How is the provision of financial assistance during the next vacation regulated (article of the Labor Code of the Russian Federation, etc.)?

The Labor Code (hereinafter referred to as the Labor Code) does not explain the concept of material assistance if it is provided when an employee goes on his next annual paid leave.

This term is used in practice and is enshrined in other legal acts, which, as a rule, are local in nature. At the same time, the regulation of such payments follows from a number of labor legislation, including the Labor Code. See the material “Regulations on the provision of financial assistance to employees” for more details.

If such assistance is not actually a social benefit and is established as a supplement to the salary and other allowances, then its regulation is carried out in accordance with Part 1 of Art. 129 Labor Code, i.e. as a component of wages. In this case, this payment is established by a local legal act or follows from departmental regulations and depends on the results of the employee’s work activity or has a fixed amount and is paid in any case when the employee goes on annual leave.

At the same time Art. 40 of the Labor Code provides for the possibility of using a collective agreement at a specific enterprise or other organization, which is concluded between representatives of the employer and the workforce. This act regulates not just labor, but social and labor relations. According to Art. 41 of the Labor Code, such an agreement, among other things, may include conditions governing the possibility of providing employees with financial assistance due to certain circumstances. In this situation, assistance is a social benefit and is provided if the employee is in need.

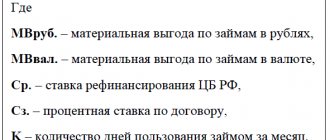

In addition, the regulation of such payments to a certain extent is carried out by the norms of tax legislation concerning the rules for calculating the tax base and the amounts for which insurance payments are calculated - Art. 217 and 422 of the Tax Code (hereinafter referred to as the Tax Code). On a number of issues, it makes sense to apply the practice developed by the courts. One of the most significant in regulating the issue under consideration is the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 14, 2013 No. 17744/12 in case No. A62-1345/2012.

The limit of financial assistance, not subject to personal income tax and insurance contributions, is 4 thousand rubles. in year.

The rules for calculating tax and insurance contributions from financial assistance, as well as the procedure for reflecting payments in accounting, were explained by ConsultantPlus experts. Get trial access to the system and proceed to a Typical situation with a calculated example.

Read how to reflect financial assistance in 6-personal income tax here.

What amount should you expect?

The amounts that subordinates receive as additional bonuses for rest days will vary depending on the organization. Large companies with large annual profits can afford to pay employees an additional 10,000 and 30,000 rubles for vacation. Small enterprises do not have that kind of money, so if they wish, they can limit themselves to 3,000–5,000 rubles, since the law does not establish limits on financial assistance.

At the same time, the current regulatory framework forces some employers to save on taxes. Thus, according to the norms of the Tax Code of the Russian Federation, amounts up to 4,000 rubles, registered as financial assistance to employees, are not subject to personal income tax (clause 28 of Article 217 of the Tax Code of the Russian Federation) and insurance contributions (clause 11 of clause 1 of Article 422 of the Tax Code of the Russian Federation). On additional income exceeding this limit, you will have to withhold both tax and insurance contributions. Therefore, in many companies the maximum amount of financial assistance will be exactly 4,000 rubles.

Form and content of an application for financial assistance for vacation, sample

An application for financial assistance for vacation does not have a legally established form. In this regard, its form can be either free or enshrined in the internal legal act of the organization. In this case, in any case, one should not forget about compliance with the rules of office work and the requirements of labor and tax legislation, since this is important, for example, for the correct calculation of corporate income tax and insurance premiums payable, as well as withholding personal income tax from workers.

Taking into account the practice of labor relations and the rules of personnel records management, the application must contain:

- data of the addressee (the official competent to make a decision on the payment of financial assistance);

- information about the employee who sent the application (name, birth details, registration address, position held in the organization, pension insurance certificate number and taxpayer number);

- grounds for payment - the reasons why the employee asks for assistance (depending on the specifics of its establishment at the enterprise);

- indication of the amount of payment (if permitted by internal regulations);

- information about the leave granted to the employee, including its time frame and date of departure (payment is made exclusively when annual leave is granted);

- date of referral and signature of the employee.

