The increase in property taxes in recent years has hit socially vulnerable segments of the population the hardest: pensioners, disabled people, and people with many children. That is why the tax benefits that the state provides to such categories of citizens are very relevant. In this article we will look at what tax breaks families raising three or more children can count on.

If you have any questions about calculating and paying taxes, it is best to contact a tax law specialist for advice.

Do you want to figure it out, but don’t have time to read the article? Lawyers will help

Entrust the task to professionals. Lawyers will complete the order at the cost you specify

63 lawyers on RTIGER.com can help with this issue

Solve the issue >

Which families are considered large

To find out what tax benefits are available to parents with children, you need to figure out which family in Russia is considered to have many children. This issue is delegated by legislation to the regions. Therefore, a family with three children may or may not be assigned the status of a large family in different places of the Russian Federation. The fact is that in a number of regions only parents who have given birth or adopted a fifth child are considered to have many children.

The same applies to tax benefits. The law provides only a general list of tax benefits for parents with three or more children. These include transport tax, property tax and land tax. In what cases and in what amount a tax benefit will be provided is decided by the local municipality. The only tax that is exempt for families with many children throughout the country is personal income tax.

In most cases, a family with three or more children under the age of 18 is considered large. This applies not only to biological parents, but also to adoptive parents and guardians. In some cases, tax breaks are extended if a child under the age of 24 is a full-time student at a higher educational institution.

Anastasia Rakova spoke about supporting large families in Moscow

Moscow Mayor Sergei Sobyanin has simplified the procedure for assigning the status of a large family. What other social support do large families receive, said Deputy Mayor of Moscow for Social Development Anastasia Rakova.

“Today, about 1.5 million families live in the capital, 11% of which are large families. More than 410 thousand children are raised there. The city provides comprehensive assistance to such families. Along with various types of social assistance, there is a whole range of support in all areas: education, medicine, social support, transport, communications, and from November 10, the procedure for assigning and extending the status of a large family has also been significantly simplified. Now this can be done on the mos.ru portal,” commented the vice mayor.

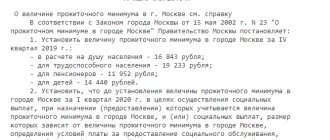

Large families in Moscow receive a monthly compensation payment for utility bills depending on the number of children in the family. Also, large families have a 30% discount on housing and communal services, and a 50% discount on major repairs. In addition, families are provided with dairy products for children under seven years of age and free medicines until they reach adulthood. Travel for children and one parent on public transport is also free. You can also ride commuter trains for free. In Moscow, approximately 40 thousand large families use personal cars. Parking for them is free. Muscovites with many children can count on exemption from transport tax and a significant discount on property tax.

It is important to note that mothers of three children have the right to retire at 57 years old, and mothers of four children - at 56 years old. Mothers of five children retire at 50. Those families who are just planning to give birth to a third child or subsequent children can receive significant benefits on mortgage interest, as well as 450 thousand rubles in mortgage payments.

From January 1, 2022 in Moscow, all payments to families with children have been increased by 5.6%. In addition, for low-income families, according to the Decree of the President of Russia, the monthly benefit for a child aged three to seven years inclusive is set at 50% of the child’s subsistence level. In Moscow, this amount is 7,613 rubles. Low-income families raising a child under three years of age are paid 10,560 rubles per month. The amount of benefit for children aged 7 to 18 years is 4,224 rubles.

“Large families have priority rights to a child’s place in kindergarten. At school, children are entitled to two free meals a day. In addition, once a year, the city allocates 10,560 rubles for uniforms for each schoolchild from a large family. It is enough to issue this payment once before the child enters school, and every year in May these funds will come automatically,” added Anastasia Rakova .

To support families in difficult life situations in Moscow, there are 29 family and childhood support organizations: 26 “My Family Centers”, as well as a crisis center for helping women and children, social rehabilitation centers for minors “Vozrozhdenie” and “Altufyevo”. The main directions of their activities are organizing social support for families with children, providing assistance if necessary and helping to overcome difficult life situations.

