The minimum wage (minimum wage) at the federal level is established annually by the Russian Government. It is directly dependent on the cost of living (for the working population), which was noted in the Russian Federation in the second quarter of the previous year. In 2022, the all-Russian minimum wage is 11,280 rubles.

Russian subjects have the right to set their own minimum wage (but not lower than the federal level) taking into account the socio-economic situation and the cost of living that has developed in a particular region (Article 133.1 of the Labor Code of the Russian Federation). The current value of the minimum wage is used when calculating various social benefits and determines the limit below which wages cannot be set. Let's take a closer look at the minimum wage in Moscow and the minimum wage in the Moscow region in 2022.

Federal minimum wage in 2019-2022

The minimum wage (minimum wage) at the state level is approved by the relevant federal law.

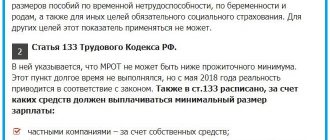

The minimum wage is valid throughout Russia and cannot be less than the subsistence level of able-bodied citizens for the purpose of calculating wages, and from 01/01/2021 it is equal to the median wage for the previous year, calculated by statistical authorities (Article 1 of the Federal Law “On the Minimum Wage” dated 06/19/2000 No. 82-FZ). The minimum wage is important not only when calculating wages, but also when enterprises receive various government support measures.

An employee who has actually worked the standard amount of time established by the labor agreement cannot receive a salary less than the established minimum wage. If an employer pays a salary less than the minimum wage, he faces a fine under clause 6 of Art. 5.27 Code of Administrative Offenses:

- from 10,000 to 20,000 rub. on officials;

- from 30,000 to 50,000 rub. for legal entities;

- from 1,000 to 5,000 rubles. for individual entrepreneurs operating without forming a legal entity.

To avoid sanctions, issue an additional payment to the employee up to the minimum wage. ConsultantPlus experts explained in detail how to do this correctly. Get trial access to the K+ system and upgrade to the ready-made solution for free.

Note that the corresponding additional payment in the general case is not related to wage indexation, which is also required by law.

Previously, neither the social nor financial departments of the Russian Federation, nor parliamentarians could establish compliance of the minimum wage with the subsistence minimum. But in March 2022, the President of the Russian Federation signed Law No. 41-FZ dated 03/07/2018, according to which, from 05/01/2018, the minimum wage was equal to the subsistence level of the working-age population for the 2nd quarter of last year. The minimum wage and the cost of living have become inextricably linked.

Read more about the connection between the minimum wage and the living wage in the expert article posted in the ConsultantPlus system. Get trial access for free.

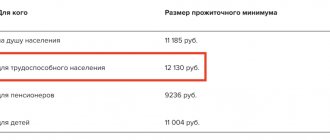

Thus , the minimum wage as of May 1, 2018 was 11,163 rubles. The Ministry of Labor approved the cost of living for the 2nd quarter of 2022 in the amount of 11,280 rubles. And since the cost of living for the 2nd quarter of 2022 is equal to the minimum wage for 2019, then from 01/01/2019 the value of the federal minimum wage is 11,280 rubles. In 2022, the minimum wage was 12,130 rubles.

Since 2022, the minimum wage is not tied to the subsistence level. In accordance with the wording of Law No. 82-FZ of 01/01/2021, it was equal to the median salary calculated by statistics - 12,792 rubles. And from 01/01/2022 the minimum wage was established, as follows from the current version of Law No. 82-FZ, in the amount of 13,890 rubles. per month.

Find out more about the practical significance of introducing a new minimum wage for enterprises from a special publication prepared by ConsultantPlus experts. Get trial access for free.

The minimum wage regulates not only wages, but also the amount of benefits (including maternity benefits), and until the end of 2022, the amount of contributions for individual entrepreneurs. Let's look at how the minimum wage changed over the period from 2013 to 2022.

What payments should the employer review in connection with the increase in the minimum wage, ConsultantPlus experts told. Study the review material by getting trial access to the K+ system for free.

Regional indices of minimum wage increases

In accordance with the legislative decision of the state government, regions are given the right to independently regulate the minimum wage, based on the state of the regional economy and the region’s standard of living.

The highest level of the minimum wage index is in the city of Moscow, which is almost 2 times higher than throughout the country. The Moscow region is also not far behind Moscow; the minimum wage is also higher than the federal figure for the entire state.

