Return without invoice is the legal right of the simplifier Note. The topic of the article was suggested by Valentina Vladimirovna Bondarenko, chief accountant, Askat LLC, Novoaltaisk, Altai Territory.

It would seem that everyone should be well aware that entrepreneurs and organizations using the simplified tax system are not required to issue VAT invoices (with the exception of intermediaries). After all, the tax is presented to buyers only by taxpayers (in certain cases, by tax agents). And simplifiers do not have to pay VAT. Therefore, they should not issue invoices. And neither to our customers nor to our suppliers.

However, there are situations when counterparties still require invoices from simplifiers.

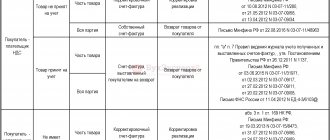

SITUATION 1. Return of defective goods to the supplier - VAT payer

The content of the article

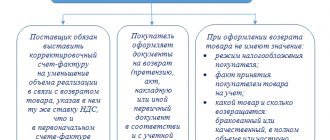

The supplier himself issues an adjustment invoice, which will reflect the decrease in the quantity of previously shipped goods. Based on this adjustment invoice, the supplier deducts VAT on goods returned by the simplifier.

If the simplifier returns all the goods received under the invoice, then the supplier registers his invoice in the purchase book, which he compiled when shipping the goods to the buyer. That is, the supplier does not even need to issue an adjustment invoice.

Please note that the tax accounting of a simplifier does not reflect the return of a defective product (if it was purchased for resale):

- the cost of returned goods is not taken into account in the costs of the simplifier, since their return does not equate to a sale;

- money received from the supplier for returned goods does not need to be included in income.

And if a simplifier who uses the “income-expenditure” simplified tax system returns defective raw materials and materials to the supplier, then the situation changes. Let us remind you that the cost of raw materials and materials is taken into account as part of material costs as soon as the raw materials and materials are received and paid for. The amount of VAT on them is also written off as expenses. Therefore, in this case, the simplifier must reduce the amount of previously recognized expenses by the cost of the returned raw materials and materials. After all, these expenses can no longer be called economically justified. It is also necessary to restore the amounts of the “accompanying” value added tax.

How to take into account the return of funds to the client when registering income

Such clarifications are given to taxpayers who have chosen the object of taxation “income”. However, one can argue with the position of officials. Here, taxpayers should pay attention to the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated 09.09.2011 N A53-24985/2010. So, the crux of the matter is this. The courts of the first and appellate instances came to the conclusion that losses for previous tax periods can only be taken into account by taxpayers applying the simplified tax system with the object “income reduced by the amount of expenses.” A loss is the excess of expenses over income. “A simplifier with the object “income”, if the amount of returned advances exceeded the amount of income received, must put a dash in the tax return, since in fact no income was received.

SITUATION 2. The supplier returned the advance payment, in which the amount of value added tax was allocated

money is indicated: “including VAT 7.2 thousand rubles.” After returning part of the advance payment, the supplier began to demand from the simplified buyer an invoice for the amount of the returned money, highlighting the amount of VAT.

Despite the fact that the simplifier received the money under a payment order in which the VAT amount was allocated, he still has no grounds for issuing an invoice.

And the supplier does not need an invoice from the buyer (even if he were not a simplifier) to deduct advance VAT. The supplier records in the purchase ledger his invoice issued to the buyer upon receipt of the advance payment. Of course, only for that part of the advance that was returned.

We do not advise simplifiers to follow the lead of suppliers who are not very tax literate and issue them invoices with allocated VAT.

Firstly, this is contrary to tax law.

Secondly, if this happens, then no later than the 20th day of the month following the quarter in which the invoice was issued:

- pay the VAT specified in the invoice to the budget;

- submit a VAT return for the quarter in which the invoice was issued, and in electronic form.

———————————

Can a consumer really protect his rights in the Russian Federation?

