By virtue of paragraph 2 of Article 54 of the Civil Code of the Russian Federation (hereinafter referred to as the Civil Code of the Russian Federation), the location of a legal entity is determined by the place of its state registration. State registration of a legal entity is carried out at the location of its permanent executive body, and in its absence - of another body or person who has the right to act without a power of attorney on behalf of the legal entity. This address is called “legal”. It is reflected in the “Unified State Register of Legal Entities” (USRLE) for the purposes of communication with a legal entity (clause “c”, paragraph 1, article 5 of the Federal Law of August 8, 2001 No. 129-FZ “On State Registration of Legal Entities” and individual entrepreneurs”, hereinafter referred to as Law No. 129-FZ).

The location of a legal entity has significant legal significance. It determines the place of fulfillment of obligations, the place of payment of taxes, and the jurisdiction of disputes. Indication of false information about this address in the constituent documents of a legal entity affects the economic interests of an indefinite number of persons who may enter into relations with a company that does not operate at the specified address, and also impedes the proper implementation of tax control. The courts also point to these circumstances (resolution of the Federal Antimonopoly Service of the East Siberian District dated April 29, 2009 No. A19-13374/08-65-F02-1648/09).

...many organizations have a question: what to do if, when registering an organization, it is not known at what address the organization will actually be located...

In addition, a legal entity bears the risk of the consequences of failure to receive legally significant messages received at its address indicated in the Unified State Register of Legal Entities, as well as the risk of the absence of its representative at this address. Such a legal entity does not have the right, in relations with persons who in good faith relied on the Unified State Register of Legal Entities data about its address, to refer to data not included in it, as well as to the unreliability of the data contained in it. This was indicated by the Plenum of the Supreme Arbitration Court in its resolution of July 30, 2013 No. 61 (clause 1). And from September 1, 2013, a norm similar to this position will be enshrined in Article 165.1 of the Civil Code of the Russian Federation (introduced by Federal Law No. 100-FZ of May 7, 2013). It states that legally significant messages are understood as statements, notifications, demands, notices or other legally significant messages with which the law or transaction associates civil consequences for another person. They entail consequences for that person from the moment they are delivered to the person or his representative.

In this case, the message is considered delivered in cases where it was received by the addressee, but due to circumstances depending on him, was not delivered to him or he did not familiarize himself with it. This can happen, for example, if the organization is not located at its legal address. In this case, we understand the actual address of the organization (address of rented or own premises) as actual. However, this address is not reflected either in the organization’s constituent documents or in the Unified State Register of Legal Entities, that is, tax authorities, counterparties or other persons do not have available information about the location of the organization at this address. The presence of addresses other than the legal address is provided for by law only in cases of registration of a branch of an organization, its representative office or a separate division

Previously, the registration authority was not vested with the authority to verify the accuracy of the information contained in the documents submitted for state registration. However, as of June 30, 2013, everything changed.

Federal Law No. 134-FZ of June 28, 2013 “On Amendments to Certain Legislative Acts of the Russian Federation in Combating Illegal Financial Transactions” (hereinafter referred to as Law No. 134-FZ), which came into force on this date, made several important changes in the Civil Code of the Russian Federation, the Tax Code of the Russian Federation (hereinafter referred to as the Tax Code of the Russian Federation) and Law No. 129-FZ.

Verifying the accuracy of the information declared during registration

Law No. 134-FZ in the new edition sets out Article 51 of the Civil Code of the Russian Federation. Paragraph 3 of this article now states that before the state registration of a legal entity, changes in its charter or before the inclusion of other data not related to changes in the charter in the Unified State Register of Legal Entities, the authorized state body is obliged to carry out, in the manner and within the period prescribed by law, a verification of the accuracy of the data included in the register.

In parallel, the list of conditions for refusal of state registration, contained in Article 23 of Law No. 129-FZ, was significantly expanded. And now subparagraph “p” of paragraph 1 of this article stipulates that refusal of state registration is permitted if the registering authority has confirmed information about the unreliability of the information about the address of the legal entity contained in the documents submitted to the registration authority.

The Plenum of the Supreme Arbitration Court hastened to answer the question under what conditions information about a legal address can be considered unreliable.

Cameral

A desk tax audit is carried out within 3 months from the moment the taxpayer submits a declaration to the local Federal Tax Service. A desk audit is carried out by tax officials without notifying the taxpayer and does not require any resolution from superiors. In addition, in a situation where companies change their legal addresses very often, such verification simply cannot be avoided . You can learn more about desk checks here, and checks after a change of address here.

What the Plenum explained

The Plenum of the Supreme Arbitration Court on July 30, 2013 issued Resolution No. 61 “On some issues in the practice of resolving disputes related to the accuracy of the address of a legal entity” (hereinafter referred to as Resolution No. 61).

