Companies in most regions can safely claim VAT deductions on invoices that contain an incorrect address. This was shown by a survey of half of the country's tax departments.

According to a survey on the website www.gazeta-unp.ru, the majority of colleagues ask counterparties to redo invoices with any errors in addresses. But, as UNP found out, it is safe to accept such documents. The Russian Ministry of Finance clarified that an incorrect address in an invoice is not a basis for refusal to deduct VAT (letter dated 08.08.14 No. 03-07-09/39449).

As the Federal Tax Service of Russia told us, the service’s specialists completely agree with this. And many regional departments share the same opinion. Of the 41 FSAs we surveyed, only two believe that an incorrect address on an invoice can be the only reason for refusing to deduct VAT.

Due to an incorrect address, deductions will not be taken.

This is what the Federal Tax Service thinks: the republics of Adygea, Buryatia, Dagestan, Karachay-Cherkessia, Mari El, Tyva, Perm Territory, Bryansk, Voronezh, Vladimir, Volgograd, Kursk, Novosibirsk, Pskov, Rostov, Ryazan and Chelyabinsk regions and the Yamalo-Nenets Autonomous Okrug.

In 18 out of 41 departments, tax officials answer unequivocally that an incorrect address on an invoice is not a critical error. It cannot prevent the company from being identified. In the listed regions they note that they adhere to established judicial practice. description

“We would be happy to remove deductions on this basis, but the taxpayer will then go to court. And the court will confirm his right to deduction,” according to the Federal Tax Service of the Republic of Mari El. “If the Ministry of Finance has allowed it, then what claims can we have,” said the Federal Tax Service for the Perm Territory. In the Rostov region, they recommend writing an official request to your inspectorate to be sure, in order to definitely avoid disputes with the tax office.

Employees of many Federal Tax Service departments warn that the inspectorate will most likely ask the company for an explanation of what the address is written on the invoice and what caused the error. But the deduction will not be removed.

"Premises" or "office"?

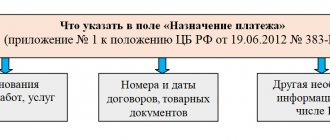

Just a few days later, the Ministry of Finance issued another letter answering the question about the requirements for filling out the fields about the address of the counterparty in the invoice (letter dated January 29, 2022 No. 03-07-09/4554). Will the inspectorate refuse a deduction if in a document the company uses the word “office” instead of the word “premises” when filling out lines about the address of a business partner? No, according to financiers, such a replacement will not be considered a mistake. The synonym for the word “premises” will not prevent controllers, according to the Ministry of Finance, from identifying buyers and sellers, which means that VAT will be deductible.

This question can only be answered in writing.

This is the opinion of the Federal Tax Service: the republics of Ingushetia, Karelia, Komi, Chechnya, Altai and Krasnoyarsk territories, Belgorod, Kaluga, Leningrad, Lipetsk and Oryol regions, Moscow and St. Petersburg.

In 12 out of 41 departments they were unable to communicate their position. But at the same time, in five regions, tax officials told us that they are not aware of cases of denials of deductions because of the address - these are St. Petersburg, Ingushetia, Karelia, Chechnya and the Altai Territory. In other regions, they agree to answer about deductions only upon written request.

Minor errors in invoices are not an obstacle to obtaining a VAT deduction

As an argument that the preparation of invoices with minor defects does not interfere with obtaining a VAT deduction, the judges also refer to the provision of paragraph 2 of paragraph 2 of Article 169 of the Tax Code of the Russian Federation. The rules of this paragraph establish that errors in invoices that do not affect the inspectors’ failure to recognize the seller and buyer, the cost of goods, the rate and the amount of VAT presented to the buyer, are not an obstacle to obtaining a deduction of VAT amounts.

When issuing an invoice, there were technical errors in the buyer's instructions. The arbitrators confirmed that these shortcomings cannot serve as a basis for the impossibility of VAT deductions due to the fact that the contents of the invoice make it possible to identify the company as a buyer and consignee. Failure to indicate certain details in the invoice did not affect the reliability of the information contained in it about the company’s business transactions (resolution of the Arbitration Court of the East Siberian District dated December 22, 2014 No. A78-859/2014).