Comparative salary index by region:

| federal subject (region) | minimum level of earnings in rubles |

| Moscow city | 18742 |

| city of St. Petersburg | 17000 |

| Murmansk city and region | 15185 |

| Moscow region | 13750 |

| Orel city and region | 10500 |

| Arkhangelsk city and region | 9489 |

Factors for increasing the minimum wage

In order to calculate the minimum wage, rather complex schemes and formulas are used, but there are main factors that directly affect the increase in the minimum wage:

- The policy of the country's leadership on pricing in the state;

- Inflation index and inflation forecasts for next year;

- Minimum for population living;

- Unemployment rate.

In addition to national conditions for increasing wages, there are regional conditions that coordinate the minimum wage based on the economic development of the region, as well as the level of unemployment in their region.

Minimum wage for 2015–2018 in Russia

The minimum wage in 2015 was 5,965 rubles. (Article 1 of the Law of the Russian Federation dated December 1, 2014 No. 408-FZ).

The minimum wage 2016, introduced on January 1, 2016, amounted to 6,204 rubles. (Article 1 of the Law of the Russian Federation dated December 14, 2015 No. 376-FZ). From 07/01/2016 it was increased to 7,500 rubles. (Article 1 of the Law of the Russian Federation dated June 2, 2016 No. 164-FZ).

Since the beginning of 2022, the value of the minimum wage has not changed, remaining equal to the value of 7,500 rubles, effective from 07/01/2016. However, from July 1, 2017, the minimum wage increased to 7,800 rubles. (Article 1 of the Law of the Russian Federation dated December 19, 2016 No. 460-FZ).

From January 2022, the minimum wage increased to 9,489 rubles. From 05/01/2018, as mentioned above, 11,163 rubles.

Read about the role of the minimum wage in setting wages in the material “Art. 135 of the Labor Code of the Russian Federation: questions and answers.”

Sources of financing

At the legislative level, a resolution was adopted that the minimum wage must correspond to the minimum to ensure the life of the working population of the state.

To comply with the decision of the legislature, the Ministry of Labor developed a program for a gradual and quarterly increase in the wage index. The minimum wage until January 2019 should be the same as the minimum to ensure living.

In order for this increase in minimum wages to occur, financial support is necessary.

Sources of financing for the minimum wage index are:

- Receipts of non-budget funds for financing;

- Financing budget flows;

- Funds from contributions for business activities;

- Budgetary finances of regional federal subjects;

- Local budget funds;

- Contributions from other employers who are not business entities.

The minimum wage is regulated by federal laws on the minimum wage for labor, as well as the Labor Code of the Russian Federation, which determines the meaning of the minimum wage and its clear formation.

The size of the minimum wage index may also be influenced by regional acts and adopted legislative decrees.

What changes in the minimum wage occurred in 2013

The minimum wage in 2013 was 5,205 rubles, which is 39.4 times more than at the beginning of 2000. The minimum wage in 2013 in Russia was equal to 68.2% of the subsistence level for able-bodied persons for the same period. At the same time, in 2000, the minimum wage was 9.33 times less than the subsistence level for able-bodied persons.

Such excesses are explained by the fact that until 2010 the minimum wage was used not only to regulate the level of wages, but also to determine the amount of various socially significant benefits. In 2013–2014, the ratio between the minimum wage and the subsistence level fluctuates at around 67–68%, without demonstrating significant positive dynamics.

Limit base for calculating contributions to the Pension Fund in 2014–2018 and the minimum wage

The size of the minimum wage in 2014 began to be used when calculating the amount of insurance premiums for individual entrepreneurs, and this procedure was applied until the end of 2017, despite the fact that insurance premiums from 2022 came under the control of the tax authorities and began to be subject to the provisions of the relevant chapter of the Tax Code of the Russian Federation.

The procedure for calculating contributions paid by individual entrepreneurs to the funds implied that the minimum wage established at the beginning of the tax period was multiplied by 12 months and by the insurance rate of the state fund (PFR, MHIF). If the income received by the entrepreneur for the year exceeds the amount of 300,000 rubles. from the amount of this excess, he had to pay another 1% (subclause 1, clause 1, article 430 of the Tax Code of the Russian Federation).

Read more about insurance premiums and other payments paid by individual entrepreneurs in this article .

To calculate the amount of insurance premiums for individual entrepreneurs for previous years, you will need to know the minimum wage values that were in effect in that tax period. Our experts have collected these values in a convenient table.

