Review from another vacation for a business trip

According to Article No. 166 of the Labor Code of the Russian Federation, a business trip is a work trip outside the municipality in which the organization is located.

If there is a need for an employee to travel on business, and he is on vacation, the employer must interrupt the vacation. To do this, you need to properly register your review and business trip.

Calculation of vacation pay taking into account business trips

Periods of absence from work for which average earnings are paid should not be included in vacation pay (clause 5 of Regulations No. 922 dated December 24, 2007). As we have already found out, payment for time spent on a business trip is made in the amount of average earnings. But is a business trip the same as being away from work?

The definition of a business trip is given in Art. 166 Labor Code of the Russian Federation. This is a trip by an employee on the orders of the boss for a certain amount to perform a job assignment outside the place of permanent work. It turns out that the employee leaves his workplace, despite the fact that he does this in the interests of the company. Thus, the business trip meets the criteria of clause 5 of Regulation No. 922 dated December 24, 2007 and is a period excluded from the calculation of vacation pay. The Ministry of Labor came to the same conclusion in Letter No. 14-1/B-608 dated August 13, 2015. Thus, the amount of travel expenses paid to an employee during a business trip is not included in the calculation of average earnings.

Important! Travel payments do not participate in the calculation of average earnings when calculating vacation pay in accordance with clause 5 of Regulation No. 922 dated December 24, 2007, with the exception of additional remunerations.

Particular attention should be paid to additional payments made by the employer when the average salary paid during a business trip does not correspond to the employee’s salary. The Ministry of Labor, in its Letter No. 14-1/5-226 dated March 16, 2016, counts this additional payment as accrued remuneration for the pay period, and it must be taken into account when calculating vacation pay.

In what cases cannot an employee be recalled from vacation?

In some cases, it is impossible to send a citizen from vacation on a business trip. The restriction applies if the employee:

- has not reached the age of majority;

- is on sick leave due to pregnancy and childbirth;

- is on study leave;

- is on vacation without pay.

A business trip during vacation is also impossible for citizens whose work activities take place in harmful or dangerous working conditions.

An employee took a leave of absence during a business trip

Sometimes a vacation is combined with a business trip. Taking a sudden paid vacation is dangerous, since vacation pay must be paid 3 days before the start of the vacation. If this is not done, the company risks receiving a fine. If an employee insists on vacation, then he can be sent on vacation without pay for 3 days and paid vacation pay as expected (Article 136 of the Labor Code of the Russian Federation). An employee does not have the right to take vacation without permission; the employer must agree on the days of vacation. But the following categories of persons cannot be denied leave without pay:

- WWII participants;

- For pensioners;

- Disabled people;

- Spouses or parents of military personnel, firefighters, etc.

An employer cannot refuse leave without pay; it cannot be refused if the employee has the following situations: wedding, birth of a child, death of a loved one (Article 128 of the Labor Code of the Russian Federation).

At the start of the vacation and the re-start of the business trip, the accountant must draw up orders.

Procedure for registering a business trip during vacation

Algorithm for the procedure for sending a citizen on a business trip during the next vacation:

- The manager draws up a notice of the need for a business trip and sends it to the employee.

- The employee familiarizes himself with the proposal received and gives his consent or refuses the trip.

- The director issues a recall order and creates a job assignment for the period of work on a business trip.

- Accounting employees recalculate and pay daily allowances and vacation pay.

The notification sent is drawn up by the director of the organization in free form. The contents of the document indicate:

- company name indicating the registration form;

- Full name and position of the citizen to whom the message is addressed;

- description of the situation and proposal to interrupt vacation for a business trip;

- clarification of the employee’s right to the opportunity to receive rest after a business trip or along with the next paid rest;

- link to Part 2 of Art. 125 of the Labor Code of the Russian Federation that a citizen has the right to refuse a recall;

- Date of preparation;

- Full name, position title and signature of the compiler.

A sample of a written notification is available here.

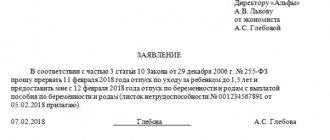

Written consent of the employee

The consent is drawn up by the employee in free form. The contents of the document indicate the following information:

- name of the organization indicating the registration form;

- Full name and position of director;

- the date when the citizen interrupts his vacation and goes on a business trip;

- indicating the dates when the employee plans to receive the remaining vacation days;

- Date of preparation;

- signature.

