Features of drawing up a foreign currency payment order

The emergence of “bank clients” has replaced paper forms in the banking sector. Although paper forms are still used, for example, to print and create a backup copy.

The payment order form and the procedure for filling it out are necessary for such an area as foreign exchange transactions. Payment in foreign currency must meet the requirements:

- Russian legislation on currency regulation and control;

- international standards ISO (International Organization for Standardization);

- standards of the SWIFT (Society for World Wide Interbank Financial Telecommunications) system.

Preparation of payment documents in foreign currency: where to start

In order to understand the details of processing a foreign currency payment, we will consider the most general case:

- the payment is made in foreign currency to a non-resident;

- payment is made under a foreign trade contract;

- the payment leaves the Russian bank to a foreign bank

How a buyer can take into account settlements under a contract in foreign currency is explained in detail in the Ready Solution from ConsultantPlus. Get trial access and proceed to the material. It's free.

To begin correctly processing a payment in foreign currency, you must first register with the bank (clauses 4.1, 4.2 of Instruction No. 181-I):

- import contract, loan agreement, the amount of obligations under which is equivalent to 3 million rubles. and more;

- an export contract, the amount of obligations under which is equivalent to 6 million rubles. and more.

IMPORTANT! Until 03/01/2018, along with the contract, it was necessary to submit a transaction passport to the bank. But after the Central Bank’s instruction dated August 16, 2017 No. 181-I came into force, the passports were cancelled.

More information about control of settlements with foreign counterparties and the nuances of registering a transfer agreement can be found in the article “Currency control when transferring money abroad.”

- take the payment form for the currency transfer that your bank uses. The general requirements for filling out such payments are established by instruction No. 181-I, but there is no uniform form for all - therefore the bank usually develops and approves its own;

- decide on the details of the payment: who pays the commissions and fees for the transfer - the payer, the recipient, or both (in the practice of international payments there are different options);

- how currency will be purchased to complete the transaction: the company will buy it in advance itself or instruct the bank to exchange the required amount immediately on the basis of a payment order;

- Is there a currency clause in the contract that may adjust the payment amount?

For information on currency clauses, see: “Sample of a currency clause in a contract and its types.”

Currency payment order form

IMPORTANT!

The codes located on the left (for example 33B, 52a, etc.) correspond to a specific field of the SWIFT format in the international ISO system. According to SWIFT standards, such payments do not allow the use of characters like: №, %, #, $, &, “ “, =, @, \, { }, [ ], ;, *,!, _, .

The correctness of the details is important for both the payer and the bank for the purposes of:

- reducing the risk of erroneous execution of orders for payment in foreign currency;

- acceleration of currency control procedures and greater efficiency of payment;

- reducing translation costs by reducing the number of investigations into unaccepted or erroneously accepted payments;

- fulfillment of obligations to the counterparty without additional costs, including due to failure to meet payment deadlines.

Field 33B Amount and currency

Filling out is required.

Indicated:

- Transfer amount – the amount of funds that the paying client transfers. The whole part of the amount is indicated without separators (including spaces). If the amount is presented only as an integer part, then two zeros (00) must be indicated after the decimal point.

- ISO currency code (see currency code reference). When transferring funds from the client's account in a currency different from the currency of the paying client's account specified in field 50a, the amount received as a result of converting the transfer amount at the rate agreed with the client is debited.

When transferring in Belarusian rubles (BYR):

- Amounts in Belarusian rubles are indicated without kopecks. Sberbank of Russia does not accept payments in which the transfer amount is indicated in kopecks.

Currency control

All transactions with foreign currency are under special control of the state. The main regulatory legislative act of December 10, 2003 No. 173-FZ. The regulation procedure is determined by the Central Bank of the Russian Federation and the Government (Clause 1, Article 5 No. 173-FZ).

The law primarily applies to residents and non-residents. Residents include, inter alia, legal entities created in accordance with the legislation of the Russian Federation, and non-residents include legal entities created in accordance with the legislation of foreign states and located outside the territory of the Russian Federation (Article 1 No. 173-FZ).

Currency transactions between residents and non-residents are carried out through authorized banks (Clause 1.1, Article 19. No. 173-FZ).

As part of control, residents are required to provide authorized banks with the information specified in clause 1.1. Art. 19. No. 173-FZ, including:

- the expected timing of receiving foreign currency or Russian currency from non-residents for the fulfillment of obligations under contracts;

- expected terms of fulfillment by non-residents of obligations under agreements.

