What is accounting policy

The term “accounting policy” refers to the methods of maintaining accounting records at an enterprise, including the creation of various types of documentation, the procedure for relations with supervisory and tax authorities, the establishment of internal connections between divisions of the organization in terms of financial interaction, etc.

Accounting policies include a number of local regulations that are developed at the stage of company formation on the basis of relevant legislative norms, regulations and instructions.

Key standards and rules of accounting policies are formed at the federal level and have their own nuances and subtleties depending on the type of activity of enterprises.

In an organization, the accounting policy is usually developed by either the director or the chief accountant, it is approved by a separate order of the manager and only after that it comes into force.

Once approved, it is binding.

How and when can you change or supplement your accounting policies?

The accounting policy of an organization is a set of methods for organizing and maintaining accounting adopted by this organization (paragraph 22 of article 1 of Law No. 57-Z).

Changing the accounting policy of the organization, i.e. replacing one method of accounting with another must be justified (clause 8 of article 9 of Law No. 57-Z) (in this case, the justification is included in the text of the accounting policy provision) and is allowed in the following cases (part 1 of clause 7 of art. 9 of Law No. 57-З):

1) by decision of the organization itself, but only if the change in accounting policies will lead to an increase in the truthfulness and relevance of the information contained in the organization’s reporting.

Attention! Such changes are made from the beginning of the year; during the year it is not allowed to adjust the accounting policy on this basis (Part 2, Clause 7, Article 9 of Law No. 57-Z).

Example. Changing accounting policies by decision of the organization

Text of the accounting policy statement before the change:

"4.5. The Commission for the Implementation of Depreciation Policy does not revise the standard service life and/or useful life of fixed assets.”

Text when making changes:

Subclause 4.5 of the accounting policy provisions should be amended as follows:

"4.5. The Commission for the Implementation of Depreciation Policy has the right to revise the standard service life and/or useful life of fixed assets from the beginning of the reporting year, as well as in cases of completion of modernization, reconstruction, partial liquidation, additional equipment, and completion.

Rationale: this change in accounting policy will ensure the distribution of the under-depreciated cost of fixed assets between reporting periods that together constitute its actual remaining useful life, which will increase the reliability of information about the amounts of accrued depreciation.”

If the result of a change in accounting policy relating to previous periods has had or is capable of having a significant impact on the financial position of the organization (its change), financial results of operations, then, if it is possible to reliably determine the value expression of such a result, it is reflected in the accounting records as a debit (credit) of the account 84 “Retained earnings (uncovered loss)” and other equity accounts and credit (debit) of the corresponding accounts (part 1, clause 4 of NAS No. 80).

The level of materiality of influence or the criterion for determining it is established in the accounting policy (paragraph 16 of article 1, paragraph 5 of article 9 of Law No. 57-Z).

Example. Establishing in the accounting policy the level of materiality of the impact of changes in accounting policies

The result of a change in accounting policy relating to previous periods is considered significant if at least one of the numerical indicators of the financial statements changes by more than 5 percent.

If the impact of the result of a change in accounting policy relating to previous periods is insignificant or it is impossible to reliably determine in monetary terms the result of a change in accounting policy relating to all previous periods, then the changed method of accounting is applied to the corresponding business transactions carried out after the introduction of this method in place of earlier applied (part 2, clause 4 of NAS No. 80);

2) when national legislation changes.

Attention! Accounting policies are changed from the date of entry into force of the relevant legislation.

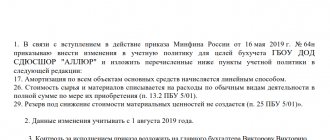

Example. Changes in accounting policies due to changes in legislation

Text of the accounting policy statement before the change:

"4.8. Exchange differences arising during the calendar year and recognized as income (expenses) in accounting are included in non-operating income and (or) expenses quarterly during the calendar year.”

