New form of salary-education (statistics)

Related publications

The quarterly statistical report in the form ZP-education contains information about the number of employees in the educational institution and the payroll.

The unified form and Instructions for filling it out are regulated by Rosstat Order No. 412 dated July 24, 2020 (Appendix No. 9). The main purpose of the salary-education form is to collect statistical information on indicators of income from the labor activities of personnel. With its help, statistical authorities monitor indicators in a specific period of time. Educational institutions will begin submitting this report using the new form starting with reporting for the 1st quarter of 2022.

Russian President Vladimir Putin instructed the Russian government to analyze the wage system for employees of budgetary organizations and provide proposals for changing it to bring the level of wages of public sector employees in line with the May decrees not on paper, but in reality. The Cabinet of Ministers must conduct an analysis during April 2022 and provide information to the head of state.

The Russian Ministry of Labor published on its official website on the Internet in letter dated March 15, 2021 No. 14-5/10/P-1949 a form for collecting information on the wages of public sector employees and instructions for filling it out.

A new one-time report must be drawn up and submitted by all state and municipal institutions. It is especially expected from budgetary organizations that employ employees of the categories listed in the decrees of the President of Russia:

These are doctors, teachers, college and university professors, social workers, and researchers.

The report form is voluminous; it must contain information on the salaries of employees of all budgetary institutions and organizations for 2020, broken down by employee category, each of which is assigned a code. The wage fund for managers, their deputies and accounting employees is indicated separately. The instructions indicate that the information must be personalized. For each employee you must indicate:

- last name, first name and patronymic (if any) of the employee separated by a space, in full, without abbreviations, in Cyrillic;

- insurance number of the individual personal account of each employee whose salary information is provided in the form;

- total length of service, full years - indicates the total duration of periods of work and (or) other activities taken into account when determining the right to a labor pension at the end of the reporting year or at the date of dismissal of the employee from the organization, if this happened during the year;

- name of the position held by the employee (one SNILS can have several lines (positions));

- personnel category code (in accordance with the instructions for filling out the forms ZP-health, ZP-social, ZP-education, ZP-culture, ZP-science of federal statistical observation, Rosstat order No. 412 dated July 24, 2020) - a three-digit digital code assigned to the position and corresponding to one of the codes from column 7 of the directory of personnel category codes (presented in Appendix 1 to the instructions);

- employment conditions - “Basic”, “External part-time”, “Internal part-time”;

- occupied rate (for example: 0.25; 0.5; 1) - the number of staff units occupied by the employee by position;

- the number of working hours according to the schedule in the reporting month, with a summarized accounting of working time (Article 104 of the Labor Code of the Russian Federation), the standard working time in the reporting month may not coincide with the standard working time calculated according to the calendar of a five-day working week for the period of work and is indicated based on the established working hours time per week according to position;

- actually worked time in the reporting month; if the employee has no time worked throughout the entire month, the value of 0.00 hours is entered in the field.

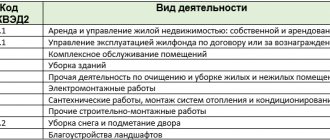

This is what a fragment of the code reference looks like:

Next, fill out information about wages in terms of salaries and tariff rates, additional payments and compensations, incentive payments, additional payments for performing additional functions.

Instructions on how to fill out report No. ZP-culture.

Contribute:

- Full and short name;

- OKPO company (IP);

- Code designation of the company type;

- Enter the address and zip code.

In gr. No. 1 enters the average number of employees (SSH).

In gr. No. 2 enter those combining from outside (groups No. 1 to No. 2 enter the comma field with one sign).

The annual average is the sum of the average for all months of the year, divided by the number of months in the year.

TSS for a month is the sum of full-time employees for each day of the month according to the calendar, taking into account holidays and weekends, divided by the number of days in the month.

In gr. from No. 3 to No. 5, the wages of regular staff and those combining from outside are entered on an accrual basis.

Wages in gr. from No. 3 to No. 5 - these are all payments regardless of the sources of their support.

According to gr. from No. 6 to No. 11 - payment for the labor of workers (from group No. 3) and payment for labor of those who combine from outside (from group No. 5) are distributed according to sources of income: according to group. No. 6 and No. 9 contribute budget support, according to gr. No. 8 and No. 11 – income from work that generates income and other income.

An employee who combines duties within the company is paid according to his main place, according to gr. No. 3 reflect earnings taking into account combinations. In gr. No. 4 from gr. No. 3 allocate payment for combination within the company.

