Correct accounting of equipment at an enterprise is an important point for conducting business activities. First of all, the cost of equipment, or rather depreciation, affects the cost of production. In addition, incorrectly organized accounting of equipment can lead to tax penalties, since depreciation is an expense item and reduces taxable profit.

In this article, I propose to consider the stages of equipment accounting in 1C 8.3 Accounting 3.0, starting with its receipt and ending with write-off.

Receipt of equipment in 1C Accounting

To complete this operation, use the document of the same name “Receipt of Equipment”. The list of documents is located in the “Receipt of fixed assets” section (main menu “Fixed assets and intangible assets”). You can go to the list by clicking on the “Equipment Receipt” link.

In the list window, click the “Create” button. Now you can proceed to filling out the document details.

- We indicate the date and number of the primary document, the date of the document in the system. The number will be assigned automatically upon registration.

- If this information base maintains records for several organizations, select the organization. If the “Organization” field is missing in the document header, it means that records are kept for only one organization. This is a common feature for all documents.

- The selection of a counterparty can be made by TIN or by name. If it is not found in the directory, the program will offer to create it.

- If the counterparty already exists and an agreement with the “With supplier” type has been concluded with it, the agreement will be entered automatically.

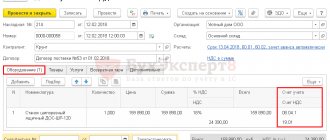

Now let's move on to filling out the tabular part. On the first tab we indicate:

- Equipment that we come;

- Quantity;

- Price;

- VAT rate;

- Accounting account (usually 04/08).

Don't forget to create an invoice below.

This is what the completed document should look like:

On the “Products” tab, you can specify related products. They arrive as usual.

The “Services” tab indicates services that are not included in the cost of the equipment. For example, services related to the delivery of goods.

To reflect the services that need to be included in the cost of equipment, there is a document “Receipt of additional. expenses."

VAT upon receipt of fixed assets

In this example, VAT was posted, since the document parameters indicate that it is not included in the price. To change this setting, follow the corresponding hyperlink in the document header and check the “Include VAT in price” flag. Then, when posting the document, there will be no movement on the account 19.01.

VAT will be reflected in the purchase book only after an invoice has been registered for this document.

If the receipt was reflected in a document with the transaction type “Receipt of equipment”, then it is additionally necessary to accept the fixed asset for accounting. This document is located in the menu “Fixed assets and intangible assets”, item “Acceptance for accounting of fixed assets”. We will not consider filling out this document, since we filled out all the necessary data, both for receipt and for acceptance for accounting, using the “Receipt of fixed assets” transaction type.

Receipt of additional expenses

Go to the list of additional documents. expenses can also be found in the “Receipt of fixed assets” section.

The header of the document is filled out in the same way as the receipt document.

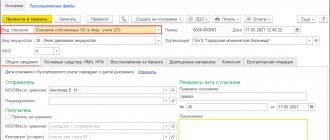

On the “Main” tab fill in:

- Name );

- Amount and rate of VAT;

- a method for allocating costs if they relate to several items of equipment.

On the “Products” tab, respectively, equipment:

Let's go through the document and look at the postings it generated:

As you can see, the amount of additional expenses increased the cost of the machine.

Write-off of fixed assets

Write-off of fixed assets in 1C 8.3 occurs as follows: select the subsection Disposal of fixed assets - the Write-off of fixed assets tab:

We create and prepare an accounting report:

We fill in all sections of the plate sequentially:

When all the data has been entered, you must immediately check the accounting entries:

Thus, in 1C 8.3 the fact of write-off of the fixed assets was reflected in the accounting. Next, we create a printed form - Certificate of write-off of fixed assets:

We print it out and give it to the head and members of the commission to sign:

According to SALT account 91.02, we check the correctness of the reflection of the operation to write off a fixed asset for other expenses:

In the SALT account 01.09, the write-off of fixed assets was reflected, that is, at the end of the reporting period, the fixed asset was no longer listed in the enterprise:

How to correctly prepare accounting documents in 1C 8.3 is described in the Help section:

Transfer of equipment for installation in 1C 8.3

This document also affects the final cost of the equipment and allows you to include in the price the components or equipment necessary for installation. In the header of the document we indicate the object for the construction of which the equipment is used, the cost account and the cost item.

