Experts from TaxCoach have prepared a fresh analytical summary.

Often, to ensure the property security of a business and the efficient use of property in a Group of Companies, redistribution of assets is required. The economic meaning of the transfer of property in a holding structure is objectively different from the sale or other form of its transfer to third parties, because in essence we are transferring assets from one “our pocket” to another. Accordingly, the taxation of these transactions has its own characteristics: tax legislation provides for tax-free transfer of assets within holding structures.

The practice of applying these norms is almost established. Less and less often, tax authorities charge income tax, calling the transfer of property within a Group of companies a gift prohibited between legal entities. However, there are some fundamental nuances that affect the success of the entire procedure for transferring assets, including taking into account changes made to the Tax Code of the Russian Federation.

Let us remind you that tax-free transfer of assets between related companies can be different and includes, for example, such methods as contribution to the authorized capital, reorganization in the form of spin-off, etc.

Today we will focus on one of these methods - contributions to property without increasing the authorized capital of the organization , when a participant (shareholder) transfers certain benefits to his company (cash, shares (shares) in other legal entities, real estate, etc.) for improvement its financial and/or property status. At the same time, the authorized capital does not increase, and the nominal size of the participants’ shares does not change.

The civil law grounds for contributions to property are Article 66.1 of the Civil Code of the Russian Federation, Art. 27 of the Law “On LLC”, art. 32.2 of the Law “On JSC”.

If the charter of the receiving party is standard and does not contain detailed norms, then contribution to the property is possible only in money and only in proportion to all participants (shareholders). In an LLC, the decision on a contribution to property is made by no less than 2/3 of the votes. In a joint stock company, making a contribution is possible on the basis of an agreement approved by the Board of Directors, or by decision of the general meeting of shareholders.

At the same time, the Tax Code provides for two preferential mechanisms that make it possible to exempt inherently gratuitous deposits from taxation:

1. Gratuitous transfer of property on the basis of subclause 11, clause 1, article 251 of the Tax Code of the Russian Federation.

It itself is possible in two forms:

- transfer of property from the “mother” or an individual participant (shareholder) in favor of an organization whose authorized capital consists of more than 50% of the contribution of the transferring party;

- "daughter's gift" This is a transfer from a subsidiary to the parent company, which owns more than 50% of the authorized capital of the subsidiary.

2. Contribution to the property of a business company or partnership from its participant or shareholder (clause 3.7, clause 1, article 251 of the Tax Code).

In other words, the Tax Code differentiated these grounds, including by the time of their appearance in the law, giving them some specific application features.

Gratuitous transfer of property under clause 11, clause 1 of Art. 251 Tax Code of the Russian Federation

Firstly, only property can be transferred . Money refers to property.

That is, this rule does not apply to property and non-property rights (assignment of claims, corporate rights, intellectual property rights, etc.). Violation of these conditions will result in additional amounts of income tax, penalties and fines.

Exemption from taxation in accordance with paragraphs. 11 clause 1 art. 251 of the Tax Code also applies to debt forgiveness.

Secondly, it is impossible to transfer it to third parties within one year from the date of receipt of property (except for cash).

In other words, significant restrictions are imposed on the use of property: it cannot be sold, leased or otherwise disposed of. The logic of the legislator is clear - some kind of assistance from a participant in his company is exempt from taxation, because he transferred the property for her own use, and not for renting out, for example.

As a result, the transfer of assets on the basis of clauses. 11 clause 1 art. 251 Tax Code in certain situations seems impossible. However, these restrictions do not apply to deposits in accordance with subparagraph. 3.7 clause 1 art. 251 NK.

Contribution to property under clause. 3.7. clause 1 art. 251 Tax Code of the Russian Federation.

Subp. 3.7. clause 1 art. 251 of the Tax Code allows the investments of participants, both in the form of property and in the form of property or non-property rights, to be exempt from taxation. In this case, the size of the participant’s share does not matter.

