Recently, Russian enterprises have begun to widely use the capabilities of various contractual policy instruments (methods of terminating obligations). But in addition to the obvious advantages of such tools, you need to be aware of their disadvantages. This article will discuss the innovation of obligations as an instrument of contractual policy. Features of accounting and tax accounting when using them are considered by V.S. Rzhanitsyna, head of the group's investment projects department.

In accordance with Article 414 of the Civil Code of the Russian Federation, novation, as one of the types of termination of obligations, is an agreement of the parties to replace the original obligation that existed between them with another obligation between the same persons, providing for a different subject or method of execution. Thus, during innovation, the subject composition (parties) of the obligation remains unchanged. It is necessary to distinguish innovation from changes in any conditions of the obligation (the deadline for its fulfillment, amount, etc.), under which the original obligation does not terminate, but continues to operate taking into account the changes made. From an accounting point of view, the conclusion of an agreement on the novation of an obligation means the simultaneous reflection of the repayment of the original obligation and the emergence of a new one. As a general rule, accounting and taxation of novation transactions is carried out in the same way as provided for the contractual form to which the original obligation is replaced. That is, after concluding a novation agreement, the rules applicable to the new obligation are applied.

In tax legislation, innovation for the creditor is equated to payment of the original obligation and serves as the basis for the assessment of taxes, although the final settlement of the contractual relations of the parties has not yet occurred. At the same time, the debtor, according to the tax authorities, cannot receive a VAT deduction on the original transaction until the new obligation is repaid. This opinion is based on the fact that the norm of paragraph 2 of Article 167 of the Tax Code of the Russian Federation on recognizing the termination of a counter-obligation (including innovation) as payment applies only to determining the tax base for sales, that is, it is valid only for the supplier. While in the part of Chapter 21 of the Tax Code of the Russian Federation devoted to deductions, there is no indication that the termination of a counter-obligation is recognized as payment. Article 171 of the Tax Code of the Russian Federation states that amounts paid by the taxpayer when purchasing goods, works and services are subject to deduction. A similar logic is present, for example, in the Resolution of the Supreme Arbitration Court of the Russian Federation dated May 15, 2002 No. 11290/01 regarding the termination of an obligation by assignment of claims. Therefore, in practice, taxpayers are denied deductions at the time of novation, when the obligation to pay is legally terminated, until the moment of payment of funds to satisfy the new obligation.

In our opinion, here we are faced with a different tax interpretation of contractual relations arising from one agreement for its two parties. At the same time, in accordance with the rules established in the general part of the Tax Code of the Russian Federation, taxation must be based on the principles of universality and equality, and taxes must have an economic justification and cannot be arbitrary. Therefore, recognition of innovation as payment for the original contract for one party and non-recognition for the other seems inconsistent. It is likely that in the future, law enforcement practice will overcome this contradiction, and both parties to the novation agreement will be equal in their rights in relation to VAT.

Innovation can be carried out in different forms. As a rule, it is addressed when one of the parties to the original contract has fulfilled its obligation, but the other was unable to do so on time and does not see the possibility of fulfilling the terms of the contract in the future. In most cases, the initial agreement is a supply agreement, sale and purchase agreement, lease agreement and the like with deferred payment. If the buyer is unable to make payment in accordance with contractual requirements, then he can enter into an agreement with the supplier to replace this obligation with a loan or a counter-delivery obligation.

Let's consider the features of accounting and taxation for different cases of innovation.

Signs of innovation

The new obligation must provide for at least one of the following conditions:

- other subject of the contract. For example, when, instead of performing work paid for by the counterparty, the organization assumes the obligation to repay the newly issued loan;

- method of execution. For example, when, instead of paying for the purchased goods, the organization makes a counter-delivery of other goods.

If the changes concern only other terms of the agreement (in particular, the timing and procedure for settlements), such an agreement is not recognized as a novation. For example, a deferment for payment of a contract granted by the counterparty does not concern either the subject of the contract or the method of its execution. It changes the timing of settlements. Thus, the primary obligation does not cease and no innovation occurs.

This procedure follows from the provisions of paragraph 1 of Article 414 of the Civil Code of the Russian Federation.

Attention: novation must be distinguished from compensation. The moments when the primary obligation is considered fulfilled for these transactions are different. Also, the novation agreement and the compensation agreement provide for different rights and obligations of the debtor and creditor.

