The basic principles for drawing up tax bills are in Appendix 1 to Bank of Russia Regulation No. 383-P dated June 19, 2012 and in Appendix 2 to Order of the Russian Ministry of Finance dated November 12, 2013 No. 107n (as amended on September 14, 2020).

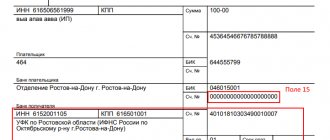

From January 1, 2022, the Federal Tax Service switched to a treasury system for servicing payments to budgets. Because of this, the details for fields 13, 14, 15 and 17 of the payment order have changed. Now they will indicate the data of the treasury account and updated data of the recipient's bank. Each tax has its own BCC, which serves as one of the main tax identifiers. In addition, the type of tax and tax period are also specified in the purpose of the payment. For example, “2022 Property Tax.”

Payment order fields

The payment order has special fields. Each separate field with its own unique number.

Characteristics of the main significant fields

In 2022, a number of changes will occur in the order in which payment order fields are filled out. The new rules were approved by the Ministry of Finance by Order No. 199N dated September 14, 2020. Some of them are valid from January 1, and some only from October 1, 2022.

Field number 5 will tell you about the type of payment: “urgent”, “mail”, “telegraph”. Fill it out in the manner prescribed by the bank. If there is no such order, leave the field blank.

In fields No. 8-11, enter your data: name of the organization or full name of the individual, account number, name and location of the bank, BIC and account number.

Field No. 16. An important field that includes the name of the recipient. When transferring the tax, you need to indicate the name of the Federal Tax Service and the short name of the Federal Treasury body. Fields No. 12, 13, 14 and 17 are used to indicate the recipient's details. Please note that from January 1, 2022 the details have changed. We'll tell you how to recognize them below.

Field No. 18. This is the transaction type code. When making a tax payment, you should use code “01”.

Field No. 21. It is very important to know the order of tax payments in the payment order. It is in this field that this information is indicated (Article 855 of the Civil Code of the Russian Federation). The fifth priority is established for all taxes.

Field No. 22. The UIP code is noted here. Most often it is equal to “0”. If the Federal Tax Service has noted the UIP in the tax request, then it must be written down in the payment slip.

Field number 24 . Here enter information about the payment to identify it: name of the tax, period and basis for payment. For example, “⅓ VAT for the 1st quarter of 2022.”

Field number 101 . This field records the payer status. For paying taxes from organizations this status is “01”, for individual entrepreneurs it is “09”. Only for personal income tax in both cases it is equal to “02”, since in this case the payer is a tax agent. Please note that from October 1, 2022, the code “09” will no longer be valid; instead, individual entrepreneurs will indicate the code “13”.

Field No. 104. This is where you need to write down the BCC. It is very important not to make mistakes in the numbers, because inaccuracies in the BCC can lead to the payment being stuck or being assigned to another type of payment.

Field No. 105 contains the OKTMO code.

Field No. 106 will tell the bank about the basis for the payment (clause 7 of Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107N). Now we indicate in it the code “TP” for current payments, “TR” for payments on claims, “AP” for a tax audit report, etc. From October 1, 2022, instead of the codes “TR”, “AP”, “PR” and “AR” it will be necessary to indicate the code “ZD” - repayment of debt for expired periods, including voluntary.

Field No. 107. It indicates the period for which a particular tax is paid.

Field No. 108. Filled in when paying a debt or a tax fine as required. It indicates the number of the foundation document; if there is no such document, simply put “0”. Despite the fact that the “TP” code and others will be canceled, they will continue to appear in this field. For example, for payment on request for tax payment No. 123, the field will be filled in as “TR0000000000123”.

Field No. 109. If the tax is paid on the basis of a declaration, the date of its signing should be indicated (clause 10 of Appendix No. 2 to Order of the Ministry of Finance of the Russian Federation dated November 12, 2013 No. 107N). If there is no date, a zero is entered.

Field No. 110 is not filled in.

Payment documents for paying taxes

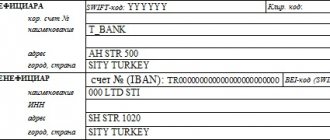

To pay taxes for an organization or individual entrepreneur, you need to generate a payment document

.

