The law establishes the employer's obligation to pay employees wages twice a month. In addition to remuneration for work, the employee may be paid compensation and incentive amounts. If the total of these payments for the month the employee receives is below the minimum wage established in the region, he is required to make an additional accrual to the minimum. In practice, there are quite a lot of nuances of such additional charges. Let's start with a question that interests many accountants: what is the nature of the additional payment to the minimum wage: compensatory or stimulating?

How to calculate and process a salary supplement up to the minimum wage ?

Is an additional payment up to the minimum wage a compensation payment or an incentive payment?

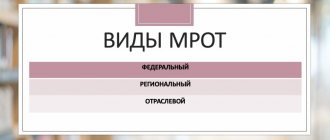

Payment for labor cannot be less than the minimum according to the Labor Code of the Russian Federation. In this case, the regional value of the minimum wage is taken into account, which, in turn, cannot be lower than the federal value of this indicator (Labor Code of the Russian Federation, Art. 133, 133.1).

Remuneration includes (according to the text of Article 129 of the Labor Code of the Russian Federation, general procedure):

- calculation of tariff (salary);

- incentive payments (bonuses, additional payments, allowances);

- compensation payments (for work in difficult weather and other special conditions).

Is it necessary to make an additional payment up to the minimum wage in case of payment of a quarterly bonus if the employee’s salary is below the minimum wage?

At the same time, the following payments to an employee are not taken into account when calculating the minimum wage and additional payments to the minimum wage:

- social nature (one-time bonuses for the anniversary, financial assistance, due to savings in payroll);

- increasing bonuses for work in harmful or dangerous conditions (Labor Code of the Russian Federation, Articles 146-1, 147-1);

- “northern” allowances (Labor Code of the Russian Federation, Art. 146-2, 148, post. Constitutional Court of the Russian Federation dated No. 38-P dated 07/12/17);

- night (Labor Code of the Russian Federation, Art. 154), holiday (Labor Code of the Russian Federation, Art. 112-4), overtime (Labor Code of the Russian Federation, Art. 152) are not included in the calculation and reduce the additional payment to the minimum wage, since care is taken on “special” days and hours should not place the employee in obviously unfavorable conditions compared to other employees;

- part-time work, part-time work (Labor Code of the Russian Federation, Article 282, Article 60.2) are not included in the calculation, since the employee performs work other than his main one in addition or at a different time.

On a note! The issue of including night, holiday and overtime surcharges in the calculation has not yet been fully regulated, and no uniform judicial practice has been developed. This is due to the fact that the provisions of Art. 129 and 133, when read literally, may contradict each other.

In some cases, regional authorities (for example, the Moscow region) enter into a tripartite agreement with trade unions and employers, according to which their own additional payments, not included in the calculation, are established. Thus, when determining the minimum wage and making additional payments to it, the burden on employers may increase.

Additional payment up to the minimum wage is made based on the calculation of the employee’s salary, consisting of the specified payments, taking into account the listed features. The employer decides independently whether to include “disputed” additional payments in the calculation. On another page you can read the order for additional payment up to the minimum wage.

Additional payment is made if the salary is calculated and its level is below the “minimum wage”. Thus, the additional payment itself cannot be classified as either compensation or incentive payments, within the meaning of the Labor Code of the Russian Federation. She occupies a special position in salary payments. This is confirmed by the courts (Armed Forces of the Russian Federation, definition 75-В10-2 of 07/23/10, 8-В10-2 of 05/21/10 and a number of other similar ones), the Ministry of Finance (letter 03-03- 06/1/768 dated 24/11/09).

The said letter from the Ministry of Finance talks about the possibility of including additional payments up to the minimum wage in expenses for NU purposes - such a nuance is important for an accountant.

On a note! Additional payment up to the minimum wage is not calculated in public sector institutions financed from the federal budget.

You might also be interested in:

Online cash registers Atol Sigma - how to earn more

How to make a return to a buyer at an online checkout: step-by-step instructions

MTS cash desk: review of online cash register models

Scanners for product labeling

Shoe marking for retail 2022

Online cash register for dummies

Did you like the article? Share it on social networks.

- Marina Zhukova 09.13.2021 18:22

Comment: The cleaning company receives money from the customer from m2 and pays the employee for 4 hours. that is, 9400 rubles per 1000 m2. but according to the Decree of the State Labor Committee of December 29, 1990 No. 469, washing floors with an average clutter of 300 m2 takes 2 hours and 52 minutes. and the company puts 8 hours on the employee report card. The question is how should wages be calculated?Answer

Maxim 09.20.2021 15:50Comment Good afternoon! We find it difficult to answer your question; we recommend that you contact a specialized specialist with an accounting education.

