What is a regional minimum wage

To establish a minimum wage in an entity, an appropriate regional agreement must be in effect. Most regions of the country did not take advantage of the opportunity to set their own indicator. But, for example, in the capital, the Moscow region and some other regions there is a regional agreement. Although from 2022 the federal minimum wage is correlated with the median salary, most trilateral agreements between business and government in the constituent entities of the Russian Federation use the cost of living in the region as a reference point.

For example, in the capital it was agreed that the minimum wage in Moscow in 2022 will be revised simultaneously with the subsistence minimum (see tripartite agreement for 2022–2024 dated December 30, 2021). As soon as it increases (the law does not allow it to be reduced), the minimum salary immediately increases. In accordance with the Decree of the Moscow Government dated October 12, 2021 No. 1597-PP, capital workers receive from January 1, 2022 no less than 21,371 rubles.

After the adoption of a regional agreement, employers begin to implement it or write a reasoned refusal. 30 days are allocated for refusal from the date of official publication of the document. After this time, employers who have not explained the reasons for their inability to pay the minimum wage in the MSK are automatically considered parties to the agreement.

You will always find the exact values of the minimum wage and other indicators in ConsultantPlus. Take advantage of this free access.

Responsibility for non-compliance with the minimum wage by the employer

If the salary is less than the minimum wage, the employer will face fines. An employee whose salary is less than the regional minimum wage has the right to complain to employees of the State Labor Inspectorate (GIT) provided they work full time.

Rostrud explained to employers that it is necessary to bring employment contracts and staffing schedules into line with the new minimum wage indicator for the Moscow Region. If the employee’s “minimum wage” amount is less than the established one, and also if he is not entitled to bonuses and compensation, the salary will have to be raised to 14,200 rubles. To do this, an order is issued and an additional agreement with a new salary is drawn up, which is attached to the main contract.

If the employer continues to pay wages to employees less than the minimum wage, then this fact will become the basis for bringing him to justice under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

To do this, the employee submits a written application to the State Tax Inspectorate. The application shall be accompanied by evidence proving a violation of the employee’s rights:

- an extract from the accounting department on the composition of the salary;

- what additional payments were made and in what amount;

- the employer’s official response to the employee’s request to bring the salary to the approved level.

In addition to the State Tax Inspectorate, an employee can apply to the prosecutor’s office and the court to protect violated rights.

Changes in the Moscow minimum wage

Unlike the entire country, the minimum wage in Moscow today is much higher, and previously it was allowed to be increased during the year, since the figures were adjusted depending on the cost of living, and it was revised quarterly. Now the cost of living is approved only once, therefore the indicator changes only from the beginning of the year.

This is interesting: individual entrepreneurs without employees are entitled to assistance from the state and unemployment benefits.

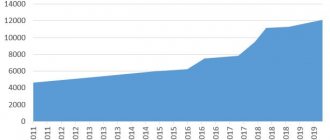

Dynamics of the minimum wage

More details on how the minimum wage has changed in Moscow are shown in the table.

| Period | Salary amount, rub. |

| 01.01.2015–31.03.2015 | 14 500 |

| 01.04.2015–31.05.2015 | 15 000 |

| 01.06.2015–31.10.2015 | 16 500 |

| 01.11.2015–31.12.2015 | 17 300 |

| 01.01.2016–30.09.2016 | 17 300 |

| 01.10.2016–30.06.2017 | 17 561 |

| 01.07.2017–30.09.2018 | 17 642 |

| 01.10.2018–30.06.2019 | 18 781 |

| 01.07.2019–30.09.2019 | 19 351 |

| From 01.10.2019 | 20 195 |

| From 01/01/2020 | 20 361 |

| From 01/01/2021 | 20 589 |

| From 01/01/2022 | 21 371 |

The size of the minimum wage in 2022

Taking into account a combination of economic factors, it was decided to index the cost of living and the minimum wage by 8.6%.

Thus, from January 1, 2022, the minimum wage is set by Federal Law dated December 6, 2021 No. 406-FZ at the level of 13,890 rubles.

In 2022, the minimum wage indicator is 12,792 rubles. per month.

Methodology for calculating the minimum wage

From January 1, 2022, a new procedure for calculating the cost of living and the minimum wage is in effect. Now the minimum wage depends on the median salary and median income for the previous year. It is 42% of the median salary calculated by Rosstat.

The minimum wage cannot be lower than the subsistence level of the working population as a whole for the next year.

What is median income

By this concept we should mean the amount of money income, relative to which half of the population has an average per capita income below this value, the other half - above this value.

The median per capita income is calculated taking into account the collected statistical information.

What is the median salary

This indicator conventionally divides all workers in half. One half has earnings higher than the indicator, the other half has lower earnings.

As noted on the Ministry of Labor website, an increase in the minimum wage leads to an increase in median income in subsequent periods. Thus, the growth of the minimum wage at a pace that is faster than the cost of living contributes to the growth of the cost of living for the next period.

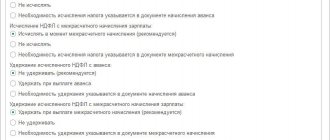

What cannot be included in the minimum wage when comparing it with wages

Not all compensation and incentive payments can be included in the minimum wage to compare it with wages.

