Transport costs in the estimate documentation

Transportation costs are the costs associated with delivering construction materials and equipment and other resources to the place where they are used.

Transport costs are taken into account in the price of construction resources as additional costs and have a clearly regulated amount in percentage terms. Transportation costs in the estimate are, in fact, an addition to the net selling price of materials and equipment from the manufacturer or supplier, without, of course, taking into account other expenses (such as the profit of the sales organization).

The percentage of transportation costs for materials in the estimate, or rather its value, is a very important issue that is often missed when calculating the total cost of construction and installation work, which leads to errors in estimate calculations.

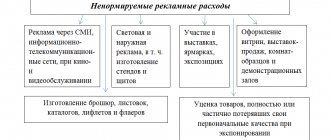

Transportation costs in estimating are often combined with other costs closely related to the delivery of materials. Such a combined group of expenses is usually called procurement, storage and transportation costs in estimates (or in other words, procurement, storage and transportation). This includes the following costs:

- — cost of containers, packaging and props;

- — cost of loading and unloading operations;

- — the cost of transporting goods.

When using materials, products, structures and equipment in estimates based on collections of estimated prices for construction resources, transportation costs are already taken into account in their cost. They are determined on the basis of average statistical data. In turn, when using at actual cost (according to price lists, supplier prices, invoices, invoices), transportation costs must be taken into account additionally, since often these costs are not included in the cost of materials, but are accepted separately at actual costs.

As mentioned above, there are average statistical data on the cost of transport costs in relation to the cost of building materials, equipment, etc. Therefore, when drawing up estimate documentation, it is customary to use fixed price premiums established by standards to resources accepted at actual cost (price lists, invoices - invoices, etc.). Thus, this makes it possible to simplify the calculation of the transport component and strictly regulate the upper thresholds of such surcharges. Let's look at these fixed limits and how they are determined for transportation cost elements.

How are shipping costs taken into account for income tax purposes?

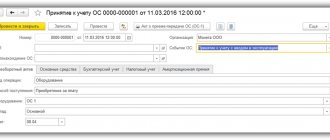

In tax accounting, transportation costs are taken into account depending on who incurred them: the buyer or the seller. If the expenses were incurred by the buyer, then they will be recognized for the purpose of calculating income tax in accordance with Art. 320 Tax Code of the Russian Federation. In addition, this norm contains the procedure for calculating direct transportation costs for unsold goods.

When delivering fixed assets and intangible assets, the buyer includes transportation costs in the cost of these non-current assets (clause 1 of Article 257 of the Tax Code of the Russian Federation). The seller reflects the amount of delivery of goods as expenses associated with production and sales (subclause 1, clause 1, article 253 of the Tax Code of the Russian Federation).

At the same time, with regard to documentary support of these services, tax legislation contains the following requirements (letter of the Ministry of Finance of Russia dated December 22, 2011 No. 03-03-10/123):

- when delivering goods by transport organizations, it is necessary to have a TN or TTN;

- When delivering by the buyer's personal transport, a waybill is required;

For information on the form of the waybill, see the article “Truck waybill for LLC - sample 2015.”

- when delivered by supplier’s transport - TN or TTN.

IMPORTANT! Letter of the Federal Tax Service of Russia dated March 21, 2012 No. ED-4-3/ [email protected] confirms the possibility of using any of the documents (TN or TTN) during transportation.

The cost of containers, packaging, props in the estimate.

Containers, packaging and props are one of the most important components, and they are necessary to protect material assets from damage during transportation and movement, and naturally they are included in the cost of estimates.

So, according to clause 4.57 of MDS 81-35.2004, if materials, equipment, products, structures are used according to collections of estimated prices (FSSC, construction price), the cost of containers and packaging, props is already taken into account in the cost. But if the actual cost and the cost of the goods do not take into account the costs of containers and packaging, then they must be taken into account additionally in the estimate calculations. Usually, in addition to the cost of the goods, the supplier writes down the cost of packaging and containers on a separate line in the invoice or commercial proposal, but more often this is forgotten and the estimator has to separately calculate these prices. Clause 4.58 helps him with this. all the same document MDS 81-35.2004. Where it is said that in the absence of detailed information about the characteristics of containers and packaging, the cost can be calculated as a percentage of the cost of materials and equipment, namely:

- — large technological equipment – from 0.1% to 0.5%;

- — machine equipment – up to 1%;

- - electrical equipment, instrumentation and automation, tools - up to 1.5%.

