Types of salary supplements

When preparing documentation, you must adhere to precise wording. If we talk about allowances, they are sometimes called surcharges. The fact is that allowances according to their functionality are divided into:

- stimulating;

- compensatory.

The latter are more often called additional payments. This is due to the fact that additional payments are compensation to the employee for harmful working conditions, especially hard work, and performing their duties beyond the norm. In most cases, these are payments required by law that the employer has no right to ignore.

Incentive bonuses are another matter. They are a voluntary expression of gratitude to an employee or employees for their responsibility and work. Bonuses of this kind affect the motivation of individual employees. Such payments include bonuses and other incentive payments.

What is included in the minimum wage?

The minimum wage is the minimum wage announced on the basis of Law No. 82-FZ of June 19, 2000. This law is regularly amended to establish a new minimum level. To determine whether an employee’s income complies with the minimum wage, their salary is taken into account, taking into account all its components (salary, bonuses, allowances, as well as compensation and other payments).

In 2022, the State Duma included a draft law changing the methodology for calculating the minimum wage from January 1, 2022. Based on the proposed calculation logic, for 2022 the minimum wage should be 12,392 rubles, which is confirmed by Order of the Ministry of Labor No. 542n dated August 28, 2020.

At the same time, the State Duma is proposing for consideration in the first reading a higher minimum wage in 2022, equal to 12,792 rubles. However, this initiative has so far been delayed, apparently due to the consequences of the pandemic.

The state also allows the constituent entities of the federation to set their own minimum wages, which must be no less than the minimum wage approved at the federal level and comply with the Labor Code of the Russian Federation, according to Art. 133, 133.1. If no additional regulations have been adopted at the regional level regarding the minimum wage, then in this situation the minimum wage adopted at the federal level is taken into account.

Note. The legislation of the Russian Federation does not provide that, when the minimum wage changes, the employer must necessarily raise salaries or tariff rates to the mandatory minimum, but if he does not do this, then he will need to publish monthly appropriate orders for calculating additional payments up to the minimum wage.

When is an additional payment required?

Despite the approved minimum wage, not every employee who receives a salary less than the minimum level has the right to count on an additional payment up to the minimum wage. This requirement applies only to those employees who work full-time, that is, with an 8-hour shift or at least 40 hours a week. In this option, an employee who received a salary less than the minimum wage is required to pay an additional payment up to the “minimum wage”.

If an employee works part-time, then in this case he has the right to count on only 50% of the minimum wage. In the same way, an additional payment up to the minimum wage will be accrued to a part-time worker. In this situation, additional payment will be calculated in proportion to the hours worked.

If this norm for additional accrual to the minimum wage is violated, the company's management may be subject to an administrative fine, according to the Code of Administrative Offenses of the Russian Federation.

Format

The order for additional salary calculation to the minimum wage does not have a unified form approved by the legislation of the Russian Federation. Therefore, such an order can be formed in any style. However, the structure of the document must comply with established rules in office work.

In addition, the enterprise has the right to independently develop its own order form, which will be mandatory for completion within the framework of this enterprise.

When filling out such an order, you must take into account that it can be filled out manually or printed out.

The order must necessarily consist of the following blocks:

- Introductory, which displays the name of the company, the name of the document with the assigned number, the place and date of its formation.

- The main one - which displays the rationale for publishing the order with reference to the legislative acts of the Russian Federation, as well as instructions to the relevant departments on the calculation of additional payments to employees who received a salary below the minimum wage.

- Final – to display the signatures of the director and other persons designated in the order.

There is no need to affix the director's signature with a seal.

Who composes?

Each company has its own procedure for drawing up orders; in most cases, the preparation of administrative documents is entrusted to specialists in the personnel department or to a lawyer, if one is included in the staffing table. In small companies, this area of work is assigned to the secretary.

However, regardless of who prepared the order for additional payment to the minimum wage, only the director of the company or his deputy is required to sign such a document, in the absence of the director. Also, such an order must be signed by interested parties.