Let us give an example of another court decision. The taxpayer complained that due to errors in the consolidated invoice regarding the indication of the incorrect address of the work site, he was deprived of the opportunity to present the VAT amounts on this invoice for deduction.

The court of first instance reasoned that the “errors” and “inaccurate information” were immaterial and could in no way prevent the inspection from determining the correct name of the work performed by the customer under the contract.

Moreover, in addition to the invoice, the basis for accepting VAT as a deduction is a primary document confirming the completion of a business transaction and the acceptance of the corresponding amounts of costs for accounting. In this case, such a document was an act on the fulfillment of the customer’s obligations, an advice note with an attached set of costs incurred by the customer to perform the work.

Based on the contents of the act, advice note and set of costs, it follows that the total cost of work indicated in them is reflected in the consolidated invoice.

Therefore, the judges indicated that the error in the address of the object did not have any significant significance and did not interfere with the reliable and accurate identification of the consolidated invoice, statement and summary of costs. And the original invoice was an unconditional basis (taking into account the act and advice note) for presenting the VAT amounts indicated in it for deduction. Accordingly, errors in the original invoice did not interfere with tax control, as well as the presentation of tax for deduction (resolution of the Ninth Arbitration Court of Appeal dated 08.08.2014 No. 09AP-28878/2014).

Commented document

: Letter of the Ministry of Finance of the Russian Federation No. 03-07-09/18318 dated 04/02/2015 “On accepting VAT for deduction if there is an error in the address in the invoice”

Tax consultant E.P. Brynchik

, for the magazine “Regulatory Acts for Accountants”

Regulatory acts with comments

Professional comments on letters from ministries and departments, expert answers to the most difficult questions, updates every day. Find out more >>

If you have a question, ask it here >>

Updated VAT return for the fourth quarter

Correction of a “technical” error in the VAT return is reflected:

In Section 8 “Information from the purchase book”: PDF

- a canceled invoice received with an old number;

- invoice received with a new number.

See also:

- Error: the amount of last year's revenue was underestimated

- Error: costs for last year's supplier services were inflated

- Unaccounted sales of services from last year

- Missing documents from last year from service provider

- The amount of expenses of the previous period is underestimated. Transport tax reduced

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Related publications

- Error Correction: Wrong Invoice Number...

- Incorrect number, invoice date when restoring VAT...

- Error in invoice date when registering in accounting...

- Error in the name of the supplier when registering an invoice in accounting...

Non-critical errors in invoice columns

Likewise, not every error on an invoice will result in loss of deduction rights. Among them are the following:

- in column 1 “Name of goods (description of work performed, services provided), property rights” there is incomplete information about the product, but this does not prevent the tax authorities from identifying the product (letter of the Ministry of Finance of Russia dated November 17, 2016 No. 03-07-09/67406, resolution AS of the Moscow District dated December 1, 2014 in case No. A40-52708/14);

- in column 2 “Code” the code of the unit of measurement of the goods is not indicated (letter of the Federal Tax Service of Russia dated July 18, 2012 No. ED-4-3 / [email protected] );

- in column 2a “Symbol (national)” instead of the national symbol of the unit of measurement, the code letter designation (national) of the unit of measurement (thousand) is given or the entry is made: “Thousand cubic meters” (letter of the Ministry of Finance of Russia dated March 26, 2012 No. 03-07 -09/27);

- in column 6 “Including the amount of excise tax” in the document drawn up when selling services, a dash is added (letter of the Ministry of Finance of Russia dated April 18, 2012 No. 03-07-09/37);

- in column 7 “Tax rate” there is no percent sign (letter of the Ministry of Finance of Russia dated 03.03.2016 No. 03-07-09/12236);

- in columns 10 and 10a “Country of origin of goods”:

- the digital code of the country of origin of the goods indicated in column 10 does not correspond to the name of the country of origin of the goods indicated in column 10a (letter of the Federal Tax Service of Russia dated September 4, 2012 No. ED-4-3/ [email protected] );

- for goods produced in the Russian Federation, in column 10, instead of dashes, the RF code “643” is reflected, and in column 10a, “Russia” is indicated (letter of the Ministry of Finance of Russia dated January 10, 2013 No. 03-07-13/01-01);

ATTENTION! When selling traceable goods to other organizations and individual entrepreneurs, electronic invoices must be issued. Buyers are required to accept them through an EDI operator, even if they are not VAT payers (Article 169 of the Tax Code of the Russian Federation).