Not really

- clause 1 art. 168, paragraph 3 of Art. 169 Tax Code of the Russian Federation

- pp. 2, 3 tbsp. 346.11 Tax Code of the Russian Federation

- Letter of the Ministry of Finance dated October 24, 2018 N 03-07-09/44918

- Letters of the Ministry of Finance dated March 19, 2018 N 03-07-15/8473; Federal Tax Service dated May 14, 2018 N ED-4-3/ [email protected]

- Letter from the Federal Tax Service dated May 14, 2018 N ED-4-3/ [email protected]

- Letter of the Ministry of Finance dated September 20, 2007 N 03-11-04/2/228

- subp. 5 p. 1 art. 346.16, sub. 1 item 2 art. 346.17 Tax Code of the Russian Federation

- Letter of the Ministry of Finance dated 09/08/2014 N 03-11-06/2/44863

- clause 1 art. 252, paragraph 2 of Art. 346.16 Tax Code of the Russian Federation

- clause 5 art. 171 Tax Code of the Russian Federation

- subp. 1 clause 5 art. 173 Tax Code of the Russian Federation

First published in the magazine "Glavnaya Ledger" N04, 2015

How to take into account the return of funds to the client when accounting for income minus expenses

At the same time, there is no need to recalculate the tax base for the first quarter12. Since the receipt and return of advance payments occur in different quarters, the company needs to pay an advance tax payment to the budget, calculated from the prepayment amount. The prepayment amount included in the advance tax payment can later be compensated by reducing the income received by it. This must be done in the quarter in which this prepayment was returned. Extract from the book of income and expenses (for example 2) Prepared using the GARANT system I. Income and expenses Registration Amount date and number of the primary document contents of the transaction income, rub. expenses, rub. 2 3 4 5 Mikhail Obukhov Tax law 03/05/2018 09:24 0 Comments

Refund from the supplier is income upon registration

Can a consumer really protect his rights in the Russian Federation?

Not really

Refund of advance payment from supplier: accounting and tax accounting

Refund of advance payment from supplier: accounting and tax accounting

An advance or prepayment is a payment that is received by the supplier (seller) before the date of actual shipment of products or before the provision of services (clause 1 of Article 487 of the Civil Code). If the supplier (performer) has not fulfilled its obligations within the period established by the contract, then it must return the funds received from the buyer (customer). How to reflect such a refund of advance payment from the supplier in the buyer’s accounting and tax records?

Accounting

To keep records of advances issued to other enterprises, the purchasing enterprise uses subaccount 60-2 “Calculations for advances issued.” The debit of this subaccount reflects the occurrence of receivables (transfer of advance payments), and the credit reflects the repayment or write-off of debt.

On February 10, 2014, Kalina LLC transferred an advance payment for the goods in the amount of RUB 236,000 to Ryabina LLC. According to the terms of the contract, the delivery of goods was to occur before April 10, 2014.

However, the delivery never took place. Kalina LLC turned to Ryabina LLC with a demand to return the transferred prepayment. On April 15, the prepayment was returned to the account of Kalina LLC.

The return of the prepayment from the supplier will be reflected by the following posting:

Debit 51 – Credit 60-2 – in the amount of 236,000 rubles. – return of advance payment from the supplier.

The presence or absence of other entries depends on whether VAT was deducted from the advance payment issued or not.

VAT accounting

When receiving an advance payment from the buyer, the supplier must charge VAT (at the calculated rate of 18/118 or 10/110, the tax base is the amount of the prepayment) and pay it to the budget (Article 154 of the Tax Code). Also, the seller must issue an invoice and send it to the buyer within five days (Article 168 of the Tax Code).

In turn, the buyer, having received an invoice issued by the seller for advance payment, has the right to accept VAT for deduction without waiting for the moment of receipt of the goods (if the goods will be used in transactions subject to VAT and the supply agreement contains a condition for advance payment, clause 9 of Art. 172 NK).