Text about amendments to the accounting policy provision:

“Subclause 4.8 of the accounting policy provisions shall be amended as follows:

Exchange differences arising during the calendar year and recognized as income (expenses) in accounting are included in non-operating income and (or) expenses in the manner and within the time limits established by the head of the organization.”

This change during 2022 had to be made by organizations that, when reflecting exchange rate differences in accounting as of 01/01/2021, used the norms of Decree N 159, that is, took them into account in income (expenses) for financial activities in the manner and within the time frame established by the head of the organization . On February 20, 2021, Decree No. 51 came into force, according to which the mechanism for accounting for exchange rate differences by decision of the head, established by Decree No. 159, also applies to their taxation. Before this date, when taxing exchange rate differences, other rules were applied: those established in paragraph 14 of Art. 167 NK. Therefore, organizations using the norms of Decree No. 159, from February 20, 2021 (from the date of entry into force of Decree No. 51) had to adjust their accounting policies. Since Decree No. 51 applies to relations arising from 01/01/2021, the changes made will be in effect from the beginning of 2022 (letter No. 15-1-20/25/2-2-10/00803);

3) when making a decision on reorganization or liquidation.

Attention! Such changes are made from the date of the decision to reorganize or liquidate the organization. The changed methods of accounting are applied to business transactions carried out after such a decision is made (clause 5 of NAS No. 80).

Attention! For other reasons, the accounting policy cannot be changed (clause 6, article 9 of Law No. 57-Z).

Addition of accounting policies. In the process of carrying out activities, new business transactions may appear that were previously absent in the organization, for which:

— the accounting procedure is not regulated by law;

— regulatory legal acts provide for several accounting options.

The procedure for recording such business transactions is fixed in the accounting policy (paragraph 16, article 1, paragraph 5, article 9 of Law No. 57-Z). In this case, the accounting policy is supplemented.

Attention! Additions are made to the text of the accounting policy provision as necessary no later than the date the corresponding new business transaction is reflected in the accounting.

The need for additional consolidation in the accounting policy of the applied methods for certain accounting objects also arises in cases where new regulations are adopted, due to which variations in the accounting of these objects appear.

Example. Making an addition to the accounting policy

For the first time, the organization plans to carry out renovations of the premises with the involvement of a contractor. Construction materials will be purchased for these purposes. To account for such materials, the organization provides a separate subaccount to account 10 “Materials”.

Text when making an addition (no later than the date of purchase of building materials for repairs):

“In connection with the purchase of building materials for renovation of premises, add subaccount 10-13 “Building materials for renovation” to the Appendix “Working Chart of Accounts” to the Regulations on Accounting Policy.”

Changes and additions to the accounting policy:

1) subscribe. The person signing changes to the accounting policy is determined based on who manages the accounting in a given organization (clause 1, article 8, clause 1, 8, article 9 of Law No. 57-Z):

| Accounting management is carried out by | Changes to accounting policies are signed by |

| Chief Accountant | Chief Accountant |

| Head of the organization | changes are only approved |

| organization (IP) providing accounting and reporting services | head of an organization (IP) providing accounting and reporting services |

2) approved by the head of the organization (clause 1, 8, article 9 of Law No. 57-Z).

When making changes or additions to the accounting policy, the organization has the right to both formalize such changes and additions in a separate document (for example, an order), and to set out the provisions on the accounting policy in a new edition. The last option is appropriate if there are a significant number of changes and (or) additions.

Read this material in ilex >>* * following the link you will be taken to the paid content of the ilex service

Who is required to comply with accounting policies?

The accounting policy must be followed by all organizations registered as legal entities whose responsibility is to maintain accounting records. accounting.

Individual entrepreneurs are exempt from compliance with accounting policies, just like divisions of foreign enterprises - for them there are other regulatory documents.

One important point should be noted: there is no need to confuse accounting (which is determined in accordance with the provisions of the accounting policy) and tax accounting - if there are exceptions for the first, then everyone is required to maintain the second, regardless of the area of work and the taxation system.