The procedure for issuing and receiving invoices electronically is described in detail in the ready-made solution from ConsultantPlus. Get trial access to the system for free and proceed to the material.

Features of accounting in one period and in different ones

If the cost of shipped products (services, property rights) increases in the current period (adjustment period):

- in the current period, the seller includes the resulting difference in the tax base, regardless of the period in which the products (services, property rights) were shipped (clause 10 of Article 154 of the Tax Code of the Russian Federation);

- the buyer makes a tax deduction for the difference between the VAT calculated before and after the adjustment (clause 13 of Article 171 of the Tax Code of the Russian Federation).

Kontur.VAT+ takes into account adjustments and corrections and verifies the results with counterparties for all quarters.

Find out more

If the cost of shipped products (services, property rights) decreases in the current period (adjustment period):

- the seller makes a tax deduction for the difference between the VAT calculated before and after the adjustment (clause 13 of Article 171 of the Tax Code of the Russian Federation). At the same time, the tax base, which was determined at the time of shipment of products (services, property rights), is not adjusted;

- the buyer recovers VAT for the amount of the difference between the VAT calculated before and after the adjustment (clause 4, clause 3, article 170 of the Tax Code of the Russian Federation);

- adjustments for reduction are carried out with KVO 18.

The seller and buyer reflect these transactions in their purchase and sales books as follows:

To correctly record adjustments in the books of purchases and sales in different reporting periods, use the following cheat sheet:

Example 1

According to the lease agreement between Sokol (lessor) and Lastochka (tenant), the rent amount is 106,000 rubles.

per month (including VAT). According to the additional agreement concluded in February 2022, the rental payment increased to RUB 112,600. per month (including VAT). According to the additional agreement, this change is effective from October 1, 2022. For the 4th quarter of 2022, rent amounted to RUB 318,000. (including VAT - 48,508 rubles). After concluding an additional agreement in February 2022, rent for the 4th quarter of 2022 increased to RUB 337,800. (including VAT - RUB 51,529).

In February 2022, after signing the additional agreement, Sokol issues an adjustment invoice to Lastochka and indicates:

- the previous amount of the lease payment for the 4th quarter of 2022 (RUB 318,000, including VAT - RUB 48,508);

- new rental payment amount for the 4th quarter of 2022 (RUB 337,800, including VAT - RUB 51,529);

- difference (increase) (RUB 19,800, including VAT - RUB 3,020).

In this situation, Sokol increases the tax base for the 1st quarter of 2019 by registering an adjustment invoice in the sales book for this period by 16,780 rubles. (without VAT).

Lastochka has the right to deduct VAT in the amount of RUB 3,020 in the 1st quarter of 2022. according to the adjustment invoice received from Sokol, registering this invoice in the purchase book of the 1st quarter of 2022.

Example 2

In September 2022, Sokol shipped products worth RUB 96,000 to Lastochka.

(including VAT - RUB 14,644). In February 2022, the parties agreed to reduce the cost of shipped products. The cost after reduction was 82,400 rubles. (including VAT - 12,569 rubles).

In February 2022, Sokol issues an adjustment invoice to Lastochka, indicating:

- the previous cost (96,000 rubles, including VAT - 14,644 rubles);

- new cost (RUB 82,400, including VAT - RUB 12,569);

- difference (decrease) (RUB 13,600, including VAT - RUB 2,075).

