Work in progress: reflected in reporting

The cost of production costs not written off to the cost of finished products (work performed, services) is recognized as the cost of work in progress.

Work in progress is reflected in the balance sheet asset in the 2nd section “Current assets” in the line “Inventories”, being part of the amount of all inventories available at the reporting date. Read more about the structure of the balance sheet in the article “Balance sheet (assets and liabilities, sections, types)” .

You will find information on the procedure for filling out a balance sheet in this material .

You will learn how to fill out a balance sheet for “simplified” people by reading the material “How to fill out a balance sheet under the simplified tax system?” .

Reflection of the cost of finished products in the balance sheet

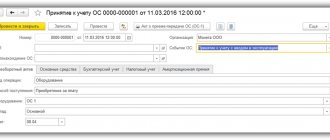

Finished products produced by the company are accounted for on account 43. They are one of the components of the organization's reserves and, in accordance with this, are shown in the balance sheet at actual cost.

However, there is a nuance here. Until the product has gone through all stages of production, it is impossible to calculate the actual costs of its creation. In this regard, it is customary for organizations to keep records of such products within a month at discount prices that are chosen by the company . At the end of the month, after all operations have been completed, actual production costs are collected and the cost of production is adjusted.

The following entries are made:

- The accounting value of products can be reflected as D43 K40 or D43 K20 (20, 29). The organization itself decides which method to choose.

- The difference between the accounting value and the actual value is reflected in D40 K20 (23, 29) or D43 K20 (23, 29). The posting is selected depending on which accounting method was selected

After the products are sold and written off, a balance appears, the amount of which should be reflected in line 1210.

Work in progress: accounting account

Costs in work in progress are taken into account in production cost accounts: 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”. But the answer to the question whether the costs of work in progress in accounting will be formed taking into account the costs accumulated in accounts 25 “General production expenses” and account 26 “General expenses” depends on what the organization has written down in its accounting policy.

Costs collected on account 25 for the month can be fully attributed to the main production cost account (20), or can be distributed either to 2 accounts (20 and 23) or to all 3 direct cost accounts (20, 23, 29) . The expenses accumulated on account 25, together with direct costs, form the production cost of products, works or services.

Account 26 can be distributed similarly to account 25 (then the full cost will be collected on the corresponding accounts), or you can write off the entire amount collected on it every month to the financial result (to the debit of account 90). In the latter case, the cost of a specific product (work, service) will not include its data.

Read more about account 20 in the material “Account 20 in accounting nuances).”

Line 1210 of the balance sheet “Inventories”

In line 1210 enter data on the total value of the company's inventories listed as of December 31, 2015. A breakdown of the data in line 1210 by groups and types of inventories listed in the organization is given in Section 4 of the Explanations to the Balance Sheet and the Income Statement. So, for example, the data could be given here:

- on the cost of raw materials and materials not written off for production, recorded in the debit of accounts 10 “Materials”, 15 “Procurement and acquisition of material assets”, 16 “Deviation in the cost of material assets”;

- on the cost of goods intended for resale, recorded in the debit of account 41 “Goods”;

- on the cost of finished products, recorded in the debit of account 43 “Finished products”;

- on the cost of finished products and goods shipped to customers, recorded as the debit of account 45 “Goods shipped”;

- on the amount of costs in work in progress recorded in accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”;

- on the amount of sales costs that were not written off to the accounts for accounting for sales revenue, recorded in the debit of account 44 “Costs of circulation”;

- on the amount of unwritten off deferred expenses recorded in the debit of account 97 “Deferred expenses”.

Raw materials

Raw materials include material assets that are the basis for the manufacture of a particular product, are included in its composition or are necessary components in its manufacture. In addition, raw materials are considered to be resources that are fully used in the process of the company's activities. According to the Chart of Accounts, these types of assets also include: purchased semi-finished products; finished components; fuel (oil, kerosene, gasoline, etc.) and lubricants; container; spare parts for repair of fixed assets; production waste (stumps, cuttings, shavings, etc.); inventory, tools and household supplies that are not included in fixed assets; special clothes.

Accounting for such property is regulated by PBU 5/01. According to paragraph 5 of the document, raw materials and materials are taken into account at actual cost.

