Let's look at this situation. The company employs specialists with a shift work schedule.

When calculating the advance for the first half of the month, the employee is paid the amount before personal income tax is withheld, and if the employee has no earnings for the next two weeks (for example, the employee took unpaid leave), then by the time the salary is paid there will be nothing to withhold personal income tax from.

As a result, at the end of the month there is an overpayment of wages to the employee and the amount of personal income tax not withheld.

When should personal income tax be withheld from an employee? When is a company obliged to transfer personal income tax to the budget in this case?

What risks exist in this situation if the organization does not accrue and transfer personal income tax to the budget?

Will it be legal to include in the payroll software used a reduction in the amount payable minus 13%?

Personal income tax on salary advance

When paying an advance on wages, personal income tax is not withheld from the advance on the basis of the following provisions.

The date of receipt of income in the form of wages is the last day of the month for which it was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Consequently, the date of receipt of wages for the first half of the month for the purpose of calculating personal income tax will be recognized as the last day of this month.

In this case, the organization as a tax agent must transfer personal income tax from wages no later than the day following the day of payment of income to the taxpayer (clauses 4, 6 of Article 226 of the Tax Code of the Russian Federation).

Thus, the tax agent calculates, withholds and transfers to the budget personal income tax from wages (including for the first half of the month) once a month upon the final calculation of the employee’s income based on the results of each month for which the income was accrued to him , within the time limits established by paragraph 6 of Article 226 of the Code (see Letter of the Ministry of Finance of Russia dated June 11, 2019 N 21-08-11/42596).

A similar point of view is expressed in Letters of the Ministry of Finance of Russia dated October 28, 2016 N 03-04-06/63250, dated October 27, 2015 N 03-04-07/61550:

Before the end of the month, income in the form of wages cannot be considered received by the taxpayer. Accordingly, tax cannot be calculated and withheld until the end of the month.Based on paragraph 4 of Article 226 of the Code, tax agents are required to withhold the calculated amount of tax directly from the taxpayer’s income upon actual payment.

Thus, the tax agent withholds from the taxpayer the amount of tax calculated at the end of the month from income when they are paid at the end of the month (on the last day of the month) in which the income taken into account when determining the tax base for personal income tax on an accrual basis was received.

Taking into account the above, in the situation described, the organization lawfully did not withhold personal income tax from the advance payment of wages.

Early tax

So, we have figured out the rules for withholding personal income tax: the tax on wages paid not in connection with dismissal is calculated only on the last day of the month for which this salary is accrued. Accordingly, withholding of estimated tax is made from any income paid on or after that date. What to do if personal income tax was calculated by mistake and withheld when paying an “advance” before the end of the month?

Unfortunately, both regulatory authorities and judicial practice avoid this issue. Although legal databases easily contain letters indicating the inadmissibility of transferring personal income tax “in advance” before the date of actual receipt of income (letters of the Federal Tax Service of Russia dated September 29, 2014 No. BS-4-11/ [email protected] and BS-4-11/ [ email protected] , Ministry of Finance of Russia dated September 16, 2014 No. 03-04-06/46268 and dated September 1, 2014 No. 03-04-06/43711). But when studying them, it turns out that a completely different situation is considered there: the budget includes amounts that were not withheld from individuals when paying income, which is directly prohibited by clause 9 of Art. 226 Tax Code of the Russian Federation. That is, these letters are not talking about the tax withheld from the “advance payment”, but about the amounts that, under the guise of personal income tax, were transferred to the budget even before any money was paid to the employees at all.

Therefore, we will rely exclusively on the norms of the Tax Code of the Russian Federation. There are two options.

Option one - return what was withheld

Return what was withheld before the date of actual receipt of income in the form of salary (until the last day of the month), and then calculate personal income tax on the last day of the month and withhold it in the future when paying any income to this employee. Then the formalities of Art. 231 of the Tax Code of the Russian Federation does not need to be observed.

In this case, the employer cannot be accused of either illegal failure to transfer personal income tax to the budget, or illegal deduction from an employee’s salary. After all, let us remind you that cases when the employer has the right to make deductions from wages are exhaustively listed in Art. 137 Labor Code of the Russian Federation. And by withholding personal income tax in a situation that is not directly provided for by the Tax Code of the Russian Federation, the employer violates this procedure, for which he may be held liable under clause 6 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Please note that in this case, the procedure for returning personal income tax established by Art. 231 of the Tax Code of the Russian Federation, does not apply. Before the end of the month for which the salary was accrued, the withheld amount cannot, in principle, be considered a tax, since the obligation to calculate personal income tax has not yet arisen. And since the amount of tax has not been calculated, then the tax cannot be withheld. Thus, before the date of actual receipt of income in the form of wages (until the last day of the month), the deduction made from the interim payment cannot be formally qualified as personal income tax. If you have time to return the withholding before the date of actual receipt of income in the form of salary (before the last day of the month), the employer does not need to notify the employee about the excess withholding, wait for his application and transfer the tax to the employee’s bank account.