The provisions of this paragraph apply to virtually any method of increasing property, including increasing the assets of the company in the form of transfer of things, cash, shares/shares in companies or securities, or, for example, rights of claim under an assignment agreement.

! Sub-clause 3.7, clause 1 of Article 251 is new and appeared in the Tax Code only in 2022. It replaced the famous sub-clause 3.4, which was popularly called “contribution to increase net assets”. Sub-clause 3.7 has a more concise content, referring to civil legislation - you can convey everything that is permitted by the Civil Code of the Russian Federation and special laws.

However, this method of tax-free transfer also has its limitations:

- Property, property or non-property rights can only be transferred from a participant (shareholder) to the relevant business company. That is, transfer in the opposite direction - from the subsidiary to the parent company - is impossible.

- Contributions to property are only possible in relation to business entities or partnerships . For example, such a contribution cannot be made to a production cooperative without tax consequences.

Contributions to the property of a JSC or LLC: tax consequences

17.01.2021

It is necessary to clearly distinguish between the concepts of “contribution to the property of the company” and “contribution to the authorized capital of the company”, since contributions to the authorized capital of the company increase the nominal value of the shares of its participants, and contributions to the property of the company do not affect the size and nominal of their shares in the authorized capital.

Let's consider what tax consequences arise when contributions to the company's property are made by its founders (participants).

Legal regulation

The procedure for making a contribution to the property of a business partnership or company is regulated by the provisions of Art. 66.1 Civil Code of the Russian Federation

(see

Letter of the Ministry of Finance of Russia dated November 16, 2018 No. 03-03-06/1/82676

).

In accordance with paragraph 1 of Art. 66.1 Civil Code of the Russian Federation

The contribution of a participant in a business partnership or company to its property may be:

- cash; - things; – shares (shares) in the authorized (share) capital of other business partnerships and companies; – state and municipal bonds; – exclusive and other intellectual rights and rights under license agreements subject to monetary valuation, unless otherwise provided by law.

According to paragraph 1 of Art. 32.2 of the Law on JSC

(

Federal Law of December 26, 1995 No. 208-FZ “On Joint-Stock Companies”

) shareholders, on the basis of an agreement with the company, have the right, in order to finance and maintain the activities of the company, at any time to make gratuitous contributions to the company’s property in cash or other form, which do not increase the authorized capital of the company and do not change the par value of the shares.

The property contributed by shareholders must be of the types specified in clause 1 of Art.

66.1 Civil Code of the Russian Federation .

As for LLCs, the procedure for making a contribution to the property of the company is determined by Art. 27 of the LLC Law

:

– participants of the company are obliged, by decision of the general meeting of its participants, to make contributions to the property of the company, if this is provided for by its charter ( clause 1

);

– contributions to the company’s property are made by all participants in proportion to their shares in the authorized capital (unless a different procedure for determining the size of contributions is determined by the company’s charter) ( clause 2

);

– contributions to the company’s property are made in money, unless otherwise provided by the company’s charter or a decision of the general meeting of the company’s participants ( clause 3

);

– contributions to the property of the company do not change the size and nominal value of the participants’ shares in the authorized capital of the company, that is, the contributions made become the property of the company and are not subject to return ( clause 4

).

Income received in the form of a contribution to property. What about income tax?

When determining the tax base, income in the form of property, property or non-property rights in the amount of their monetary value, which is received as a contribution to the property of a business company or partnership in the manner established by the civil legislation of the Russian Federation ( clause 3.7, clause 1, article 251 of the Tax Code) is not RF

).

For your information:

This rule does not require exemption from income tax, firstly, from the presence of such a purpose of the contribution as increasing the net assets of the company, and secondly, restrictions on the minimum share of the shareholder in the authorized capital of the company. The main condition for tax exemption is compliance with the procedure established by the civil legislation of the Russian Federation.

