Regulatory regulation

If a fixed asset has fallen into disrepair, the organization must write it off based on the decision of the commission (clause 77, clause 78 of the Guidelines for accounting of fixed assets, approved by Order of the Ministry of Finance of the Russian Federation dated October 13, 2003 N 91n, hereinafter referred to as Guidelines for accounting for fixed assets N 91н).

BOO. Liquidation costs and the residual value of fixed assets are included in the write-off period in other expenses (clause 86 of the Guidelines for accounting OS N 91n, clause 31 PBU 6/01, clause 11 PBU 10/99).

Materials generated as a result of the disposal of a fixed asset are accounted for at the current market value on the date of write-off of the fixed asset (clause 79 of the Methodological Guidelines for Accounting OS N 91n).

WELL. Expenses for the liquidation of fixed assets (including depreciation accrued using the straight-line method) are recognized:

- as part of non-operating expenses for fixed assets (paragraph 1, paragraph 8, paragraph 1, article 265 of the Tax Code of the Russian Federation).

For fixed assets depreciated by the non-linear method, depreciation continues to be accrued as part of the group, despite disposal (paragraph 2, paragraph 8, paragraph 1, article 265 of the Tax Code of the Russian Federation, paragraph 13, article 259.2 of the Tax Code of the Russian Federation, Letters of the Ministry of Finance of the Russian Federation dated December 3, 2015 N 03-03-06/1/70529, dated 04/27/2015 N 03-03-06/1/24095).

The generated waste at market value (confirmed by an accountant's certificate or an appraiser's report) is subject to inclusion in non-operating income (clause 13 of Article 250 of the Tax Code of the Russian Federation).

VAT. If fixed assets are written off ahead of schedule, there is no need to restore VAT (Letter of the Federal Tax Service dated April 16, 2018 N SD-4-3 / [email protected] ).

Found documents on the topic “act of writing off KKM”

- Act on write-off of technical equipment Accounting statements, accounting → Act on write-off of technical equipment

act on write-off of technical equipment I approve “” 20 year act on write-off (type of equipment) “” 20 year to ... - Act on write-off technical means

Accounting statements, accounting → Certificate of write-off of technical equipmentact on write-off of technical equipment I approve "" 20 year act on write-off (type of equipment) "" 20 year to...

- Act write-offs motor resources

Documents of the enterprise's office work → Certificate of write-off of motor resources... State Customs Code of the Russian Federation dated 02.10.96 no. 609 I approve the head (name of department) (surname and initials) “” 20, act no. write-off of motor resources commission consisting of: chairman (position, surname and , members of the commission initials)…

- Act O write-off materials for current repairs

Accounting and financial documents → Certificate of write-off of materials for current repairs... "" 20, act on the write-off of materials for current repairs No. dated "" 20, a commission consisting of: chairman and members ...

- Sample. Act on write-off damaged work record forms

Accounting statements, accounting → Sample. Act on writing off damaged work record formsm.p. I approve to the head of the enterprise (signature, surname and initials) an act for writing off damaged forms of work books of the year "" 20 by us (positions, initials and surnames of members are listed ...

- Act O write-off vehicles (Unified form N OS-4a)

Enterprise records management documents → Certificate of write-off of motor vehicles (Unified Form N OS-4a)The document “ Act on write-off of motor vehicles (unified form n OS-4a)” in excel format can be obtained from the link “sk...

- Act on write-off low-value and wearable items (Standard interindustry form N MB-8)

Enterprise records management documents → Act on write-off of low-value and wear-and-tear items (Standard interindustry form N MB-8)document “ Act for write-off of low-value and wear-and-tear items (standard interindustry form n mb-8)” in excel format you can...

- Form No. MB-8 Act on write-off low-value and wearable items

Accounting statements, accounting → Form No. MB-8 act on write-off of low-value and wear-and-tear itemsact on write-off of low-value and wear-and-tear items form no. MB-8 (front side) standard interdepartmental...