An important role is played by the organization “Association of Large Families of the City of Moscow,” which currently includes more than 40 thousand families. The association’s employees help you get legal advice and find out about the required payments and benefits. The association informs large families about the assistance they are entitled to or about changes in legislation that may affect the life of the family. Coordinators and curators provide more than 40 thousand consultations per year. Lawyers provide consultations on a wide range of issues completely free of charge and, if necessary, represent the interests of families in court.

Also, large families can receive a series within the framework of the “Large Family” life situation in any. In one visit to the office, you can submit applications for property tax benefits, recording a parking permit for a large family, a state certificate for maternity (family) capital, social support for paying for housing, utilities and communication services, a Muscovite card, and a monthly compensation payment to compensate for the increase in food costs for certain categories of citizens for children under three years of age.

Tax deduction

The tax deduction is provided to all parents, adoptive parents and guardians who have children under the age of 18. And also for those whose child is studying full-time at a university and has not reached the age of 24.

Its size is fixed:

- for the first and second child - 1400 rubles;

- for the third and subsequent children - 3000 rubles.

If parents are raising a disabled child, he is entitled to a deduction in the amount of 12,000 rubles. For guardians and adoptive parents, this amount is two times lower - 6,000 rubles.

Personal income tax benefits are provided at the place of work of the parents. You can only get it if the employee works officially. If only one of the parents works, he can apply for a double deduction. To do this, you must confirm that your spouse does not receive it. The same goes for a parent raising children alone.

If a tax deduction for a particular year was not provided, the employer is obliged to recalculate. However, this benefit can be applied for no more than three years before the date of application. There are limitations when calculating tax deductions. The income on which it is deducted is limited to a certain amount per year.

Documents for tax benefits for large families - mandatory list

In most regions, families with three or more minor children are entitled to a transport tax benefit. It is given for one car, and, as a rule, depends on its technical parameters - the laws indicate the maximum engine power at which you can count on preference. But there are exceptions, for example, in the capital the maximum power of a “preferential” car has not been established (Moscow Law No. 33 of 07/09/2008, Art. 4).

Municipalities, as well as cities of federal significance - Moscow, Sevastopol, St. Petersburg - have the right to provide local tax benefits to families with many children. These include tax on land and property of individuals.

However, tax benefits are not given automatically; the right to them must be declared. Thanks to the amendments made to the second part of the Tax Code by Law No. 286-FZ, the main document that a large family is required to submit to the inspector is an application for the provision of the benefits due to it (clause 3 of Article 361.1, clause 10 of Article 396, clause 6 of Art. 407 Tax Code of the Russian Federation). Its form and rules for filling out were approved by Order of the Federal Tax Service No. ММВ-7-21/897 dated November 14, 2017.

The applicant must also verify his identity by presenting a civil passport or other equivalent document.

A taxpayer with many children has the “right” to present a package of documents confirming the right to the privilege, but is not obliged. If the applicant does not have them, tax authorities, based on the information specified in the application, themselves request information from the relevant government agencies and officials. In this case, the period for consideration of the application may be extended, but not more than by 30 days.

In the event that an applicant with many children has not independently presented supporting documents, he will have to sign a consent to the processing/distribution of personal data requested by various authorities.

Tax benefits on land plots

In the general procedure for land tax, according to the Tax Code, parents with three or more children can count on a deduction for the cost of 600 square meters. meters from the cadastral value of the plot. This rate may vary by region. For example, in Moscow the tax is reduced for one of the parents. And in Krasnoyarsk, mothers and fathers with three or more children do not pay land tax at all.

In order to receive such a relief, parents should contact the Federal Tax Service inspectorate at their place of residence. You must have identification documents for all family members (passports, birth certificates), ID cards for a large family, and papers for a land plot. It is better to check the exact list of documents with your tax office.