Option two - transfer the tax to the budget

If for some reason the employee cannot return the “personal income tax from advance payment”, then this tax must be transferred to the budget no later than the working day following the day of deduction. Otherwise, the organization faces a fine of 20% of this amount under Art. 123 Tax Code of the Russian Federation.

The deadlines for transferring withheld personal income tax to the budget are established in clause 6 of Art. 226 Tax Code of the Russian Federation. In this case, the general period applies, since this article does not establish any exceptions for “early” personal income tax.

It will also not be possible to appeal to the fact that this amount is not taxable until the end of the month. Indeed, the withheld amount will acquire personal income tax status only when the last day of the month arrives. But on this date the deadline for transferring this amount to the budget will already be missed! After all, according to paragraphs 4 and 6 of Art. 226 of the Tax Code of the Russian Federation, is counted precisely from the date of payment of the money from which the tax was withheld. So if you do not transfer the withholding to the budget on the next working day and do not return this amount to the employee by the end of the month, then the organization may be fined.

Alexey Krainev, tax lawyer

The salary advance exceeded the amount of income accrued to the employee

According to the situation described, the wage advance exceeded the amount of income accrued to the employee.

In this case, given that the advance was paid in an amount greater than the employee’s actual time worked, the advance paid should be offset against wages at the end of the month. The date of actual receipt of income in the form of wages for tax purposes is defined as the last day of the month for which the taxpayer was accrued income (clause 2 of Article 223 of the Tax Code of the Russian Federation). Since the advance payment is offset against accrued wages at the end of the month, the date of receipt of the specified income is considered to be the last day of the month. In turn, the object of personal income tax is the income received by the taxpayer (Article 209 of the Tax Code of the Russian Federation). Thus, personal income tax must be calculated on the advance amount on the last day of the month. According to paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, the withheld personal income tax must be transferred to the budget no later than the date following the day of payment of income. In our case, this day is the last day of the month when the advance was counted towards wages.

Since the calculated amount of tax must be withheld directly from the employee’s income upon actual payment, during subsequent settlements with the employee, the calculated amount of personal income tax (clause 4 of Article 226 of the Tax Code of the Russian Federation) and the amount of the unearned advance issued on account of wages are withheld from his earnings ( Article 137 of the Labor Code of the Russian Federation).

Procedure and methods for calculating the advance payment

The Ministry of Labor of Russia, in letter No. 14-1/B-765 dated September 18, 2018, explains that the determination of specific terms for payment of wages, as well as its amount for half a month, “are related to legal (collective bargaining) regulation at the institution level.” The letter proposes that when calculating the advance payment, one should rely on Article 129 of the Labor Code of the Russian Federation, which determines the composition of wages. The Ministry of Labor warns that reducing the amount of the advance may be interpreted as discrimination in the world of work. However, at the same time, the letter does not recommend taking into account incentives, compensation and some other types of payments when calculating the advance in order to avoid overpayment.

Based on the explanations, we can draw the following conclusion: since the legislation does not contain restrictions on the amount of the advance, clear calculation conditions must be enshrined in local regulations. And in order to comply with the recommendations given in this and other letters of the Russian Ministry of Labor (for example, dated 02/05/2019 No. 14-1/OOG-549), the advance payment should not be reduced relative to the stated conditions.

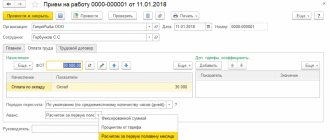

In the 1C: Salaries and Personnel Management 8 program, edition 3, an advance can be assigned to an employee in one of three ways (Fig. 2):

- Fixed amount;

- Percentage of the tariff;

- Calculated for the first half of the month.

Rice. 2. Selecting the method for calculating the “Advance”

The method for calculating the advance payment is established and changed in personnel documents Hiring, Personnel transfer, Personnel transfer list, Transfer to another employer, Reinstatement, etc. and in documents changing employee pay: Change in wages, Change in terms of payment for parental leave child, etc.

Assignment of advance payment “Fixed amount”

The Fixed Amount method may be justified for organizations with a small number of employees and with a constant salary. It is essentially an approximate manual pre-calculation of half a month's salary for each employee. This method does not require additional calculations in the program. The advance is formed in the payroll and is paid exactly in the specified amount.