Thus, when determining the income tax base for LLCs and JSCs, income in the form of property and rights received as a contribution to the company’s property in accordance with Art. 27 of the LLC Law

,

art.

32.2 of the Law on JSC and

Art.

66.1 of the Civil Code of the Russian Federation (see, for example,

letters of the Ministry of Finance of Russia dated November 26, 2020 No. 03-03-06/1/103198

,

dated November 28, 2018 No. 03-03-06/1/86007

,

dated November 23, 2018 No. 03-03 -06/1/84929

).

Contribution to property through forgiveness of the company's debt by a participant

Today, the question is relevant: is it legal for a company not to impose income tax on a contribution in the form of forgiveness of debt by the founders (participants), which the company previously incurred to them?

For example, the founder issued a loan to the company, and then an agreement was drawn up under which the founder forgives the debt in connection with making a contribution to the company’s property that does not increase the authorized capital.

Or another example - the founder, by way of assignment, received the right of claim against the company (under a loan or supply agreement) and intends to forgive the debt.

Can society in these situations apply paragraphs. 3.7 clause 1 art. 251 Tax Code of the Russian Federation

, considering debt forgiveness as a contribution to the company’s property, given that the founder did not actually transfer funds to the organization?

When answering such a question, the regulatory authorities do not give a specific answer, but only list the above-mentioned norms of the Tax Code and the Civil Code of the Russian Federation (see letters of the Ministry of Finance of Russia dated April 13, 2018 No. 03-03-06/1/24606

and

the Federal Tax Service of Russia dated March 13, 2019 No. SD-3-3/

[email protected] ).

As for arbitration practice, due to the “youth” of the rules of paragraphs. 3.7 clause 1 art. 251 Tax Code of the Russian Federation

(valid from 01/01/2018) we were able to find only one court decision -

Resolution of the Supreme Court of the Russian Federation dated 07/07/2020 No. F08-4773/2020 in case No. A63-16832/2019

.

The essence of the matter was as follows.

A company participant (with a 50% participation share) provided funds to the LLC under interest-free loan agreements.

Subsequently, the LLC and the company participant, in accordance with Art. 415 Civil Code of the Russian Federation

, entered into agreements to forgive debt in connection with making a contribution to the company’s property that does not increase the authorized capital by the amount of the loan.

The tax inspectorate included the amount of the forgiven debt in the calculation of the taxable base for income tax, recalculated the amount of tax, and assessed fines and penalties.

The tax judges supported, rejecting the company's argument that funds received under loan agreements are a contribution to the company's property, and therefore are not taken into account as income when determining the taxable base.

Note:

The judges proceeded from the fact that the company, in support of its arguments, did not present a decision of the general meeting of company participants on making contributions to the company’s property. The LLC did not have a document providing the basis for classifying the funds received by the company from the founder through debt forgiveness as a contribution to the organization’s property.

The courts have found that the obligation to make contributions to the property of a company arises provided that it is provided for in its charter and a decision is made by the general meeting of participants to make such contributions.

In this case, the LLC had two participants with shares of 50% each, and only one participant made a contribution to the property. The company's charter does not provide for provisions establishing the procedure for determining the amount of contributions to the company's property disproportionate to the size of the shares of the company's participants, as well as provisions establishing restrictions related to making contributions to the company's property. The company did not provide evidence of relevant changes being made to the charter.

The judges also took into account that, in accordance with the provisions of the LLC Law

a company participant does not have the opportunity to individually contribute funds to the company’s property, since contributions to the company’s property must be made by all company participants in proportion to their shares in the authorized capital.

Let us note that the courts also indicated that there were no grounds for not including in the income part of the taxable base funds received by the company under another norm - paragraphs. 11 clause 1 art. 251 Tax Code of the Russian Federation

, since the share of the participant who has forgiven the debt in the authorized capital of the company is exactly 50% (and until 2022, this provision provided for tax exemption for income received from the founder with a share of more than 50%).

