What is the statute of limitations for a loan or loan, or at least for a receipt for borrowing money? And is it possible, after the statute of limitations expires and the bank or microfinance organization does not have time to sue you for debt repayment, to consider yourself free from debt repayment? Do banks and microfinance companies write off overdue debts? We'll tell you everything in this post.

Although the bankruptcy procedure for individuals helps debtors pay off their debts, it also has its pitfalls. But remember that only bankruptcy will allow you to write off debts and legally close the issue at its roots. Everything else is half measures.

Firstly, the bankruptcy procedure is quite lengthy. Secondly, to the surprise of many, in order to become bankrupt, you first need to pay. Before bankruptcy, the applicant must pay a state fee, as well as the services of a financial manager.

Then the citizen will have to bear postal costs for sending notices of his insolvency to creditors, and the costs of publishing information about bankruptcy in the Kommersant publication and on the specialized portal Fedresurs - as required by the bankruptcy law.

Material on the topic

Fedresurs - check for bankruptcy of individuals Check for bankruptcy of individuals through Fedresurs. How to find a bankrupt on Fedresurs. What information about the debtor and bankruptcy is available in the EFRSB? Who can check a debtor for bankruptcy? Who submits information to Fedresurs Bankruptcy in the Kommersant newspaper: what secrets does the publication reveal about debtors? Interested parties can find the bankruptcy notice in the daily newspaper Kommersant. This is an information portal on the Internet and a printed publication.

Thirdly, after bankruptcy, the debtor will inevitably face its consequences. One of them is that within 5 years after the procedure, when receiving new loans, the debtor is obliged to notify the creditor of his bankruptcy status.

However, bankruptcy is the surest way to get rid of debt, albeit a long one. Well, if you don’t consider the option of paying off the entire debt with interest and penalties. But in some cases, it is possible to write off debts after the statute of limitations has expired. In this article, we will get acquainted with the concept of “the period for writing off accounts payable” - also known as the “limitation period”. And let's figure out why it is so important for the debtor. True, this will not be exactly a “write-off”, but you can get rid of part of the overdue debt this way. But let’s talk about everything in order.

Statute of limitations

The statute of limitations is the time during which a creditor can protect his violated rights by filing a lawsuit and demanding collection of the debt.

As a general rule, the statute of limitations is 3 years and is calculated from the moment the creditor learned of the violation of his rights, that is, the delay in fulfilling the obligation. For a loan, it is counted from the first day after the calendar date when the bank or microfinance organization does not receive the next payment for the loan.

So, when the borrower does not make the next payment, the date of which is fixed in the payment schedule, a delay occurs. From this moment the limitation period begins to count, which will end after 3 years. During these 3 years, the creditor has the right to sue the debtor and recover his money.

Can a creditor collect a debt from my relatives?

The creditor has the right to demand collection of the debt in court from the debtor himself, but with one caveat. He also has the right to demand payment from the guarantor or co-borrower of the debtor. And also from his legal successor.

The guarantor, co-borrower and legal successor may be a relative of the person. Therefore, debt collection from a relative with such a status is not excluded.

But simply from the relatives and friends of the debtor, who did not vouch for the solvency of the borrower, even if they live under the same roof with him, neither the creditor nor the collectors have the right to demand payment of the debt.

Terms of retention

Upon dismissal, the employer makes a final calculation of the amounts due to the resigning employee.

And from these amounts he can withhold the amount that the employee owes to the company. True, there are a lot of nuances that the employing company should take into account. Firstly, the organization cannot withhold any debt from the employee’s account. All cases of deduction from wages are described in Article 137 of the Labor Code of the Russian Federation and the list given there is exhaustive.

Thus, deductions from an employee’s salary to pay off his debt to the employer can be made:

- to reimburse an unpaid advance issued to an employee on account of wages;

- to repay an unspent and not returned timely advance payment issued in connection with a business trip or transfer to another job in another area, as well as in other cases;

- to return amounts overpaid to the employee due to accounting errors, as well as amounts overpaid to the employee, if the body for the consideration of individual labor disputes recognizes the employee’s guilt in failure to comply with labor standards or downtime;

- upon dismissal of an employee before the end of the working year for which he has already received annual paid leave for unworked vacation days. True, in some situations the company does not have the right to withhold “extra” vacation pay from the employee (for example, if the dismissal occurs due to staff reduction or liquidation of the company).

There are two things to note about the first three payments.