In this situation, in February 2022, Sokol has the right to claim VAT in the amount of 2,075 rubles. according to the adjustment invoice issued to Lastochka. To do this, Sokol registers the adjustment invoice issued to Lastochka in its purchase book for the 1st quarter of 2022.

Lastochka in February 2022 must restore VAT in the amount of 2,075 rubles indicated in the adjustment invoice received from Sokol. In this regard, in February 2022, Lastochka must make a restoration entry in its sales book for the 1st quarter of 2019.

Registration of corrections depending on the period occurs according to the scheme presented below.

The practice of drawing up adjustment invoices has shown that adjustments to the cost of goods, services or property rights can be carried out repeatedly.

Please note: When a re-adjustment occurs, the seller will issue an adjustment invoice. It records the data from the previous adjustment invoice. This is how the next adjustment invoice includes the difference between the new data and the data from the previous adjustment.

In this case, the new adjustment invoice includes the date and number of the previous one. It is registered by the parties in the books of sales and purchases in the generally established manner for the amount of the difference indicated in it. In this case, the records of the previous adjustment invoice are not canceled (they remain in the form in which they were reflected when it was issued).

Violation of invoice numbering

Many VAT payers are concerned about the question of whether the current legislation provides for penalties for violating the numbering of issued invoices? This question is answered by specialists from the 1C:Consulting project. Standard".

Invoices are filled out in accordance with the requirements of the Tax Code of the Russian Federation. According to subparagraph 1 of paragraph 5 of Article 169 of the Tax Code of the Russian Federation, the invoice issued for the sale of goods (work, services), transfer of property rights must indicate the serial number and date of issue of the invoice.

Sanctions for violation of tax legislation are provided for in Chapter 16 of Part 1 of the Tax Code of the Russian Federation. In particular, Article 120 of the Tax Code of the Russian Federation provides for a fine for gross violation of the rules for accounting for income and expenses and objects of taxation. A gross violation of the rules for accounting for income and expenses and objects of taxation means, in particular, the absence of invoices.

This means that a penalty will arise if the seller fails to issue an invoice. In the case we are considering, invoices are issued. Consequently, there are no grounds for liability under Article 120 of the Tax Code of the Russian Federation.

So, the Tax Code of the Russian Federation does not provide for penalties directly for violation of the numbering of invoices .

The arbitrators also emphasize that a violation in the form of incorrectly filling out invoices does not fall under the definition of a gross violation of the rules for accounting for income and expenses and taxable items (Resolution of the Federal Antimonopoly Service of the North-Western District dated October 11, 2004 No. A56-6325/04).

However, if the numbering of invoices is violated, claims from the tax authorities are inevitable . The fact is that controllers may suspect incomplete reflection of revenue from the sale of goods (works, services). After all, they will not have confidence that all invoices issued are recorded in the sales book.

The buyer may also find himself in a difficult situation. Tax authorities will probably refuse to deduct VAT if they determine that the chronology of invoice numbers issued by the supplier is broken.

The buyer may also have problems if controllers find out that invoices with different dates, but with the same numbers, were received from the same supplier. For example, invoices dated January 26, 2009 No. 67 and dated February 10, 2009 No. 67.

True, there are chances to challenge such claims of inspectors. This is confirmed by court decisions taken in favor of the taxpayer. Thus, the Federal Antimonopoly Service of the Ural District came to the conclusion that the presence of identical numbers on invoices, but with different dates, is not a violation of the requirements for the procedure for issuing invoices. Consequently, it cannot serve as a basis for refusing to accept the deduction of VAT amounts paid to the supplier (resolution dated May 13, 2008 No. F09-3337/08-S2 in case No. A76-19348/07). Let us note that in this case, the judges drew attention to the fact that the supplier established such a procedure for numbering invoices, within a month, in its accounting policy.

The Moscow District Federal Antimonopoly Service emphasized that suppliers’ keeping records of invoices out of chronological order did not impede the implementation of tax control and, therefore, cannot indicate the illegality of applying VAT deductions (resolution dated October 7, 2008 No. KA-A40/8215-08 in the case No. A40-77769/06-75-465).