Specific rules for drawing up such a statement should be contained in the instructions for office work in the organization, as well as in the document regulating the issues of making financial payments. You can find a sample application for assistance when going on your next vacation on our website (after downloading, you can use it as a basis when drawing up your own version).

Procedure for registration and application

Payment of financial assistance for vacation, provided for in the internal documentation of the institution, must occur on the basis of a written application from the employee. It is the preparation of this document that is the first stage of processing the payment.

The legislation does not provide for an established form of application for payment of financial assistance, therefore in most cases it is drawn up arbitrarily or according to a sample provided by the manager. The specificity of financial assistance for leave is that the employee has the right not to write a separate application at all - the request for its payment can be indicated in the application for leave.

How to make an application?

For example, the main text of the document may be as follows: “I ask you to provide me with annual paid leave from June 20, 2016 for 28 calendar days and financial assistance in the amount of two salaries, provided for by the collective agreement.” However, it is better to check with the employer for more detailed wording.

In addition, the optional nature of writing an application is evidenced by the fact that the payment of financial assistance is provided for by local acts of the institution.

Therefore, the transfer of this amount to the employee along with vacation pay must occur without fail, regardless of whether he asked for it in writing or not.

Basic rules for drawing up an application:

- the applicant must indicate not only his first and last name, but also his position and place of work (for example, a specific structural unit);

- the document is drawn up in the name of the head of the institution, the chief accountant or the chairman of the trade union (this is determined by the internal documents of the organization);

- After the main text, the date of preparation of the document and the signature of the employee are indicated.

Afterwards, the application is considered by the responsible person, who makes a decision on payment of assistance or refusal of it. If, as a result of the review, a positive decision was made, then the payment order is then transferred to the accounting department. After the calculations have been made, assistance is paid in the manner prescribed for vacation pay, that is, at least three days before the start of the vacation.

The amount of unemployment benefits depends on the average salary from your previous job. Read about the benefits for retirees living in Moscow and the region here. Do you think you deserve a better salary? Then it's time to write a memo about a salary increase. You will find a sample in this article.

When is payment of financial assistance for vacation made?

The employer makes financial payments for vacation in accordance with the rules approved by the internal document of the enterprise (collective agreement or regulations on remuneration). In any case, in order to make a payment, it is important to comply with a number of conditions determined by current legislation and judicial practice (for example, the appeal ruling of the Krasnoyarsk Regional Court dated September 3, 2014 in case No. 33-8545/14), according to which it is necessary:

- establishment of such a payment in a written document with legal force (or the willingness of the employer’s representative to make such a payment if there is sufficient authority to do so);

- the location of the recipient of such assistance on the staff of the organization;

- providing the employee with annual paid leave (as a rule, the payment is one-time in nature and when the leave is divided, it is paid when the first part is provided);

- the employee writing a corresponding statement;

- existence of grounds for receipt if the payment is of a social nature and is not established for all employees without exception as an additional payment to the salary.

In the case where the obligation to pay financial assistance for vacation is enshrined in a regulatory legal act and/or internal act of the organization (including a collective agreement), the employer cannot refuse to provide it.

Find out also “Is financial assistance for vacation included in the calculation of vacation pay?”

If the company documents do not provide for the payment of financial assistance

The employer may decide to assign a payment, even if the company’s local documents do not mention financial assistance as part of the payments. The financial condition of the organization is of decisive importance.

To receive financial assistance for vacation, when it is not mandatory for employees, the employee must:

- write an application addressed to the manager, setting out a request for financial support;

- justify the need to receive financial assistance, attach documents (if any) confirming the need to receive additional funds.

If the manager, after considering the employee’s application, makes a positive decision and signs an order to allocate a certain amount, the accounting department must accrue and issue the due financial assistance to the employee along with vacation pay.

Payment amount

When the amount of financial assistance is not recorded in the company’s documents, the employee can draw up an application for the allocation of the necessary amount based on his needs. The manager has the right to both approve the request and refuse to satisfy it.