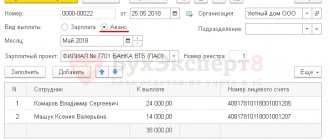

Assignment of advance payment as “Percentage of tariff”

The Percentage of Tariff method historically assumes a value of 40%. This percentage is set in the program by default and represents the average half of the employee’s monthly rate minus 13% (personal income tax, which is subsequently assumed to be withheld). You can set any reasonable calculation percentage. The advance is calculated as a percentage of the employee’s entire payroll fund, i.e. all the employee’s planned accruals that make up the payroll are taken into account. The method allows setting the calculation base for calculating the percentage only simultaneously with a change in the composition of the payroll. The inclusion of accruals in the payroll is set when setting up the Accruals type (see Fig. 3) with the Include in payroll flag. When choosing this option, the specific advance amount is calculated when filling out the payroll.

Rice. 3. Setting up the accrual type

Tax liability

The duties of a tax agent for personal income tax imply that he must calculate, withhold from the taxpayer and pay the amount of tax to the budget (clause 1, clause 3, article 24, clause 1, article 226 of the Tax Code).

Failure of a tax agent to fulfill the duties assigned to him entails liability under Art. 123 of the Tax Code of the Russian Federation. This provision establishes penalties for unlawful non-withholding and (or) non-transfer (incomplete withholding and (or) transfer) of tax amounts within the prescribed period.

However, it is obvious that non-calculation of personal income tax entails its non-withholding and, as a consequence, non-payment. The amount of sanctions in this case is 20 percent of the amount of tax subject to withholding and (or) transfer. In addition to penalties for paying taxes later than required by law, the organization will have to pay penalties for each day of delay.

Advance payment for work and services

When determining the tax base for personal income tax, all income received by a person, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account (clause 1 of Article 210 of the Tax Code of the Russian Federation).

The date of actual receipt of income will be the day of its payment, including transfer to a bank account (clause 1 of Article 223 of the Tax Code of the Russian Federation).

Based on this, many withhold personal income tax from advances paid to contractors. In our opinion, this should not be done for two reasons.

Under a contract, a person undertakes to perform certain work according to the customer’s instructions and hand over the result. The customer, in turn, must accept the result of this work and pay for it (Clause 1, Article 702 of the Civil Code of the Russian Federation). The parties may provide in the contract for the payment of an advance for work that has not yet been done (Article 711 of the Civil Code of the Russian Federation). The same rules apply to a contract for the provision of paid services (Article 783 of the Civil Code of the Russian Federation).

The employer, when paying income to employees, becomes their tax agent and is obliged to calculate, withhold and transfer to the budget personal income tax on the income received from it (Article 226 of the Tax Code of the Russian Federation).

The definition of income is given in Article 41 of the Tax Code - it is an economic benefit in monetary or in-kind form, which is taken into account if it can be assessed and is determined in accordance with Chapter 23 of the Tax Code “Income Tax for Individuals”.

It is impossible to reliably estimate the economic benefit of receiving an advance, because its amount may decrease. This can happen, for example, if the customer does not like the result. Work of poor quality may result in a reduction in the contract price. Then part of the advance received will have to be returned (clause 1 of Article 723 of the Civil Code of the Russian Federation).

Thus, it is impossible to assess a person’s economic benefit from receiving an advance under a civil law agreement. This is the first reason not to pay personal income tax before signing the acceptance certificate for the work performed.

The second reason is that the advance payment given to the contractor (even if the amount does not change) will become his income only when the customer accepts the result of the work.

An advance paid under a civil contract cannot be considered a person’s income. After all, the result of the work for which remuneration is provided does not yet exist, the service has not yet been provided. And according to the Tax Code, income from sources in the Russian Federation, among other things, can include remuneration for work already performed or services provided (subclause 6, clause 1, article 208 of the Tax Code of the Russian Federation).

Based on this, the advance paid to the contractor will become his income only when the work or service is fully completed and accepted by the customer (confirmed by the act). Only after this can payments under a civil contract be included in the personal income tax base.

Thus, when paying an advance under a civil law agreement, there is no need to calculate and withhold personal income tax. The advance is not considered the contractor's income until the result of his work (service) is accepted by the customer.

We emphasize that tax inspectors may not support this point of view, and then it will have to be proven in court.

Judicial practice on this issue is contradictory. Thus, the FAS Moscow District ruled that the receipt of funds as a prepayment or advance payment before the fulfillment of obligations under the contract does not entail the emergence of a personal income tax item (Resolution of the FAS Moscow District dated December 23, 2009 No. KA-A40/13467-09 in case No. A40 -66058/09-140-443).

In contrast to this, the resolution of the Federal Antimonopoly Service of the West Siberian District. The judges emphasized that the company is obliged to withhold and transfer to the budget personal income tax from an advance to an individual, since the date of actual receipt of income is the day of its payment (resolution of October 16, 2009 in case No. A03-14059/2008).