The judges first of all noted that since the location address of a legal entity is reflected in the Unified State Register of Legal Entities for the purposes of communication with a legal entity, the registering authority has the right to refuse state registration if there is confirmed information about the unreliability of the information provided about the address (that is, that such an address was indicated without the intention of using it to communicate with a legal entity).

However, such a refusal must be fully motivated and contain not only a reference to the rule of law, but also all specific circumstances that indicate the unreliability of the information (clause 3 of Resolution No. 61).

note

Information about “mass addresses” is posted for information support of taxpayers on the website of the Federal Tax Service of Russia www.nalog.ru.

The following may indicate this:

- "Mass address". That is, according to the Unified State Register of Legal Entities, it is designated as the address of a large number of other legal entities, in relation to all or a significant part of which there is information that communication with them at this address is impossible: representatives of the legal entity are not located at this address, correspondence is returned with a note “the organization has left”, “beyond the expiration of the storage period”, etc.

- The address does not actually exist or the property located at this address has been destroyed.

- The address is a conventional postal address assigned to an unfinished construction project.

- The address obviously cannot be freely used for communication with a legal entity (addresses where government bodies, military units, etc. are located).

- There is a statement from the owner of the property that he does not allow legal entities to be registered at the address of this property.

If at least one of these conditions is present, information about the address is considered unreliable, unless the applicant has provided the registration authority with other information (documents) confirming that contact with the legal entity at this address will be carried out. The Plenum of the Supreme Court, however, does not explain what these documents are. Meanwhile, Law No. 129-FZ contains comprehensive lists of documents submitted for state registration. The registration authority does not have the right to place on the person who applied for state registration the burden of confirming the accuracy of the information provided, including additional documents, in addition to those provided for by the Law (Clause 4 of Article 9 of Law No. 129-FZ). The Plenum of the Supreme Arbitration Court reminded us of this (clause 2 of Resolution No. 61).

At what address should I register an “officeless” organization?

Many organizations have a question: what to do if, when registering an organization, it is not known at what address the organization will actually be located? That is, lease agreements for premises have not yet been concluded and, perhaps, will not be concluded, since there is no need for an office at all. Can registration or “re-registration” of a company be refused if it has entered into a lease agreement for premises that are unsuitable for its activities? Such situations are not hopeless. The SAC Plenum made two important comments.

Firstly, the address of a legal entity may differ from the address at which its direct activities are carried out, including economic activities (production workshop, retail outlet, etc.). After all, a permanent body must be located at its legal address. Therefore, the registration authority does not have the right to refuse state registration on the basis that the premises or building, the address of which is indicated for communication with a legal entity, is unsuitable for carrying out activities in general or the type of activity indicated in the documents submitted for state registration (clause 4 Resolution No. 61).

Secondly, registration at the address of a residential property is permissible, but only in cases where the owner of the property has given consent to this. Consent is assumed if this address is the address of residence of the founder (participant) or a person who has the right to act on behalf of a legal entity without a power of attorney (for example, the address of the general director).

The panic is somewhat exaggerated.

The total number of conversations about the risk of receiving a “mass address” clearly does not correspond to the actual threat. The greatest risks arise in the following cases:

- The place of registration of the company is the private apartment of the owner, an individual, and in addition to the location, there is also a sign of the mass nature of the founder - the same person is listed in several companies;

- Many companies are “registered” using one house number, most of which do not receive correspondence from the Federal Tax Service, and an on-site inspection was unable to establish their presence at the specified coordinates;

- A legal address exists nominally, like a room or premises to which many organizations are assigned.

In the listed cases, you can easily and naturally get marked as unreliable information. To prevent this from happening, we recommend:

- Buy the company’s registration address from a trusted company, at the same time finding out all the important nuances;

- Be sure to check for signs, plaques and other information identifying your organization;

- Agree on a postal service so as not to miss important letters from the Federal Tax Service and not to provoke the authorities to check the place of registration of the company.

You should not expect problems if your business plans to locate an office in a large business anthill. The Federal Tax Service is also staffed by not stupid people who understand perfectly well that if the building was originally built for offices, then blaming its “inhabitants” for the mass population is at least absurd, and at most illegal.

What are the dangers of an inaccurate address?

