If the buyer decides to return the goods to the supplier, a special document will be required - a return invoice. In case of return of goods already accepted for accounting, an invoice in the TORG-12 form is used. Such a document is used only when resolving issues between legal entities and individual entrepreneurs; in case of returning goods in retail trade, this return invoice is not used. In the article we will consider in what cases and how the TORG-12 consignment note is drawn up, and we will also provide a sample of how to fill it out.

Registration of goods return to the supplier

If the customer, upon acceptance of the goods, even before registering it, discovers discrepancies, then the parties must sign a statement of discrepancies. This act is the return invoice TORG-12. If the customer has already accepted the goods for accounting, and only then discovered discrepancies, then a return invoice is drawn up, to which the grounds for return are indicated (inconsistency in quantity, inadequate quality or hidden defects). The return invoice is accompanied by supporting documents, which are acts, claims and letters. All information about discrepancies must be indicated in the return documentation (

The legislative framework

In the Civil Code, the buyer’s right to return goods received is provided for by the following rules: clause 2 of Art. 475; clause 3 art. 468; clause 2 art. 480; clause 3 art. 482. The Civil Code of the Russian Federation provides only some reasons for the return, but it does not prohibit the return of goods and materials for other reasons. In particular, you can return even high-quality goods, the delivery of which was paid for by the buyer. But such a condition must be provided for in the contract.

At the end of this article, anyone can download the return invoice form for free.

When can a product be returned?

In accordance with current legislation, the customer has the right to return the goods to the supplier if:

- the goods received do not comply with the terms of the contract, for example, their quality, quantity, configuration or packaging;

- the delivered product has expired;

- the product cannot be used and sold;

- the assortment is being updated;

- the goods are not accompanied by accompanying documents;

- delivery deadlines for goods were violated;

- there was a delay in payment;

- defective products were discovered;

- other reasons.

Important! The customer checks the compliance of the characteristics specified in the contract with the supplier during the acceptance of the goods, or upon acceptance within the period established by the contract or legislation.

If a quality supply is returned

This situation can only be resolved if there is a condition in the contract or with the consent of the seller. If there are no such conditions in the contract, but there is the seller’s consent to accept the delivered products, an additional agreement should be drawn up with a mandatory indication of:

- reasons for refusal;

- return dates;

- delivery conditions;

- the procedure for making payments;

- other conditions necessary for the parties.

There is no approved form for such an additional agreement. We offer you a sample.

Refusal of a delivery for which there are no quality claims is reflected in the following entries:

| From the seller | From the buyer | ||

| Dt 41 Kt 62 | Products returned by the buyer are registered | Dt 41 Kt 60 reversal | for the amount of returned products |

| Dt 19 Kt 62 | reflected “input” VAT | Dt 19 Kt 60 reversal | for the amount of VAT on returned inventory items |

| Dt 68 Kt 19 | accepted for deduction of “input” VAT | Dt 68 Kt 19 reversal | for the amount of VAT accepted for deduction |

| Dt 62 Kt 51 | money was returned to the buyer | Dt 51 Kt 60 | received funds from the seller |

Refusal of goods and materials in specialized accounting/tax accounting programs is formalized by the buyer with a special document - “Return of goods to supplier”.

If a citizen identifies defects in a product, he or she has the right to demand money by filling out a form to return the product to the supplier.

Return processing times

When accepting the goods, the buyer checks its quality, compliance of the supplied quantity with that specified in the documents, as well as the packaging. If any discrepancies are identified, then a return certificate is drawn up even before the goods are received. You can return low-quality goods within the established time frame (Article 477 of the Civil Code of the Russian Federation):

- no later than 2 years – if the manufacturer has not provided a guarantee for the product;

- during the shelf life of the product, if available;

- during the product warranty period.

In the case of retail trade, the date indicated in the official document upon sale will be the beginning of the period for returning the goods.

When processing a product return, the supplier must prepare certain documents:

- acceptance certificate, which indicates the registration number;

- a claim made in writing in free form;

- return note.

In what cases is it necessary to do

The return of low-quality goods to the counterparty is determined by articles: 468, 475, 480 and 482 of the Civil Code of the Russian Federation

If any of the following violations are found in the product, the buyer can make a return or demand replacement with products of proper quality.

- Goods without packaging or in inappropriate packaging material;

- There are no accompanying documents for the product;

- Violations in delivery times;

- Delay in payment;

- Impossibility of further sales of products;

- The product package is incomplete or incorrect;

- The product was found to be defective;

- The quantity of goods does not match the invoice data;

- The product has expired.

On a note! The legislation also provides for other return situations if they were specified in the supply agreement.

Return note TORG-12

Important! The return invoice (form TORG-12) is a special document drawn up with the necessary details and in accordance with the regulations established by law. In the event of a special audit, the tax authority may request invoices from the organization.

A return invoice is issued if the product is found to be defective or does not meet quality standards. This document is a confirmation of the shipment of the goods from the supplier and its receipt by the buyer. Based on the consignment note, goods in the warehouse are taken into account, and the resulting final information is entered into the financial statements (

How to prepare a return invoice TORG-12

The procedure for issuing a return invoice TORG-12 will be as follows:

- the document must contain the name “Invoice”, as well as the serial number and date of preparation;

- further, the Supplier’s details are indicated (its name, INN and KPP, legal address and bank details);

- information on the Shipper is indicated (the details of the shipper are filled in by analogy with the Supplier);

- information is entered (company details and bank details) for the Payer;

- information about the Consignee is filled in (as a rule, the Consignee and the Payer are the same, in this case you can indicate “he”);

- the basis for returning the goods is indicated (this may be a supply agreement or other agreement), the number and date of the document;

- further describe the product that the buyer returns to the seller (indicate its name, quantity, price, as well as the total cost in accordance with the quantity and price);

- the document is signed by the heads of the consignee and the consignor (the finished TORG-12 is stamped and the date of drawing up the return document).

