Why do you need a gateway?

Each employer submits reports to the Social Insurance Fund:

- Quarterly form 4-FSS.

- Once a year - an application to confirm the main type of activity.

More details:

- how to fill out the 4-FSS report

- how to confirm the main activity of the Social Insurance Fund

The employer has the right to submit reports:

- on paper, if the number of employees is less than 25 people;

- electronic.

To submit electronic reporting, a special service has been introduced: a gateway for receiving reports to the Social Insurance Fund on the official website of the fund. To use it, there is no need to enter into an agreement with an EDF operator and pay for its services. The organization has the right to install the necessary software and use the gateway completely free of charge. A prerequisite is that the organization has a digital signature of the head to sign reports to regulatory authorities.

How to issue and send an electronic sick leave to the Social Insurance Fund in a couple of minutes

Anastasia Cheremnykh, a consultation line specialist, told us how to prepare your database so that issuing electronic sick leave takes only a few minutes.

Registration of sick leave usually consists of three steps. The data is filled in automatically:

1. Sick leave;

2. Information for the register of direct payments to the Social Insurance Fund;

3. Register of direct payments to the Social Insurance Fund and Register of Electronic Taxpayers for the Social Insurance Fund.

We recommend that you check in advance that the required information is filled out. Namely:

- check the completion of the regional coefficient. For more details, read point 1 in the article Why the regional coefficient is not calculated or has ceased to be calculated in ZUP 3.1;

- check the phone and email details in the organization card;

- check the completion of the employee’s personal data. The address must be filled in according to the classifier;

- fill out the length of service to calculate sick leave. In the employee’s card, following the link “Labor activity”, the “Insurance record for calculating sick leave” must be filled out;

- fill out information about your earnings from your previous job. Section “Salary” - “Certificates for salary calculation”;

- clarify which card the employee will receive benefits on. By default, the program will select the same account as for salary transfers. If benefits need to be transferred to another account, then you can indicate this information in the employee’s card, using the link “Direct Social Security Payments.”

Further actions occur as sick leave is received from employees.

The 1C-Reporting service greatly simplifies the work with electronic sick leave certificates. The service is included free of charge in the 1C:ITS PROF support agreement.

1C-Reporting

. Set up an exchange with all regulatory authorities or only with the Social Insurance Fund. Our specialists will tell you what is included in your support and help with setup. Submit your application

Those who use an external program to exchange with the fund will need to perform additional steps, namely:

- in an external program, using the employee’s data and sick leave number, download data from the fund;

- save the received ELN to a file (xml format). We save the file in a folder so that we can access it from the 1C program;

- when we finish the registration in the 1C program, we will need to upload the registry to a file and load it into an external program for sending.

When the employee brought the electronic sick leave number, we proceed to register it in 1C.

1. Sick leave

.

Create a document “Sick Leave”. In it we fill in the employee, the sick leave number, and click the “Get from the Social Insurance Fund” button. For those who use an external program to send reports - “Load from file”. The calculation data and details will be filled in, incl. and on honey institution.

Rice. 1 (click to enlarge)

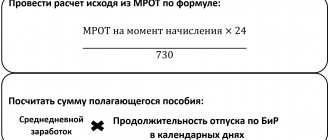

We check the benefit calculation. We remind you that the procedure for calculating sick leave established from April 2022 has been extended and is still in effect. The special features apply to employees with low average earnings. You can read more about the formula used for calculation in our article New procedure for calculating sick leave in ZUP 3.1 from April 2022 until the end of the year

2. Information for the register of direct payments to the Social Insurance Fund

.

In the “Sick Leave” document, go to the “Information for the Social Insurance Fund” tab and click the link “Enter information for the register of direct payments to the Social Insurance Fund.” Thus, the document “Information for the register of direct payments to the Social Insurance Fund” will open in front of us. We check the document and carry it out.

Rice. 2 (click to enlarge)

Read what has changed in this document for 2022 in our article How to generate documents for payment of benefits at the expense of the Social Insurance Fund in ZUP 3.1

3. Register of direct payments to the Social Insurance Fund

.

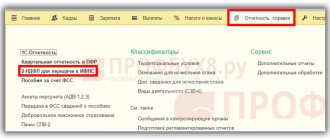

Next, we proceed directly to the creation of the Register of direct payments for the Social Insurance Fund. It can be created from different document journals. For example, “Reporting, certificates” - “Transfer of information about benefits to the FSS” - “Create” - “Register of direct payments to the FSS”.

Rice. 3 (click to enlarge)

In the window that opens, click “Fill”. We check the data, incl. tab “Information about the policyholder”. We are conducting a register.

Click the “Submit” button. For those who use an external program to send reports - “Upload”.

Rice. 4 (click to enlarge)

After sending a report directly from 1C, the response from the FSS most often comes immediately, within a few minutes.

! Please note that together with the “Register of direct payments to the Social Insurance Fund” we also send to the fund the “Register of Elite Taxpayers for sending to the Social Insurance Fund”. This report is created in the “Reporting, references” menu - 1C-Reporting. Filled in automatically.

| Author of the article: Anastasia Cheremnykh, consultation line specialist at Support Center LLC. Order a consultation |

How to prepare 4-FSS for delivery through the gateway

The procedure for submitting electronic reports 4-FSS is prescribed in FSS Order No. 19 dated February 12, 2010. For preparation and submission you need:

- Internet access.

- Software for preparing the calculation, downloading it in the appropriate format, encrypting and signing it before sending. Use your own software or download free programs from the FSS website.