Payment documents are as follows:

- Payment order

– for non-cash payments. The payer must have a bank account. - PD form (tax)

– for cash payments. This method is only suitable for individual entrepreneurs and individuals.

Typically, payment documents are generated using various programs. For example, when using the 1C program.

You can also use the free service of the Federal Tax Service for generating payments.

How to fill out a payment order

Account owner (payer) via payment order

(payments) gives the bank the task: “Transfer so much money from my current account to such and such a recipient to this account.”

To make it easier to fill out a payment order, each field is assigned a number.

The rules for filling out a payment slip for paying taxes are prescribed in Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n.

A payment with fields looks like this:

Basic rules for filling out fields in a payment slip for taxes and contributions

| Field name (field number) | How to fill out the field |

| Payment order no. (3) | Payment order number in numerical order. |

| Payment type (5) | Not filled in |

| Payer status (101) | 01 – organization; 02 – tax agent (when transferring personal income tax by employers); 08 – when transferring contributions for injuries; 13 – Individual entrepreneur, notary, lawyer, head of a peasant farm, individual. |

| Payer INN (60) | TIN of the organization; Entrepreneur's TIN. |

| Payer checkpoint (102) | checkpoint of the organization; for IP it is indicated 0. |

| Payer (8) | Short name of the organization; Full name of the entrepreneur/notary/lawyer/head of the peasant farm and in brackets (IP/notary/lawyer/peasant farm), and after – the registration address, highlighted with the signs “//”. For example, “ANTONOV IVAN SERGEEVICH (IP) // 353900, NOVOROSSIYSK, ST. MIRA, 10, Apt. 12 //"; Full name of the individual and address, which is highlighted with “//” signs. |

| Recipient (16) | Abbreviated name of the Federal Treasury and Tax Inspectorate in brackets. For example, “UFK FOR THE KRASNODAR REGION (INSPECTIVE OF THE FEDERAL TAX SERVICE FOR THE CITY OF NOVOROSSIYSK).” |

| Recipient's TIN (61) | INN of the tax office to which the tax is paid; When paying contributions for injuries, the TIN of the FSS branch is indicated. |

| Recipient checkpoint (103) | Checkpoint of the Federal Tax Service to which the tax is transferred; Checkpoint of the FSS branch when paying contributions for injuries. |

| Recipient's bank (13) | Name and location of the recipient's bank; BIC of this bank (BIK TOFK); number of the bank account included in the single treasury account and the number of the treasury account. From 2022, the details of the recipient and his bank are listed here. |

| BIC of the recipient's bank (14) | |

| Recipient bank account number (15) | |

| Recipient's account number (17) | |

| Type op. (18) | 01 |

| Payment order (21) | 5 |

| Code (22) | UIN (unique accrual identifier), if known. For example, the UIN is indicated in the tax payment request. If there is no data, reflect 0. |

| Payment deadline. (19), Name pl. (20), Res. field (23) | Not filled in |

| KBK (104) | Budget classification code corresponding to the tax paid |

| OKTMO (105) | Eight-digit code of the municipality at the location of the organization/subdivision/real estate/place of residence of the individual entrepreneur. It can be found on the Federal Tax Service website. |

| Reason for payment (106) | TP – current payment; ZD – repayment of arrears voluntarily or upon request |

| Period for which tax is paid (107) | The period for which the tax is paid. Consists of 10 characters: XX . XX – type of period: MS - month, Q - quarter, PL - half-year, GD - year; YY – period number: 01, 02, etc., for annual payments – 00; YYYY - year. For example, when paying VAT for the 2nd quarter of 2022 - “KV.02.2021”. When paying a tax or contribution on demand, the payment deadline from the demand is indicated. |

| Document number (108) | The number of the document on which the tax is transferred. For current payments or voluntary repayment of debt, 0 is indicated. When paying on demand, indicate “TR” and the demand number. For example, "TP52451". |

| Document date (109) | Date of the document on which payment is made. For current payments, the date of declaration or settlement is indicated. If a tax or contribution is paid before reporting, as well as when repaying the arrears, 0 is entered. For example, “0” will be in payments for insurance premiums, personal income tax, advances under the simplified tax system. When payment is made on demand, its date is indicated. |

| Payment type (110) | Not filled in |

| Payment purpose (24) | Brief information about the payment. For example, advance payment under the simplified tax system for the 1st quarter of 2022. |

Sample VAT invoice

Sample payment form for contributions for injuries

PD form (tax)

An entrepreneur or individual can pay taxes:

- by bank

transfer using a payment order, if you have a bank account; - cash

.