Add a comment Cancel reply

Also read:

Digital platform for small and medium-sized businesses in 2021

The Russian Ministry of Economic Development will launch a digital platform for small and medium-sized businesses by the end of 2022.

The project is currently being tested, but the final version will be launched by the end of December this year. Thanks to the development of a digital platform for business, entrepreneurs and enterprises will be able to gain access to ordering the necessary services using this platform: searching for purchases, obtaining preferential lending conditions, receiving subsidies, as well as... 958 Find out more

Economic census of small businesses - new report to Rosstat in 2021

The economic census of small businesses, according to government decree, should be conducted again in 2022.

Rosstat will conduct continuous static monitoring of all enterprises that fall under the category of small and medium-sized businesses. This means that all individual entrepreneurs, small and micro organizations are required to submit reports to the Federal State Statistics Service containing certain information about their enterprises collected for 2022. Open a current account for… 803 Find out more

Business inspections in 2022: what inspections await individual entrepreneurs, plan

Business inspections in 2022 will take place according to a plan that was drawn up in advance by the Prosecutor General’s Office.

This plan was formed to control the activities of legal entities, as well as individual entrepreneurs. You can familiarize yourself with the contents of the drawn up plan on the official website of the prosecutor's office. There you can see whether your company is included in the list of those being inspected. The service is quite thoughtful and convenient; to clarify the necessary information, you need to enter your Taxpayer Identification Number... 966 Find out more

How the tax office will check online cash registers. Fines in 2021

Tax checks on cash registers resumed in 2022 - the moratorium imposed due to the sudden outbreak of the Covid-19 virus pandemic has ended and from now on control activities will take place as usual. The main goal of these checks, as before, is to motivate entrepreneurs and organizations to use online cash registers when making payments to consumers, as well as to increase the amount of incoming tax payments. If violations are detected during inspections, the Tax Service will...337 Find out more

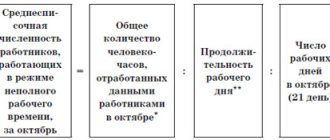

When recording working hours in total

Additional payment up to the minimum wage for cumulative accounting of work time begins with the determination of the standard time. It is taken according to the production calendar of a 5-day working week (Order of the Ministry of Health and Social Development No. 588n dated 08/13/09). An accounting period is established, usually a year.

Summarized working time recording is used for employees who may be overworked in one month and underworked in another.

Example: a security guard was hired at a rate of 0.5, his salary was set at 40,000.00 per month at full rate. There are no additional payments. If he worked all days according to schedule, his salary at the end of the month will be 20,000.00 rubles. The standard hours do not play a role here. They clarify what the minimum wage is for the current month in the region. Let it be equal to the federal average and be 11,280 rubles. 1⁄2 of this amount is less than the amount due to the employee - 20,000.00 rubles, therefore, he is not entitled to an additional payment up to the minimum wage.

If the security guard’s salary is set (in violation of labor legislation!) at 1.0 times the rate of 10,000.00 rubles, 1⁄2 times the rate is equivalent to a payment of 5,000.00 rubles, and the “minimum wage” is equal to (11280/2) 5,640, rubles. The additional payment is RUB 640.00.

When paid hourly, the employee is paid for the actual time worked each month. The rate itself must be calculated taking into account the minimum wage and order No. 588n. Recycling must be paid for.

Question: The employer uses a bonus-time wage system; the wages of employees also include payment for work in conditions deviating from normal (night, holidays, combined work). In addition, a monthly bonus is accrued in the amount of 40% of the amount, which consists of the salary and other allowances accrued due to working conditions that deviate from normal ones. The procedure for calculating this bonus is fixed in the regulations on remuneration. How is the size of the bonus calculated taking into account the allowances taken into account when calculating the additional payment up to the minimum wage, if the wage supplements themselves for working conditions that deviate from normal ones are not taken into account when the additional payment up to the minimum wage is made? View answer

Deficiencies are paid based on the provisions of Art. 155 Labor Code of the Russian Federation:

- absenteeism and tardiness are not paid;

- an error on the part of the employer is paid based on average earnings, comparing it with the actual accrued payment for hours worked;

- force majeure, there is no fault of both parties - payment in the amount of 2/3 of the rate.

Let us consider in more detail how to calculate the minimum wage and additional payment for a work schedule that involves shifts, as well as for an incomplete month worked.

What should be the minimum wage?

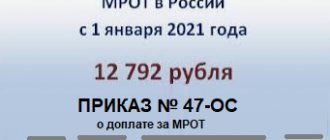

So, according to the adopted federal bill, the minimum wage from January 1, 2022 is 12,792 rubles. For several years, the amount of minimum payments to employees was calculated based on the cost of living established in the country or region. However, in 2022, a different methodology will be used: the amount of payments will be calculated based on the median wage, and not on the cost of living.