What are the bonuses for?

The Labor Code regulates only the minimum acceptable values. The general level of allowances in a particular organization remains at the discretion of the manager. Thus, allowances can be set:

- For having a special type and level of education, an academic degree, awards, etc. The more qualified an employee performs the duties assigned to him, the greater the bonus he deserves.

- For high results of efforts made in professional activities in this organization.

- For high professional excellence in the performance of their duties.

- For performing a particularly responsible and important function in the overall cycle of work, etc.

Components of an order

The best option is to draw up such documents on the official letterhead of the organization. The company details necessary for legal literacy of registration are initially printed on them at the top. After the details, the order must contain:

- Order number.

- Date of.

- City.

- Link to Article 129 of the Labor Code.

- A link to a specific clause of the collective labor agreement, the Regulations on remuneration or other local regulatory act of the company, which talks about bonuses. This is the stating part of the order.

After the word “I order” there is a list of orders, divided into separate paragraphs. They contain:

- Position and full name of the employee who receives the bonus. If necessary, the structural unit of the organization in which the employee serves is also indicated here.

- Supplement amount. It is indicated in rubles, and not as a percentage of the salary. This is because, from a legal point of view, the premium is part of the overall benefits.

- How often is the specified amount paid? It can be either a one-time payment or accrued monthly. There are options for paying a quarterly bonus if certain targets are met. Be that as it may, this information must be duplicated in the employment contract. Inconsistencies in data are unacceptable.

- From what date will the order be executed, from what date does the salary bonus actually begin to accrue.

- An order regarding the accountant’s duties to calculate the payments due to the employee, as amended by the first paragraph of the order.

- Who is responsible for familiarizing the employee with the order.

- Who remains in control of the implementation of all points of the document.

- Base. The date and number of the collective labor agreement, regulations on remuneration or other local regulatory act, which states the amount of the bonus in specific situations, are indicated here.

At the very bottom of the sheet (at the end of the document) there should be signatures of the manager, a representative of the accounting department (if it was mentioned in the order), as well as the employee himself.

An order for a wage increase is registered in the personnel order journal and stored for 75 years.

The procedure for organizing the payment of personal allowance

An order for the payment of an allowance is entrusted to be prepared by an authorized person (as a rule, this is an employee of the personnel department or accounting department). The document is drawn up at the organization’s corporate bank and has the following structure:

- Order details (date and serial number).

- Preamble. The rationale for assigning the allowance is indicated here. It may look like this: “Taking into account the high qualifications of senior engineer R. A. Varenin, on the basis of Art. 129 of the Labor Code of the Russian Federation and paragraph 8 of the employment contract dated February 12, 2016 No. 189, I order...”

- Next comes the point that a personal bonus is established to the official salary (indicating the amount of payment).

- Instructing the responsible employee to organize work on payment of the bonus.

- The clause states that the HR specialist must familiarize the employee with the order against signature.

- Determination of the person responsible for the execution of the provisions of the order.

- The document is completed by affixing the signature of the head of the enterprise and the official seal.

The employee is familiarized with the order against his signature.

Relations with the tax service

According to Article 57 of the Labor Code, mention of the amount of the bonus is mandatory in the employment contract (or the presence in it of a reference to the local regulatory act of the organization). In addition, Article 255 of the Tax Code clearly states that the taxpayer’s labor costs include allowances of any kind.

These clarifications in the legislation exist so that the heads of organizations are not tempted to set a minimum wage for all employees in their companies, and arrange the rest in the form of bonuses.

All additional payments and allowances are subject to taxes, just like the employee’s basic salary.

Personal allowances to the basic salary

In Art. 129 of the Labor Code of the Russian Federation states that the salary system includes various types of allowances and additional payments, which in essence are compensatory or incentive payments. At the same time, it does not specify what personal allowances are, however, from the provisions of the code it can be concluded that these are funds that are paid in excess of the established base salary and are accrued along with the salary. The bonus can be either personal (that is, assigned to a specific employee and, accordingly, not applicable to other employees) or collective (for example, for work under certain conditions).