When paying in cash, you need to fill out a payment form called “ PD Form (tax)

" This form is often called a payment notice.

This form was approved by Letter of the Ministry of Taxes and Taxes of Russia jointly with Sberbank of Russia dated September 10, 2001 No. FS-8-10/1199 and No. 04-5198.

The reverse side of the form contains out-of-date field codes.

Thus, in field (101) of the PD (tax) form, from October 1, 2021, you can only indicate:

02

– tax agent (when paying personal income tax by employers),

08

– when employers transfer contributions for injuries,

13

– Individual entrepreneur, notary, lawyer, head of a peasant farm, individual.

The rules for filling out the PD (tax) form are not much different from the payment order. We have numbered the fields in the payment form in the same way as a payment order, to make it easier to figure out in which field what needs to be indicated.

We pay special attention to the “ Document Index”

(22)".

In this field you need to specify the UIN

(unique accrual identifier). UIN is a personal code for a specific payment, which is assigned by the recipient of the payment. It is usually indicated by tax authorities in a tax notice for payment of property taxes or in a request for repayment of debt.

If there is no UIN, “0” is entered in field (22).

Barcode

document is filled in by the program with which the payment document was generated. When filling out the PD (tax) form yourself, instead of a barcode, you need to provide brief information about the payment: name of the tax; the period for which the tax is paid; basis for payment, if any.

Sample PD (tax) form for fixed payments of individual entrepreneurs

Where to get details for payment orders in 2022

Due to the transition to the treasury account servicing system, the details of payment orders have changed. The new details are valid from January 1, 2022. To facilitate the transition and avoid a large number of unclear payments, the Federal Tax Service allowed the use of old details until April 30. But we recommend not to delay and immediately use the new instructions, since many banks no longer accept payments filled in with old data.

Each region has its own details - there are 85 of them in total. The Federal Tax Service provided information about the details in the table, which is given in the letter dated 10/08/2020 No. KCH-4-8 / [email protected] For example, Moscow indicates the following data:

- Field 13 “Name of the recipient's bank” - GU BANK OF RUSSIA FOR THE Central Federal District//UFK FOR MOSCOW, Moscow;

- Field 14 “BIC of the recipient’s bank” - 004525988;

- Field 15 “Recipient bank account number” - 40102810545370000003;

- Field 17 “Treasury account number” - 03100643000000017300.

Generate receipts for paying taxes directly in Externa! We give you 14 days!

Try for free

Document form

So, in order to pay the budget, taxpayers use special unified forms of documents. For example, companies and individual entrepreneurs must transfer tax payments to the Federal Tax Service using a payment order.

Read more: “How to fill out the fields of a payment order.”

But ordinary citizens cannot pay fees and contributions to the Federal Tax Service by payment order. For them, in fact, a special form was developed: receipt form PD (tax). However, both entrepreneurs and legal entities can pay the duty or fee using this receipt.

The unified form was approved in Appendix No. 1 to the Letter of the Ministry of Taxes of Russia and Sberbank of Russia dated September 10, 2001 No. FS-8-10/1199/ 04-5198 (as amended by the Letter of the Federal Tax Service of Russia and Sberbank of Russia dated December 11, 2013 No. ZN-4-1/ [email protected] /12/677).

How to find out the document index for tax payment

The Federal Tax Service may write such an index in the tax payment request for legal entities. And for individuals, the document index is present in the receipt (notification) of accrued taxes. If an individual does not receive such notifications, then you can find out the document index and print a receipt in your personal account on the Federal Tax Service website.

If you are transferring a current payment, arrears not at the request of the inspection, or the UIN is simply not indicated in the request, leave field 22 empty.