This is not an obligation, but a right of the buyer, which allows you to quickly exercise the right to deduction if the transfer of the advance payment and the shipment of the goods were in different quarters.

Continuing our previous example, we can imagine 2 possible situations:

1. Kalina LLC did not accept VAT from the advance payment for deduction. Then, when the prepayment is returned, there will be no additional transactions.

2. Kalina LLC received an invoice and accepted VAT from the advance payment issued for deduction:

Debit 68-2 – Credit 76VA – in the amount of 36,000 rubles. – accepted for deduction of VAT on the advance payment issued (in 1C: Accounting, enter the statement where the advance was paid, then in Operations “Enter based on”, select “Invoice received”).

In this case, when returning the advance, the VAT accepted for deduction must be restored.

Debit 76VA – Credit 68-2 – in the amount of 36,000 rubles. – VAT, previously accepted for deduction, has been restored

Please note: the right to deduct VAT from advances issued can be used selectively, depending on the situation - the advance was closed with shipment in the same quarter or not.

Tax accounting

From the point of view of calculating income tax, the return of an advance from a supplier does not entail tax consequences. This is due to the fact that when making an advance payment, the buyer does not incur any expenses.

For organizations and individual entrepreneurs working on the simplified tax system, the return of an advance from a supplier does not entail tax consequences. Despite the use of the cash method, no expenses arise when transferring the prepayment, since materials, goods, services have not yet been received, etc. Therefore, the returned advance is not recorded in KUDi R, but should be recorded in accounting (in the bank statement) be a note clarifying the meaning of the transfer of money received.

Read more about deducting VAT on advances paid to the supplier here. How to take into account cash bonuses (discounts) provided by the supplier, see here.

What system do you work with your suppliers on – advance payments or post-payment? Please share in the comments!

Refund from the supplier, what to do with VAT

We issue a refund of the advance payment to the simplified tax system

On February 28, the “simplified” contractor () entered into an agreement with the customer () for the provision of services on the terms of 100 percent prepayment. March 1, guided by paragraphs. 2.1—2.11 The procedure for filling out Section I “Income and Expenses”, on the date of return of the prepayment will reflect the amount of the returned advance payment with a minus sign 10. Since the receipt and return of the prepayment were made in the same reporting period, these operations will not affect the amount of the advance tax payment 11. Thus, tax on the advance received is not actually paid to the budget. Simplified sales revenue includes prepayment amounts (advance payments) received for the upcoming delivery of goods. After all, when accounting for income, they must be guided, among other things, by Article 251 of the Tax Code 2. The received prepayment may not be included in the tax base only by firms that use the accrual method 3. Therefore, the amounts of received advances are included in income on the date of their receipt 4. When upon the return of a previously received advance payment, the simplifier reduces by its amount the income of the tax (reporting) period in which such a return was made 5. This rule is in effect from January 1, 2008 6. Let us recall that until 2008, the Russian Ministry of Finance required that the simplified person clarify the basis for tax period in which the advance payment was received by the seller 7. Thus, the company also has the right, when determining the base for the “simplified tax,” to adjust the income received in the book of income and expenses8 on the day the funds are written off from the bank account or reduce its income in another way. In this case, the return of money must be confirmed by primary documents that allow us to determine the fact, basis and amount of the amount 9. It is necessary to have the following documents: When returning, also for “simplified” people who have chosen the object “income”.

This rule provides the taxpayer with the opportunity, when returning an advance payment, to exclude from the object of taxation the income that was actually not received in the tax period when the advance payment was returned to the counterparty. In this case, the return of the advance cannot be considered as expenses and is not a loss of previous periods.

Refund from the supplier, what to do with VAT

Let's consider this situation. Before accepting the goods for registration, the buyer discovers that less of it was shipped than indicated in the delivery notes and invoices. According to the Russian Ministry of Finance, in this case the buyer does not have the right to deduct VAT on the missing quantity of goods, which means that he will not subsequently restore it.