It is worth noting that when determining the amount of employees’ salaries, it is also necessary to take into account the size of the minimum wage by region. Different regions of the Russian Federation have the right to establish a separate minimum wage for their region. However, there is an important condition: the payment rate must be equal to or higher than the established federal wage. As a result, an employee working in this subject must receive a salary not lower than the established regional minimum wage. Enterprises that have joined regional agreements are required to comply with these requirements. However, you can refuse to join, which will happen automatically, if within a month after the entry into force of the agreement, you do not submit a written refusal, which must be factually justified. If your company has refused the agreement, or the regional size of payments for labor activity has not been established in this entity, wages can be paid in accordance with the established federal minimum wage in 2022.

Based on the new methodology for calculating wages, it is necessary to increase the wages of employees receiving a salary (not taking into account the deduction of personal income tax) less than the established minimum wage for the period worked. Indexing can be done using an additional appendix to the employment contract, and then, starting from January 1, wages can be credited to company employees, the amount of which will be higher than the smallest wage.

This article does not provide information on industry minimum payouts. The necessary information can be found in industry agreements posted on the official website of the Ministry of Labor.

With a shift work schedule

A shift work schedule itself implies a cumulative accounting of hours, since fluctuations in the use of working time established by the schedule must be taken into account.

Hence the rules for calculating additional payments up to the minimum wage:

- If the tariff rate is not established, it is calculated by salary and hours of the working week (40-hour, 36-hour, 24-hour).

- The use of rates and salaries without taking into account the minimum wage during a shift work schedule, as in other cases, is prohibited.

- If a full-time employee has worked a full month according to the schedule, he will receive full payment according to the hours or salary established taking into account the minimum wage. No additional payment up to the minimum wage is required.

- If a part-time employee has worked a full month according to the schedule, he will receive proportional payment according to the hours or salary established taking into account the minimum wage. The minimum wage is taken in proportion to its rate (as in the example above).

- If there is a delay in the schedule through no fault of the employee, he is paid additionally according to the rules of Art. 155 Labor Code of the Russian Federation.

- All additional payments to the minimum wage must be taken into account within the working week established for the employee, regardless of his actual schedule. The length of the working week cannot be more than 40 hours (Labor Code of the Russian Federation, Article 91). All calculations of tariffs and salaries, including for shift work schedules, must not violate these provisions. If at the end of the billing period there is overtime, it is paid to the employee additionally. This paid processing is not included in the additional payment up to the minimum wage.

Is it legal for a resigned employee, who for three years received wages below the regional minimum wage, to demand that he be paid additional wages to the minimum ?

In case of incomplete working month

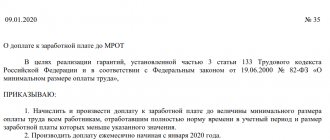

IMPORTANT! A sample order for additional payment to the salary up to the minimum wage from ConsultantPlus is available at the link

So, we found out that the application (or non-application) of an additional payment to the minimum wage takes into account many factors in practice:

- the regional minimum wage itself;

- actual payments to the employee, including wages and additional payments in accordance with the Labor Code of the Russian Federation;

- his rate, full or partial;

- the established standard of time for the employee.

How do these provisions apply if the month is not fully worked? Let's look at a situation in which an employee worked for less than a full month, for example, due to his dismissal. Let the security guard mentioned earlier in the example have a salary of 20,000.00 rubles, there are no other payments. He works full-time and has a 40-hour work week. The security guard worked only 35 hours on schedule this month and then quit. Let's find out whether in this situation he is entitled to an additional payment up to the minimum wage.

This month he has 143 normal working hours. The salary will be: 20000.00: 143*35 = 4895.10 rubles. Despite the fact that the amount is less than the minimum wage (11,280 rubles), the employee is not entitled to additional payment, since the salary for the full number of hours worked at the rate (143) is greater than the minimum wage (20,000 rubles).

Conclusion

- An additional payment up to the minimum wage is made if the employee’s wage income for the month is lower than the current minimum wage in the region.

- At the same time, payment according to the tariff rate, and payment according to the salary, and the work schedule, including shift work, cannot affect the specified norm. Whatever the calculation procedure for the employee is enshrined in the employment contract, LNA, income at a monthly rate below the minimum wage are subject to additional payment. It is produced at the expense of the company and is included in costs for NU purposes.

- Additional payments for processing, if they are allowed according to the schedule or for other reasons, do not count towards additional payments to the minimum wage.

- Whether to include additional payments for overtime, holidays, “seasonal” and other payments in the calculation of wages in relation to the additional payment of its amount up to the minimum wage is a question that has not been clearly resolved today. Judicial practice on it is contradictory, which means that the final decision is made by the employer.