First: deductions can be made only if the employee does not dispute the grounds and amounts of deductions. Proof that the employee does not dispute the fact of withholding will be his consent in writing. Such conclusions follow from letters from officials and judicial practice (Letter of the Ministry of Labor of the Russian Federation dated 08/09/2007 No. 3044-6-0, Cassation ruling of the Supreme Court of the Republic of Tatarstan dated 03/14/2011 in case No. 33-2570/2011, Appeal ruling of the Moscow City Court dated 20.08 .2015 in case No. 33-29621/2015). And second: the company has the right to make a decision to deduct from wages no later than one month from the date of expiration of the period established for the return of the advance, repayment of debt or incorrectly calculated payments. If the deadline is missed, the company no longer has the right to deduct from the salary. Please note that the above list does not include loan debt. This means that the company will not be able to withhold the outstanding loan from the resigning employee’s salary. But as for the damage caused by the employee, the opportunity to withhold the amount of damage from the salary is provided for, but in another article of the Labor Code - Article 248. At the same time, there are features that you can learn about from the article.

Secondly, the total amount of all deductions for each payment of wages cannot exceed 20 percent (Article 138 of the Labor Code of the Russian Federation). And thirdly, the amount of deductions from the employee’s salary is calculated from the amount remaining after taxes are withheld (Letter of the Ministry of Health and Social Development of the Russian Federation dated November 16, 2011 No. 22-2-4852).

What happens after 3 years?

Three years after the start of calculation of the limitation period, that is, from the date of the first delay, this period ends. Consequently, the period during which the creditor has the right to go to court to collect the debt ends.

However, if 3 calendar years have passed since the date of delay, this does not mean that the statute of limitations has definitely expired. There is the following reason for this: the statute of limitations may be suspended or interrupted.

The grounds for suspending the limitation period are:

- Obstacles in filing a claim in the form of force majeure;

- The presence of the debtor in the troops brought under martial law;

- Moratorium imposed;

- Suspension of the legal act regulating these legal relations;

- Out-of-court dispute resolution procedure.

In all these cases, the limitation period is, as it were, “paused.” As soon as the grounds for suspension disappear, the period continues.

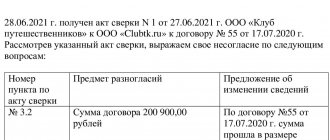

In addition, the deadline may also be interrupted. The reason for this is actions that indicate that the debtor acknowledges the debt, that is, the debt does not remain in the status of “unconfirmed accounts payable.” From this moment, the statute of limitations for writing off loan debts is renewed and begins to count again.

What can interrupt the statute of limitations? The simplest thing is the debtor’s recognition of his debt, in whole or in part. For example, a bank or collection agency writes you a letter - citizen Ivanov, have you borrowed 100 thousand rubles from a bank with the letter X? And even your answer was yes, but what do you care about my debt? - will be interpreted by the court (when the case comes to court) as a fact of recognition of the debt. And from the date of this answer, the statute of limitations will begin to run again. Yes, the creditor will again have exactly three years to collect the debt!

Accounts receivable - an economist's view

At large enterprises, control over working capital is carried out by the financial department or directly by the financial director. In small organizations, this is usually done by the accounting department. The main task here is to prevent them from “bloating”. The smaller the amount of accounts receivable and the longer the deferment in payment of accounts payable, the better for the company, the less problems it experiences with finding inexpensive funds.

Enterprises use various methods to maintain accounts receivable within normal limits: regular reminders to debtors about existing debt in the form of periodic calls or recurring invoices; bonuses to managers based on funds received from customers, and not on sales volume; factoring of accounts receivable; providing customers with incentive discounts for early payment or prepayment; thorough analysis of the payment history of new buyers, provision of guarantees from friendly organizations, insurance and others. All these measures are completely justified, because shortcomings in the field of current and forecast analysis of receivables are fraught with loss of solvency for the enterprise. And these are delays in wages (and subsequent complaints from dissatisfied employees to various authorities), overdue taxes, penalties, suspension of production...

Surely the vast majority of accountants prepare accounts receivable reports for their managers. As a rule, these are standard reports provided for by the configuration of 1C programs. Some develop their own forms informing managers about the size and structure of receivables, indicating the timing of their formation and the established repayment date, the presence of overdue debts and, in general, problem debtors. In a more complete form, these reports also contain forecast data on the expected values of accounts receivable and a number of economic indicators, such as: the share of accounts receivable in the total volume of current assets, the share of doubtful accounts in accounts receivable, the ratio of accounts receivable to sales volume, the turnover period of accounts receivable debt, planned value of receivables, etc.