ATTENTION! According to Art. 125 of the Labor Code of the Russian Federation, it is impossible to recall a citizen from vacation without approval. If a notice of interruption is refused, the employer may not take disciplinary action. Otherwise, the manager is held accountable in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

The manager does not have the right to deprive bonuses, discriminate in career growth, reduce wages, etc. When using illegal methods of influence in accordance with Art. 356 of the Labor Code of the Russian Federation, a citizen can appeal to the labor inspectorate with a complaint.

Manager's decision

After receiving consent, the manager formalizes his decision. To do this, he needs to issue a recall order. It can be drawn up in free form or on a form regulated by local acts of the organization.

The contents of the order indicate the following information:

- Company name;

- Date of preparation;

- registration number of the order;

- link to article 125 Labor Code of the Russian Federation;

- date the employee returns to work;

- basis for drawing up (details of the notification sent to the citizen);

- an order for the accounting department to recalculate vacation pay;

- signature of the recalled employee;

- compiler's signature.

A sample order is available here.

Service assignment

The fact of going on a business trip must be recorded by an appropriate order. It is drawn up in the T-9a form or on the enterprise’s own form.

Details of the trip are reflected in the job description. Its contents indicate:

- document number and date of its preparation;

- Company name;

- information about the employee (full name, position);

- place of business trip;

- length of stay on a business trip;

- list of goals;

- regulations on working hours and days off during travel;

- payment provisions;

- regulations on additional charges (payment for accommodation, travel, food, etc.);

- signatures of the parties;

- Date of preparation.

To fill out a job assignment, you can use the organization’s form or the unified form T-10a. The sample is available here.

ADVICE! A job assignment is not required. The manager has the right to decide on the need to draw it up.

From business trip to vacation, travel expenses

Expert consultation

Many employers have to send employees on business trips. There are many situations that arise in this regard and require separate consideration. Here is one of them: the employee was sent on a business trip, and immediately after the business trip he was granted leave. Our expert Viktor Bocheev spoke about how to arrange everything correctly.

***

Let's consider a situation where an employee was sent on a business trip, and immediately afterwards he was granted annual paid leave or leave without pay. One of the important questions that arises is: in what order is the employer obliged to reimburse the employee for travel expenses?

According to labor law, the employer is obliged to reimburse the posted worker for travel expenses there and back, provided there are documents confirming these expenses. This is one of the guarantees of the Labor Code.

If an employee goes on vacation after a business trip, the employee still incurs travel expenses. Undoubtedly, first of all, these are the costs of travel there, that is, to the place of business trip. If this expense is documented, the employer is obliged to reimburse the employee. In this case, the employee does not generate any income; the employer does not withhold personal income tax from this compensation. And here it doesn’t matter whether the business trip is followed by vacation or not.

If a business trip is followed by a vacation, then it also does not matter where the employee will spend it. An employee can stay on vacation either in the area of business assignment or go on vacation to another area. Thus, the employer reimburses the expenses for travel there, that is, to the place of business trip, to the employee in the general manner.

The main question that arises in a situation where immediately after a business trip an employee goes on vacation is whether the employer is obliged to reimburse the employee for the cost of return travel, that is, travel expenses at the end of the business trip. In this case, a business trip can be followed by either planned or unplanned annual paid leave, as well as unpaid leave. In addition, the employee can either stay to spend his vacation in the area of business assignment or go on vacation to another location.

Previously, we told you how to correctly determine the duration of a business trip if an employee arrives at the place before the start of work or, on the contrary, leaves later.

In the above situations, our employee does not have travel expenses for travel back at the end of the business trip, since he stayed on vacation at the place of business trip and, returning back, he has expenses for travel from the place of vacation, and not from the business trip. The law does not oblige the payment of return tickets to an employee who spends his vacation at the place of business trip. After all, he is returning from vacation, not from a business trip. Employers are also not required to pay the employee for travel expenses from the place of business trip to the place of vacation.

If, in the current situation, the employer decides to compensate the employee for the cost of a return ticket at the end of the business trip, then personal income tax must be withheld from this amount and insurance premiums charged, since the employee has taxable income, that is, the employee receives economic benefits. This position is taken by the Ministry of Finance of the Russian Federation (letters of the Ministry of Finance of Russia dated December 6, 2019 No. 03-04-06/94974, dated June 16, 2017 No. 03-03-06/1/37573).

