You must submit your VAT return electronically, regardless of the number of employees. Only in exceptional cases is it possible to submit a declaration on paper (clause 5 of Article 174 of the Tax Code of the Russian Federation).

The deadline for sending the declaration is the 25th day of the month following the reporting quarter.

VAT accrued for the quarter must be transferred in equal parts within three months. The tax payment deadline is until the 25th day of each of the three months following the expired tax period (clause 1 of Article 174 of the Tax Code of the Russian Federation). If for the 1st quarter of 2022 it is necessary to transfer VAT in the amount of 6,000 rubles to the budget, the taxpayer must make the following payments:

- until 04/26/2021 - 2,000 rubles;

- until 05.25.2021 - 2,000 rubles;

- until June 25, 2021 - 2,000 rubles.

Some organizations transfer VAT in one amount in the first month following the reporting quarter, without breaking it down into months - this is the right of the taxpayer.

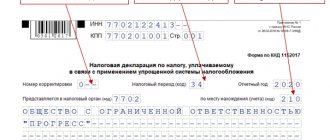

The declaration form and the procedure for filling it out were approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558. The latest edition of the form and instructions for filling out was made in accordance with Order of the Federal Tax Service of the Russian Federation dated March 26, 2021 No. ED-7-3 / [email protected] It is valid from the report for the 3rd quarter of 2021.

View the filling procedure

Sample of filling out a VAT return

Let's look at an example of filling out a VAT return for the 1st quarter of 2022. Kolos LLC is located at OSNO and sells equipment. All transactions carried out by the company are subject to VAT at a rate of 20%.

During the period January - March 2022, the following operations were carried out in the company:

- Stationery was purchased in the amount of 1,500 rubles, including VAT of 250 rubles (invoice No. 1 dated 03/02/2022).

- Equipment sold for the amount of 40,000 rubles, including VAT of 6,666.67 rubles (invoice No. 19 dated 01/11/2022).

- Invoice No. 5 dated November 12, 2021 was received in the amount of 5,600 rubles, including VAT of 933.33 rubles. Furniture according to this document was accepted for accounting on 02/12/2022. The Tax Code of the Russian Federation allows VAT to be deducted within three years after the goods are accepted for registration (clause 1.1. clause 1 of Article 172 of the Tax Code of the Russian Federation).

It is necessary to fill out the title page and section 1 of the declaration. The remaining sections are completed if the appropriate indicators are available. If there are no indicators for any of the sections, then it can simply not be included in the declaration.

In this example, you also need to fill out sections 3, 8 and 9.

Try submitting your reports through the Extern system. Use all the features for free for 14 days!

Try for free

Deadlines for submitting VAT reports and paying taxes

There are no special rules for individual entrepreneurs regarding the deadlines for filing VAT reports and paying the tax specified therein.

The deadline for filing the declaration is set for the 25th day of the month following the completed reporting quarter (clause 5 of Article 174 of the Tax Code of the Russian Federation). Moreover, tax defaulters are also targeted for the same period, filing a declaration as the need arises and, unlike taxpayers, having the right to submit it in paper form. For the 3rd quarter of 2022, the declaration must be submitted by October 25, 2021.

There are several deadlines for making tax payments (clauses 1, 4, Article 174 of the Tax Code of the Russian Federation):

- Taxpayers pay it in three installments during the quarter following the end of the one for which the next report was submitted, doing this monthly no later than the 25th day of each of three months, in an amount equal to 1/3 of the amount accrued in the declaration.

- Non-payers who need to submit a declaration make only one payment - on the due date, the deadline of which expires simultaneously with the deadline for submitting the VAT report.

- Tax agents making payments to foreign counterparties must pay tax simultaneously with the transfer of funds to the counterparty.

- Payment of tax in connection with the import of goods into the territory of the Russian Federation is subject to the rules established by customs legislation.

Thus, if there is only one deadline established for filing a VAT report, the timing of tax payments may be different.

Section 3

This section collects all the data for tax calculation. It includes transactions subject to VAT at regular and estimated rates, as well as deductions.

Line 010 of column 3 corresponds to the amount of revenue reflected on the credit of account 90.1 for the reporting period. Line 010 of column 5 corresponds to the amount of VAT reflected in the debit of account 90.3.

Line 070, column 5 corresponds to the amount of advance VAT reflected in the debit of account 76 “VAT on advances” (VAT accrued on prepayment received).