Tax benefits for families with many children

Preferences for personal income tax (NDFL) are enshrined in amendments to the Tax Code of the Russian Federation (TC) of 2016.

Thus, Article 218 P. 4 reads:

Clause 4, Article 218 of the Tax Code of the Russian Federation:

4) the tax deduction for each month of the tax period applies to the parent, spouse of the parent, adoptive parent, who is supporting the child, in the following amounts:

1,400 rubles - for the first child;

1,400 rubles - for the second child;

3,000 rubles - for the third and each subsequent child;

12,000 rubles - for each child if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II;

The tax deduction for each month of the tax period applies to the guardian, trustee, adoptive parent, spouse of the adoptive parent who supports the child, in the following amounts:

1,400 rubles - for the first child;

1,400 rubles - for the second child;

3,000 rubles - for the third and each subsequent child;

6,000 rubles - for each child if a child under the age of 18 is a disabled child, or a full-time student, graduate student, resident, intern, student under the age of 24, if he is a disabled person of group I or II.

A tax deduction is made for each child under the age of 18, as well as for each full-time student, graduate student, resident, intern, student, cadet under the age of 24.

In addition, citizens pay the following types of taxes:

- on a vehicle;

- to the ground;

- for real estate.

Personal income tax is paid into the federal budget, preferences for it are regulated by the Tax Code of the Russian Federation.

Other taxes are set at the regional level. Discounts and benefits, including for families with many children, are regulated by local regulations. Download for viewing and printing the Tax Code of the Russian Federation (part two) dated 05.08.2000 N 117-FZ.doc

Personal income tax

Benefits for this mandatory payment are usually provided at the place of service.

It applies to all parents with many children who:

- officially employed;

- perform a certain amount of work under the contract;

- carry out activities on a contract basis.

In this case, parents mean all persons caring for children without regard to official status (see above).

- If there is one parent in the family, then his deduction is doubled.

- The same thing happens when the spouse officially renounces the tax preference (confirmed by a certificate from the place of service).

- The right to a discount begins from the moment of the birth of the third child (if the first two have not reached the age limit).

- In case of late application for deduction, the employer is obliged to recalculate. But its terms do not exceed three years from the date of filing the application.

The right to tax preferences is lost when a family officially loses its status as a large family: no more than 2 minors remain (children exceed the age limit or die).

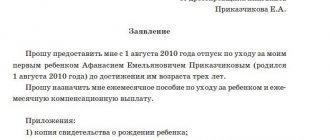

Registration process

To receive a tax deduction, you must provide the following documents to the administration of the enterprise (private entrepreneur):

- statement;

- copies of documents for children: their birth certificates;

- acts of adoption;

- papers for guardianship (guardianship);

Other documents may also be required.

They are required to prove the right to deduction in the tax authorities. They are determined individually. Example of tax deduction calculation

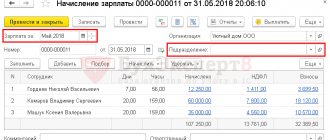

Let's say a mother is raising three children: 5, 12, 16 years old. The second child is disabled. Dad left the family and refused tax benefits. Mom’s salary is (without taxes) 40 thousand rubles.

- Without applying preferential tariffs, she will receive:

40 thousand rubles. — 40 thousand rubles. x 13% = 34.8 thousand rubles.

- Tax preferences apply to the following amounts:

- 1st child - 1.4 thousand rubles.

- 2nd child - disabled - 12 thousand rubles.

- 3rd child - 3 thousand rubles.

- Total: 16.4 thousand rubles.

- The salary using tax preferences will be:

The tax base for calculating personal income tax will be calculated as follows:

RUB 40,000.00 — 16,400.00 rub. * 2 = 7,200.00 rub.

Personal income tax calculation: RUB 7,200. * 13% = 936.00 rub.