Important! The return invoice must be issued in two copies, one of which remains with the buyer, and the second is given to the seller.

TORG-12 can be filled out by hand, without errors, typos or corrections. You can also create an invoice in 1C or in the VLSI program.

SAMPLE TORG-12

How to fill out a statement of discrepancy

If the customer identified discrepancies in inventory and materials during the acceptance process and did not have time to register the products and register the transactions, then the return is carried out using the following forms:

- TORG-2 - for inventory items of Russian origin;

- TORG-3 - for imported products.

In fact, this is not a return invoice, but an act in which the customer makes claims to the supplier regarding the entire delivery batch or individual types of products. The procedure for filling out the return certificate is as follows:

- Fill in the information about the customer organization, enter the address and contacts and the necessary codes according to the all-Russian classifier.

- Indicate the details of the act - its number and date.

- Fill in information about the place of delivery, the basis document (primary delivery note), the consignor and consignee, and the government contract.

- Indicate the time of receipt of the goods.

- On the second and third sheets, document the reason for the return - indicate all quantitative and qualitative discrepancies, actual and planned indicators and their discrepancies.

- The last page of the form indicates the persons responsible for shipment, delivery and acceptance. The members of the commission that identified the inconsistencies are listed. All commission members must sign. In addition to the commission, the form is signed by the chief accountant. At the end of the document, the customer’s manager makes his decision.

The rules for forming TORG-2 and TORG-3 are absolutely the same.

IMPORTANT!

Form No. 2 is used to formalize the return of domestically produced goods, and form No. 3 is used to return foreign goods.

Invoice for return note

The return of defective products is a business transaction that must be reflected in the accounting accounts. Moreover, each operation must be accompanied by a supporting document.

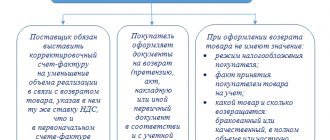

In addition to the return label, a return invoice may also be issued. When registering a return, the product is returned to the supplier either of proper or inadequate quality. In this case, the return occurs either before the invoice is signed or after it is signed.

When registering the return of goods between organizations on OSNO, quality products can be returned only if there is mutual agreement of all parties, and this condition must be provided for in the agreement. If ownership of the goods has passed to the buyer, and the goods have already been accepted for accounting, then the return will be processed as a reverse sale. In this case, the buyer will have to issue an invoice to the counterparty for the cost of the returned goods. This invoice must be recorded in the sales ledger.

Important! Reverse sales must be made for the same amount as the purchase of the goods.

When registering the return of low-quality goods not accepted for accounting between organizations on the OSN, the buyer does not have to issue an invoice for the return, nor do they have to calculate VAT. The supplier issues an adjustment invoice on its own behalf, which is not entered into the sales book by the buyer. This is due to the fact that there is no input VAT on this purchase. If it turns out that the goods are defective after they have been accepted for accounting, the buyer unilaterally terminates the contract and formalizes this with special documents. An adjustment invoice is issued by the supplier and such a return is not recognized by the sale. In case of a partial return, the buyer does not need to issue an invoice on his own, since part of the goods has already been accepted for accounting. An adjustment invoice is issued by the seller for the balance of the goods that remains after the return. The seller enters the invoice into the purchase book, after which he makes a VAT adjustment to the budget. The buyer, in turn, registers in the purchase book that part of the goods that he accepts for accounting.

How to issue a return in case of defect

Here is a list of what documents to fill out to return goods to the supplier due to defects:

- An act on identified deficiencies, on the basis of which a claim is made to the supplier (a self-developed form containing all the mandatory details of the primary document). This form is applicable when rejecting inventory items already accepted for accounting. When returning at the acceptance stage, you can use the TORG-12 consignment note (marked “return”).

- Return note.

- A letter (claim) to the seller demanding to accept the goods and materials back and return the amount paid for it.

Sample act

Sample letter of claim

When registering unaccepted goods and materials, no sale occurs (no transfer of ownership). No transactions are reflected in the buyer's accounting. In the seller's accounting, such a transaction is reflected by records of reversal of transactions recorded for the sale of returned goods.

When returning products accepted for accounting to the seller and buyer, use the following entries to return the goods to the supplier:

| From the seller | From the buyer | ||

| Dt 62 Kt 90-1 reversal | for the amount of income from the sale of inventory items | Dt 76-2 Kt 41 | for the returned value |

| Dt 90-3 Kt 68 reversal | for the amount of accrued VAT | Dt 76-2 Kt 68 | for the amount of VAT on returned inventory items previously accepted for deduction |

| Dt 90-2 Kt 41 (43) reversal | reversal for the amount of expenses for the purchase of inventory items (production of finished products) | Dt 51 Kt 76-2 | money refunded for poor quality delivery |

| Dt 62 Kt 51 | money was returned to the buyer | ||

Returning goods under special conditions

Companies that are on the simplified tax system and UTII are exempt from paying VAT. They do not have to issue an invoice, and the procedure for document flow will depend on whether the entire shipment is returned to the seller or only a part.

If the goods are returned in full, the seller enters the invoice into the purchase book. The document is registered in the tax period when the goods are returned.

In the case of returning only part of the goods, the seller issues an adjustment invoice for the total cost, and also adjusts the amount of tax to the budget. In this case, the cost in the adjustment invoice must match the amount for which the goods were returned from the buyer.