Here, the value of the goods changes before the transfer of ownership of it, and the transaction is completed based on actual conditions. That is, no adjustment of VAT liabilities is required. Thus, the buyer does not reflect the data contained in the adjustment invoice, as well as the information entered in the primary documents, in the sales book. He must register the account only in the journal of received and issued invoices (letter of the Ministry of Finance of Russia dated February 10, 2012 No. 03-07-09/05).

In the Resolutions dated August 13, 2013 in case No. A40-54899/12-20-303, dated August 12, 2013 in case No. A40-54875/12-91-306, the FAS MO indicated: the arguments of the complaint about the need to submit documents confirming the change or termination contracts cannot be accepted by the court of cassation, since clause 8 of Art. 171, paragraph 6 of Art. 172 of the Tax Code of the Russian Federation does not establish requirements for the provision of these documents for the deduction of VAT paid on an advance payment. For organizations and individual entrepreneurs working on the simplified tax system, the return of an advance from a supplier does not entail tax consequences.

Despite the use of the cash method, when transferring the prepayment, no expenses arise, since materials, goods, services have not yet been received, etc. Therefore, the returned advance is not recorded in KUDiR, but should be recorded in the accounting (in the bank statement) a note clarifying the meaning of the transfer of money received. Upon receipt of prepayment, the seller charges VAT. When shipping goods as an advance payment, he has the right to apply a deduction of this amount of tax. However, there are situations when, due to a change in the terms of the contract or its termination, the prepaid goods are not shipped or are shipped in smaller quantities. In this case, the seller can claim VAT on the advance payment.

Also, the right to deduct tax accrued on proceeds from the sale of goods arises from the selling company when they are returned by the buyer. For the procedure for applying VAT deductions in such situations, read the article prepared based on the materials of the reference book “Annual Report - 2012” published by Garant-Press.

What is the procedure for accounting for VAT when returning goods to the supplier?

Since the transfer of ownership of the defective goods does not occur, the buyer does not issue an invoice on his own behalf, and the supplier issues an adjustment invoice, having agreed on the amount of the defective goods with the buyer (resolution of the Federal Antimonopoly Service of the Volga District dated February 12, 2013 in case No. A65-14995 /2012, resolution of the Federal Antimonopoly Service of the Moscow District dated December 7, 2012 in case No. A40-54535/12-116-118). If a non-conformity of the goods is detected after it has been accepted for accounting, the buyer has the right to unilaterally terminate the contract, which implies a refusal to transfer ownership, and the right to the goods passes back to the supplier (Clause 2 of Art.

475 of the Civil Code of the Russian Federation). Detection of the fact that a product does not meet the stated requirements must be documented with documents for the return of goods of inadequate quality - this can be an act of sorting or a list of claims for dissatisfaction with the delivered product. However, officials think differently: from their point of view, the return of goods by the buyer is recognized as a sale if the goods are registered on the date of return. The reasons why the item is returned does not matter.

This means that such returns of goods are subject to VAT on a general basis. In this case, the buyer must issue an invoice (see, for example, letters of the Ministry of Finance of Russia dated November 29, 2013 N 03-07-11/51923, 08/10/2012 No. 03-07-11/280, 08/07/2012 No. 03-07- 09/109 and 07/31/2012 No. 03-07-09/100, as well as the Federal Tax Service of Russia dated 07/05/2012 No. AS-4-3 / [email protected] ). In other words, the buyer issues a return of low-quality goods through regular sales and charges VAT. If a product does not conform to the declared quality before the buyer signs the delivery note, its value is taken into account as a debit to off-balance sheet account 002 “Inventory accepted for safekeeping”, and when the product is returned, it is written off to the credit of account 002.

The buyer does not issue an invoice when returning such goods, and does not calculate VAT. In turn, the supplier issues an adjustment invoice (paragraph 3. clause 3 of article 168 of the Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated February 10, 2012 No. 03-07-09/05 and 02.20.12 No. 03-07-09/ 08).

