26.07.2019

0

2011

6 min.

Every citizen of Russia upon employment is guaranteed wages in accordance with current legislation. At the moment, remuneration is made in accordance with the Labor Code of the Russian Federation, namely on the basis of certain articles. Employees are advised to familiarize themselves with the terms of payment of funds, as well as the features of payroll calculation.

Payroll

Payment of wages under the Labor Code is made in strict accordance with the content of the articles. Every employee, whether he is a main employee or a part-time worker at the enterprise, must know his rights and defend them in case of violation.

Legislative regulation

The main document that regulates employment issues for Russian citizens is the Labor Code. The revised version, adopted in April 2022, is currently in effect. Remuneration according to the Labor Code of the Russian Federation occurs in accordance with the following legislative norms:

- Article 129 of the Labor Code of the Russian Federation stipulates the provision regarding mandatory wages for an employee’s work. Among other things, by decision of the employer, employee salaries can be increased by compensation and incentive payments.

- Article 133 of the Labor Code of the Russian Federation establishes the fact of the existence of a minimum wage (minimum wage), which is formed in accordance with the economic situation in the region of Russia.

- Article 132 of the Labor Code of the Russian Federation - there is no maximum and strictly limited salary. In Russia, every person can earn according to their capabilities.

- Article 131 of the Labor Code of the Russian Federation - contains mandatory standards regarding wages. According to the act, the employer does not have the right to replace money with coupons, receipts, things and other items for employees. It is also approved that each worker should receive 20% of the required payments in cash equivalent.

Attention! The legislation does not regulate wages only in Art. 129 Labor Code of the Russian Federation. Depending on the circumstances, Government Decrees and the Civil Code of the Russian Federation are also affected.

Basic Concepts

Wages under the Labor Code include the basic concepts that are contained in the text of regulations. It is difficult for a beginner to understand the features of calculating payments, so it is recommended to study some definitions in advance:

- Salary. Mandatory remuneration for payment to the employee, depending on numerous labor factors and the complexity of production. Accrual occurs in accordance with the volume completed or time worked (based on the number of work shifts).

- Tariff rate. In the Labor Code of the Russian Federation it is synonymous with the definition of “salary”. Employee remuneration at any enterprise is formed in accordance with the value specified in the contract. There may also be a cash accrual amount for hours worked in a shift (sometimes the organization sets a percentage rate on the volume of production produced). Remuneration is specified in the employment contract.

- Forms of remuneration. At the moment there are hourly and piecework. First, the payment is calculated according to the employee’s hours worked. The second one requires counting the products produced, payment is made according to the number of finished units of goods. It often operates in small enterprises where each employee produces the entire product (for example, dumpling shops or bakeries, where the employer counts the products produced in kilograms or loaves of bread, respectively).

- Minimum wage. Minimum wage. The indicator strictly “fixes” the minimum in monetary terms that an employer must pay to employees per hour, shift, day, week, month or year. The value is calculated individually for each region of Russia, since the calculation takes into account the established amount of the subsistence minimum.

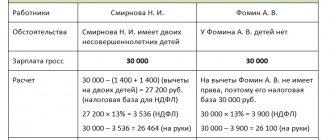

The minimum wage in 2022 is 11,280 rubles. Each region must comply with the basic rule prescribed in Article 133 of the Labor Code of the Russian Federation. The indicator cannot be less than the established value at the state level.

Accrual rules

The rules for calculating wages for main employees and part-time employees contain slight differences. Payments are made in accordance with the Labor Code of the Russian Federation, which the employer relies on in his calculations.

Main employees

The main employees of the enterprise are employees working under an employment contract. They are paid their salaries in accordance with the conditions specified in this document. Additionally, the procedure for calculating payments prescribed in the Charter and other approved acts is used. Rules for the formation of wages for main employees:

- The employee is accrued payments from the date of signing the employment contract and issuing an order on enrollment.

- When calculating wages, the wage system is taken into account (depending on the form specified in the employment contract) and the actual time worked or the volume of products produced.

- If wages are accrued as a result of dismissal, the calculation of working days occurs before the day the order for the employee’s departure from the state is signed.

- Payment of wages occurs twice a month - advance payment and main payment. The employer sets the date for transferring funds independently. The same applies to the advance payment - it is either a fixed amount or a percentage (30-40%) of the salary, calculated from the time actually worked for the month.

- If the date of issue of money falls on a weekend or holiday, the transfer is made the day before the holiday.

- From accrued wages, the employer can deduct income tax, the amount of material damage caused to the worker, alimony, and previously overpaid amounts.

- Additional charges may be added to the salary - a bonus, a coefficient established in the region, an allowance due to the peculiarities of working conditions, vacation pay, overtime allowed by law.

It is important to know! Contributions to the Pension Fund or Social Insurance Fund are made by the employer himself. The amounts and values depend on the form of its registration in the Unified State Register of Legal Entities.

Part-timers

Part-time work at an enterprise is regulated by Article 285 of the Labor Code of the Russian Federation, which states that employment in this case is possible on a temporary basis, piecework basis or otherwise, as specified in the employment contract. Based on other legislative acts, the following list of payroll rules is compiled:

- The working hours of a part-time worker should be no more than 4 hours a day;

- salary – no more than half of that of the main employee;

- hours worked - no more than half of the established norm for the month of the key employee;

- calculation of wages, the day of their transfer and other conditions do not differ for a part-time worker from other workers;

- salary may include salary, bonuses, regional coefficient and other allowances specified in the employment contract.

Sometimes situations occur when a part-time worker earns more than the main employee. This can be explained by the production of an identical volume of products in a full day or as a result of increased qualifications. In this case, the employer has the right to make changes to its staffing table for each part-time worker or only indicate other rules for calculating wages.