If financial assistance for vacation is enshrined in a local act, then the amount of such payment is usually fixed. It may depend on:

- period of work at the enterprise;

- qualifications;

- positions;

- employee salary;

- other conditions.

In any case, the current financial capabilities of the company will be taken into account.

Additional payment may not be assigned, for example, if the employee has worked for less than 6 months (since the right to vacation has not yet accrued), or upon dismissal (since formally dismissal is not recognized as vacation, but the employee is given compensation for unused rest days).

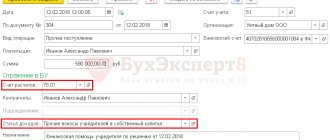

Order for financial assistance for vacation

The order of the head of the organization (as well as a branch or separate division), on the basis of which the employee is accrued the required financial assistance paid for vacation, must comply with the rules of office work. It is important to ensure that it contains:

- a list of legal acts on the basis of which the order is issued and the payment is made (taxation and calculation of insurance premiums will depend on this);

- information about the employee’s application, as well as a description of the circumstances (financial situation, going on vacation, etc.);

- an exact indication of the amount of assistance due;

- list of orders for accounting (need for accrual, timing of issuance, procedure for making payments, etc.);

- details of the internal act that allow it to be individualized (as a rule, date and serial number);

- signature of the manager or other authorized person;

- printing (if available and necessary).

In general, an order for financial assistance corresponds to the form of any other personnel order, differing only in content.

For a sample order for financial assistance, see here.

How to take into account financial assistance for vacation when calculating taxable profit? Find out the answer to this survey in ConsultantPlus by getting free trial access to the system.

Is financial assistance available for leave upon dismissal?

Questions about the provision/non-provision of financial assistance, which is provided for vacation, often cause disputes between the parties to labor relations, as evidenced by the extensive practice of courts at various levels. The judicial authorities have generally developed a unified position regarding such disputes, which makes it possible to say definitively whether such a payment is due if a person resigns.

In particular, the Supreme Court of the Republic of North Ossetia-Alania, in its appeal ruling dated August 12, 2014 in case No. 33-943/14, clearly indicated that the plaintiffs cannot demand payment of financial assistance for their annual leave, since they were not on it , the rules for monetary compensation for vacations established in the relevant legal act do not provide for such payment. A similar position follows from the appeal ruling of the Kaliningrad Regional Court dated October 7, 2015 in case No. 33-4953/2015, according to which the plaintiff had the right to receive one-time assistance for her vacation, although she was on it for only 1 day, since the right to such payment is established by a number of regulations relating to the remuneration of state civil servants in the region.

A number of conclusions follow from the above:

- Upon dismissal from work, an employee can receive financial assistance only if it is provided for by legal acts or an employment contract.

- As a general rule, financial assistance for leave upon dismissal can be provided if the person actually goes on leave (at least for 1 day), as follows from the very name of the payment.

- Only if a legal act or agreement of the parties establishes the possibility of receiving financial assistance for vacation along with compensation for unused vacation, such a payment can be received by the resigning (dismissed) employee.

In addition, it should be taken into account that Part 2 of Art. 127 of the Labor Code provides for the possibility of providing, by agreement of the parties, a dismissed employee (upon his personal application) with unused vacations, after which the legal termination of the employment relationship occurs. In this case, financial assistance, which is paid specifically for the vacation, must be provided without fail.

Read more in the material “Financial assistance upon voluntary dismissal.”

Results

Thus, financial assistance when providing the next annual paid leave is paid in accordance with a local legal act or (in some cases) on the basis of regulatory legal acts (for example, in the case of municipal or state civil servants). It may take the form of a social benefit and depend on the occurrence of certain circumstances or act as a component of the salary paid in any case to the employee when going on vacation. As a general rule, such assistance can be provided only if you are actually on vacation, therefore, if you quit your job and receive compensation for unused vacations, it is impossible to receive it.

Sources:

- Tax Code of the Russian Federation

- Labor Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.