The cost of loading and unloading operations in the estimate documentation

Loading and unloading work is work associated with loading into transport and unloading from transport materials, products, structures, which are carried out during the delivery of these resources to a construction site.

Loading and unloading operations can be carried out using different methods:

- 1) Manually;

- 2) Using available means - winches, rigging devices, jacks, hoists;

- 3) Using large equipment - cranes, loaders, excavators, conveyors, etc.

The cost of these works, if it is not included in the price of the goods, can be applied according to collections of estimated prices for loading and unloading operations (FSTSpg), taking into account the categories of materials, products, structures, equipment and depending on the method of loading and unloading. The cost of work on these collections is calculated in tons. These collections contain a very large list of such works.

In the absence of any work in these collections, and also by agreement with the construction customer, the actual cost of mechanisms and machinery can be applied, taking into account the time spent on work. The actual cost is determined based on the preparation of a separate calculation for these works according to the current price tags of organizations and price lists. Unlike the size of transportation costs for materials in the estimate, loading and unloading operations do not have a fixed percentage in relation to the cost of building materials and equipment.

Tax accounting of goods and materials: nuances

It will be useful to consider some of the nuances of tax accounting for TZR. There are 2 of its most common schemes - accounting for goods and materials in a trade organization and a similar procedure at a manufacturing enterprise.

One of the key tasks of the company’s accountant in both cases is to calculate the correct amount of TZR for the purpose of writing off as expenses in the reporting period. Let's consider how it is solved.

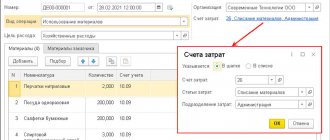

How to determine the amount of “trading” TKR? In accordance with the provisions of Art. 320 of the Tax Code of the Russian Federation, the following scheme should be used for this:

1. The average percentage (PERC) of TWP is calculated using the formula:

(TZR (NM) + TZR (TM)) / (SEB (TM) + OST (KM)) × 100%,

Where:

TZR (NM) - expenses for the balance of unsold goods as of the beginning of the month;

TZR (TM) - the total amount of expenses in the current month;

SEB (TM) - cost of goods sold in the current month;

OST (KM) - the balance of unsold goods in the warehouse as of the end of the month.

2. The amount of goods and materials is calculated for the balance of unsold goods (total goods (OST)) using the formula:

OST (KM) × PERC.

3. The amount of equipment and materials that can be written off as expenses in the reporting period is determined using the formula:

TZR (NM) + TZR (TM) – TZR (OST).

If the company is engaged in production, then to calculate the TZR for materials (as the main MPZ), a different formula should be used (it is based on the provisions of clause 87 of Order of the Ministry of Finance of the Russian Federation dated December 28, 2001 No. 119n):

(TZR (NM) + TZR (OTCH)) / (OST (NM) + ST (OTCH)) × 100% / ST (RASKH),

where TZR (NM) is the balance of TZR as of the beginning of the month;

TZR (OTCH) - the amount of TZR for materials that arrived at the factory for the month;

OST (NM) - the cost of remaining materials at the beginning of the month;

ST (OTCH) - the cost of materials arriving at the factory per month;

ST (EXP) - the cost of materials that were consumed in production per month.

Note that if TZR relate to materials that are released into production, for management needs or other purposes, they should be written off monthly (clause 86 of Order No. 119n).

The tax schemes considered can also be used in accounting, including to minimize the differences between tax and accounting calculations.

The cost of freight transportation in the estimate

When drawing up estimates for construction and installation work financed from the federal or municipal budget, collections of estimated prices for the transportation of goods by road are required. These collections were developed in databases based on the price level for 2001 (FER, TER, etc.) and are translated into the current level through indexation.

However, in the calculations between the Customer and the Contractor, the actual costs of transporting goods at current market prices in a particular region can be used, but this is only possible if there is no competitive type of transportation in the price collections or this type of work is financed from a non-state budget. In these cases, a calculation is also drawn up justifying the actual transportation costs.

The procedure for calculating the estimated prices for the transportation of goods by road in 2022 is determined by Order of the Ministry of Construction of Russia No. 517/pr dated 09/04/2019 “On approval of the Methodological Recommendations for determining the estimated prices for materials, products, structures, equipment and prices of services for the transportation of goods for construction » section 3.