Line 1210 includes the initial cost of raw materials and materials not written off for production as of December 31, 2015. It is recorded in the debit of account 10 “Materials”. This balance line shows the debit balance of this account as of the mentioned date.

Materials can be reflected both at actual cost and at accounting (planned) prices. When using the second option, their cost is formed using accounts 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets.” In this situation, line 1210 of the balance sheet indicates the debit balance of account 10 (accounting price of materials), 15 (cost of materials in transit) and 16 (deviations). If the balance of account 16 is credit, then it reduces the cost of materials at which they are reflected in the balance sheet.

The company has the right to create a reserve for depreciation of the cost of raw materials and materials. Its amount is taken into account in the credit of account 14 “Reserves for reduction in the value of material assets.” If there is a reserve, its amount reduces the cost of materials at which they are reflected in the balance sheet.

Formation of the actual cost of materials...

The actual cost of materials is based on all costs associated with the acquisition of this property (excluding VAT, if the company accepts it for deduction). According to paragraph 6 of PBU 5/01, such costs include, in particular:

- amounts paid to the materials supplier;

- expenses for information and consulting services related to the purchase of materials;

- customs duties accrued when importing materials into Russia;

- expenses for the services of the intermediary through whom the materials were purchased;

- costs for the procurement and delivery of materials to the place of their use;

- materials insurance costs;

- expenses for maintaining the company's procurement and warehouse division;

- interest costs on commercial loans provided by material suppliers;

- expenses for paying interest on bank loans received for the purchase of materials and accrued until the moment of their receipt;

- expenses for bringing materials to a state suitable for use for the intended purposes (for example, for their additional processing, sorting, packaging, improving technical characteristics);

- general business expenses directly related to the purchase of materials.

Like any other property, materials can be obtained in several ways. For example, purchased for a fee, manufactured by the company itself, received as a contribution to the authorized capital or free of charge, acquired as part of commodity exchange (barter) transactions, capitalized as a result of disassembly and dismantling of fixed assets. Depending on the method of acquiring materials, the company forms their initial cost.

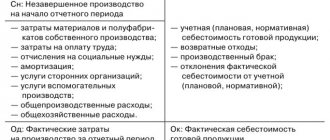

Composition of main production costs

Account 20 is used to account for direct and indirect expenses incurred in connection with:

- with the production of products of any kind;

- provision of all types of services;

- performing construction and contracting, design, survey and geological exploration work;

- carrying out repair work;

- carrying out design and research work, etc.

Direct expenses are written off to the debit of the “Main production” account from the credit of the accounts:

- 02 and 05 - regarding depreciation of property used for main production

- 10, 15, 16, 21 - for used inventories and costs associated with their acquisition;

- 60 and 76 - for production services directly related to the main production;

- 69 and 70 - regarding the salaries of the main production personnel and charges for it.

Defects subject to correction are also written off for the main production (Dt 20 Kt 28). Every month, from the credit of account 23 to account 20, part of the costs of auxiliary production is received, from the credit of account 25 - indirect costs (or part thereof) to ensure production, from the credit of account 26 - part of general business expenses (if the organization does not use the direct costing method and does not write off these expenses are debited to account 90).

Formation of the balance of work in progress

The actual cost of manufactured products (works, services) is written off from the credit of the “Main production” account. In this case, account 20, depending on the adopted accounting policy, corresponds with accounts 40, 43, 90.

The balance of account 20 remaining at the end of the month reflects the value of the main work in progress (WIP).

Balances on accounts 23 “Auxiliary production” and 29 “Service farms” are formed in a similar way. Accordingly, the balance on account 23 shows the cost of auxiliary work in progress, and the balance on account 29 shows the cost of work in progress at service farms.

The balance of work in progress in accounts 20, 23, 29 is the balance of work in progress in accounting for the organization as a whole. Work in progress - account 20 + account 23 + account 29, not closed at the end of the reporting period - the balances on them are summed up with other data entered in the “Inventories” line in the balance sheet.

The procedure for filling out a balance with a breakdown of accounts is discussed in detail in the Guide from ConsultantPlus. Get free trial access to the system and study the material.

Does not apply to work in progress:

- raw materials, supplies, purchased finished products transferred to workshops (sites), but not processed;

- rejected semi-finished products that cannot be corrected.

Read about the entries that arise when accounting for irreparable defects in the article “Accounting for defects in production - accounting entries.”