A full-time employee of a company on a civil contract in his own company is entered once based on the main place.

In gr. No. 1 and No. 2 do not include persons, freelance workers on civil contracts and part-time workers from outside.

The average number of employees combining from outside (groups No. 1 and No. 2) and the wage fund (groups No. 3 and No. 5) on page No. 01 correspond to report No. P-4.

Page No. 01 includes personnel of cultural institutions.

On page No. 02 enter the head of the company and his data;

On page No. 03, information about the company’s deputy management is entered.

Page No. 04 provides information about the artistic staff.

On page No. 05 they cite artistic workers - art. manager, head artist, head choreographer, head conductor.

On page No. 06, specialists are entered, such as a librarian, production designer, production director, archivist, tour guide.

On page No. 07, scientific workers are identified, of which, on page No. 08, scientific workers are identified.

A scientist is a person who conducts research and has special knowledge.

Researchers supervise fundamental and applied research: chief, senior, leading, junior researcher.

On page No. 09, full-time teachers with a license for educational activities are entered. If there is no license, then the data is entered on page No. 13 “other personnel”;

On page No. 10, doctors are distinguished from “specialists”;

In page No. 11 they include serving honey. employees, including dentists;

On page No. 12 enter junior med. staff.

Page from No. 10 to No. 12 are added if honey. personnel are included in the staff of art and cinema companies (reflected in group No. 1) and those combining internally (combining from outside, are included in group No. 2);

Page No. 13 includes service workers who are not included in pages No. 02 to No. 12: museum caretaker, cleaner, cloakroom attendant, others, teachers without a license for educational activities.

You can download the report form from the link, Appendix No. 5.

Salary education: instructions for filling out

The salary-education form should be drawn up on an accrual basis. Information should be accumulated for the 1st quarter, for six months, for 9 months and then for a year. Registration of salary-education from 2022 includes the need to enter information on the title page and a separate tabular part of the report. In particular, the first page provides the following information :

specific reporting period;

- name of the educational institution. In this case, it is necessary to write down the name of the organization in full, and then - in brackets - note the abbreviated name;

- actual address;

- OKPO code, as well as the code of the reporting institution. The last digital combination should be taken from the list noted in the Instructions for filling out.

- managers of organizations and departments;

- teachers who implement educational programs of general, preschool and additional education;

- teachers;

- industrial training masters;

- professors;

- research assistants;

- doctors;

- personnel in the field of culture;

- social workers;

- other categories of workers. For example, service personnel, accounting, etc.

If the legal and actual addresses of the educational organization coincide, the information in the report should be entered only in the “Postal Address” column. In turn, the tabular part of the document is a more massive information block. It is necessary to enter information both for the entire workforce and for individual categories of personnel . In particular, these categories of employees include the following groups :

Instructions on how to fill out Form No. Salary-education.

Enter the full and short name of the company, address with index, OKPO, code designation of the type of company.

In gr. No. 1 enter the average number of employees for the reporting period, in gr. No. 2 - the average number of part-time workers from outside (gr. No. 1 and No. 2 are filled in with one decimal place).

In gr. from No. 3 to No. 5, they contribute the accrued total of wages for full-time employees and part-time workers from outside, calculated for the reporting period.

Wages in gr. No. 3-No. 5 are payments regardless of the sources of their receipt.

According to gr. No. 6-No. 11 – wages for all personnel (from group No. 3) and part-time workers from outside (from group No. 5) are distributed by type of income: by name of group. No. 6 and No. 9 according to gr. No. 7 and No. 10.

According to gr. No. 8 and No. 11 – income from income-generating activities and other funds.

SSC (gr. No. 1 and No. 2) and wages from gr. No. 3 and No. 5) on page No. 01 correspond to form No. P-4.

Educational companies that organize various training programs not related to their main activities include employees in training programs separately.

According to page No. 01, all employees of the company are entered.

They do not distribute persons by rank; they are included in page No. 28 “Other personnel.”

Page No. 02 reflects the company's management.

On page No. 03, deputy management of the company is listed.

Page No. 04-No. 28 are filled out according to the company’s staffing arrangement.

In page No. 04 they list preschool teachers.

In page No. 05 teachers and heads of educational departments of general education companies are included.

According to page No. 06, teachers are allocated from grades 1 to 4 of the school.

Page No. 07 includes teachers who work with children - speech therapist, social teacher, psychologist, defectologist.

You can download the report form from the link, Appendix No. 1.

When do you need to submit your salary-education report to statistics?

The organization's salary-education report is submitted quarterly. This must be done on the 10th day of the month following the expiration of the reporting period.