So, what conclusion can be drawn from this ruling? The judges did not say that debt forgiveness cannot be considered a contribution to the community's property. The organization lost because it did not properly formalize the very possibility of one of the participants making a contribution to the management company.

Of course, on the basis of one court decision it is impossible to talk about any trend, however, we believe that correctly executed documents will significantly reduce tax risks and the taxpayer will be able to bring debt forgiveness by a participant under paragraphs . 3.7 clause 1 art. 251 Tax Code of the Russian Federation

.

Contribution to property in the form of subsidies received by the JSC from the budget

In practice, situations similar to the one described in the Letter of the Ministry of Finance of Russia dated October 27, 2020 No. 03-03-06/1/93381

.

100% of the shares of the joint-stock company are owned by the Russian Federation, which contributes to the property of the joint-stock company by providing a subsidy to compensate for lost income. In this case, is the amount of the provided subsidy included in the tax base for income tax?

Clause 1 of Art. 32.2 of the Law on JSC

provides for the right of shareholders to finance and support the activities of the company by making gratuitous contributions to the company’s property in cash or other forms, which do not increase the authorized capital of the company and do not change the par value of the shares (hereinafter referred to as the contribution to the company’s property).

In addition, paragraph 1

and

4.2 Art.

78 of the Budget Code of the Russian Federation provides for the provision of subsidies to legal entities - producers of goods, works, services on a free and irrevocable basis in order to compensate for lost income and (or) financial support (reimbursement) of costs in connection with the production (sale) of goods, performance of work, provision of services.

These subsidies may be provided in the form of contributions to the property of such legal entities that do not increase their authorized capital, in accordance with the legislation of the Russian Federation.

For the purposes of calculating corporate income tax, funds in the form of subsidies, with the exception of those specified in Art. 251 Tax Code of the Russian Federation

or received within the framework of a compensation agreement, are recognized as part of non-operating income in the manner established by

clause 4.1 of Art.

271 Tax Code of the Russian Federation .

At the same time, based on paragraphs. 3.7 clause 1 art. 251 Tax Code of the Russian Federation

When determining the tax base, income in the form of property, property or non-property rights in the amount of their monetary value, which is received as a contribution to the property of a business company or partnership in the manner established by the civil legislation of the Russian Federation, is not taken into account.

Thus, the Ministry of Finance believes, income in the form of subsidies received by the joint-stock company as a contribution to the property of the joint-stock company in accordance with Art. 66.1 Civil Code of the Russian Federation

and

Art.

32.2 of the JSC Law are not taken into account when determining the income tax base.

Reverse operation

From 01.01.2019 clause 1 art. 251 Tax Code of the Russian Federation

paragraph

was added 11.1 , according to which, when determining the tax base, income in the form of

funds

received by an organization free of charge from a business company or partnership of which such an organization is a shareholder (participant) is not taken into account, within the amount of its contribution (contributions) to property in the form of

funds

, previously received by a business company or partnership from such an organization.

Note:

the specified business company or partnership and organization (their legal successors) are obliged to keep documents confirming the amount of relevant contributions to the property and the amount of funds received free of charge.

An operation, the income from which is not taken into account for profit tax purposes on the basis of paragraphs. 11.1 clause 1 art. 251 Tax Code of the Russian Federation

, is the reverse of the operation of receiving funds as a contribution to the property of a business company or partnership in the manner established by the civil legislation of the Russian Federation, income from which is not taken into account for profit tax purposes by virtue of

paragraphs.

3.7 of this paragraph.

Moreover, for the purpose of applying paragraphs. 11.1 clause 1 art. 251 Tax Code of the Russian Federation

it does not matter when the contribution to the property of a business company or partnership was made (before or after 01/01/2018) (

Letter of the Ministry of Finance of Russia dated 02/14/2019 No. 03-03-06/1/9345

).