Organizational inventory accounts. Formula for calculating the amount of reserves

Since an organization’s reserves include many different types, there are quite a lot of accounts for their accounting. To calculate the amount of inventory for reporting, it is necessary to collect information on the following accounts:

- Account 10. It collects information about the cost of those material resources that are involved in the production of products. This includes the raw materials from which products are made, fuel, spare parts, containers, equipment and other similar property. Special clothing is also taken into account here.

- For livestock organizations, account 11 is relevant, which takes into account animals on the balance sheet

- When purchasing inventories, depending on the provisions of the accounting policy, accounts 15 or 16 can be used. When inventories are received from suppliers, in this case posting D15 (16) K60 is made. After registering, for example, fuel, a D10 K15(16) entry is made. But since this method of accounting is quite cumbersome and intermediate posting appears, these accounts are often not used

- The calculation involves accounts reflecting the presence of semi-finished products or defects - accounts 21 and 28, respectively. The amounts for them must be taken into account when calculating

- Information on different types of production is collected on accounts 20, 23 and 29

- The next large group for which information is collected when calculating data for line 1210 of the balance sheet concerns goods and products already produced. This includes accounts 41, 42, 43, 44, 45

- In addition, when calculating, the amount in account 97 is taken into account, but not all, but only that which relates to expenses written off during the year

Account 14 deserves special attention. The organization’s accounting policy may include a condition for creating a special reserve to reduce the cost of inventories. This reserve is created at the end of the year, before the balance sheet is formed. This occurs if the value of inventory at accounting prices is higher than at market prices. That is, the amount of the reserve is the difference between the book value and market value, multiplied by the amount of inventory .

The creation of such a reserve is reflected in D91 K14, and its write-off in D14 K91.

Direct and indirect costs

Features of accounting for costs related to work in progress are determined by industry guidelines, since they quite strongly depend on the specifics of the type of specific production.

There is no clear list of costs that should be classified as direct in the law on accounting and other regulatory materials. There is only a mention in the Instructions for using the chart of accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n, that direct costs should include the cost of inventory and the cost of paying workers involved in the production process.

Such uncertainty in regulations indicates that the enterprise, in accordance with the characteristics of its production, should reflect in its own accounting policies which costs for accounting purposes will be classified as direct and which as indirect.

Direct costs include:

- material costs for production (raw materials, materials, semi-finished products and components);

- expenses for remuneration of personnel involved in production and maintenance of the production process;

- expenses for compulsory pension, social and medical insurance accrued for the remuneration of the above-mentioned personnel;

- depreciation charges for fixed assets used in the production process.

For methods for valuing inventories written off for production, read the material “Methods for valuing inventories .

Then all other expenses will be indirect.

To learn how to divide production costs into direct and indirect for income tax purposes, read the article “How to divide income tax expenses into direct and indirect?” .

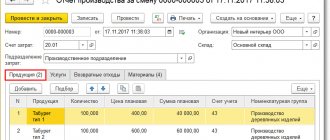

Work in progress in accounting

In accordance with paragraph 63 of the PBU on accounting and accounting, approved by Order of the Ministry of Finance dated July 29, 1998 No. 34n, products or services (work) that have not completed all phases of the production cycle should be classified as work in progress (work in progress). This also includes products that are understaffed and/or have not passed testing and technical acceptance.

As stated in paragraph 64 of the PBU on accounting and accounting, for reflection in the balance sheet, the assessment of work in progress can be carried out according to:

- actual production cost;

- standard (planned) production cost;

- cost of material costs (raw materials, materials and semi-finished products);

- the amount of direct costs.

Those enterprises that have established serial or mass production can choose one of the indicated methods for assessing work in progress. And those manufacturers who produce products in single copies should show work in progress only based on actual costs incurred.

The chosen method of assessing work in progress must be fixed in the accounting policy. When choosing a method for estimating work in progress using direct cost items, it is recommended that the accounting policy reflect how the organization will distribute current expenses and work in progress balances at the beginning of the month between the release of finished goods and work in progress at the end of the month.

From 2022, the procedure for assessing work in progress is determined by the new FSBU 5/2019 “Reserves”. It is discussed in detail in the Ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Details

Accounting for finished products is carried out at actual (debit 43 Credit 20 - receipt of goods at the warehouse) or planned cost (debit 43 Credit 40 - receipt of goods at the warehouse).