A personal allowance can be assigned for various reasons: for length of service, professional skills, work with certain documents that constitute a trade secret, etc. The choice of the basis on which the additional payment will be made is the prerogative of the organization’s management. At the same time, it is necessary to understand that due to the absence of legislative requirements defining the procedure and grounds for payments, the employer has the right to choose absolutely any justification.

As for the amount of the bonus, it is also set at the discretion of the head of the enterprise:

- or as a percentage of the salary;

- or in the form of a fixed amount, which is paid monthly (quarterly, semi-annually, etc.).

Is it necessary to include it in an employment contract?

Since an allowance (of any nature), according to the Labor Code, is considered an integral part of wages, it will need to be reflected in the employment contract. This applies to both collective agreements and individual employee agreements.

But there are certain nuances here. The specific amount of the bonus may not be reflected in the employment contract. You just need to provide a link to one of the company’s local regulations that discusses this point in detail. This may be a signed and entered into force Regulation on Remuneration.

Requirements

The conditions that must be met by the employer when assigning any types of bonuses can be found in articles 147-154 of the Labor Code. They discuss the main key points that relate to the employee-employer relationship. Some of them are mandatory. Their minimum permissible size is also determined.

In general, we can say that an order for a salary increase is an integral part of the document flow when assigning such payments. The most important thing is not to limit yourself only to them. It is necessary to coordinate the information contained in it with the employment contract and local regulations of the company, which establish the specific amount of payments.

How to draw up an order for additional payment to the minimum wage in 2022?

The order for additional accrual to the established minimum is issued in one copy for each employee whose income is below the minimum wage approved in the region.

The following requirements apply to such an order:

- The document must be completed without errors or corrections in compliance with the structure established in office work for similar orders.

- The order form can be filled out manually or printed out.

- The administrative document can be drawn up on an ordinary A4 sheet or on the company’s letterhead.

- An order for additional accrual to the minimum wage can be issued for the entire period, until the advent of a new law, or monthly, ensuring regular reconciliation of the income received by the employee with the established minimum wage.

- The order may be published individually for each employee or published generally for all those in need of additional payment up to the “minimum wage”.

When creating this order, you must fill out the introductory part displaying:

- Company names. When filling out an order on the company’s form, this information is already displayed.

- The title of the document, with an assigned number.

- Places and dates of document execution.

- Preambles, with reference to the Labor Code of the Russian Federation.

In the administrative part you need to indicate:

1) Full name the employee and his position, or a list of employees, indicating the actual salary and the amount of additional payment up to the minimum wage.

2) The procedure for paying the additional payment, indicating the start date of its accrual.

3) Full name an official who ensures control over the execution of the order.

The final stage of processing an order for an additional payment to the “minimum wage” is:

- Placing the signature of the director of the enterprise or his deputy, in the absence of the first person.

- Inviting the working persons specified in the administrative document to familiarize themselves with the order and sign it, indicating the date of familiarization.

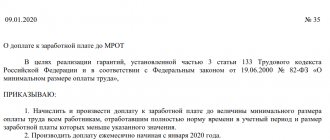

Content

An order for additional charges up to the minimum wage is drawn up in a free style, in compliance with the generally accepted structure for similar administrative documents.

The order must contain the following points:

1) Company name.

2) Title of the document, with an assigned number.

3) Place and date of its formation.

4) Preamble, with justification for the order and reference to Art. 133 Labor Code of the Russian Federation.

5) The administrative part, with the designation:

- Additional payment amounts and full name. specialist to whom it should be additionally assigned.

- Procedure for calculating surcharges.

- FULL NAME. the person responsible for executing the order.

6) Signature of the director of the company who gave the order to publish the order.

7) Signatures of the persons specified in the order.

Below is a sample of such an order.