If the deadline for submitting a report falls on a weekend or holiday, it is postponed to the first working day following it. Rosstat notes that the priority is to provide statistical reports in electronic form. But the ZP-education form can also be submitted on paper or sent by mail.

Submission of statistical reports is a mandatory procedure. If a business entity does not provide it within the established time frame, it will have to bear administrative responsibility. The amount of penalties is prescribed in 13.19 of the Code of Administrative Offenses of the Russian Federation: up to 70 thousand rubles. for legal entities and up to 20 thousand rubles. for an official. If the violation is repeated, the fines will increase significantly.

Report N ZP-health.

Report No. ZP-health is submitted by state and municipal healthcare companies to Rosstat, with OKVED coding 86.

| OKOPF CODES | NAME |

| 3 00 00 | Organizational and legal forms of organizations created without the rights of a legal entity |

| 3 00 02 | Branches of legal entities |

| 3 00 03 | Separate divisions of legal entities |

| 3 00 04 | Structural divisions of separate divisions of legal entities |

| 7 51 01 | Federal state autonomous institutions |

| 7 51 03 | Federal state budgetary institutions |

| 7 51 04 | Federal government agencies |

| 7 52 01 | State autonomous institutions of the constituent entities of the Russian Federation |

| 7 52 03 | State budgetary institutions of the constituent entities of the Russian Federation |

| 7 52 04 | State government institutions of the constituent entities of the Russian Federation |

| 7 53 00 | State academies of sciences |

| 7 54 01 | Municipal autonomous institutions |

| 7 54 03 | Municipal budgetary institutions |

| 7 54 04 | Municipal government institutions |

For OKOPF encoding, see the table above.

Who submits the report

Rosstat collects information on the number and wages of employees in various reports. In form No. 1, respondents distribute the number of employees on the payroll by salary level. The sample is based on April accruals.

Interval accrual values are constantly adjusted due to changes in the minimum wage. From 01/01/2021, the minimum wage was increased to 12,792 rubles: Rosstat updated Form No. 1 and differentiation by the amount of accrued wages. The form and procedure for filling out in 2022 were approved by Rosstat Order No. 37 dated January 27, 2021.

Order No. 37 explains who submits statistical form No. 1 - all organizations (from among medium and large ones) regardless of the organizational and legal form, type of ownership, type of economic activity.

Institutions included in the sample are required to report to the territorial statistics office at their location. Separate divisions, branches and representative offices submit information to the Rosstat department at the address of actual economic activity.

Form No. ZP-culture.

Report No. ЗП-culture is submitted by state and municipal cultural institutions with OKVED coding from No. 59 to No. 93, and OKOPF coding, see table:

| OKOPF CODES | NAME |

| 3 00 00 | Organizational and legal forms of organizations created without the rights of a legal entity |

| 3 00 02 | Branches of legal entities |

| 3 00 03 | Separate divisions of legal entities |

| 3 00 04 | Structural divisions of separate divisions of legal entities |

| 7 51 01 | Federal state autonomous institutions |

| 7 51 03 | Federal state budgetary institutions |

| 7 51 04 | Federal government agencies |

| 7 52 01 | State autonomous institutions of the constituent entities of the Russian Federation |

| 7 52 03 | State budgetary institutions of the constituent entities of the Russian Federation |

| 7 52 04 | State government institutions of the constituent entities of the Russian Federation |

| 7 53 00 | State academies of sciences |

| 7 54 01 | Municipal autonomous institutions |

| 7 54 03 | Municipal budgetary institutions |

| 7 54 04 | Municipal government institutions |

The report is submitted to Rosstat at the location of the organization or designated unit.

What to consider when filling out form No. P-3 in 2022

Federal statistical observation form No. P-3 “Information on the financial condition of the organization” is provided by all organizations, except, for example, those whose average number of employees did not exceed 15 people during the previous 2 years, including part-time workers and civil contracts, and during the previous 2 years, the organization’s annual turnover did not exceed 800 million rubles.

From 2022, form No. P-3 must be submitted by non-profit organizations when providing services and producing goods intended for sale to other organizations and individuals.

Form No. P-3 should be filled out for the organization as a whole, including all separate divisions that are part of it, including those that operate abroad.

From 2022, some lines of form No. P-3 must be filled out, taking into account the following changes:

- on line 13 there is no need to take into account deferred tax liabilities;

- on lines 26 and 27 in column 1 it is necessary to show the total amount of debt on loans and credits received, taking into account interest.