In the practice of employers, other situations arise. For example, an employee, on his own initiative, may remain after the end of a business trip at the place of business trip to spend weekends, non-working holidays or days off. In such a situation, expenses for travel back, that is, from the place of business trip, are reimbursed to the employee in accordance with the general procedure. In this situation, the employee does not receive income, that is, economic benefit. Therefore, the employer does not need to withhold personal income tax on compensation for the cost of return travel, nor does it become necessary to charge contributions. This position is adhered to by the Ministry of Finance of the Russian Federation (Letter of the Ministry of Finance of Russia dated October 21, 2020 No. 03-15-06/91634).

In this case, the employee’s daily allowance is paid only for those days that are included in the period of the employee’s actual stay on a business trip. Since the actual duration of the employee’s stay on a business trip is confirmed by travel documents, and the dates in them go beyond the duration of the business trip, ask the employee, upon returning from a business trip, to provide the employer with an explanatory note (memo, statement), from which it will follow that he was delayed after the end of the business trip at the place of business trip on your own initiative to spend days off (non-working holidays or days off).

Previously, we talked about how to pay for returning from a business trip on a day off.

Thus, labor legislation does not oblige employers to pay return tickets for an employee who spends his vacation at the place of business trip. After all, he is returning from vacation, not from a business trip. There is also no obligation to pay employees for travel from business trips to vacations. If you compensate for such expenses, pay personal income tax and contributions.

Let me remind you that such unique analytical materials of SPS ConsultantPlus, such as ready-made solutions and standard situations, will provide you with serious support in resolving non-standard complex controversial situations. The conclusions of ready-made decisions and typical situations take into account the norms of current legislation, current established judicial practice and official explanations of authorities.

Ready-made solution: How to provide another vacation immediately after a business trip (ConsultantPlus, 2021) {ConsultantPlus}

Typical situation: How to take into account payment for travel from a business trip to vacation (Glavnaya Kniga Publishing House, 2021) {ConsultantPlus}

With the help of the ConsultantPlus legal reference system, you will easily navigate labor legislation.

Viktor Bocheev, legal consultant at “What to do Consult” LLC

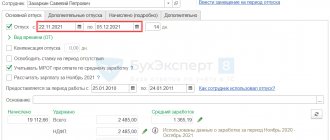

Calculation of business trip payments and recalculation of vacation pay

Since the citizen left his vacation early, he returns part of the funds received. Their sum is calculated using the following formula:

SO / KD × KND , where:

- SO – the amount of vacation pay received;

- KD – number of days of rest provided;

- KND – number of unused days.

Travel allowances are paid based on the citizen’s average earnings over the last 12 months. Additionally, the employer compensates for the cost of accommodation, food, travel or fuel consumed.

Determination of vacation payments

Article 114 of the Labor Code of the Russian Federation regulates the employee’s right to leave, which gives him the right to retain his job and receive the average wage (AW).

Calculating the daily wage in this case is very similar to calculating earnings for business trips. The calculation period is also the last 12 months. The periods specified in clause 5 of the Regulations on the specifics of the procedure for calculating average wages dated December 24, 2007 No. 922, relating to average earnings and social insurance payments, are excluded. Formula for calculating average earnings per day:

SZP = DRP / 12 / 29.3,

Where:

DRP - income of the billing period;

12 — number of months;

29,3 — average number of days in a month.

However, this formula only applies if there are no months of part-time work. If the employee was absent for part of the days, the number of days actually worked is calculated separately for each part of the month.

However, the question remains: does travel compensation count towards holiday pay or should it be excluded from the calculation period? For this we have prepared a table:

| Payments to an employee on a business trip | Is the payment taken into account when calculating vacation pay? | Regulatory document |

Average earnings for business trip days and reimbursement of expenses:

| No | Art. 139, 167 and 168 Labor Code of the Russian Federation, subp. “a” clause 5 of Regulation No. 922 |

| Additional payment of payments before salary, if average earnings are lower than actual. | No | Art. 139 Labor Code of the Russian Federation, sub. “a” clause 5 of Regulation No. 922 |

| Additional rewards in the form of bonuses. | Yes | Part 2 art. 135, parts 2 and 4 of article 139 of the Labor Code of the Russian Federation, subp. “and” clause 2 and clause 15 of Regulation No. 922 |