The compensation agreement implies the possibility not to fulfill the contract. For example, it gives the debtor the right to pay the creditor in a way other than that specified in the original agreement, but does not make this his obligation. In this case, the obligation is considered extinguished only after the actual transfer of compensation (money or other property). This follows from Article 409 of the Civil Code of the Russian Federation and information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 102.

The purpose of novation is to replace the original obligation with another obligation, which the debtor is obliged to fulfill. In this case, the primary debt is considered repaid after the conclusion of the novation agreement. This follows from paragraph 1 of Article 414 of the Civil Code of the Russian Federation.

The new obligation replaces not only the main debt, but also additional debt arising from the primary obligation (unless otherwise provided by the novation agreement itself). In particular, by default, the novation agreement pays off the penalty arising due to non-fulfillment or improper fulfillment of the main obligation. This follows from paragraph 2 of Article 414 of the Civil Code of the Russian Federation.

For more information about this, see How to take into account the receipt of legal interest, penalties and interest for late fulfillment of obligations.

Situation: does the executed novation agreement interrupt the limitation period for the new (initial) obligation?

Yes, he interrupts.

An agreement to terminate an obligation by novation indicates recognition of a debt (clause 1 of Article 414 of the Civil Code of the Russian Federation).

It follows from this that the limitation period for the original obligation is interrupted and for the new obligation it begins to run anew (Article 203 of the Civil Code of the Russian Federation, Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation of November 9, 1999 No. 4021/99).

What to include in the agreement?

The debt novation agreement must indicate: information about the initial obligations (which of them are subject to replacement or termination); references to the primary documents on the basis of which the debt was formed (note: only a debt reconciliation act as a basis for innovation is not enough, since rights and obligations do not arise directly from it); original contract and method of fulfillment of the obligation. In addition, the novation agreement must comply with the legal norms applicable to the contract that defines the newly arising obligation. For example, when nominating the debt of a buyer of goods (works, services) into a loan, the agreement must contain the essential terms of the loan agreement.

If, before the conclusion of the agreement on novation of the debt of the negligent buyer, fines or penalties were accrued to him, then the agreement must reflect information about the fate of the already accumulated amounts of sanctions. Otherwise, due to the termination of the initial obligation to repay the debt, the obligation to accrue penalties will also cease.

The novation agreement can either provide for a condition on preserving the creditor’s rights to receive the penalty accrued at the time of conclusion of the agreement, or increase the amount of the novation debt by the amount of the debt.

Documenting

Form the novation of an obligation under the contract in writing in the form of a bilateral document (or documents emanating from each of the parties). Novation cannot be made unilaterally or on the basis of a court decision. This follows from paragraph 1 of Article 452 of the Civil Code of the Russian Federation.

The form of the document that will confirm the novation agreement is not established by law. Therefore, compose it in any form. For example, in the form of a contract or agreement. Indicate in it:

- what primary obligation and in what amount is renewed (repaid);

- what new obligation arises and in what amount.

This will confirm the connection between the primary and the new obligation, as well as determine all the essential conditions with which the law connects the emergence of new debt.

This procedure follows from paragraph 1 of Article 414, paragraph 1 of Article 432 of the Civil Code of the Russian Federation and paragraphs 2 and 3 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 103.

The agreement drawn up by the parties will serve as the basis for reflecting the innovation operation in accounting (Article 9 of the Law of December 6, 2011 No. 402-FZ).

Situation: is it possible to confirm the novation of an obligation by business correspondence with a counterparty (for example, letters in which one party proposes to nove an obligation, and the other accepts this proposal)?

Yes, you can.

A contract (agreement) on innovation can be drawn up either in the form of a single document signed by both parties, or in the form of separate documents emanating from each of the parties (clause 1 of article 414, clause 1 of article 452 and article 434 of the Civil Code RF).

In this case, the innovation document(s) must clearly indicate:

- what primary obligation and in what amount is renewed (repaid);

- what new obligation arises and in what amount.

That is, the parties must prove the connection between the primary and the new obligation, as well as determine all the essential conditions with which the law connects the emergence of a new debt.

This procedure follows from paragraph 1 of Article 414, paragraph 1 of Article 432 of the Civil Code of the Russian Federation and paragraphs 2 and 3 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 103.