This order explains in detail how to correctly and accurately calculate the cost of transporting goods by road, depending on the class of cargo, types of vehicles, transportation distance and types of roads along which transportation is carried out.

Carrying out calculations

Calculation of transport costs in the estimate is based on tariff rates. They, in turn, are calculated for the delivery of various types of cargo. If the available information is not enough to carry out calculations, then organizations have the right to use aggregated indicators. They have information about the price of TRP per 1 ton of cargo, which can be expressed in monetary terms or as a percentage of the cost. Moreover, indicators may differ depending on areas and types of construction.

The level of regulatory markup depends on the type of cargo. For example, if we are talking about the costs of adapting large-sized cargo, then the size of the TZR in the estimate is usually considered as 5% of the cost. This figure includes delivery costs, intermediary services and other expenses incurred.

Construction companies use route diagrams to calculate transportation costs. If they seriously differ from the established ones, then a calculation must be carried out. For this purpose, form 12 and 13 from Appendix R to the RDS Guidelines No. 8.01.105-3 is used. Such information is displayed as follows:

- First, the initial information is written down;

- then a direct calculation of future transportation costs for certain operations is made.

When carrying out calculations, construction companies are guided by SNiP No. 4.04-91. The types of prices used must also be taken into account. For example, the transfer of cargo can be carried out at the manufacturer’s warehouse, with an intermediary. The final cost level may include many components. This also includes allowances, if any.

Sometimes the buyer is unable to provide a detailed estimate. In this case, an agreement is concluded between the customer and the cargo manufacturer to display transportation and procurement costs as a percentage in the estimate of the cost amount. Moreover, the percentage value can be set at the level of regional standards or in accordance with individual calculations.

Procurement, storage and transportation costs in estimates

Most often, when calculating estimate documentation, we use the term transportation and procurement costs (TPP) - this concept, in addition to the above costs, can be divided into smaller, but important costs associated with the procurement and delivery of material assets (goods, raw materials, materials, tools). However, this term is more applicable to accounting than to budgeting, but it is often considered in this form.

Transportation and procurement costs include:

- - costs of loading, transportation and unloading, provided that they are not included in the price of the goods;

- — expenses for procurement, storage of materials, maintenance of warehouses, wages of workers associated with procurement, storage, shipment;

- — costs of paying for the services of intermediary organizations;

- — costs of payment for storage of materials at suppliers’ warehouses, railway stations, ports, marinas;

- — expenses for paying interest on loans associated with the purchase of goods;

- - and other expenses.

The amounts of transportation costs for materials and equipment in the estimate, procurement and warehouse, as well as packaging, containers and props can be summarized as a single reference in the following table:

Table No. 1. Amounts of procurement, storage and transportation costs in the estimate documentation

| № | Cost item | Method for determining estimated prices and the amount of transportation costs. |

| 1 | Fare | 1. Collections of estimated prices (FSTSpg, construction price). 2. Calculation of the cost of transportation costs based on actual expenses. 3. Calculation according to Order of the Ministry of Construction of Russia No. 517/pr dated 09/04/2019. 4. In the absence of standards, transport costs can be accepted in the amount of 3 - 6% of the selling price. |

| 2 | Procurement and storage costs | 1. For budget construction - 1.2% of the cost of materials and equipment. |

| 3 | Expenses for packaging, containers, props | 1. If the cost is not included in the price and in the absence of detailed information about the characteristics of the container and packaging, the cost can be calculated as a percentage of the cost of materials and equipment: - large technological equipment - from 0.1% to 0.5%; — machine equipment – up to 1%; - electrical equipment, instrumentation and automation, tools - up to 1.5%. |

TZR in accounting

TZR can be accounted for in accounting in several ways.

1. TZR can be directly included in the cost of inventories. The corresponding transactions in accounting are documented by posting Dt 10 Kt 60. This option is optimal if during the corresponding period there are no significant deviations in the amount of inventory for batches of the same type of inventory.

Let us note that if the average amount of material and equipment in the total cost of supplies does not exceed 10%, then it can not be taken into account separately - instead, including it in the cost of the batch of goods and materials. If it is possible to calculate the average percentage of inventories, the corresponding expenses can also be written off by increasing the cost of capitalized inventories by the calculated percentage of inventories.

2. It is possible to record transactions with inventories in separate subaccounts of inventory accounts and write them off as expenses in proportion to the turnover of used (sold) inventories.

The chosen option for accounting for goods and materials must be recorded in the accounting policy.