- Act O write-off goods (Unified form N TORG-16)

Enterprise records management documents → Certificate of write-off of goods (Unified form N TORG-16)The document “Weight sheet (Unified form N MX-9)” in Excel format can be obtained from the link “Download

- Act on write-off low-value and high-wear items. Form No. MB-8

Accounting statements, accounting → Act on write-off of low-value and wear-and-tear items. Form No. MB-8…G. no. 1148 +-+ Okud code 0311008 3 +-+ I approve: (position) (signature) (full name) “” 20 +-+ act no. +-+ for writing off low-value and wear-and-tear items “” 20g. commission appointed by order no. from "" 20 ...

- Sample. Act on write-off low-value and high-wear items. Form No. MB-8

Accounting statements, accounting → Sample. Act on write-off of low-value and high-wear items. Form No. MB-8...acceptance, organization) code by okud +-+ approve (position) (signature) (and., o., surname) "" 20 year act on write-off of low-value and wearable items commission appointed by order dated "" 20 no . , examined the p...

- Sample. Act on write-off tools (devices) and exchanging them for suitable ones. Form No. MB-5

Accounting statements, accounting → Sample. An act for writing off tools (devices) and exchanging them for suitable ones. Form No. MB-5...approved by the resolution of the State Statistics Committee of the USSR dated December 28, 1989 no. 241 +-+ (enterprise, organization) okud code +-+ the act for writing off tools (devices) and exchanging them for suitable ones (position) (signature) (f., f., surname) ...

- Sample. Act on write-off fixed assets. Form No. os-3 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)

Accounting statements, accounting → Sample. Act on write-off of fixed assets. Form No. os-3 (Resolution of the USSR State Statistics Committee dated December 28, 1989 No. 241)... code for okud (enterprise, organization) +-+ approved by the head of the enterprise (signature) (full name) "" 20 act +-+ for write-off of fixed assets number date code of the type of document for drawing up the transaction +- +-+- +-+ +-+ debit credit...

- Act for culling and write-off car (car trailer) (in relation to standard form No. os-4a)

Accounting statements, accounting → Certificate of rejection and write-off of a car (car trailer) (in relation to standard form No. os-4a)act for rejection and write-off of a car (car trailer) (in relation to the standard form no. os-4a) appendix n...

- Logbook for registering readings of summing money and control counters KKM (Unified form N KM-5)

Documents of the enterprise's office work → Journal of recording the readings of summing cash and control counters KKM (Unified form N KM-5)The document “Logbook of recording readings of summing cash and control meters of KKM (unified form n km-5)” in excel format can be obtained from the link “download file”

Accounting in 1C

On November 30, the commission drew up an act on the write-off of a woodworking machine that had become unusable and beyond repair.

At the time of write-off:

- the residual value of the machine is RUB 93,750.02.

- the remaining depreciation period is 18 months (straight-line method).

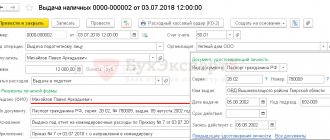

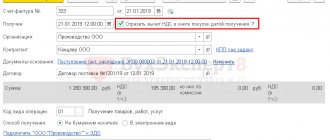

Decommissioning of OS

Complete the write-off of fixed assets using the document Write-off of fixed assets in the section fixed assets and intangible assets - Disposal of fixed assets - Write-off of fixed assets - Create button.

Indicate in the header of the document:

- Location of the OS - the name of the division in which the OS is listed is selected from the Division ;

- Write-off account - 91.02 “Other non-operating expenses”;

- Other income and expenses - an article from the directory Other income and expenses: Type of article - Liquidation of fixed assets ;

- Accepted for tax accounting checkbox is checked;

Add the fixed asset to be written off to the table section.

Postings according to the document

The document generates transactions:

- Dt 20.01 Kt 02.01 - depreciation for the month of disposal of fixed assets;

- Dt 02.01 Kt 01.09 - write-off of accumulated depreciation to determine the residual value;

- Dt 01.09 Kt 01.01 - write-off of the original cost to determine the residual value;

- Dt 91.01 Kt 01.09 - write-off of the residual value of fixed assets.

The procedure for writing off fixed assets in 2022 - 2021

The write-off of fixed assets (FPE) is regulated by methodological guidelines for the accounting of property of this type, approved by Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n.