- Electronic digital signature of the policyholder (or authorized representative).

- Certificates of authorized fund officials. They must be downloaded and installed on your computer.

The algorithm for sending reports through the gateway is as follows:

1. Prepare Form 4-FSS using software.

2. Download the report in xml format.

3. Upload the prepared report in the form of an downloaded xml file into the gateway in the “Submit Document” section; upon submission, the report will be assigned an identifier.

4. Receive a receipt for submitting the report in the “Check and Control” section of the gateway by entering the previously received identifier.

IMPORTANT!

The Social Insurance Fund has developed a special service for preparing Form 4-FSS on the FSS portal. It allows you to prepare a report and upload it in xml format without installing software. The service is intended only for preparing 4-FSS calculations. The uploaded form must be signed and sent according to the algorithm we provide.

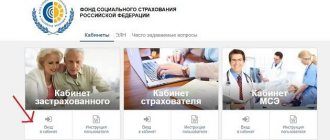

Connecting to EDMS in 1C

The 1C: Salary and Personnel Management 8 program, edition 3, provides a connection to the EDMS in the Settings - Organizations menu (Fig. 2). In the card of the customized organization, following the link Social Electronic Document Flow Settings, the FSS EDMS Settings window opens, where you need to set the Receive messages about changes in electronic document states flag.

Rice. 2. Setting up a connection to the EDMS

Please note that in order to work with EDMS, you must enter into an appropriate agreement on interaction with the Social Insurance Fund. At the moment, the procedure for concluding an agreement has not been approved. Follow the news on the website.

Submission confirmation and error correction

The Fund, when receiving the report, uses the following procedure:

- checking the name and size of the encrypted file;

- decryption and verification of electronic signatures;

- checking the compliance of the calculation file structure with the approved format;

- logical and arithmetic control of indicators of form 4-FSS.

If there are no errors, the sender will receive a receipt confirming that the fund has accepted the form.

If there are errors in the control ratios, the fund will send a receipt acknowledging receipt of the report containing the errors. In this case, it is necessary to correct the errors and send the updated Form 4-FSS.

If there are critical errors, the report will not be accepted and the sender will receive a negative verification report. Such errors include (clause 4.10 of the FSS Order dated February 12, 2010):

- A discrepancy between the file name format and file size was detected.

- There is no digital signature, errors were identified in the procedure for signing the digital signature report or encrypting the file.

- The settlement was signed with an inactive (ceased) digital signature.

- The calculation was signed by a person who does not have the right to sign 4-FSS.

- The file does not comply with the structure of the approved format.

IMPORTANT!

The Foundation has developed a FSS test gateway for checking reporting, which allows you to check 4-FSS for errors in advance. Pre-checking will help you pass your report the first time.

New FSS gateway for sending registers of certificates of incapacity for work

From January 1, 2022, all regions of the Russian Federation switched to direct payments of social benefits from the Social Insurance Fund. To process the payment, the employer transmits information about employees’ sick leaves in the form of a register.

Read more about the register of sick leave certificates

Electronic transmission is mandatory for organizations with 25 or more employees. To transfer registers electronically, the FSS service has been developed: a gateway for receiving documents from electronic signatures.

The principle of its operation and requirements for use are similar to those described above.

The employee’s consent to receive notifications from the Social Insurance Fund

The FSS website provides an answer to the question “How reliable is the security system of the UIIS “Sotsstrakh”? Can a patient be sure that his personal data and information about the diagnosis will not fall into the wrong hands?

The FSS guarantees that the IS of the FSS of the Russian Federation provides all the necessary conditions for protecting information and maintaining its confidentiality in accordance with the requirements of legislation in the field of information technology. Information about the patient's diagnosis from the medical organization that generated the electronic certificate of incapacity for work is not provided to the employer; only the code is provided. Third parties do not have access to the electronic certificate of incapacity for work.

An employer that does not use EDMS usually receives information about the employee’s health status from himself: at the employee’s request, provide information about temporary disability and the availability of sick leave. In the conditions of EDMS, the employer receives information about changes in the status of the electronic data automatically, after subscribing to receive alerts, therefore, in accordance with Federal Law dated July 27, 2006 No. 152-FZ “On Personal Data,” the employer will require the employee’s consent.

The FSS told us what's new in the appointment, calculation and payment of benefits in 2022

The program “1C: Salaries and Personnel Management 8”, edition 3, provides for the preparation of employee statements of consent to receive notifications from the Social Insurance Fund about the status of the employee payroll and monitoring the receipt of such consents. In the menu Personnel - Benefits - Consent to notification of ELN, you can print a personalized application form (Fig. 3). Based on the results of receiving an application from an employee in electronic form, you should set the flag corresponding to the state of the document. Conditions provided:

- Awaiting signature;

- Signed;

- There are no plans to sign.

Rice. 3. The employee’s consent to notification of ELN

The states of Consent to notifications about electronic communication are displayed in the list of employees (Fig. 4).

Rice. 4. Status of employees’ consent to notifications about electronic health insurance and subscriptions to receive information from the Social Insurance Fund

You can generate and register statements of consent from employees to the processing of personal data about their health status in a list.

If consent has been received from the employee, then click on the button of the same name to Enable subscription to receive information from the Social Insurance Fund about changes in the status of the personal income tax (see Fig. 4). If an employee revokes his consent or is fired, click the button of the same name to Disable subscription. The program monitors the status of the employee's application and promptly reminds him of the need to enable or disable the subscription.