your attention and remember that you can safely contact us with any complex questions - our specialists are always in touch and happy to help!

Specialist

Aidar Farkhutdinov