After the goods have arrived at the warehouse, they need to be sold. Unsold products are recorded in line 1210 as a debit balance.

Products that must be sold are taken into account in the balance sheet according to the following scheme:

By debit 41 accounts (goods in warehouse) - by credit 42 accounts (trade margins) + by debit 44 accounts (selling expenses) + by debit 45 accounts (goods shipped). In accordance with Order No. 66n, in line 1210 of the balance sheet, the numbers are not written in thousands of rubles (for example, not 55,000, but 55 thousand).

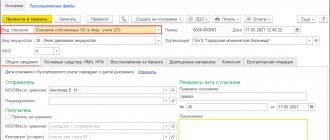

Unfinished cost accounts - on them the organization generates all expenses related directly to the production process. In the balance sheet, work in progress is shown as the value of debit balances. The best option is when all costs are reset to zero at the end of the year.

Costs accounted for in the debit of account 97 (deferred expenses) - the company spent on them in the current month, however, they will be deducted next month. Such expenses include: licensing, insurance, subscription services, and other expenses deferred to the future. For example, an enterprise is insured for 12 months, the insurance policy was purchased at full price, but insurance costs will be written off monthly. For example, an enterprise insured gas equipment for a period of one year on September 1. The cost of insurance was 36,000 rubles. Monthly write-off: 36,000/12=3,000 rub.

Typical wiring:

— debit 76 accounts Credit 51 accounts – payment for an insurance policy in the amount of 36,000 rubles;

- debit 97 account credit 76 account - receipt of an insurance policy from the insurer in the amount of 36,000 rubles;

- debit 23 (20.26) accounts credit 97 accounts - written off for expenses of 3,000 rubles per month;

— 3,000 rubles *4 months = 12,000 rubles;

36,000 – 12,000 =24,000 rub.

The amount not written off as of December 31 in the amount of RUB 24,000 is entered into the balance sheet line for deferred expenses.

Inventories on the balance sheet, in other words, are a current asset indicating the material well-being of the company. The absence of indicators in line 1210 or their sharp drop may indicate an insufficient amount of resources in the company’s warehouses. However, there are exceptions when the movement of asset turnover into cash proceeds so quickly that the enterprise does not keep up with the activities of the marketing service.

Results

The balance on the accounts “Main production”, “Auxiliary production”, “Service production and farms” at the end of the reporting period indicates that there is unfinished production. The cost characterizing work in progress at the end of the reporting period is taken into account in the data that forms the indicator of line 1210 of the “Inventories” balance sheet.

Account 20 takes into account direct production costs;

Every month, at the end of the month, part of the indirect expenses is included there, taking into account the peculiarities of their distribution established by the accounting policy. In addition, the accounting policy establishes the rules for dividing expenses into direct and indirect, the procedure for closing accounts for indirect expenses and assessing work in progress. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Line "Inventories" in the balance sheet

Inventories in the balance sheet are reflected in the second asset section on line 1210. It combines information about all types of inventories (MPI) at the beginning and end of the period.

Inventory includes several categories of assets, for the accounting and movement of which a number of accounting accounts are used. Upon completion of all operations related to inventories for the year, the debit balances of the accounts participate in the formation of the total amount in line 1210:

- 10 "Materials",

- 11 “Animals for fattening and growing”,

- 15 “Procurement/purchase of MTs (material assets)”,

- 16 “Deviations in the cost of MC”,

- 20 “Main production”,

- 21 “Semi-finished products of our own production”,

- 23 “Auxiliary production”,

- 28 “Defects in production”,

- 29 “Service industries”,

- 41 "Products",

- 43 “Finished products”,

- 44 “Sales expenses”,

- 45 “Goods shipped”,

- 97 “BPR (deferred expenses)”,

and credit balances on accounts:

- 14 “Reserves for reducing the cost of MC”,

- 42 “Trade margin”

The amount of inventory on the line “Inventories” in the balance sheet asset at the end of the year is calculated using the formula:

Ʃ MPZ = Sum of debit balances for accounts 10,11,15,16,20,21,23,28,29,41,43,45,97 – Sum of credit balances for accounts 14 and 42.

Let us consider in detail how the final result is formed, reflecting the value of the MP in the balance sheet.