In this case, since the buyer did not deduct input VAT on such defective goods, the buyer should not register an adjustment invoice in the sales book. After all, the buyer has no reason to restore “input VAT” (initially “input VAT was not accepted for deduction on unpaid goods).

Cases of returning goods

In accordance with the norms of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the return of goods can be carried out:

- according to the law: if the goods were delivered of inadequate quality or not at all what was specified in the contract (i.e., there is a failure to fulfill the contract);

- an agreement (such a clause on the return of goods of proper quality may be specified in the contract, or may exist in the form of implementing the rules on the buyer’s responsibility if he does not pay the full amount for it on time).

Based on Art. 454 of the Civil Code of the Russian Federation, the seller transfers the goods to the buyer, who pays for it and takes ownership of it. At the same time, in accordance with Art. 223 of the Civil Code of the Russian Federation, the moment of transfer of goods is at the same time the moment of transfer of ownership of it from the seller to the buyer. In addition, the contract may establish another moment for the transfer of ownership.

The grounds for returning goods are given in the Civil Code of the Russian Federation. So, a refund can be made:

- in case of short delivery of goods (Articles 465 and 466 of the Civil Code of the Russian Federation);

- deliveries with a violation of the assortment (Articles 467 and 468 of the Civil Code of the Russian Federation);

- deliveries without proper packaging or in violation of the integrity of the packaging (Articles 481 and 482 of the Civil Code of the Russian Federation);

- the presence of a marriage (Article 475 of the Civil Code of the Russian Federation);

- detection of shortages (Articles 479 and 480 of the Civil Code of the Russian Federation);

- if the seller did not transfer accessories or documents related to the goods within the prescribed period (Article 464 of the Civil Code of the Russian Federation).

The contract may also provide for other grounds for returning goods.

In these cases, the buyer has the right to refuse to accept the goods and is not obliged to pay its cost, while the received advance payment must be returned by the seller upon the buyer’s first request.

VAT deduction when returning goods from a simplified seller

Accordingly, on the basis of paragraph 1 of Art. 146 of the Tax Code of the Russian Federation, when transferring goods to a former supplier, the former buyer is obliged to calculate VAT on the cost of this product (clause 1 of Article 154 of the Tax Code of the Russian Federation), present it to the former supplier (clause

1 tbsp. 168 of the Tax Code of the Russian Federation) and issue the corresponding invoice (clause 3 of Art.

168 Tax Code of the Russian Federation, letters of the Ministry of Finance of Russia dated 05/21/2012 N 03-07-09/58, dated 04/13/2012 N 03-07-09/34, dated 03/02/2012 N 03-07-09/17, dated 02/27/2012 N 03-07-09/11, dated 02/20/2012 N 03-07-09/08). As for the return of goods by a buyer who is not a VAT payer (using the simplified tax system and (or) UTII), in this case the seller should issue adjustment invoices in the manner established by Decree of the Government of the Russian Federation of December 26, 2011 N 1137, regardless of whether the goods are accepted or not accepted for registration by the buyer (letters of the Ministry of Finance of Russia dated July 31, 2012 N 03-07-09/96, dated July 24, 2012 N 03-07-09/89, dated July 3, 2012 N 03-07-09 /64, dated 05/16/2012 N 03-07-09/56). They explained that when such persons return the entire batch of shipped goods, both accepted and not accepted for registration, one should be guided by clause 5 of Art. 171 Tax Code of the Russian Federation.

In this case, the invoice registered by the seller in the sales book when shipping goods is registered by him in the purchase book as the right to tax deductions arises, taking into account the provisions of clause 4 of Art. 172 of the Tax Code of the Russian Federation. According to paragraph 4 of Art. 172 of the Tax Code of the Russian Federation deductions of tax amounts specified in paragraph 5 of Art.