Documentation of control requirements is carried out on the basis of Instruction of the Central Bank of the Russian Federation dated June 4, 2012 No. 138-I. It contains the procedure for residents to provide control documents, the forms of these documents, as well as information for filling them out, in particular, the code for the type of currency transaction in the payment order.

Field 70 Payment purpose

Filling out is required. Information about the payment intended for the beneficiary client is indicated, including: the purpose of the transfer (payment for the contract / agreement / training / voucher, financial assistance, etc.), number and date of the agreement / contract, sales documents, name of the work performed / services provided, goods, etc. (no more than 140 characters, format 4*35x).

When transferring funds to foreign banks (including the Baltic countries), information must be provided in English. When transferring funds to Russian banks and banks in the CIS countries, information may be indicated in Russian. When transferring funds within Sberbank of Russia, information must be indicated in Russian (without transliteration into Latin).

Information in the field can also be specified using code words (see field 70 code words reference) enclosed in slashes /. Features of using code words:

- information must be indicated behind the code words;

- Several references can be indicated after the code words, but then they must be separated by two slashes //;

- code words between two homogeneous references are not repeated;

- When transferring the information specified after the code word to the next line, no characters are required.

For example:

/INV/abc/SDF-02//1234-123///ROC/02E

U87/RFB/BET072

When transferring in Ukrainian hryvnia (UHR):

- The following is indicated: the content of the transaction (for which product/service the payment is being made); contract number; date of conclusion of the contract (in the format YYYY.MM.DD).

When transferring in Belarusian rubles (BYR):

- The contract number and the date of its conclusion are indicated; name of goods, works and services for which payment is made.

- It must be filled out in Russian using the substitution of Russian letters for Latin ones.

When converting into Kazakhstan tenge (KZT):

- The payment purpose code (KNP) from the State classifier - the Unified Payment Purpose Classifier (UPC) is indicated on the first line. The KNP is indicated in the following form: KNP-7!n, where 7!n is the code from the EKNP.

- When making tax payments to the budget, the budget classification code (KBK) is indicated in the following form: KBK6!n, where 6!n is the KBK code.

- The number and date of the trade document, transaction, contract, agreement are indicated.

- The amount of value added tax (VAT) is indicated, if any, except for settlements between correspondent banks.

Types and codes of currency transactions

Appendix 2 of the Central Bank of the Russian Federation Instruction No. 138-I contains a list of transactions of residents and non-residents. It is used to process transactions and related documents. The currency transaction code in the payment order is indicated based on the data specified in the List.

Here are some codes in general form (the code for the type of operation group is not considered):

| Operation type code | Name of the type of operation | |

| 01 | 010 | Sale by a resident of foreign currency for Russian currency |

| 01 | 030 | Purchase of foreign currency by a resident using Russian currency |

| 11 | 100 | Payments by a resident in the form of advance payment to a non-resident for goods imported into the territory of the Russian Federation, with the exception of payments specified in group 23 of the List |

| 13 | 020 | Settlements by a resident in favor of a non-resident for goods sold on the territory of the Russian Federation, with the exception of settlements under codes 23110, 23210, 23300 of the List |

| 20 | 200 | Payments by a non-resident for work performed by a resident, services provided, with the exception of payments under code 20400, and those specified in groups 22 and 58 of the List |

IMPORTANT!

The type of currency transaction in the payment order is indicated in numbers.

The absence of a unified federal form of payment order for the transfer of foreign currency has led to the appearance in each bank of some differences in the details and procedure for filling out this document.

Another feature is that currently filling out almost every banking document is carried out through the “bank-client” application interface, which also differs from the type of similar program in another bank.

With this specificity in mind, let’s look at the procedure for filling out a payment order step by step, using the form from the first section of our article.

Non-resident codes

The transaction type code is a combination of 5 digits that reflects the essence of the banking transaction being carried out. It consists of two parts:

- the first 2 digits indicate the group of the operation being performed;

- the remaining 3 digits indicate the essence of the currency transaction.

The current list of codes can be found in Appendix No. 1 to Bank of Russia Instruction No. 181-I dated August 16, 2017 (as amended on July 5, 2018). The encoding is selected taking into account the purpose of the payment and the content of the documents accompanying the transaction. The code and payment purpose must match, otherwise the bank will reject the funds transfer operation.

If an accountant has any difficulties regarding how to correctly fill out a payment order to a non-resident and which code to choose from the Central Bank Instructions for a specific transaction, he can seek advice from a representative of his servicing bank.

This code is mandatory for payments for currency transactions. This requirement is specified in clause 2.13 of Instruction No. 181-I.