You can see how to correctly draw up a payment order using an example. The sample shows a payment slip for the transfer of personal income tax for March 2022. The personal income tax amount is 17,144 rubles. The drafter of the document and tax agent is LLC “White Bear”.

filling out a payment order

payment order for income tax (federal budget)

Instructions for filling out online

To avoid languishing in queues at Sberbank of Russia, fill out the receipt at home. To do this you will need a computer and Internet access. No special knowledge or registration required. Follow the step by step instructions:

- Go to the official website of the Federal Tax Service.

- We select the payer status, that is, we determine the category of the person who will make the payment. There are three options available: individual, entrepreneur or legal entity.

Let's look at the features of filling out a ticket for ordinary citizens using a specific example.

Citizen Exemplary Anton Petrovich wishes to pay transport tax for his car in the amount of 2000 rubles. Payment for 2020.

Therefore, select “Individual” and “Payment document”:

- Let's move on. Now you need to enter the budget payment classification code, or BCC. Not many people know him, so we skip the field. Please note that the KBK will be filled in automatically after entering information in other fields of the form.

First, we select the type of payment; according to the conditions of our example, these are taxes on the property of citizens.

Now we select the purpose of payment, in our case it is transport tax.

Determine the enumeration type. Since this is a current payment, and not penalties, fines and penalties, we choose:

As you can see, the budget classification code was generated by the system independently.

Let's move on.

- We register information about the Federal Tax Service, to which the funds should be credited. Then we determine the OKTMO code (from the proposed list). Let's move on.

- We fill in the remaining fields: the basis for the transfer and the tax period: our year is 2022. We write down the amount and continue.

- Now we register information about the payer - an individual. We indicate his full name. and residential address. Let's move on.

- The system is ready to generate a payment document. Online payment is also available on the Federal Tax Service website. That is, you can transfer money to the budget without leaving your home.

Ready-made PD form of the Federal Migration Service of Russia, sample filling based on example conditions

Filling out form No. PD (tax)

FULL NAME. payer. The full last name, first name and patronymic of the individual must be indicated. For individual entrepreneurs, notaries, lawyers, heads of farms, the corresponding profession (notary, lawyer, individual entrepreneur, etc.) is additionally indicated in brackets.

Payer's TIN. If it is missing, then zeros are written.

Recipient's TIN. The identification number of the tax office is affixed.

Recipient's checkpoint. The checkpoint of the tax authority is indicated.

Recipient. The full name of the payment recipient is written. First the federal treasury authority, then, in brackets, the tax authority.

KBK. This is a required field in which the budget classification code is written.

OKATO. The value is indicated according to the classifier.

Basis of payment. Indicate, for example, TP - current payment, 3D - voluntary repayment of debt, TP - repayment of debt on demand, etc.

Payment type. It is indicated by two signs, for example, PE - penalties, PC - payment of interest, or a zero is put when paying taxes, fees, duties.

This form for paying taxes is not the only one. For example, individual entrepreneurs and individuals who carry out business activities and do not have a current account can use a Sberbank receipt in form No. PD-4sb (tax).

Receipt for transport tax

a notification and receipt for payment of transport tax ( form PD-4 ) no later than 30 days before the deadline for its payment (clause 2 of Article 52 of the Tax Code). At the same time, the Tax Code states that the tax should not be paid later than December 1 of the “year following the expired tax period” (that is, the past year). For example, if you are paying taxes for 2022, the latest date to pay it is December 1, 2022. This rule applies to all regions of Russia. It is defined by paragraph 1 of Article 363 of the Tax Code.

Example A person is a transport tax payer.

Situation 1 Tax must be paid for 2022. He must receive the notification and tax receipt (No. PD-4 (tax)) no later than November 1, 2022, and pay the tax no later than December 1, 2020.

Situation 2 Tax must be paid for 2022. He must receive the notification and tax receipt (No. PD-4 (tax)) no later than November 1, 2022, and pay the tax no later than December 1, 2021.

If the Tax Payment Notice was not sent to you, then you have no obligation to pay it. But tax authorities have the right to send you “forgotten” Notifications immediately for the last 3 years preceding their sending. For example, in 2022 they have the right to demand payment of transport tax and send you receipts for 2022, 2022 and 2018.