- line 26 shows the amount of debt on loans and credits received, taking into account interest (accounts 66, 67);

- line 27 reflects the amount of debt on loans and credits received, taking into account interest for a period of no more than 12 months (account 66).

Form No. ZP-science.

Institutions of state and municipal ownership working in the field of scientific research and development submit the form to Rosstat.

| OKOPF CODES | NAME |

| 3 00 00 | Organizational and legal forms of organizations created without the rights of a legal entity |

| 3 00 02 | Branches of legal entities |

| 3 00 03 | Separate divisions of legal entities |

| 3 00 04 | Structural divisions of separate divisions of legal entities |

| 7 51 01 | Federal state autonomous institutions |

| 7 51 03 | Federal state budgetary institutions |

| 7 51 04 | Federal government agencies |

| 7 52 01 | State autonomous institutions of the constituent entities of the Russian Federation |

| 7 52 03 | State budgetary institutions of the constituent entities of the Russian Federation |

| 7 52 04 | State government institutions of the constituent entities of the Russian Federation |

| 7 53 00 | State academies of sciences |

| 7 54 01 | Municipal autonomous institutions |

| 7 54 03 | Municipal budgetary institutions |

| 7 54 04 | Municipal government institutions |

OKVED 72 encoding and OKOPF encoding in the table above.

Who, when and where to submit the RSV form

Persons using hired workers - individuals with whom employment or civil law contracts have been concluded, must report to the tax authorities by calculating the DAM, then if there is an obligation to make insurance contributions for these persons. That is, you must report:

- all organizations;

- Individual entrepreneur if there are employees;

- lawyers, notaries, if there are employees;

- heads of peasant farms with employees.

If there was at least one payment under an employment contract (for example, to the general director of an LLC) or a civil partnership agreement (for example, the provision of services or performance of work), subject to insurance contributions in the reporting period, then you need to fill out the DAM form with the total indicators.

If there were no payments in the billing period, but there are employees - individuals, then you will need to fill out a zero DAM.

Important: if the contract is concluded with an individual in the status of an individual entrepreneur or self-employed, then there is no need to fill out the DAM for such performers, since there is no obligation to pay insurance premiums for these individuals.

Where to submit the report

The calculation is submitted to the department of the Federal Tax Service, in which the organization is registered as a legal entity, or in which an individual is registered as an individual entrepreneur, lawyer, notary, head of a peasant farm.

Separate divisions of the DAM are rented out independently if they themselves accrue and pay income to employees.

When is it due?

In 2022, the calculation in the DAM form must be submitted upon the expiration of:

- 1st quarter - until April 30, 2021;

- half-year - until July 30, 2021;

- 9 months - until November 1, 2022 (since October 30 falls on a calendar holiday);

- year - until January 31, 2022 (since January 30 falls on a day off).

That is, in general, the deadline for submitting the DAM is until the 30th day inclusive of the month following the period.

When to pay

Insurance premiums must be paid monthly - before the 15th day inclusive of the month following the billing month. If this deadline falls on a weekend or non-working day, the due date is postponed to the next closest working day.

For example, for three months of the 2nd quarter of 2022, contributions had to be paid within the following terms:

- for April - until May 17 (May 15 - Saturday);

- for May - until June 15;

- for June - until July 15.

In what form should I submit it?

Format for submitting calculations for insurance premiums:

- paper or electronic - if there are 10 or fewer employees (a paper report can be brought to the Federal Tax Service in person or sent by mail);

- only electronic - if there are more than 10 employees.

Violation of the format for submitting the calculation (for example, an organization with 11 employees submits the DAM on paper) leads to a fine of 200 rubles. If such violations are repeated, the fines increase.

New form of the RSV in 2022

In 2022, the calculation of insurance premiums must be filled out using a new form; below you can download the current form in excel format. For the first time, it must be submitted to the Federal Tax Service for the 1st quarter of 2022; for the first half of 2022, the DAM calculation must also be submitted using the form from the Federal Tax Service Order No. ММВ-7-11 dated September 18, 2019 / [email protected] taking into account changes from October 15, 2020.

Changes in the calculation are associated with a reduction in insurance premium rates for industries affected by coronavirus, for IT companies, small businesses, as well as in connection with the transition in 2021 of all regions to direct payments from the Social Insurance Fund for sick leave.

Samples of filling out the RSV can be downloaded below in the article.

Instructions on how to fill out report No. ZP-health

Fill in the full name of the company, postal address with index, code designation according to OKPO, code designation of the company type according to the list.