The salary will be with withheld personal income tax, taking into account the deduction for children: RUB 40,000.00. — 936.00 rub. = 39,064.00.00 rub.

Conclusion: the benefit increased earnings by 4,264 thousand rubles.

For private entrepreneurs, a similar calculation is carried out by the tax authorities. You need to contact your local office with all of the above documents.

Preferences for taxation of land plots

This type of fees will go to regional budgets in 2022. So clause 6.1 of Art. 391 of the Tax Code of the Russian Federation states that, as a general rule, large families are provided with a deduction reduced by the cadastral value of 600 square meters of land area owned. The relevant regional departments can set their own rates and allocate beneficiaries.

Eg:

- In the Krasnodar Territory, this category of citizens is completely exempt from land taxes.

- In the capital, this tax is reduced for one of the spouses with many children.

Discounts are issued at the tax authority. To do this, you need to provide the above papers there and write an application.

The specific procedure should be found out in the tax office of the region of residence.

Transport tax for families with many children

This fee is also the responsibility of the regions. Consequently, the availability of discounts for families with many children depends on the decisions of local authorities.

For example, in Moscow, one of the parents is completely exempt from paying transport tax (Article 356, paragraph 2 of Article 387, paragraph 2 of Article 399 of the Tax Code of the Russian Federation).

You can apply for a benefit at the tax office. To do this, you need to provide copies of the following documents:

- passports of the taxpayer - applicant;

- certificates of a large family;

- children's birth certificates.

If the region has approved this benefit, then you only need to declare it once. Subsequently, specialists will take into account the right to a discount, up to:

- loss of status;

- vehicle sales.

Property tax for families with many children

The obligation to pay the tax for ownership of real estate to the regional budget is enshrined in Art. 407 of the Tax Code of the Russian Federation. This paragraph of the legislation does not provide for the provision of special conditions to large families, however, clause 6.1 of Article 403 of the Tax Code of the Russian Federation states that the tax base for large families is reduced by the cadastral value of 5 square meters of the total area of the apartment, the area of part of the apartment, room and 7 square meters meters of the total area of a residential building, part of a residential building per each minor child. This preference is valid only for one property.

This right is delegated to local authorities (Clause 2, Article 39 of the Tax Code of the Russian Federation). But it is not implemented everywhere.

- Thus, citizens with many children in Nizhny Novgorod do not pay real estate fees. This is enshrined in the relevant decision of the city State Duma.

- The same conditions are provided to beneficiaries of this category in Novosibirsk and Krasnodar Territory.

You can find out what benefits for this tax are provided in the region from local authorities or on the official portal of the tax service.

Transport tax

The size and procedure for calculating transport tax are also determined by the regions. For example, in the Nizhny Novgorod region, a large family may not pay tax for one car whose power does not exceed 150 hp. In Moscow, one of the parents does not pay for his car, regardless of its capacity.

The tax benefit is also issued by the Federal Tax Service. It is enough to submit documents once. It will be valid until the car is sold or until the status of a large family is lost. If the spouses purchase another car and decide to re-register the deduction for it, they must contact the tax office again.

In Moscow, a tax benefit is provided to families with many children for transport tax

State duty is not paid for one vehicle, regardless of its capacity. If parents own several cars at once, they can choose which one they will not pay tax on.

After this, they will need to submit an application to the Federal Tax Service office indicating the vehicle.

Tax benefits for families with many children in the Moscow region also provide a discount on transport fees.

In such a family, it is allowed that there are no tax assessments on one car. However, the vehicle power should not exceed 250 hp. With.

Otherwise, you will need to pay a fee.

Property tax benefit for families with many children.

It is established at the regional level, like many other social support measures.

In Moscow, tax breaks on land for large families, like payment of state duty for real estate, are not provided.

But since 2022, a federal law has been adopted, which makes it possible to reduce the state duty paid for real estate.

According to the document, the taxable area is reduced by 5 square meters. meters for each minor child.