It is convenient to present data on accounts receivable in the form of a pivot table. For example, such a table might look like this:

| Accounts receivable by type, by counterparty | Total at the end of the period, rub. | Incl. by period of education | Incl. overdue, rub. | ||

| Up to 14 days, rub. | From 14 days to a month, rub. | Over a month, rub. | |||

| Buyers and clients | |||||

| Primer LLC | 345000 | 40000 | 100000 | 205000 | 55000 |

| IP Ivanov I.I. | 112500 | 112500 | |||

| Advances issued | |||||

| LLC "Supplier" | 270000 | 270000 | |||

| Other debtors | |||||

| Commodity expert Petrova N.A. | 10000 | 10000 | |||

| Tax calculations | 8300 | 8300 | |||

| TOTAL | 745800 | 162500 | 370000 | 213300 | 55000 |

But personally, I still think two points are important when working with accounts receivable:

- For long-term receivables, it is necessary to bring their value to the real level, i.e. discount. This must be done because the value of money changes over time. Plus, the company incurs certain losses, excluding these funds from its turnover for a long time. This approach is widely used by organizations that apply IFRS.

- Especially highlight foreign currency debt. Not all managers understand what currency risks are.

- Comparison of receivables and payables, incl. their individual components. After all, even with apparent balance, the ratio of their individual elements may not be balanced. Let me illustrate with a simple example:

| Accounts receivable | Amount, rub. | Accounts payable | Amount, rub. |

| Debt of buyers (customers) | 120000 | Debt to suppliers and contractors | 297000 |

| Amounts of advances and prepayments issued | 355000 | Amounts of advances and prepayments received | 178000 |

| TOTAL | 475000 | 475000 |

Despite the balance of debts, with a more detailed analysis we see that the amounts already received (but not closed) and expected amounts are an order of magnitude less than the amounts that the organization has already withdrawn from circulation, and should also withdraw in the near future: 652,000 rubles. against 298,000 rub. And such a ratio cannot be called satisfactory, which must be conveyed to the manager!

It is impossible not to mention one more argument in favor of strict control of accounts receivable: it is in this section of accounting that the phenomenon of internal fraud is most often discovered. For example, transferring salaries to “dead souls”, kickbacks and bribes (for example, for an unreasonable price reduction by a sales manager), falsifying documents on travel expenses, etc.

It turns out that you can not pay for three years and then write off the debt?

Due to its interest in receiving the debt, the creditor acts quickly and, as a rule, within these three years, receives at least something from the debtor. Therefore, it is not worth hoping only that you can simply hide from the bank for three years and not pay anything.

Three years is not so little. Since the direct interest of the creditor is to receive his money, for this purpose he can take advantage of all the opportunities provided to him by law. That is, sue. It should be remembered that debt to banks and microfinance organizations is an unconditional debt.

That is, a debt for which no additional evidence needs to be presented to confirm and repay it. Therefore, it can be recovered through the magistrate’s court and the issuance of a court order. And to issue such an order, the debtor is not required to be summoned to court. If you borrowed funds, please pay!

Next, the debt will be collected with the help of bailiffs. In addition, the bank is free to sell the debt to collectors, whose methods of “knocking out” debts are not the most pleasant. A bank or microfinance organization even has the right to file for bankruptcy of the debtor themselves.

In addition, by avoiding payment of his obligations, the debtor worsens his credit history (which is a fairly important indicator these days), the debt grows, as interest and penalties are added to it, and the ban on traveling abroad by bailiffs.

Let's take a closer look at the methods that a creditor can use to collect his debt in order to understand why the creditor may never miss the statute of limitations.

Debt collection through bailiffs and banks

When a debtor does not pay his debts, the creditor usually sues. The judicial proceedings themselves end with the issuance of a judicial act.

If what is stated by the creditor corresponds to the state of affairs and there really is a violation of his rights - there is a non-repayment of money, then the court makes a decision to collect the debt in full or part of it. However, even with a court decision in hand, the creditor will not always receive repayment of the debt.

For this purpose, there are methods of forced collection. So, the creditor can contact a banking organization or directly the bailiffs in order to get what is due according to the law.