171 of the Tax Code of the Russian Federation, are carried out in full after the corresponding adjustment operations are reflected in the accounting in connection with the return of goods or refusal of goods (work, services), but no later than one year from the date of return or refusal. For example, the letter of the Federal Tax Service of Russia dated October 26, 2012 N OA-4-13/18182 states that if the return of goods is due to a reason other than those indicated above, this means that the seller fulfilled its obligations under the sales contract properly and ownership of the goods passes to the buyer. If ownership has passed to the buyer, then the buyer can return the goods to the original owner of the goods (supplier) only on the basis of a separate purchase and sale (supply) agreement, in which he himself acts as the seller.

Deduction of VAT from the seller when returning advances and goods

Upon receipt of an advance payment, the seller (executor) is obliged to charge VAT, including if the advance payment was received in non-monetary means (for example, by a third party’s bill of exchange). In paragraph 5 of Article 172 of the Tax Code, the condition for deducting VAT in the event of a change in conditions or termination of a previously concluded agreement with the buyer (customer) is the return of the corresponding amounts of advance payments. However, it is not indicated that such a return must necessarily be made in cash. In this regard, we can conclude that when an advance payment previously received by the seller is returned by a third party bill of exchange, the corresponding amount of VAT is subject to deduction, regardless of whether this third party bill of exchange was received as an advance from the buyer (customer) or otherwise. This conclusion is also confirmed by a number of court decisions (post. FAS MO dated June 20, 2005 in case No. KA-A40/5402-05, FAS PO dated March 28, 2005 in case No. A12-20637/04-C36, dated April 26, 2007 in case N A55-11874/06, dated January 15, 2009 in case N A65-9611/2008). CORRECT OPTION OF CALCULATIONS At the time of provision of services: DEBIT 62 CREDIT 90-1 – 107,600 rubles. — revenue from the provision of services is reflected; DEBIT 90-3 CREDIT 68 – 16,414 rub. — VAT is charged on the sale of services; DEBIT 68 CREDIT 62 “Advance received” – 16,414 rubles. — previously accrued VAT was accepted for deduction in the part of the realized CREDIT 62 – 107,600 rubles. - offset of advance payment. At the time of transfer of the unused advance: DEBIT 62 “Advance received” CREDIT 51 – 10,400 rubles. — return of the advance payment to the buyer; DEBIT 68 CREDIT 62 “Advance received” – 1586 rubles. — accepted for deduction of VAT on the returned part of the advance. Please note that in practice a situation may arise when the seller returns the unused advance payment to the buyer for the upcoming delivery of goods, performance of work or provision of services. In this case, the return of the advance payment is not related to the termination of the contract.

As a rule, the amount of tax previously accrued upon receipt of this amount has already been taken for deduction. With a literal interpretation of the provisions of the Tax Code, in the case of a refund of an advance payment not related to a change or termination of a contract, a deduction of previously accrued tax is not provided. Therefore, there is a high probability of tax disputes related to the legality of deducting VAT previously accrued on payment amounts for upcoming deliveries of goods (performance of work, provision of services). In this case, we recommend that you reverse this tax amount in your accounting and submit an updated VAT return to the tax authorities.

In one of their latest letters, tax authorities explained the procedure for applying VAT deductions in the event that the receipt and return of advance payments are carried out in the same tax period upon termination of the contract. The organization must reflect in the VAT return the amount of tax on the prepayment received and in the same tax period, if there are documents confirming the return of the amounts of this prepayment, and subject to a change or termination of the contract, it has the right to deduct the corresponding amount of tax 5. Refund from the supplier as be with VAT

Read other articles about product returns:

- Application for a refund if a receipt is lost

- Where to go to get a refund from buying an apartment

- Refund of money to an individual upon revocation of a bank’s license

- How many days does it take to return money to an aliexpress card?

- Refund of money for goods but no complete set

How to write a statement → Sample documents → Emails → How to write a complaint → Step-by-step instructions → Best deals → Organizational work schedules → Official websites of organizations → How to write a complaint