In gr. No. 1 of the report is entered in the SCH for the period, in gr. No. 2 – the average number of those combining from outside (groups No. 1 and No. 2 are entered with one decimal place).

In gr. from No. 3 to No. 5 pay wages for full-time employees and part-time employees from outside.

In gr. from No. 3 to No. 5 make all payments to workers.

In gr. No. 6 to No. 11 wages by funding sources.

You can download the report form from the link, Appendix No. 3.

When to submit PM statistics

There are uniform rules for all organizations.

Companies submitting a statistical report using the PM form must submit the completed form by the 29th day of the month following the previous quarter. Thus, for the first quarter, which includes January, February and March, the report is submitted by April 29. For the second quarter, the deadline for submitting the form is July 29. Attention should be paid to situations where the last day for submitting a report falls on a holiday or weekend. In this case, you should adhere to the rules for submitting any reporting documents. Accordingly, in such situations, the deadline for submitting the report can be postponed. In addition, the state reserves the right, at its discretion, to postpone the submission of reports. This may be due to unforeseen circumstances that cannot be prevented. For example, this happened in the spring of 2022 due to the general quarantine due to the Covid-19 pandemic.

Who and when must submit the Salary-Education form in 2021

The ZP-education form refers to statistical documents. Educational organizations must provide the marked reports if the OKVED code of a particular institution corresponds to the list from Appendix No. 9 of Order No. 412. In particular, these are pre-school educational organizations, institutions providing primary, secondary, vocational (secondary and higher), additional education, as well as vocational training and etc.

If the institution has separate divisions that carry out their professional activities outside the territory of Russia, there is no need to submit the form in question.

It is appropriate to clarify the need to submit a document on the official Rosstat website. To obtain the required information, simply enter OKPO, INN or OGRN. After entering the information, the site will provide a list of reports that a specific company must submit.

When answering the question, what are the deadlines for completing the salary-education in 2022, it should be noted that the document according to the new form (Order No. 412) must be submitted from 01/01/2021. It will have to be provided quarterly. The paper must be sent to the regulatory authority before the 10th day of the month following the reporting quarter.

If the deadline for sending a report falls on a non-working day or holiday, the maximum allowable date for submitting the document is postponed to the next working day after the event. Rosstat emphasizes that it is advisable to send the report in electronic format. However, the legislation does not prohibit sending paper by registered mail, or providing a document on paper during a personal visit to the regulatory organization of a representative of an educational institution.

Providing the report in question is a mandatory procedure. If the organization ignores this need or violates the deadline for sending the document, the manager will be held administratively liable. The amount of fines for such an offense is noted in Art. 13.19 Code of Administrative Offenses of the Russian Federation. In particular, for companies the sanction will be up to 70,000 rubles, and for officials – up to 20,000 rubles. Accordingly, if a violation occurs again, the fines will be increased.

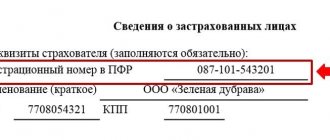

How Kontur.Extern will help fill out the SZV-TD

How to fill out an application for Externship:

- Enter Extern. In the side menu, find the Pension Fund icon and select “Registration with the Pension Fund”. Three links will appear on the main screen - click “Application for connecting the policyholder to the electronic document flow of the Pension Fund of Russia (ZPED)”. The form will open.

- Enter the required details. Or scroll down the form and select the certificate with which the document will be signed. If all the data in the payer's details is filled in, they will appear in the form automatically.

- When everything is ready, click “Sign and Submit.”

If the company reports to the Pension Fund through an authorized representative, a notice of authorization to the representative should also be sent.

If you have already filled out the SZV-M form in Extern, then the employee’s data (full name, SNILS, date of birth) will be added to SZV-TD automatically.

The employee’s card reflects all actions performed on him. Based on the previously sent SZV-TD report, you can immediately create a report with a canceling event. To cancel a specific event, simply indicate the date of cancellation.

You can add employees to the report en masse - this is convenient when you need to submit a form for a large number of employees, in particular, when renaming an organization.

Before sending the form, Extern checks it for formatting and logical errors, as well as according to the Pension Fund of Russia methodology.

Sample of filling out form P-5(m) in 2022

Let's consider the example of the enterprise LLC "Princip". Let this company provide services for installing monitoring systems on customer vehicles. LLC “Princip” does not produce its own products; it purchases equipment for installation from third parties. Customers are large transport companies.

A sample of filling out form P-5(m) in 2022 for the above example can be viewed below and downloaded for free from the link below.