By submitting information about the debtor to banks, bailiffs write off money from the debtor’s accounts. And if there are enough funds in the accounts, debt collection can occur as a one-time write-off.

Bailiffs, in turn, are vested with a wide range of powers to collect debt. This includes requesting information from various authorities about accounts and property, automatically writing off up to 50% of funds received in salary accounts, searching, seizing and selling property.

Selling debt to collectors

The creditor has the right to sell the debt to collectors. This means that after such a sale, the bank debtor becomes a debtor to the collection agency, which, as a rule, has its own methods of collecting overdue loans.

However, the current actions of collectors are not at all what you could imagine from stories from the 90s. Since 2022, a law has been introduced that protects citizens from the arbitrariness of collection agencies using “old” methods of debt collection.

Debtor's bankruptcy

Bankruptcy of a debtor at the initiative of a creditor is also possible. The creditor's right to file for bankruptcy of the debtor occurs when the amount of debt exceeds 500,000 rubles. Thus, a creditor has the right to file a lawsuit for bankruptcy of an individual, either independently or by combining his claims in one application with other creditors.

After which the debtor goes through all the bankruptcy procedures, as if he had filed the application himself - debt restructuring, sale of property, obtaining bankrupt status and all its consequences. True, there are a couple of significant “buts” - if the bankruptcy was initiated by the creditor, then he pays for the services of the financial manager. But rest assured, the manager hired by the creditors will do everything to find liquid property from the debtor and let the person “go around the world.”

The company forgave the employee's debt

If the amounts are insignificant, then organizations, as a rule, do not want to get involved in litigation and simply forgive the debt to the resigned employee.

This is stated in the debt forgiveness agreement. The accountant needs to keep in mind that the former employee may have income subject to personal income tax. For example, if we are talking about unrepaid accountable amounts, then when this debt is forgiven, the former employee will have taxable income (Letter of the Ministry of Finance of the Russian Federation dated September 24, 2009 No. 03-03-06/1/610). Officials believe that taxable income appears for a citizen even if his debt for paid vacation pay, which he has not worked, is forgiven. Since the company does not have the ability to withhold personal income tax in these situations, it is limited to submitting information to the Federal Tax Service about the impossibility of withholding tax.

If we are talking about forgiveness of debt under a loan agreement, then the employee also receives income in the amount of debt forgiven by the creditor-employer (Letter of the Ministry of Finance of the Russian Federation dated October 28, 2014 No. 03-04-06/54626). In this case, the company also submits to the Federal Tax Service information about the impossibility of withholding tax.

The amount of forgiven debt is not taken into account in expenses, since it does not meet the criteria established by paragraph 1 of Article 252 of the Tax Code of the Russian Federation. In addition, paragraph 16 of Article 270 of the Tax Code of the Russian Federation directly states that the value of gratuitously transferred property does not reduce taxable profit. This is also confirmed by officials (Letter of the Federal Tax Service of Russia for Moscow dated June 20, 2012 No. 16-15 / [email protected] ).

As for insurance premiums, the situation here is not very pleasant for companies. There are explanations from officials, according to which, in the event of termination of the employee’s obligations to return funds under the loan agreement, the amount of the unrepaid debt is subject to insurance premiums in accordance with Part 1 of Art. 7 of Federal Law No. 212-FZ as a payment made in favor of an employee within the framework of his labor relations with the organization. This opinion can be seen in Letters of the Ministry of Health and Social Development of the Russian Federation dated May 21, 2010 No. 1283-19, dated May 17, 2010 No. 1212-19.

However, judicial practice does not support this conclusion. The courts proceed from the fact that there is no relationship between the issuance of a loan (loan) to an employee and the performance of his labor functions, therefore, when the debt is forgiven, there is no object subject to insurance premiums (Determination of the Armed Forces of the Russian Federation dated September 26, 2014 No. 309-KG14-1674, Resolutions of the Federal Antimonopoly Service of the Volga District dated May 21, 2013 No. A65-18287/2012, dated August 29, 2013 No. A65-18176/2012).

In order to reduce tax risks, we advise you to apply for debt forgiveness after the employee has quit. In this case, it will be difficult for inspectors to charge companies with the obligation to charge insurance premiums, since at the time the debt is forgiven there is no longer an employment relationship with the employee.

Or maybe leave the debt “hanging” until the statute of limitations has passed? More on this later.

How to cancel a loan due to the statute of limitations, if it is still missed by the lender?