In paragraphs 75–86 of these instructions stipulate the stages that must be completed when registering the disposal of fixed assets. Firstly, a special commission must be organized. The list of commission members and other aspects of its functioning are fixed by order of the head of the organization. The commission should include the chief accountant and employees monitoring the safety of the assets being written off.

Retirement commission:

- checks the OS for the possibility of its functioning, checks its condition with technical documentation and information from accounting, determines the rationality of repairs;

- if it is impossible to restore the functions of the object, establishes the reasons for write-off;

- determines the culprits if the reason for write-off is early failure due to someone else’s fault;

- determines which spare parts and parts of the decommissioned asset can still be used, evaluates their market value, monitors actions with non-ferrous and precious metals included in the object;

- draws up an act on write-off of the OS.

The write-off report reflects the following points:

- date of manufacture or construction of the OS;

- date of acceptance for accounting;

- useful life;

- initial cost;

- change in value;

- accrued depreciation;

- reasons for write-off;

- quality characteristics of the main parts.

The entry of such data is provided for in standard act forms, which have different forms depending on the type of asset being disposed of. Possible options could be:

- OS-4 - upon disposal of one fixed asset (not motor transport);

- OS-4a - upon disposal of vehicles;

- OS-4b - upon disposal of a group of fixed assets (not vehicles).

These types of acts were approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. They are not mandatory and can be replaced by similar forms developed independently if all the requirements for their preparation are taken into account (Article 9 of the Law “On Accounting” dated December 6, 2011 No. 402 -FZ).

The act must be approved by the manager. Then it is transferred to the accounting service, whose employees adjust the asset inventory card, making a note about disposal. The inventory card remains in the organization’s archives for at least 5 years. In addition, accounting entries are made on the basis of the act.

If the OS is transferred into the ownership of other owners, the documentary justification for its write-off will be the acceptance and transfer certificate in the form OS-1, OS-1a or OS-1b.

Read about the contents of acceptance certificates in the articles:

- “Unified form No. OS-1 - Certificate of acceptance and transfer of fixed assets”;

- “Unified form No. OS-1a - form and sample”;

- “Unified form No. OS-1b - form and sample.”

ConsultantPlus experts explained in detail how to reflect the write-off of fixed assets in tax accounting:

Get trial access to the K+ system and upgrade to the Ready Solution for free.

Typical faults that cause office equipment to be written off

The most common malfunctions of inkjet printer models, as a result of which this office equipment can be written off, include the following:

- A problem occurs in the paper path, which is associated with the use of the wrong type of paper or the ingress of some foreign objects. In addition, such damage may occur due to wear of parts during intensive use of the device.

- Print head failure. The source of the problem is long breaks between jobs, poor quality ink, and improper cleaning and refilling of consumables.

- Malfunction of the head cleaning unit. This type of problem is most often associated with excess dried paint. Its source is intensive use of devices with cartridge changes and excessively frequent head cleaning.

- Those printer malfunctions for write-off that are common include severe contamination of parts with ink, which, in turn, can lead to the most tragic consequences - complete failure of the device.

Malfunctions of laser printing devices that lead to write-off of office equipment are the following:

- Failure of the node responsible for image transfer. The source of the problem is damage to the laser unit or wear to the cartridge (the photo roller usually wears out first).

- Failure of the path for passing paper sheets - the reasons are similar to inkjet devices.

- Malfunctions associated with the unit designed to secure the image. Such breakdowns most often occur due to damage to the heating element or thermal film.

- The device board has burned out. The cause could be a short circuit.

- Common to all models of laser printers is the presence of severe contamination on the device components, consisting of toner, dust and other impurities found in the environment. In this regard, experts recommend carrying out preventive maintenance to clean the “insides” of the device.

In general, it should be noted that writing off printers and other office equipment is quite a responsible matter. To solve this problem as quickly as possible, you can seek help from a specialized company that disposes of office equipment that is subject to write-off. Employees of such an organization will correctly and quickly dispose of failed or obsolete devices. In return, they will provide your company with all the documents necessary to write off office equipment. The cost of their services has become quite affordable in recent years, and when concluding an agreement for the disposal of a large number of devices, favorable conditions are possible, including discounts.