Practical material:

Sample documents for salary increases from 2022

When calculating the minimum wage for comparison with wages, it does not include incentive payments from Article 165 of the Labor Code of the Russian Federation and payments that are excluded from the minimum wage by court decisions. This:

- payments when sent on business trips;

- compensation for moving to work in another area;

- payments in the performance of state or public duties;

- when combining work and study;

- payments for downtime through no fault of the employee;

- vacation pay;

- payments upon termination of an employment contract;

- fines from the employer, for example, for delays in issuing a work book upon dismissal of an employee;

- regional coefficients and northern allowances;

- allowances for shift work;

- additional payment for days off;

- payment for work on holidays and weekends;

- payments that are not included in the remuneration system established in the organization by the Regulations on remuneration or a collective agreement.

The salary includes only those payments that depend on the employee’s qualifications and working conditions. Payments such as financial assistance and birthday bonuses, which are paid to all employees, cannot be considered as part of the salary.

Related details:

Minimum salary for a part-time worker according to the new minimum wage in 2022

When calculating the salary of an internal part-time worker, you will need to separately compare the minimum wage with the salary at the main place of work and part-time work. At the same time, the salary received for part-time work must not be lower than the minimum wage in terms of full-time work.

For pros, materials in the berator:

What cannot be included in the minimum wage?

Northern allowances and minimum wage

Minimum wage when paying for holidays, overtime and night work

Sick leave payment not lower than the minimum wage

Minimum wage for 2015–2018 in Russia

The minimum wage in 2015 was 5,965 rubles. (Article 1 of the Law of the Russian Federation dated December 1, 2014 No. 408-FZ).

The minimum wage 2016, introduced on January 1, 2016, amounted to 6,204 rubles. (Article 1 of the Law of the Russian Federation dated December 14, 2015 No. 376-FZ). From 07/01/2016 it was increased to 7,500 rubles. (Article 1 of the Law of the Russian Federation dated June 2, 2016 No. 164-FZ).

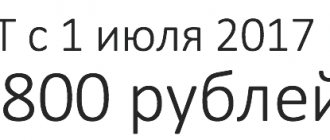

Since the beginning of 2022, the value of the minimum wage has not changed, remaining equal to the value of 7,500 rubles, effective from 07/01/2016. However, from July 1, 2017, the minimum wage increased to 7,800 rubles. (Article 1 of the Law of the Russian Federation dated December 19, 2016 No. 460-FZ).

From January 2022, the minimum wage increased to 9,489 rubles. From 05/01/2018, as mentioned above, 11,163 rubles.

Read about the role of the minimum wage in setting wages in the material “Art. 135 of the Labor Code of the Russian Federation: questions and answers.”

Regional minimum wage (regional minimum wage)

Subjects of the Russian Federation, in accordance with Article 133.1 of the Labor Code of the Russian Federation, can establish a higher minimum wage on their territory. The minimum wage for a particular subject is determined taking into account socio-economic conditions and the cost of living in its territory.

The minimum wage in the region is established by a regional agreement of three parties (Part 6 of Article 133.1 of the Labor Code of the Russian Federation):

- government of a constituent entity of the Russian Federation;

- union associations;

- associations of employers.

After the agreement is concluded, all employers are invited to join it: the proposal to join the agreement is officially published in the media. If the employer does not submit a reasoned written refusal within 30 calendar days from the date of official publication of the proposal, it is considered that he has acceded to the agreement and is obliged to apply it.

The regional minimum wage is mandatory for commercial organizations and entrepreneurs of a constituent entity of the Russian Federation, separate divisions located in the constituent entity, government agencies financed from the budgets of constituent entities of the Russian Federation, and municipal institutions. Federal government, budgetary and autonomous institutions are not required to apply the regional minimum wage.

In addition to the regional minimum wage, bonuses and coefficients established in the region are applied. For example, in the Altai Territory, the agreement for 2019-2021 established a minimum wage of 13,000 rubles. At the same time, in certain municipalities of the region there is a regional coefficient of 15%, which means employers do not have the right to set wages below 14,950 rubles (13,000 × 1.15).

New minimum wage from January 1, 2022

From January 1, 2022, the minimum wage will change in the Russian Federation. The new minimum wage will be 13,890 rubles. This fact will affect the amount of minimum sick leave, child care benefits, maternity benefits, benefits when registering in the early stages of pregnancy.

Also, due to the increase in the minimum wage, it is necessary to recalculate payment for vacation and business trips if the employee’s actual average earnings for the billing period are less than 13,890 rubles and the vacation or business trip began before January 1.

Try for free

By whom and how is it installed?

In order to understand the meaning of this term, as well as changes in the minimum wage by region of the country and by year, you need to clearly understand who sets the minimum wage and controls it.

So, today, wages, or rather monetary remuneration for an employee’s work, depends on the following factors:

- The level of complexity of the actions performed.

- Demand for labor.

- Qualifications of the employee himself.

- Employer experience.

- Dangers and harmful working conditions.

In addition, monetary remuneration also includes compensation and incentives. But, despite all of the above, it is the Labor Code of the Russian Federation that introduces some amendments, or rather exceptions, to the established minimum wage rules.

Controls the minimum wage - the Russian Ministry of Labor.

What changes in the minimum wage occurred in 2013

The minimum wage in 2013 was 5,205 rubles, which is 39.4 times more than at the beginning of 2000. The minimum wage in 2013 in Russia was equal to 68.2% of the subsistence level for able-bodied persons for the same period. At the same time, in 2000, the minimum wage was 9.33 times less than the subsistence level for able-bodied persons.

Such excesses are explained by the fact that until 2010 the minimum wage was used not only to regulate the level of wages, but also to determine the amount of various socially significant benefits. In 2013–2014, the ratio between the minimum wage and the subsistence level fluctuates at around 67–68%, without demonstrating significant positive dynamics.