Thus, if it definitely follows from business correspondence with the counterparty that the parties replaced one obligation with another, then the novation agreement in the form of a single bilateral document need not be concluded. In this case, it is considered that the agreement is reached by one party sending a proposal (offer) to conclude an agreement and its acceptance by the other party (acceptance). This follows from paragraph 2 of Article 432 of the Civil Code of the Russian Federation.

The conclusion of the novation agreement will be confirmed by documents of postal, telegraph, teletype, telephone, electronic or other communications. For example, letters, telegrams, telexes, telefaxes, etc. (clause 2 of article 434 of the Civil Code of the Russian Federation).

Situation: can the debtor novate the obligation by transferring his own bill of exchange to the creditor? The parties do not draw up a novation agreement.

No, he can not.

The innovation document(s) must clearly indicate:

- what primary obligation and in what amount is renewed (repaid);

- what new obligation arises and in what amount.

That is, the parties must prove the connection between the primary and the new obligation, as well as determine all the essential conditions with which the law connects the emergence of a new obligation.

This procedure follows from paragraph 1 of Article 414, paragraph 1 of Article 432 of the Civil Code of the Russian Federation and paragraphs 2 and 3 of the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 21, 2005 No. 103.

Such data is not indicated in the bill of exchange (Articles 1 and 75 of the Regulations approved by Resolution of the Central Executive Committee of the USSR and the Council of People's Commissars of the USSR dated August 7, 1937 No. 104/1341). Thus, if you transfer a bill of exchange to the creditor without drawing up, for example, a novation agreement, it will only serve as security for the primary obligation (clause 1 of Article 414 of the Civil Code of the Russian Federation).

Own bill in economic circulation

Let's consider business situations in which companies most often use their own promissory notes.

A bill of exchange is property (Article 128 of the Civil Code of the Russian Federation). But your own promissory note is just an IOU. Its registration on the balance sheet does not create an asset. And until the bill is transferred to a third party, you also have no obligations under it.

It is important to know

It is prohibited to use your own bills of exchange to pay wages (Article 131 of the Labor Code of the Russian Federation; paragraph 1 of Article 3 of ILO Convention No. 95 “Concerning the Protection of Wages”, adopted in Geneva on July 1, 1949).

Companies often issue their own promissory notes for issuance in advance. And since the presentation of a bill gives the right to receive money, this document is valuable in the eyes of thieves. Bill theft is not uncommon. Therefore, they should be stored on the same basis as monetary valuables. The head of the company bears full financial responsibility for their loss by force of law (Article 277 of the Labor Code of the Russian Federation).

Accounting for bills prepared for issuance is carried out on off-balance sheet account 006 “Strict reporting forms” in a conditional valuation:

DEBIT 006 subaccount “Own bills in storage” - a bill of exchange has been issued for issue;

LOAN 006 subaccount “Own bills in storage”

- the bill was issued to the holder indicated in it; the bill is stolen.

The debt is novated into a loan obligation

Almost any debt under a civil contract can be converted into a loan obligation (clause 1 of Article 414 and clause 1 of Article 818 of the Civil Code of the Russian Federation). In this case, the debtor becomes a borrower, and the creditor becomes a lender (Clause 1, Article 807 of the Civil Code of the Russian Federation).

For example, you can novate the debt for goods (work, services) that has not been paid by the buyer (customer). In this case, the supplier (performer) becomes the lender, and the buyer (customer) becomes the borrower. After concluding the novation agreement, the obligation to pay for the goods (works, services) is considered fulfilled.

It is also possible to convert into a loan the obligation of the supplier (performer) to supply goods (services, work) on account of the advance received. In this case, the buyer (customer) becomes the lender, and the supplier (performer) becomes the borrower. After the conclusion of the novation agreement, the obligation to return the advance payment to the buyer is considered fulfilled.

If, along with the main debt, an additional obligation is novated (for example, a penalty for failure to fulfill an obligation under a contract), this must also be reflected in the accounting.

In accounting for the debtor, the initial obligation (both primary and additional) must be transferred from the account in which the accounts payable to the counterparty are recorded (for example, from accounts 60, 62 and 76) to the account:

- 66 “Settlements for short-term loans and borrowings” if the loan is issued for a period of less than one year;

- 67 “Calculations for long-term loans and borrowings” if the loan is issued for a period of more than one year.

This procedure follows from paragraph 2 of PBU 15/2008 and the Instructions for the chart of accounts (accounts 66 and 67).