Remuneration under special conditions

In Russia, the concept of “special conditions of remuneration” applies, which implies that employees work in a difficult situation. Their remuneration requires mandatory additional payments and other privileges - this is also confirmed by law. There are other features with additional payments:

- Hazardous production includes a list of professions whose specialists are forced to work in an enterprise with damage to their health. There are bonuses in the form of 4% or more of the interest rate established in the organization, milk delivery, and a shortened working day.

- Work in the North - higher regional coefficients, early retirement and other additional payments have been approved.

- Weekends and holidays - in accordance with Article 153 of the Labor Code of the Russian Federation, are paid at a double rate. The employer can set rates higher.

- Night time is regulated by Article 154 of the Labor Code of the Russian Federation, on the basis of which the director of the enterprise sets a tariff rate higher than the indicators for daytime hours. How much the salary increases in this case is prescribed in the Charter.

- Overtime – Article 152 of the Labor Code of the Russian Federation stipulates the conditions for remuneration for allowed hours worked. The employer pays wages for the first 2 hours of work at 1.5 times the rate, for subsequent ones – at 2 times.

These are the main differences in the employment of citizens at the enterprise. Each organization must familiarize employees at the time of hiring with the approved conditions described in the Charter.

TIME-TIME WAGE SYSTEM

If the employee has only a tariff rate or official salary (salary), their specific amount in numerical terms (for example, 100 rubles per hour or 50,000 rubles per month). Such explanations are given by Rostrud[2].

The wording may be as follows:

3.1. For the performance of labor duties provided for in this employment contract, the Employee is set a salary of 50,000 (Fifty thousand) rubles per month.

3.1. For the performance of labor duties provided for in this employment contract, the Employee is set an hourly tariff rate of 100 (One Hundred) rubles per hour.

In this case, the employment contract cannot use the wording “Payment according to the staffing table” or “The employee’s official salary is established in accordance with the staffing table.” If the employer does not indicate a specific salary amount, this will violate the requirements of paragraph 5 of Part 2 of Art. 57 Labor Code of the Russian Federation.

Thus, referring to the staffing table instead of indicating the specific amount of the employee’s salary is a violation of the requirements of labor legislation, for which the employer may be brought to administrative liability under Part 1 of Art. 5.27 of the Code of the Russian Federation on Administrative Offenses (CAO RF).

Therefore, when paying time-based labor, the employment contract must indicate the specific amount of the tariff rate or official salary of the employee, as well as additional payments, allowances and incentive payments.

Salary payment procedure

Payroll is one story. It is much more important to check the accuracy of the payment being made.

Issue date

As stated earlier, salaries are paid to employees twice a month and on certain set days. The intermediate period is no more than 15 days (Article 136 of the Labor Code of the Russian Federation). A delay in payment in accordance with Article 236 of the Labor Code of the Russian Federation entails additional charges in the form of compensation and an amount of 1/150 of the key rate of the Central Bank of Russia.

Pay slip

Each employee must be familiar with the procedure for setting up wages. To do this, he is given a pay slip, which includes the following information:

- personal data of the worker - full name, position, account of the recipient, if the money is transferred to a bank card;

- the tariff rate specified in the employment contract, which is included in the calculation;

- hours of actual work or volume of products produced;

- payroll – salary;

- additional amounts that act as a salary supplement;

- contributions to the Tax Service - personal income tax;

- other monetary minuses indicating the reason or name of the payment.

It is important to know! The last paragraph includes such deductions as payments for alimony, for a loan or loan previously issued by the enterprise, and replenishment of material damage. At the end, the document contains the amount intended for final transfer to the employee’s account.

ADDITIONAL PAYMENTS, ALLOWANCES, BONUSES

Norm of paragraph 5, part 2, art. 57 of the Labor Code of the Russian Federation allows you not to indicate in the employment contract the specific amounts of additional payments, allowances and bonuses.

If the employer has established additional payments, allowances and incentive (incentive) payments (including bonuses), then you can indicate their types and amounts:

a) directly in the employment contract;

b) in the form of a reference to the local regulatory act of the employer (for example, regulations on remuneration of employees, regulations on bonuses for employees) or the collective agreement by which they are established. Employees must be familiarized with the specified documents against signature (paragraph 10, part 2, article 22, part 3, article 68 of the Labor Code of the Russian Federation).

The fact that in this case it is possible to use reference norms in an employment contract is confirmed in its explanations by Rostrud2.

Extract from the letter of Rostrud dated March 22, 2012 No. 428-6-1 2. […] The specific amount of the tariff rate or official salary is indicated directly in the employment contract. As for additional payments, allowances and incentive payments due to an employee, they can be directly indicated in the employment contract or it can make a reference to the relevant local regulation or collective agreement, which provides the grounds and conditions for their payment. In the latter case, the employee must be familiarized with the content of local regulations and the collective agreement against signature.

The wording may be as follows:

3.1. For the performance of labor duties provided for in this employment contract, the Employee is paid a salary that includes: 3.1.1. Official salary in the amount of 50,000 (Fifty thousand) rubles per month. 3.1.2. Quarterly and annual bonuses that are accrued and paid to the Employee in the manner and on the terms established by the Regulations on bonus payments to employees of New Technologies LLC.

3.1. For the performance of labor duties provided for in this employment contract, the Employee is paid a salary that includes: 3.1.1. Official salary in the amount of 30,000 (Thirty thousand) rubles per month. 3.1.2. Personal bonus for high qualifications in the amount of 10,000 (Ten thousand) rubles per month.

Please note that in an employment contract with an employee who will work in the Far North or equivalent areas[3], you must indicate the regional coefficient and percentage increase in wages. If the employer violates this rule and does not include such conditions in the employment contract, the employee will still be able to demand their payment. This position is confirmed by judicial practice[4].