If the code in the payment is not specified or is specified incorrectly, the bank will reject the payment due to the inability to control the movement of funds. And the sender of the funds will have to fill out the payment form again. It should be noted that Instruction No. 181-I also contains a list of situations when, due to an error in the code, the bank will accept a payment document (Chapter 16 of Central Bank Instruction No. 181-I).

Sample of filling out a foreign currency payment order

Let's consider the conditions that:

- a transaction is completed for our payment of 10,000 US dollars to the Turkish supplier (hereinafter referred to as the beneficiary), in the form of advance payment for goods imported into the territory of the Russian Federation;

- payment is made directly from a current account in Sberbank (without purchasing currency);

- terms of payment: commissions of our bank are carried out at the expense of the payer, and commissions and expenses of other banks are at the expense of the beneficiary client (SHA details in the “Commissions and expenses” section of the order).

Step 1: details of the parties

Indicate not only the details of the beneficiary and his bank (indicating, if necessary, the clearing code), but also your own details in English: international details of your bank, foreign currency account number and more.

In the filling samples, improvised details of the parties are indicated, in fact, they are determined by the foreign trade agreement.

IMPORTANT!

Details are indicated in the currency order in capital letters (upper case).

Step 2: Exchange control data

At this stage, information from the transaction passport can be used.

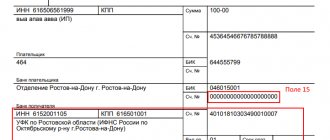

Step 3: filling out the top part (“header”) of the order

Indicate the document number, the date of its preparation, the payment amount and the ISO code of the payment currency (in the example, the code is US dollars, USD).

Step 4: payer details

Enter the data collected in step 1 in the fields of the “Payer Client” and “Payer Bank” sections.

Step 5: recipient details

Enter the data collected in step 1 in the fields of the “Beneficiary Bank” and “Beneficiary Client” sections.

Step 6: Section “Payment Purposes” and “Commissions”

Indicate the purpose of payment (in English, not Turkish) and check the SHA option (see payment terms at the beginning of this section of the article).

Step 7: Opcode

Indicate the code of the type of operation, defining it in Appendix 2 of the Instruction of the Central Bank of the Russian Federation No. 138-I. For our case it will be:

| 11 | 100 | Payments by a resident in the form of advance payment to a non-resident for goods imported into the territory of the Russian Federation, with the exception of payments specified in group 23 of the List |

If the transaction passport has already been issued, then its number and date are indicated. Since the example considers an advance payment for goods, the field “Customer declaration No.” is not filled in, since the goods have not yet been delivered.

The registration is completed with the signatures of authorized persons of the organization and a seal (if applicable).

The general appearance of the completed order should be as follows:

Field 57a Beneficiary's bank

Filling out is required. Indicate the details of the bank in which the beneficiary client's account is serviced (field 59a).

The field is filled in one of four options:

- If you have a SWIFT code: SWIFT code and the corresponding name of the beneficiary's bank;

- City, country.

- national clearing code (see the reference book Structure of National Clearing Codes) and the corresponding name of the beneficiary's bank (full);

Note: In this case, filling out field 56a is mandatory.

- the number of the correspondent account of the beneficiary's bank with the intermediary bank, which it is advisable to indicate without service separator characters (hyphen, space, etc.);

name of the beneficiary's bank (full);

- name of the beneficiary's bank (full);

When transferring in Ukrainian hryvnia (UHR):

- The code of the bank participating in interbranch turnover (MFO), assigned by the National Bank of Ukraine (NBU) to resident banks of Ukraine and their branches, is indicated. The MFO code is indicated in the Clear subfield. code in the form of a national clearing code (see the reference book Structure of national clearing codes): //UA6!n , where 6!n is a microfinance organization of a resident bank of Ukraine. For example: //UA300335.

When transferring in Belarusian rubles (BYR):

- The interbranch turnover code (MFO) of the beneficiary bank is indicated in the form of a national clearing code in the Clear field. code (see the reference book Structure of national clearing codes): //BY[6!n]3!n , where [6!n]3!n is the code of the MFO bank in the Republic of Belarus.

When converting into Kazakhstan tenge (KZT):

- The bank identification code (BIC) of the beneficiary's bank is indicated after the name of the bank with the designation BIC in the following form: BIC9!n , where 9!n is the BIC of the bank in Kazakhstan.

When paying in Chinese Yuan (CNY):

- If the country code is 156 CHINA and the bank is not part of the Bank of China group (the bank's SWIFT does not begin with BKCH), then in the Cor. account, you must indicate the bank's CNAPS code containing 12 or 14 characters.