Taking into account the above, income in the form of funds received by an organization free of charge from a company of which such an organization is a participant is not subject to withholding tax, within the amount of its contribution to the property of this company in the form of funds previously received by the company from such an organization in accordance from Art. 66.1 Civil Code of the Russian Federation

.

Note:

according to

clause 2.3 of Art.

309 of the Tax Code of the Russian Federation , income specified in

paragraphs.

11.1 clause 1 art. 251 of the Tax Code of the Russian Federation , payments are not subject to taxation at source.

That is, this rule applies in a situation where a Russian organization returns to a foreign participant funds previously received from it within the amount of the contribution to the property. There is no taxable income for a Russian organization (as a source of payment) (see Letter of the Ministry of Finance of Russia dated October 3, 2019 No. 03-08-05/75878

).

Strizh K. S., expert of the information and reference system "Ayudar Info"

Send to a friend

"Daughter's Gift"

The Tax Code allows tax-free transfer of property not only from the “mother”, but also in the opposite direction - from the “daughter” to. The exemption is provided under sub-clause 11, clause 1 of Article 251 of the Tax Code, subject to compliance with an important condition - the parent company’s share in the authorized capital of the subsidiary is more than 50%.

Important!

It will not be possible to transfer a “child gift” to an individual participant without taxes. Such payment will be equivalent to dividends.

At some point, the tax authorities had problems with “daughter gifts”: they persistently assessed income tax when transferring property to parent organizations, citing the fact that donations between legal entities are prohibited.

The Presidium of the Supreme Arbitration Court of the Russian Federation put an end to this matter, indicating in its Resolution:

“Economic relations between the main and subsidiary companies may involve not only investments of the main company in the property of the subsidiary at the stage of its establishment, but also at any stage of its activity. In addition, economic feasibility in relations between a subsidiary and the main company may necessitate the reverse transfer of property. At the same time, the absence of direct reciprocity is a feature of the relationship between the main and subsidiary companies, which from an economic point of view are a single economic entity.” Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 4, 2012 No. 8989/12.

After this, the Ministry of Finance of the Russian Federation supports the possibility of a “daughter gift” not subject to income tax.

A “subsidiary gift” in some cases is an alternative to paying dividends when the conditions for a tax-free transfer of profit from a subsidiary to the parent organization are not met, in particular:

- the holding period of 365 days has not been met;

- In addition to the majority participant with a share of more than 50%, there are minority shareholders in whose favor you do not want to “distribute profits”: dividends are distributed in most cases proportionally, and such a requirement is not imposed on a “child gift”.

What methods of transferring property are best used in different situations?

We will show in the table possible options for transferring property, depending on the relationship between the parties to the transaction.

| Transfer options/parties to the transaction | Sale | Contribution to the management company | Contribution to property | Free transfer | Selection |

| From founder to subsidiary | + — | + + | + — | + — | + + |

| From subsidiary to founder | + — | — — | — — | + — | — — |

| Between companies with a common owner | + + | — — | — — | — — | — — |

«+ +» - acceptable from a legal point of view and beneficial in terms of taxes

«+ —"- acceptable from a legal point of view, but unfavorable from a tax point of view

«— —» – unacceptable from a legal point of view

A businessman will have the most options if he transfers property from the founder to a subsidiary company. In this situation, the most profitable would be a contribution to the authorized capital or allocation.

If the object is transferred in the opposite direction - from the subsidiary to the parent company, then the only choice left is between sale and gratuitous transfer. The advantages of one method or another will depend on tax regimes and the ability to justify a low price.

In the case when both companies work for OSNO and the property is sold at its residual value, there will be no need to pay income tax and VAT for the group as a whole. Then buying and selling property will be more profitable.

And if the market price of a fixed asset significantly exceeds the residual value, or the receiving company operates on a special regime and cannot refund VAT, then it is better to use a gratuitous transfer.

If you need to transfer property between two companies that are connected only by a common owner, then there is only one option left - a standard purchase and sale agreement.