In the tabular part the equipment is selected:

Acceptance of equipment for registration

After registration of receipt, the equipment must be accepted for accounting.

From the same section, go to the document list form “Acceptance for accounting of fixed assets” and click the “Create” button.

Let's start filling out the document details:

- “ OS event ” – we indicate how we will accept the equipment for accounting, with commissioning or not. Affects generated wiring;

- “ MOL ” – indicates the financially responsible person to whom the equipment will be assigned;

- “ Location of OS ” is the division for which equipment records will be kept.

Let's move on to the tabular part. The first tab is “Non-current asset”. Here you need to indicate the type of operation, the method of receipt and select from the “Nomenclature” directory the equipment that was installed at the arrival:

On the “Fixed Assets” tab, select an equipment card, which must first be entered into the “Fixed Assets” directory.

This directory stores all information about fixed assets. For the most part, the equipment card is filled out automatically when you post this document. It stores information about the initial and current cost of equipment, accrued depreciation, and reference information. The data is taken from the document. When a document is changed, the data in the directory also changes.

On the “Accounting” tab, we indicate which method will be used for depreciation and the period over which the equipment should be depreciated. The depreciation account is usually 02.01. Equipment account – 01.01:

If the company pays income tax, the “Tax Accounting” tab is also filled out. As a rule, it contains the same values as in the previous tab.

Let's run the document and see what transactions it generated in 1C 8.3:

It can be seen that the equipment was registered on account 01.01.

Video on receipt and accounting of fixed assets in 1C 8.3:

Receipt and acceptance for accounting of OS in 1C 8.3

The purchase of fixed assets can be registered in the 1C Accounting 3.0 program with the document “Receipts (acts, invoices)”, selecting the appropriate type (“equipment” or “fixed assets”).

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

For convenience, this document is also located in the “Fixed assets and intangible assets” menu in the form of two items with already established types: “Receipt of fixed assets” and “Receipt of equipment”.

A document with the type “Fixed Assets” is needed to account for those assets that do not require installation and additional costs.

- In the latest editions of 1C Accounting 8.3 (starting from 3.0.45), when using this type of operation, you do not need to additionally create the “Acceptance for accounting of fixed assets” document. All postings are made as receipts with the type of operation “Fixed Assets”, which greatly simplifies the life of accountants.

- The type of operation “Equipment” implies a purchase on accounts: 08.04.1 and 07. Equipment received on account 07 requires further installation. The equipment that arrived to the account on 08.04 does not require installation, and in the future should be accepted for accounting. VAT is reflected on the account on 19.01.

In our example, we will consider the receipt of fixed assets, since this functionality is new. To do this, in the “Fixed assets and intangible assets” menu, select the “Receipt of fixed assets” item. In the list form that opens, create a new document.

As you can see, it combines the details of receipt and acceptance for accounting.

Fill out the counterparty and the agreement in the header of the document. The method for reflecting depreciation expenses will be filled in automatically, but you can adjust it if desired. You can also indicate the location of the OS and the financially responsible person, but these fields are not mandatory. In the event that this object will be rented out, it is necessary to set the appropriate flag.

Next, fill out the tabular part of the document, making sure to indicate the service life for each item in months. If any of the positions has not been created previously, it must be created.

It is very convenient to create a new fixed asset directly from the tabular part of this document. For the created object, the OS accounting group will be set in accordance with the value specified in the header. The depreciation group is filled in when recording a document with a value corresponding to the specified service life.

Moving Equipment

Unlike goods, equipment moves not between warehouses, but between departments. In addition, the movement of equipment can be done between financially responsible persons.

During the move, the depreciation calculation method may change. In this case, you need to fill in the appropriate details.

Otherwise, there should be no questions regarding this operation:

Equipment inventory

This document allows you to identify either a shortage or surplus of equipment. When filling out, indicate the location of the equipment and the person responsible for it.

Then it is better to use the “Fill” button to fill out the list.

If an actual surplus is identified, a document is created for accepting equipment for accounting; if there is a shortage, a write-off is made: