How to fill

The list is required to confirm payment and when checking policyholders by fund specialists. Here's how to fill out the sick leave register in 2022:

- Enter information about the employer: name, registration number, subordination code, INN, KPP and OGRN, contact details of the contractor.

- Enter information about the employee: full name, date of birth and registration address, INN and SNILS, passport details.

- Indicate the number and date of the certificate of incapacity for work.

- Determine the start and end day of the illness, the number of total days of absence and the date of return to work.

- Calculate payments from the employer and the fund.

Sign the completed document with an electronic signature.

Creating a new document

To add a document you need:

- Go to the main page of the service, select the “FSS” and then “FSS Benefits” .

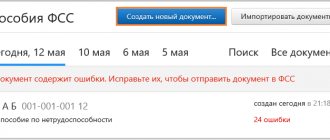

- On the page that opens, select “Create document” :

- In the shape of "Creating a new document" you need to select the type of benefit:

- Specify the type of certificate of incapacity for work "Paper". To create an electronic sick leave certificate, we recommend that you refer to the separate instructions.

- Select employee:

- The employee is on the list. You should select it and click “Create document” . You can use the search bar. The search is carried out by last name or SNILS of the employee. After entering the data in the line, click “Find” .

- The employee is not on the list. You need to use the “Add a new employee” . After entering your last name, first name and SNILS, you need to click “Add employee” . The newly created employee will appear in the list. You should select it and click “Create document” . When you create a new employee, he will be displayed in the “Contour. PF report” (the services have the same list of employees). It will be available for reporting to the Pension Fund.

- Enter data into the table. The information consists of several sections, the number of which depends on the type of benefit.

How to transfer data to the FSS

With electronic document flow between the organization and the Social Insurance Fund, the accountant receives an electronic certificate of incapacity for work of the employee, fills out the employer’s part and sends the information to the fund within 5 calendar days. Instructions on how to send the register of sick leave to the Social Insurance Fund via TKS:

- The accountant creates a list online in one of the user programs - 1C, SBIS, "Kontur".

- The document is signed with an electronic signature and submitted to the social insurance department.

- The Foundation verifies the register.

- The policyholder receives notification of the result of the inspection.

- If filled out correctly, the money will be transferred to the employee within 10 days.

Bulk sending of documents

Sending documents to the Social Insurance Fund can be done en masse. To send several documents at once, you need to go to the page with a list of documents, then select the “Details and Settings” and then “Enable bulk sending mode.” This sending procedure is enabled for all users of the organization at the same time.

To disable bulk sending of documents, in the same window you must select the “Disable bulk sending mode” .

To send documents in bulk, select a date (the last 4 days are displayed by default) and click “No errors” . Next, click “Send N documents to the FSS” , then select an electronic signature certificate.

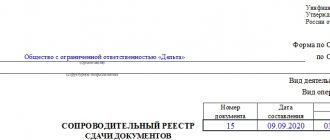

Inventory for transferring documents to the Social Insurance Fund on paper

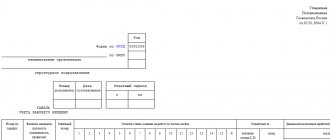

If it is necessary to transfer information to the Social Insurance Fund not in electronic form, but on paper, in ZUP 3.1 we use the document Inventory of employee applications for payment of benefits .

By clicking the Fill the Inventory will include all employees with the right to receive benefits who are not included in other registers or inventories.

A printed form of the Inventory can be obtained by clicking the button with the “printer” icon in the document header.

Additionally, you can watch a video on the FSS registers:

How to issue and send an electronic sick leave to the Social Insurance Fund in a couple of minutes

Anastasia Cheremnykh, a consultation line specialist, told us how to prepare your database so that issuing electronic sick leave takes only a few minutes.

Registration of sick leave usually consists of three steps. The data is filled in automatically:

1. Sick leave;

2. Information for the register of direct payments to the Social Insurance Fund;

3. Register of direct payments to the Social Insurance Fund and Register of Electronic Taxpayers for the Social Insurance Fund.

We recommend that you check in advance that the required information is filled out. Namely:

- check the completion of the regional coefficient. For more details, read point 1 in the article Why the regional coefficient is not calculated or has ceased to be calculated in ZUP 3.1;

- check the phone and email details in the organization card;

- check the completion of the employee’s personal data. The address must be filled in according to the classifier;

- fill out the length of service to calculate sick leave. In the employee’s card, following the link “Labor activity”, the “Insurance record for calculating sick leave” must be filled out;

- fill out information about your earnings from your previous job. Section “Salary” - “Certificates for salary calculation”;

- clarify which card the employee will receive benefits on. By default, the program will select the same account as for salary transfers. If benefits need to be transferred to another account, then you can indicate this information in the employee’s card, using the link “Direct Social Security Payments.”

Further actions occur as sick leave is received from employees.

The 1C-Reporting service greatly simplifies the work with electronic sick leave certificates. The service is included free of charge in the 1C:ITS PROF support agreement.

1C-Reporting

. Set up an exchange with all regulatory authorities or only with the Social Insurance Fund. Our specialists will tell you what is included in your support and help with setup. Submit your application

Those who use an external program to exchange with the fund will need to perform additional steps, namely:

- in an external program, using the employee’s data and sick leave number, download data from the fund;

- save the received ELN to a file (xml format). We save the file in a folder so that we can access it from the 1C program;

- when we finish the registration in the 1C program, we will need to upload the registry to a file and load it into an external program for sending.

When the employee brought the electronic sick leave number, we proceed to register it in 1C.

1. Sick leave

.

Create a document “Sick Leave”. In it we fill in the employee, the sick leave number, and click the “Get from the Social Insurance Fund” button. For those who use an external program to send reports - “Load from file”. The calculation data and details will be filled in, incl. and on honey institution.

Rice. 1 (click to enlarge)

We check the benefit calculation. We remind you that the procedure for calculating sick leave established from April 2022 has been extended and is still in effect. The special features apply to employees with low average earnings. You can read more about the formula used for calculation in our article New procedure for calculating sick leave in ZUP 3.1 from April 2022 until the end of the year

2. Information for the register of direct payments to the Social Insurance Fund

.

In the “Sick Leave” document, go to the “Information for the Social Insurance Fund” tab and click the link “Enter information for the register of direct payments to the Social Insurance Fund.” Thus, the document “Information for the register of direct payments to the Social Insurance Fund” will open in front of us. We check the document and carry it out.

Rice. 2 (click to enlarge)

Read what has changed in this document for 2022 in our article How to generate documents for payment of benefits at the expense of the Social Insurance Fund in ZUP 3.1

3. Register of direct payments to the Social Insurance Fund

.

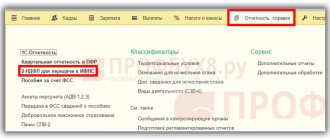

Next, we proceed directly to the creation of the Register of direct payments for the Social Insurance Fund. It can be created from different document journals. For example, “Reporting, certificates” - “Transfer of information about benefits to the FSS” - “Create” - “Register of direct payments to the FSS”.

Rice. 3 (click to enlarge)

In the window that opens, click “Fill”. We check the data, incl. tab “Information about the policyholder”. We are conducting a register.

Click the “Submit” button. For those who use an external program to send reports - “Upload”.

Rice. 4 (click to enlarge)

After sending a report directly from 1C, the response from the FSS most often comes immediately, within a few minutes.

! Please note that together with the “Register of direct payments to the Social Insurance Fund” we also send to the fund the “Register of Elite Taxpayers for sending to the Social Insurance Fund”. This report is created in the “Reporting, references” menu - 1C-Reporting. Filled in automatically.

| Author of the article: Anastasia Cheremnykh, consultation line specialist at Support Center LLC. Order a consultation |

2323 views

Sick leave - direct payment from the Social Insurance Fund

With direct payments, the procedure for processing and paying benefits differs from the procedure used under the credit system.

More details Direct payments of benefits from the Social Insurance Fund

To receive temporary disability benefits, the employee brings documents to work (clause 2 of the Decree of the Government of the Russian Federation of April 21, 2011 N 294):

- information about the insured person (FSS Order No. 26 dated 02/04/2021) - contains information about the method of payment of benefits. Provided: once - upon employment or during the period of work;

- again - make changes if necessary;

- in paper form;

For sick leave in case of an industrial injury or occupational disease, the organization provides all documents to the Social Insurance Fund in paper form , additionally attaching (in case of injury):

- report on an industrial accident (Form N-1) or copies of the investigation materials (clause 3 of the Decree of the Government of the Russian Federation of April 21, 2011 N 294).

The employer calculates the benefit for the first 3 days of temporary disability (clause 6 of the Decree of the Government of the Russian Federation of April 21, 2011 N 294) and pays it on the next day after the calculation, established in the organization for the payment of wages (part 1 of article 15 of Law N 255- Federal Law).

Sick leave for caring for a sick family member is paid in full from the Social Insurance Fund (Part 3, Article 3 of Law No. 255-FZ).

Send calculation

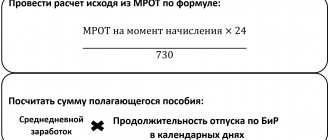

- In the “Benefit amount” block, fill in the amounts and check the number of calendar days for calculating the benefit. The default is 730 days. You can change this number, for example, for maternity leave or if the calculation year is a leap year.

If an employee has written an application to change the period for calculating benefits, click on the year and select the desired one. The date and number of the application are not indicated in the calculation. - To send a register of information along with a sick leave payment, please indicate the method of payment. If a personal account is added to an employee’s card, it will be filled in automatically on sick leave. If not, the icon will appear.

Click “Details”, in the “Pay employee via” line, click “Not selected” and select the payment method.Fill in the details depending on the method you chose:

- Click "Submit Calculation". If the employee has provided the number of the electronic certificate of incapacity for work, SBIS will send the calculation via ENL and register of information

;

If you do not want the register of information to be sent along with the sick leave bill, disable automatic sending.

Also, the registry will not be sent automatically if:

- a negative protocol was received for calculating the ELN;

- the primary LN indicates a period of incapacity for work of less than 3 days (including the third) and does not indicate the period for payment of benefits at the expense of the Social Insurance Fund;

- in the “Other” field the disabled status is set to “died”;

- the cause of disability is indicated “04 - industrial accident” or “07 - prof. disease" - sending the registry in electronic form is not provided for them.