Line 090 of column 5 corresponds to the amount reflected in the debit of account 76 “VAT on advances” (VAT on advances issued).

Line 118 of column 5 corresponds to the amount reflected in the credit of account 68 “VAT”. In addition, this line can be checked against the total VAT amount in the sales book.

Line 120 of column 3 corresponds to the amount reflected in the credit of account 19.

Line 130 of column 3 corresponds to the amount reflected in the credit of account 76 “VAT on advances” (VAT on advances issued).

Line 170 of column 3 corresponds to the amount reflected in the credit of account 76 “VAT on advances” (VAT accrued on the received prepayment).

Line 190 of column 3 corresponds to the amount reflected in the debit of account 68 “VAT” (excluding VAT transferred to the budget for the previous tax period). In addition, this line can be checked against the total VAT amount in the purchase book.

Line 200 indicates the tax accrued for payment to the budget.

Section 6

Section 6 is intended to reflect transactions for which the deadline for submitting documents confirming the right to apply the zero VAT rate has expired.

The duration of this period is 180 calendar days. For exported goods, the 180-day period is counted:

- from the date of shipment (for deliveries to countries participating in the Customs Union) (clause 5 of Appendix 18 to the Treaty on the Eurasian Economic Union);

- from the date of placing goods under the customs export procedure (for deliveries to other countries) (clause 9 of article 165 of the Tax Code of the Russian Federation).

In relation to work (services) related to the export of goods (import of goods into Russia), the procedure for determining the 180-day period depends on the type of work (service).

On line 010, enter the operation code. For each transaction code, fill in lines 020–040.

On line 020 reflect the tax base.

On line 030, indicate the amount of VAT calculated based on the tax base on line 020 and the VAT rate (10 or 18%).

Line 040 reflects the amounts of tax deductions:

- input VAT paid to the seller;

- VAT paid when importing goods into Russia;

- VAT paid by the tax agent when purchasing goods, works, services.

Fill in lines 050–060 only on the first page, and put dashes on the rest.

On line 050, reflect the total amount of VAT (the sum of all lines 030 for each transaction code).

For line 060, enter the summed indicator of lines 040 for each transaction code.

If the buyer returned some of the goods to the exporter, fill in lines 080–100:

- on line 080 – the amount by which the tax base is reduced;

- on line 090 – VAT adjustment (the amount by which the calculated VAT is reduced);

- on line 100 – the amount of VAT that needs to be restored (previously accepted for deduction).

If you increase or decrease the price, fill in lines 110–150:

- on line 120 - the amount by which the tax base is increased;

- on line 130 – the amount by which VAT is increased;

- on line 140 – the amount by which the tax base is reduced;

- on line 150 – the amount by which VAT is reduced.

Calculate the amount of VAT payable to the budget for line 160 as follows:

| Line 160 = (line 050 + line 100 + line 130) – (line 060 + line 090 + line 150) |

Calculate the VAT refund amount for line 170 as follows:

| Line 170 = (line 060 + line 090 + line 150) – (line 050 + line 100 + line 130) |

Please take into account the amounts of VAT payable (reduced) reflected in sections 4–6 when filling out section 1 of the VAT return (clauses 34.3, 34.4 of the Procedure approved by order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/558) .

Section 8 and Section 9

These sections were added to the declaration when taxpayers were required to provide the Federal Tax Service with data on invoices that were issued or received.

Section 8 corresponds to data from the purchases ledger, and section 9 corresponds to data from the sales ledger.

In each of them you need to indicate the type of transaction, the number and date of the invoice.

For section 8, additionally indicate the number and date of the document confirming payment of the tax. Additionally, indicate the date the goods were accepted for accounting. Line 190 records the final calculated VAT.

In section 9, on lines 230 - 280, the total amounts of sales and tax are written down at the appropriate rates.

Since 2022, sections 8 and 9 have been supplemented with new lines to reflect transactions with traceable goods. They indicate the RNPT or registration number of the goods declaration, the code of the quantitative unit of the goods, the quantity of the goods and its cost without VAT.

Our experts answered frequently asked questions from Extern users and provided explanations for filling out annexes to the VAT return.

How to fill out the second section of the declaration

This section of the report will have to be completed separately for each counterparty for which the reporting organization is a tax agent. That is, the reporting contains several sections No. 2, exactly as many as there were counterparties in the reporting period.