If for any reason the debtor ceased to repay his obligations to the creditor, and the creditor did not act in any way regarding such a violation of his rights, then after three years the creditor loses the right to demand repayment of the debt through the court.

But is the overdue debt reset to zero, that is, is the loan canceled due to the statute of limitations? No.

We remind you that only bankruptcy can save you completely from debt.

However, after the three-year period has expired, the creditor will still be able to file an application to the court. In judicial practice, the court often accepts such applications and even initiates proceedings and collects debts.

It is necessary for the debtor himself to declare that the creditor has missed the statute of limitations and as early as possible. As soon as the debtor files a petition for the creditor to skip the statute of limitations, the court, if there are sufficient grounds, will terminate the proceedings due to the statute of limitations. But the debt itself is not canceled by the statute of limitations. The creditor has the right to collect it further. But - without resorting to the help of the court. It is very important. That is, the bailiffs will not be able to describe and sell your property. But they can not let you go abroad due to an outstanding debt.

What happens when claims are made against the guarantor or assignee?

As stated above, the creditor has the right to “share” debts not only from the debtor himself, but also from the guarantor and legal successor.

Thus, in the case of a guarantee, the period during which the creditor can demand credit debt from the guarantor is equal to the period specified in the guarantee agreement.

If the guarantee period established in the contract has expired, the creditor can no longer demand fulfillment of obligations from such a guarantor.

If the guarantee period was not specified in the agreement, then, in accordance with the law, it is valid for another year after the expiration of the loan agreement itself. But again - no more than three years after the start of the first delay. During this period, the creditor has the right to demand payment of the debt from the guarantor.

As for the successor, in cases where the bank loan has not yet been repaid and the borrower has died, then all the rights and obligations of the debtor under the loan are legally transferred to a new person - the heir. But only if an individual enters into inheritance rights. That is, the statute of limitations continues to run. The bank can demand the debt from the heir only until this period has expired.

As in the case of presenting claims against the debtor himself, the court may accept an application to collect the debt from the guarantor or assignee after the statute of limitations has expired. Here, the defendant himself in the case also needs to act - to apply for a missed deadline, then the proceedings will be terminated.

Conclusion

Yes, after the statute of limitations has passed, the issue of collecting a loan from previous years through the court will be closed. However, we do not recommend counting on a miracle and relying on the creditor’s inattention and missing the statute of limitations.

If there is a problem, then it is better to do something to solve it.

Debt is debt. If you have made commitments, be kind enough to fulfill them. If the financial situation worsens, the law provides the debtor with the opportunity to restructure or refinance debts, as well as take a credit holiday.

In critical situations, the law provides for the opportunity to declare oneself bankrupt. This is the so-called “debt write-off”.

And, of course, even if you don't pay off a debt that's expired, it will ruin your credit history forever. You can no longer count on getting a new loan.

In any case, it is better not to waste time and contact a lawyer. In consultation with debtors, we build a strategy of action aimed at resolving debt-related problems and help cope with this burden.

Write-off of overdue receivables in accounting

In accounting, creating a provision for doubtful debts is the responsibility of the company. She does not have the right to choose whether to create a reserve or not. It is possible not to form it only if there is strong confidence that the debt will be repaid (letter of the Ministry of Finance dated January 27, 2012 No. 07-02-18/01).

| For more information on creating a reserve for doubtful debts, read the article “Provision for doubtful debts: the procedure for creating and calculating deductions . |

The formation of the reserve in accounting is reflected in the credit of account 63 in correspondence with account 91.

When writing off debt from the reserve, an entry is made: Dt 63 Kt 62 (76 or other accounts for accounting for debt to your organization) - writing off accounts receivable from the reserve for doubtful debts.

If the debt is greater than the reserve, then the difference is charged to the account of other expenses: Dt 91.2 Kt 62 (or another accounts receivable account).

A similar entry (Dt 91.2 Kt 62) is used to write off debt that suddenly became hopeless and was not reserved (for example, the counterparty was liquidated, and the company learned about this after the fact of liquidation).

The debt written off within 5 years should be recorded as the debit of account 007 in the full amount. And only after this period is it written off completely.

For accounting purposes, you need to store documents confirming the fact of writing off receivables for at least 5 years from the date of writing off the overdue debt to your company. On account 007, analytical accounting should be maintained for each counterparty.

The nuances of writing off accounts receivable in various situations are described in detail in the Ready-made solution from ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.