If the primary obligation is converted into an interest-bearing loan, open two subaccounts to account 66 (67). For example, account 66 subaccount “Principal payments” and account 66 subaccount “Interest payments”. This is due to the fact that interest amounts must be taken into account separately, as part of other expenses of the organization (clause 4 of PBU 15/2008).

In the article: debit and credit, what they are in simple words, we examined the basic principles of forming the balance between debit and credit, describing them using simple examples.

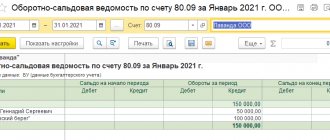

When concluding a novation agreement in accounting, make the following entry:

Debit 60 (62, 76) Credit 66 (67) subaccount “Settlements of the principal debt” - the debt to the counterparty has been converted into a loan.

On interest-bearing loans, accrue interest monthly:

Debit 91-2 Credit 66 (67) subaccount “Interest payments” - interest is accrued on the loan received.

This follows from the Instructions for the chart of accounts (accounts 66, 67 and 91-2).

For more information on processing and accounting for a loan received and interest on it, see:

- How to apply for a loan (credit);

- How to reflect the receipt of a loan (credit) in accounting;

- How to calculate interest on a loan received.

An example of reflecting in the accounting of an organization (debtor) the novation of an obligation to pay for purchased goods into an obligation to repay a loan

On May 13, Torgovaya LLC shipped a consignment of goods worth 118,000 rubles to Alpha LLC. (including VAT – 18,000 rubles). According to the supply agreement, Alpha must pay for the goods within 5 days from the date of shipment (i.e., until May 18 inclusive).

Alpha's accountant made the following entries in the accounts.

may 13:

Debit 41 Credit 60 – 100,000 rub. (RUB 118,000 – RUB 18,000) – purchased goods are capitalized;

Debit 19 Credit 60 – 18,000 rub. – reflected input VAT on purchased goods;

Debit 68 subaccount “Calculations for VAT” Credit 19 – 18,000 rub. – accepted for deduction of input VAT on purchased goods.

“Alpha” did not fulfill its obligation to pay for the goods on time, and therefore, under the terms of the contract, it must pay a penalty. Its size is 0.07% of the debt amount for each day of delay.

On June 15, the parties entered into an agreement to nominate the obligation to pay for goods into an obligation to repay the loan. Alpha’s obligation to pay the penalty for the period from May 19 to June 15 (28 days) was retained in the novation agreement (i.e., the additional obligation was not novation). Alpha paid for it on the same day.

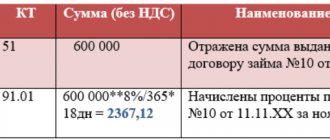

Interest on the loan is set at 10% per annum. Alpha must repay the short-term loan on September 15.

Alpha's accountant reflected these transactions in accounting as follows.

June 15:

Debit 91-2 Credit 76-2 – 2313 rub. (RUB 118,000 × 0.07% × 28 days) – the counterparty’s claim for the amount of the penalty for late payment for goods was recognized;

Debit 76-2 Credit 51 – 2313 rub. – the penalty was paid to the counterparty;

Debit 60 Credit 66 subaccount “Settlements of the principal debt” – 118,000 rubles. – the debt to the counterparty was converted into a short-term loan.

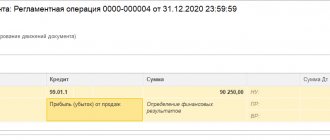

30 June:

Debit 91-2 Credit 66 subaccount “Interest payments” - 485 rubles. (RUB 118,000 × 10%: 365 days × 15 days) – interest accrued on the loan received.

Alpha's accountant calculates interest on the loan monthly until the loan obligation is repaid.

In creditor accounting, the initial liability must be transferred from the account in which the counterparty's receivables are recorded (for example, from accounts 60, 62 and 76) to the account:

- 58-3 “Loans provided” if an interest-bearing loan is issued;

- 76 “Settlements with various debtors and creditors” subaccount “Provided loans” if an interest-free loan is issued.

When concluding a novation agreement in accounting, make the following entry:

Debit 58-3 Credit 60 (62, 76) – the counterparty’s debt has been converted into an interest-bearing loan

or

Debit 76 subaccount “Provided loans” Credit 60 (62, 76) – the counterparty’s debt has been converted into an interest-free loan.

This follows from paragraph 2 of PBU 19/02 and the Instructions for the chart of accounts (accounts 58-3, 60, 62, 76).