The consequences of an unreliable legal address of an organization can be:

Liquidation of a legal entity

If the registration authority has information that communication with a legal entity at the address reflected in the Unified State Register of Legal Entities is impossible, it will send it, its founders, and the general director notifications about the need to provide reliable information about the address to the registration authority. If such information is not provided within a reasonable time, he may apply to the arbitration court with a request to liquidate the legal entity (clause 6 of Resolution No. 61);

Termination of a bank account agreement

Banks are required to identify persons under their service and establish in relation to legal entities, in particular, the address of their location (Clause 1, Article 7 of the Federal Law of August 7, 2001 No. 115-FZ “On Combating the Legalization (Laundering) of Income obtained by criminal means and the financing of terrorism”, hereinafter referred to as Law No. 115-FZ). They are also obliged to systematically update information about Clients (clause 3 of Article 7 of Law No. 115-FZ).

Thus, reliable information about the location of a legal entity is an essential condition of a bank account agreement both during its conclusion and during the execution of this agreement. Therefore, failure by the client to provide the necessary information when changing his identification characteristics may serve as grounds for termination by the bank of the agreement by virtue of the Law on Combating Money Laundering (Resolution of the Presidium of the Supreme Arbitration Court of April 27, 2010 No. 1307/10);

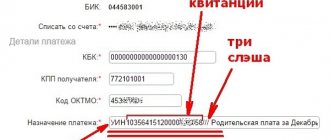

Failure to receive documents from tax authorities

Failure to receive documents from tax authorities (requirements for the submission of documents, payment of taxes, etc.). From July 30, 2013, in the case of sending documents that are used by tax authorities in the exercise of their powers in relations regulated by the legislation on taxes and fees, by mail, they must be sent to the taxpayer - a Russian organization (its branch, representative office) - at its address location (location of its branch, representative office) contained in the Unified State Register of Legal Entities. Such changes to paragraph 5 of Article 31 of the Tax Code of the Russian Federation were introduced by Law No. 134-FZ. Documents sent to “official” addresses will be considered received on the sixth day from the date of their sending by registered mail, even if the taxpayer did not actually receive them (Clause 4 of Article 31 of the Tax Code of the Russian Federation as amended by Federal Law dated July 23, 2013 No. 248-FZ);

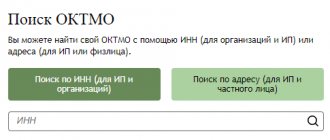

Violation of the procedure for registering with tax authorities

Bringing to tax liability for violation of the procedure for registration with the tax authority. Any division territorially isolated from the organization, at the location of which stationary workplaces are equipped, is recognized as a separate division of the organization. Recognition of a separate division of an organization as such is carried out regardless of whether its creation is reflected or not reflected in the constituent or other organizational and administrative documents of the organization, and on the powers vested in such a division. In this case, a workplace is considered stationary if it is created for a period of more than one month (Article 11 of the Tax Code of the Russian Federation).

Thus, if an organization operates at an address different from its legal address, then this address is formally the location of its separate division. The organization must report such a separate division to the tax authority within one month from the date of its creation (clause 3, clause 2, article 23, clause 1, article 83 of the Tax Code of the Russian Federation). Paragraph 2 of Article 116 of the Tax Code of the Russian Federation provides for tax liability for the conduct of activities by an organization without registration with the tax authority on the grounds provided for by the Tax Code of the Russian Federation in the form of a fine in the amount of 10 percent of the income received during a specified time as a result of such activity, but not less than 40 thousand rubles (letter of the Ministry of Finance dated September 3, 2012 No. 03-02-07/1-211, resolution of the Federal Antimonopoly Service of the Moscow District dated July 25, 2012 in case No. A40-123199/11-20-500). Although it is possible that the tax authorities will take advantage of the explanations of the Ministry of Finance given in letter dated April 17, 2013 No. 03-02-07/1/12946, and will hold the organization accountable in accordance with paragraph 1 of Article 126 of the Tax Code of the Russian Federation for failure to submit within the prescribed period the taxpayer provides information to the tax authorities (if such an act does not contain signs of tax offenses provided for in Articles 119 and 129.4 of the Tax Code of the Russian Federation). Then the fine will be only 200 rubles for each unsubmitted document. However, in our opinion, one should not count on such loyalty from the tax authorities.

In addition, if an organization is not actually located at the address indicated in the Unified State Register of Legal Entities, it should “re-register” at a reliable (actual) address, and not register an “imaginary” separate division. Administrative liability is provided for providing false information about a legal entity, including its address.

Submission of false information about a legal entity to the body carrying out state registration of legal entities, in accordance with Part 3 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation, is an administrative offense for which liability is provided in the form of a warning or the imposition of an administrative fine on officials in the amount of 5 thousand rubles.

Yulia Sinitsyna

, leading expert lawyer of the First House of Consulting “What to do Consult”, for the magazine “Consultant”

The state registration process is easy

With the “Lawyer at the Enterprise” berator, you can easily reorganize your company, create a new one, resolve any conflict with counterparties and pass any inspection procedure with honor. Find out more >>