Correcting errors in accounting (financial) statements

An error in accounting (financial) reporting is considered to be an omission and (or) distortion that arose during accounting and (or) preparation of reporting as a result of incorrect use or non-use of information about the facts of the economic life of the reporting period, which was available on the date of signing the reporting.

An error in the reporting period is classified depending on the period in which it was made:

- reporting year error - an error was made in a period (in a year) for which the accounting entity did not generate reporting (interim or annual), or in a period for which annual reporting was generated but not approved;

- error of previous years - an error was made in the period for which the annual reports were approved.

More on the topic: Video surveillance system: how to take it into account in public sector organizations

How to change accounting policy

Accounting policy is a system of rules chosen at a time for a long time.

It comes into effect at the beginning of each calendar year.

Changes to it during the reporting period can only be made in extreme cases, for example:

- when this is required to provide the most truthful information about the accounting object;

- when editing the law on accounting policies;

- when the enterprise itself changes its direction of activity.

In order to make the necessary amendments or additions to the accounting policy, the organization must issue a corresponding order.

We formalize changes to the accounting policy (sample)

The need to make changes may arise not only in relation to accounting, but also in relation to tax accounting policies. The conditions under which changes are made to the tax accounting policy are specified in paragraph. 6 tbsp. 313 of the Tax Code of the Russian Federation, they are identical to the accounting standards described above.

Read about how tax accounting is organized and how it differs from accounting.

Let's look at how to formalize changes in an organization's accounting policies using an example.

Example

applies the accounting policy approved by order dated December 28, 2020 No. 412/U. According to clause 5.8 of the accounting policy, the tax method used for calculating depreciation of fixed assets is linear. According to a management decision made in October 20XX, the depreciation method is planned to be replaced with a non-linear one.

When formalizing the changes, the following organizational and methodological aspects were taken into account:

- changes are introduced into the accounting policy from 01/01/20XX - this rule is established in Art. 313 of the Tax Code of the Russian Federation for changes made by the taxpayer not in connection with changes in legislation, but because of a decision made by the taxpayer himself;

- the introduction of a new “depreciation” method is carried out by issuing an order signed by the general director of Mir LLC;

- As preliminary measures to prepare for the transition to a new accounting method, total balances were calculated for each depreciation group, registers for accrued depreciation were developed, and the period for using this method was determined, taking into account the restrictions established by the Tax Code of the Russian Federation.

You can see a sample order for amending the accounting policy on our website.

To learn about what other types of accounting policies may need to be amended, read the articles:

- “Accounting policies for management accounting purposes”;

- “Accounting policies in IFRS format - main provisions”.

Who signs the document

Regardless of who exactly forms the order, the document must be signed by the highest official of the enterprise - the director or an employee temporarily in his place.

This is due to the fact that all orders are always issued on behalf of the chief executive of the company - this is established by law, i.e. Without his signature, the document will not be considered valid.

In addition, all employees indicated in it, as well as those who are obliged to monitor its implementation, must sign the order. Thus, all these persons indicate that they have read the order and are ready to carry it out.

Additional orders

Order on new forms of primary documents

On changes in the forms of primary documents at Cozy House LLC

Moscow December 31, 2022

I ORDER

Add Appendix No. 2 “Primary accounting documents” to the Order “On approval of the accounting policy of Cozy House LLC” with the following information:

From 01/01/2021, use the modified form in document flow:

- waybills in connection with the addition of mandatory new details by Order of the Ministry of Transport of the Russian Federation dated September 11, 2020 N 368 (Appendix No. 1);

- waybill in connection with the approval of a new mandatory form in Appendix 4 of the Decree of the Government of the Russian Federation of December 21, 2020 N 2200 (Appendix N 2).

CEO /

Order No.

On approval of forms of primary documents of Cozy House LLC

Moscow January 12, 2015

I ORDER

To account for the costs of entertainment expenses, use a self-developed form - Report on entertainment expenses (Appendix No. 1 to the Order).