If the primary obligation is converted into an interest-bearing loan, take into account the amount of interest on account 76 “Settlements with various debtors and creditors”. To do this, open a sub-account for it “Interest calculations”. This is due to the fact that interest amounts must be taken into account separately, as part of the organization’s other income (clause 34 of PBU 19/02, clauses 2 and 7 of PBU 9/99).

In accounting, make monthly entries:

Debit 76 subaccount “Calculations of interest” Credit 91-1 - interest has been accrued on the loan issued.

This procedure follows from the Instructions for the chart of accounts.

For more information on registration and accounting of the issued loan and interest on it, see:

- How to apply for a loan;

- How to calculate and reflect in accounting the interest on a loan issued;

- How to reflect in accounting the provision of a loan to another organization.

An example of reflecting in the accounting of an organization (creditor) the novation of an obligation to pay for purchased goods into an obligation to repay a loan

On May 13, Torgovaya LLC shipped a consignment of goods worth 118,000 rubles to Alpha LLC. (including VAT – 18,000 rubles). Cost of goods sold – 60,000 rubles. According to the supply agreement, Alpha must pay for the goods within 5 days from the date of shipment (i.e., until May 18 inclusive).

The Hermes accountant made the following entries in the accounting.

may 13:

Debit 62 Credit 90-1 – 100,000 rub. (RUB 118,000 – RUB 18,000) – revenue from the sale of goods is reflected;

Debit 90-2 Credit 41 – 60,000 rub. – the cost of goods sold is written off;

Debit 90-3 Credit 68 subaccount “VAT calculations” – 18,000 rubles. – VAT is charged on the sale of goods.

Alpha did not fulfill its obligation to pay for the goods on time, and therefore, under the terms of the contract, it must pay a penalty. Its size is 0.07% of the debt amount for each day of delay.

On June 15, the parties entered into an agreement to nominate the obligation to pay for goods into an obligation to repay the loan. Alpha’s obligation to pay the penalty for the period from May 19 to June 15 (28 days) was retained in the novation agreement (i.e., the additional obligation was not novation). Alpha paid for it on the same day.

Interest on the loan is set at 10% per annum. Alpha must repay the short-term loan on September 15.

The Hermes accountant reflected these transactions in accounting.

June 15:

Debit 76-2 Credit 91-1 – 2313 rub. (RUB 118,000 × 0.07% × 28 days) – a penalty recognized by the buyer for late payment for goods was accrued;

Debit 51 Credit 76-2 – 2313 rub. – payment of the penalty has been received;

Debit 58-3 Credit 62 – 118,000 rub. – the counterparty’s debt was converted into a short-term loan.

30 June:

Debit 76 subaccount “Interest payments” Credit 91-1 – 485 rubles. (RUB 118,000 × 10%: 365 days × 15 days) – interest accrued on the loan issued.

The interest on the loan is calculated monthly by the Hermes accountant until Alpha repays the loan obligation.

Bill as a gift

Can a company issue a so-called "non-cash" bill - in the absence of a counter-representation from the recipient?

As a result of delivery of the bill of exchange, its holder free of charge receives a property right of claim against the drawer.

Such a transaction characterizes a gift (clause 1 of Article 572 of the Civil Code of the Russian Federation). True, donations between commercial organizations are prohibited (subclause 4, clause 1, article 575 of the Civil Code of the Russian Federation). But you can give your own bill of exchange to an individual without hindrance. Do not forget to first draw up a gift agreement (clause 2 of Article 574 of the Civil Code of the Russian Federation). Example 6

gave an individual as a gift her own promissory note for 100,000 rubles with a maturity date of presentation.

Since the deadline for fulfilling the obligation on the bill of exchange is unknown, the accountant reflected a short-term estimated liability in accounting (clause 5 of PBU 8/2010): DEBIT 91 CREDIT 96 subaccount “Bills given”

- 100,000 rubles. – a reserve has been formed for the repayment of a non-cash bill. There is no need to report gifts to individuals to the tax office (in Form 2-NDFL) (clause 2 of Article 226, subclause 7 of clause 1 of Article 228 of the Tax Code of the Russian Federation).

A citizen does not have to pay personal income tax on such a gift right away. Taxable income will arise for him (clause 8 of Article 214.1 of the Tax Code of the Russian Federation) in the event of:

- sale of a bill, that is, when transferring it into ownership to a third party;

- repayment of a bill, that is, when it is paid by the drawer.