About debt forgiveness

As we have already mentioned, sub. 3.7. clause 1 art. 251 of the Tax Code of the Russian Federation replaced subclause 3.4, which directly provided for the possibility of contributing to property by forgiving a debt by a participant in his organization.

Currently there is no such clarification, although the possibility is still relevant.

Let's figure out whether it is now possible to forgive debt without taxes.

When the share of participation is more than 50%, then we can confidently refer to the clause already known to us. 11 clause 1 art. 251 Tax Code of the Russian Federation.

If the share of participation in a subsidiary is less than 50%, then we can only be guided by the new subclause 3.7, clause 1, article 251 of the Tax Code of the Russian Federation.

Neither the Ministry of Finance of the Russian Federation nor the courts have yet voiced their position.

We believe that you can get out of the situation in this way:

At the first stage, the participant (shareholder) or the general meeting, as before, decides to make a contribution to the property. But not in the form of debt forgiveness, but by transferring funds, the amount of which is exactly equal to the debt formed to him (for example, the amount of an unrepaid loan).

Makes a decision, but does not implement it.

At the second stage, the participant (shareholder) - creditor signs an agreement with the subsidiary to offset counterclaims (in our example with a loan - obligations to repay the loan and make a cash contribution).

As a result, the subsidiary's obligation to the participant is extinguished tax-free.

To be on the safe side, in the charter of a subsidiary company, as well as when applying subclause 3.4, which has become invalid, it is advisable to include a provision on the possibility of making contributions to property not only in money.

Contribution to the authorized capital and contribution to property

These two methods are only suitable when transferring property from a parent company to a subsidiary. From the point of view of registration, a contribution to property is simpler. In general, if the possibility of making contributions was initially stated in the Charter, there is no need to change the constituent documents for this. However, to save on taxes, it will be more profitable to replenish the authorized capital (AC).

- Income tax and simplified tax system

Income from income tax and the simplified tax system does not arise for both options for depositing fixed assets (clauses 3 and 3.7, clause 1, article 251 and clause 1.1, article 346.15 of the Tax Code of the Russian Federation).

If a fixed asset is contributed to the authorized capital , then its initial value from the subsidiary is taken equal to the residual value from the founder at the time of transfer (clause 2, clause 1, article 277 of the Tax Code of the Russian Federation).

And when making a contribution to property, the receiving party, according to tax authorities, cannot depreciate the received object for tax accounting. Officials believe that the initial cost in this situation should be taken equal to zero, or only the recipient’s costs for delivery and installation, if any, should be included in it (letter of the Ministry of Finance of the Russian Federation dated May 14, 2018 No. 03-03-06/1/31986).

- VAT

When making a contribution to the authorized capital, VAT is not required, because transfer of property for investment purposes is subject to a benefit ( subclause 1, clause 2, article 146 and subclause 4, clause 3, article 39 of the Tax Code of the Russian Federation). But the founder who works for OSNO is obliged to restore the tax in proportion to the residual value of the transferred object (clause 3 of Article 170 of the Tax Code of the Russian Federation). If a subsidiary also works with VAT, then it can take this amount as a deduction (clause 11 of Article 171 of the Tax Code of the Russian Federation). Then no additional costs will arise within the holding. But if the recipient works in a special regime, then the VAT will be “lost”. In this case, the higher the wear and tear of the transferred object, the more profitable the deal will be.

When investing in property, the situation with VAT is more complicated. Officials believe that property investments that are exempt from VAT are only contributions to the management company. If the authorized capital does not change, then there should be no VAT benefit (letter of the Ministry of Finance of the Russian Federation dated July 15, 2013 No. 03-07-14/27452). And the recipient of the fixed asset cannot deduct VAT, since the transaction was free of charge.

The position of the tax authorities can be challenged. After all, any investment of property in a subsidiary company is clearly of an investment nature, even if the charter capital does not change. But in this case, the businessman needs to be prepared for litigation. There are prospects for a positive outcome of the case (Resolution of the Federal Antimonopoly Service of the Eastern Military District dated December 3, 2012 No. A29-10167/2011).