When filling out the form, it is mandatory to fill in all the details specified in the Federal Law of December 6, 2011 N 402-FZ “On Accounting”. The form is recommended for use and can be changed by order of the manager.

CEO /

Order No.

On approval of forms of primary documents of Cozy House LLC

Moscow December 31, 2014

I ORDER

To formalize operations for the shipment of goods, for the provision of services, for the performance of work, use the “Universal Transfer Document” form proposed in the Letter of the Federal Tax Service of the Russian Federation dated October 21, 2013 N ММВ-20-3/ [email protected] (Appendix No. 1 to the Order).

When filling out the form, it is mandatory to fill in all the details specified in the Federal Law of December 6, 2011 N 402-FZ “On Accounting”. The form is recommended for use in the organization and can be changed by order of the manager. The form of this document for processing transactions for the sale of goods, works, and services can also be agreed upon with counterparties when concluding contracts with them.

CEO /

Order on the right to sign primary accounting documents

Order No.

On the list of persons authorized to sign primary accounting documents

Moscow December 31, 2014

I ORDER

Determine the following persons who have the right to sign primary accounting documents in Cozy House LLC:

- Chief accountant Vorobey Alla Gennadievna

CEO /

Order on persons responsible for maintaining registers

Order No.

On the list of persons responsible for maintaining accounting and tax registers

Moscow December 31, 2014

I ORDER

Determine the following persons responsible for maintaining accounting registers at Cozy House LLC:

- Chief accountant Vorobey Alla Gennadievna

Determine the following persons responsible for maintaining tax registers at Cozy House LLC:

- Chief accountant Vorobey Alla Gennadievna

CEO /

Order on execution of settlements with accountable persons

Order No.

On registration of settlements with accountable persons at Cozy House LLC

Moscow December 31, 2022

I ORDER

Add Appendix No. 2 “Primary accounting documents” to the Order “On approval of the accounting policy of Cozy House LLC” with the following information for processing settlements with accountable persons:

- The issuance of money on account to an employee is formalized on the basis of:

- a written statement from the employee in any form;

- order from the manager to issue money on account. An administrative document can be issued for one or more accountable persons, for several cash payments to accountable persons. For each issue, the deadline for issuing money on account is indicated directly in the order;

- If the employee was not given in advance the amounts allocated to him for administrative, economic and other expenses for the needs of the organization, then compensation of expenses to the employee is carried out on the basis of:

- a written application from the employee for reimbursement of expenses in any form;

- a report on the funds spent with documents for purchase and payment attached to it (sales receipt, delivery note, invoice, etc.), approved by the manager;

- by order of the manager to compensate expenses to the employee.

- The report of the accountable person on the expenditure of funds, regardless of whether they were issued on account or will be compensated by the organization, is drawn up by an employee in Form N AO-1, approved by Resolution of the State Statistics Committee of the Russian Federation dated 01.08.2001 N 55. In this case, the numbering of advance reports is carried out as follows :

- advance reports for the purchase of fuel (fuel and lubricants) for cash register receipts are numbered separately in chronological order from the beginning of the year with the prefix PL in the NAO / PL format;

- advance reports for settlements with accountants (except for the purchase of fuel and lubricants by check) are numbered in the usual manner from the beginning of the year without a prefix in the NAO format.

CEO /

See also:

- Accounting policy designer

- Example of UP for trade

- Example of UE for works and services

- Example of CP for production

- Example of UE under simplified tax system

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- An example of an accounting policy for works and services (simplified methods) (OSN) Let's consider an example of an order approving the accounting policy of an organization for the purposes of...

- An example of an accounting policy for an organization that does not have the right to simplified accounting methods (SAM) for 2022. Let's consider an example of an order approving an accounting policy for accounting purposes...

- An example of an accounting policy for production, trade, work, services (simplified methods) (STS) Let's consider an example of an order approving an accounting policy for accounting purposes...

- An example of an accounting policy for an organization entitled to simplified accounting methods (SAM) for 2022. Let's consider an example of an order approving an accounting policy for accounting purposes...