Table of minimum wages by year

The minimum wage table is also convenient because you can see not only the value of the indicator, but also track its dynamics.

| Minimum wage 2013 The minimum wage for 2013 is 5,205 rubles. (approved December 2012) |

| Minimum wage 2014 The minimum wage in 2014 is 5,554 rubles. (approved December 2013) |

| Minimum wage 2015 The minimum wage in 2015 is 5,965 rubles. (approved December 2014) |

Minimum wage 2016

|

Minimum wage 2017

|

Minimum wage 2018

|

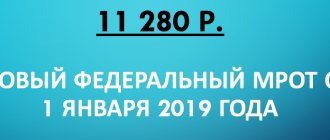

| Minimum wage 2019 From 01/01/2019 - 11,280 rubles. |

| Minimum wage 2020 From 01.01.2020 - 12,130 rub. |

| Minimum wage 2021 From 01/01/2021 - 12,792 rubles. |

| Minimum wage 2022 From 01/01/2022 - 13,890 rubles. |

Attention! Here you can read about the details of the establishment of a new minimum wage by the legislator.

How much is the minimum wage in 2022 in the largest regions

In accordance with Art. 133.1 of the Labor Code, governments of constituent entities can sign regional agreements with associations of trade unions and employers, which establish the local level of the minimum wage.

IMPORTANT! The regional minimum wage cannot be lower than the minimum wage established by federal legislation.

If a subject has established its own minimum wage, then the salary of an employee who has worked the standard amount of time cannot be lower than the regional minimum wage.

In some cases, sick leave is calculated based on the minimum wage. Read more in a special material from ConsultantPlus experts. Get trial access to the system for free.

Let's consider the minimum wage values in 2022 in the regions of the Russian Federation (as of January 18, 2022):

- The minimum wage for Moscow is 21,371 rubles.

- In St. Petersburg, the minimum wage is 21,500 rubles.

- In the Moscow region it is 16,300 rubles.

- In almost all other constituent entities of the Russian Federation, the minimum wage for 2021 is equal to the federal average of 13,890 rubles. In a number of regions, regional coefficients need to be taken into account.

You can learn more about the practical calculation of wages taking into account the minimum wage and regional coefficients in the expert material posted in the ConsultantPlus system. Get a free trial.

There are nuances to taking into account the regional coefficient when calculating sick leave.

A complete directory of minimum wages by region can also be found in ConsultantPlus. Get free access to the system and go to the material.

When can a salary be less than the minimum wage?

Sometimes the salary may be less than the minimum wage after January 1, 2022, since the salary includes not only the salary itself, but also compensation payments (for example, various allowances for working conditions), as well as incentive payments (for example, bonuses) (Art. 129 of the Labor Code of the Russian Federation). Therefore, if in a month an employee receives, taking into account all allowances and incentives, an amount greater than or equal to the minimum wage, then this is quite normal.

If, after deducting personal income tax, from the income due to the employee, he receives an amount less than the minimum wage (RUR 12,130), then this is normal.

Keep in mind: do not include bonuses for work in the Far North and the regional coefficient in the amount of the salary that you compare with the minimum wage. Accrue these payments on top of your salary. That is, the salary should be no less than the regional or sectoral minimum wage, without the regional coefficient and the “northern bonus.”

Results

The minimum wage has been increased to 13,890 rubles from 2022.

Since 2022, officials have decoupled the minimum wage from the subsistence level. Now it is equal to the median salary calculated by statistical authorities. In 2022, the minimum wage was 12,792 rubles, in 2022 it was 12,130 rubles, and in 2019 - 11,280 rubles. Since May 2022, the minimum wage has become equal to the subsistence level of the working-age population for the 2nd quarter of 2022 and amounted to 11,163 rubles. Regions also have the right to set the minimum wage, but it cannot be lower than the federal figure. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Living wage in the Rostov region

At the moment, the indicators for the 3rd quarter of 2022 have been determined, which, according to the Decree of the regional government No. 797 of November 7, 2019, amounted to (in rubles):

- per capita - 10,351;

- for able-bodied citizens - 11,033;

- for pensioners - 8,377;

- for children - 10,752.

The cost of living for a child is set at an amount less than for a working person, but higher than for a pensioner.

For the 4th quarter of 2022, indicators will be approved at the beginning of 2020, based on practice, no earlier than February. This year, the indicators for the 1st quarter of 2022 were determined only on May 17. It is likely that the size of the PM for the 1st quarter of 2022 will also be set no earlier than May of next year.