A spoon of tar. VAT

But what will happen if a participant, for example a company on a special operating system, transfers not money, but property as a contribution? Is this transaction subject to VAT? Yes and no. In the sense that the transfer of property itself is not subject to VAT, but the transferring party (if it is on the general taxation system) must restore VAT on the residual value of the property. In this case, the restored value added tax can be included in expenses.

But the receiving party will not be able to deduct VAT, since it did not pay money for this property, because a contribution to property is a type of gratuitous transfer. So you can’t do without a fly in the ointment...

How to return a deposit to property

A contribution to property is irrevocable: unlike a loan, it cannot be demanded back.

Some kind of return on investments made is only possible in the form of dividends. The same as for investments in the form of a contribution to the authorized capital.

However, unlike contributions to the authorized capital, the amount of contributions made to property will not count towards the costs of acquiring a share (shares) upon subsequent sale of the share (shares), exit or liquidation of the company.

This injustice will probably soon be eliminated. The State Duma is considering a bill according to which the receipt by the parent organization from the subsidiary of funds within the limits of the previously made contribution to the property will not be subject to income tax.

If the bill is passed, there will be a tax-free way to “return” deposits, along with dividends, which in some cases are taxed at a rate of 13%.

Contribute to company assets

The sole founder of the LLC (hereinafter referred to as the owner) has the right to contribute money, equipment, goods, raw materials and other property to the organization. Before choosing this method, make sure that the founder's obligation to contribute is provided for in the LLC charter. It can be written like this:

- Participants of the Society are obliged to make contributions to the property of the Society by decision of the general meeting of participants of the Society, adopted by at least ⅔ votes of the total number of participants.

- Participants make contributions to the Company's property in proportion to their shares in the authorized capital of the Company.

The information in the Unified State Register of Legal Entities does not change: this is how a contribution to property differs from an increase in the authorized capital (Clause 4, Article 27 of the Federal Law of 02/08/1998 No. 14-FZ).

Take a course in financial analysis to establish management accounting in your company and work without cash gaps

To formalize a contribution to the property, the owner issues a decision in writing and has it certified by a notary (clause 3 of the Review of Judicial Practice, approved by the Presidium of the Supreme Court of the Russian Federation on December 25, 2019).

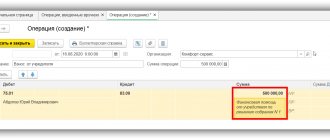

The cash contribution to the property is reflected by the posting:

| Dt 51 (50) | Kt 83 |

| Current accounts (cash) | Extra capital |

The company does not pay taxes on the contribution made under any taxation system. There are two disadvantages:

- To register the deposit, you must involve a notary;

- the owner will not be able to demand the company to return this money.

"Underwater rocks"

Any tax-free transactions traditionally attract the attention of regulatory authorities. Investing in property is no exception.

Tax authorities may attempt to deem a transfer of property and/or property/non-property rights between “related” entities to be economically unjustified if a reasonable “business purpose” is difficult to discern.

For example, a new member makes a generous contribution and immediately leaves the company. The tax authority will most likely say that the lender “investor” did not intend to participate in the company’s activities and receive profit from this activity, and his only goal in entering the business was the tax-free transfer of expensive property or funds.

Example taxCOACH®

Let's look at how this tool can work successfully using the example of a case study by experts from the taxCOACH Center for the retail sector. Let's imagine a business that is conducted within a Group of companies. Retail stores are independent legal entities (and the area of each store allows the use of UTII).

However, what about the profit of each operating point? You can use the investment in property that we already know! Retail companies establish a legal entity (let's designate it as an investment center) and make agreed funds received from the sale of products as contributions to property. There is no need to pay income tax, and the investment center can freely manage the participants’ money, for example, by investing it in new areas of activity.