Let us remind you that you will have to fill out section No. 2 for:

- a foreign person who is not registered with the Federal Tax Service, and for foreigners registered with our Federal Tax Service for real estate, transport, and separate divisions;

- public authority that is the lessor of state property;

- a government agency that is the seller of state or municipal property, etc. (Article 161 of the Tax Code of the Russian Federation).

For a foreign entity that is registered with the Russian Federal Tax Service in separate divisions, VAT is paid by agents if such a company does not carry out sales through its own separate division.

IMPORTANT!

If several agency agreements have been concluded with one counterparty, then there is no need to provide detailed information. Section No. 2 is completed for one foreign person or authority, regardless of the number of concluded agreements, contacts and contracts.

The algorithm and example of filling out a VAT return by a tax agent in 2022 are given in the table:

| Line number | Information to reflect |

| 020 | The name of the economic entity for which you are a tax agent. |

| 030 | TIN of the state authority. If the counterparty is a foreign person, then put dashes on the paper report or leave the field blank for the electronic format (foreigners do not have a tax identification number). |

| 040 | We indicate the budget classification code. KBK 182 1 03 01000 01 1000 110. |

| 050 | We prescribe OKTMO for your company. |

| 060 | We indicate the amount of value added tax to be paid to the budget. |

| 070 | We fill in the operation code in accordance with section. 4 appendices No. 1 to the procedure for filling out a tax return. |

Operation codes that are used most often:

- 1011703 - if a transaction for the acquisition or lease of state or municipal property is being formalized;

- 1011711 - for business transactions involving the purchase of goods from a foreign company;

- 1011712 - if transactions for the purchase of works or services from a foreign person were completed;

- 1011714 - if you are an intermediary in the sale of electronic services of foreign companies;

- 1011707 - for intermediaries in the sale of goods of foreign companies not registered with the Federal Tax Service.

How to check the declaration?

If you work in a specialized program, the VAT return is most likely filled out automatically based on the documents entered. The declaration indicators can be compared with the balance sheet data for the reporting period. To check, you need revolutions of the specified sheet.

The balance sheet reflects the amounts for accounting and tax accounting. To verify the declaration, we will need tax accounting data.

You can correct errors in the declaration or supplement the submitted information using VAT adjustments. The procedure for working with updated declarations is described in paragraph 2 of the filling procedure.

Try submitting your reports through the Extern system. Use all the features for free for 14 days!

Try for free

Who is required to submit VAT reports?

In accordance with paragraph 5 of Art. 174 and paragraphs. 1 clause 5 art. 173 of the Tax Code of the Russian Federation, the following are reported for VAT:

- organizations and individual entrepreneurs are VAT payers (firms and individual entrepreneurs who have switched to the simplified tax system, PSN, unified agricultural tax or initially use these regimes do not pay this tax: there is no point in worrying about how to make a VAT report, for them this report does not exist);

- tax agents;

- intermediaries who are not payers, who allocate VAT amounts in issued invoices.

Organizations and individual entrepreneurs using special taxation systems - simplified tax system, PSN, unified agricultural tax, which are not VAT payers, are exempt from the obligation to report VAT. For organizations whose total income does not exceed 2 million rubles for three consecutive months, there is no need to provide a report, provided that they have sent a notice of exemption to the Federal Tax Service (Article 145 of the Tax Code of the Russian Federation). If taxpayers did not notify the Federal Tax Service, the declaration will have to be submitted on the same basis as everyone else.

For taxpayers who did not conduct financial and economic activities in the reporting period and did not use funds in their current accounts, VAT for the 4th quarter of 2022 is provided without indicators, that is, a zero declaration.

Submit a declaration at the place of registration of the company or registration of the place of residence of the individual entrepreneur exclusively in electronic format. This report is no longer available on paper.

ConsultantPlus experts have compiled a detailed guide to filling out and submitting a VAT return. Use these instructions for free.

How and in what form are agent VAT reports submitted?

The current form used when filling out value added tax reports by a tenant under a lease agreement for non-residential municipal property and in other cases listed above is approved by Order of the Federal Tax Service dated October 29, 2014 No. MMV-7-3/ [email protected] Reporting is provided quarterly to the Federal Tax Service on location of the organization.

From the 3rd quarter of 2022, a new reporting form is used, updated by order of the Federal Tax Service dated March 26, 2021 No. ED-7-3 / [email protected] This is due to the introduction of a goods traceability system.