Who is required to provide the Certificate When to submit the Certificate For whom the Certificate must be provided Reporting period and date of submission of information Certificate for husband/wife If it is not possible to provide the Certificate Regulatory framework

Civil servants have their own list of privileges and responsibilities. One of the responsibilities is the annual provision of a Certificate of income, expenses, property and property-related obligations . This is a special form in which summary information about all movements of funds in accounts is entered.

This certificate is often called a declaration for civil servants. This name is essentially incorrect, so we recommend using the legal wording.

The certificate of income and expenses is carefully checked, and if errors or inconsistencies are found, an internal audit is assigned.

Who fills out the declaration

Presidential Decree No. 559 of May 18, 2009 strictly stipulates what kind of declaration must be filled out when applying for a job in the civil service - a declaration that confirms the income received, the property owned and the obligations of a property nature (79-FZ dated July 27, 2004, p. 1 of Decree No. 559). In addition, civil servants provide information about the property of spouses and minor children (a certificate must be filled out for each). But such a declaration is submitted not only when a civil servant is employed, but also at the end of each reporting year - during the entire period of filling civil service positions.

IMPORTANT!

State and municipal employees are required to report annually on their income, property and property-related liabilities. The list of positions of civil servants who submit a declaration is given in Presidential Decree No. 557 of May 18, 2009.

Procedure and deadlines for submitting a certificate

In 2021, employers will submit a certificate as an appendix to the 6-NDFL certificate. Moreover, not once a quarter, but once a year . Accordingly, certificate 6-NDFL and annex on the income of an individual are filled out based on the results of 2021 and sent to the Federal Tax Service, where the individual entrepreneur or legal entity is listed as a taxpayer, before March 1, 2022 .

- employers whose number of employees does not exceed 10 people can submit 6-NDFL and a certificate both in paper and electronic form

- employers with more than 10 submit certificates exclusively electronically

For legal entities with several separate divisions, there are separate rules:

- if both the head office and separate divisions of the legal entity are located in the same municipality, the employer reports to the Federal Tax Service at the place of registration of the head office

- if the head office of a legal entity is located in one municipality, and separate ones are in others, the employer has the right to choose one Federal Tax Service Inspectorate to which it will submit reports on all separate units

In order for the employer to be able to exercise this right, he needs to notify all the Federal Tax Service Inspectors with which the departments are registered by 01/01/2022.

It is impossible to change your decision within a year. You will have to notify tax authorities only if there is a change in the number of separate divisions or if there are other circumstances that could affect the procedure for submitting reports.

What are the filling requirements?

Key requirement: the declaration should be submitted not only about the civil servant, but also about his family members - spouses and children under 18 years of age as of December 31 of the reporting year. The certificate contains information about all income and expenses received, property and vehicles in possession, securities and various property obligations.

From 03/01/2017, the declaration is generated through a special program “BK Help” of the current version. Civil servants have the opportunity to download the program for free from the official website of the Federal Tax Service (declaration for civil servants in 2022), the website of the President of the Russian Federation or from the official portal of the certificate-bk.rf.

Civil servants fill out the declaration themselves - in the “BK Certificates” program. To fill out, you will need supporting documents - income certificates (formerly 2-NDFL), certificate of state registration of property rights, purchase and sale agreements, bank statements.

The Ministry of Labor annually issues methodological recommendations for filling out reports. The form for 2022 was filled out according to the rules from the letter of the Ministry of Labor No. 18-2/10/B-12837 dated December 29, 2020. Recommendations for the 2022 report are already available in ConsultantPlus. Use them for free.

The general rules are:

- civil servants fill out the declaration in the “BK Certificates” program or by hand;

- For manual filling, use only a pen, a pencil is not suitable;

- Crossing out, making corrections, or using a proofreader is prohibited;

- print the declaration on A4 sheets;

- Damaged or spoiled reports will not be accepted for verification.

ConsultantPlus experts analyzed what typical mistakes are made when filling out certificates of income, expenses, property and property-related obligations. Use these instructions for free.

Who is required to prepare a certificate of income for a civil servant?

A complete list of positions, holding (replacing) which a civil servant is required to declare income and expenses, is given in Decree of the President of the Russian Federation of May 18, 2009 No. 557 “On approval of the list of civil service positions for which civil servants are required to provide information on income.”

A civil servant should look for his position in the list if it meets the following criteria:

- Is a state federal or military.

- The holder of the position is vested with the powers of a representative of state power or performs organizational, administrative or administrative functions in government agencies.

- Job responsibilities include: providing government services to citizens and organizations;

- implementation of measures for state control and state supervision;

- management of property owned by the state, including storage and distribution of material resources;

- organization of public procurement;

- issuance of licenses and permits.

How to fill out a declaration

Title page

The title page (page 1) of the report contains general information:

- the name of the personnel department of the government body to which the employee submits the report;

- FULL NAME. employee, his passport details;

- employee position;

- registration address;

- reporting period.

As an example, we suggest looking at the income statement of civil servants for 2022 of an employee of the Department of Museums of the Ministry of Culture of the Russian Federation.

Section 1

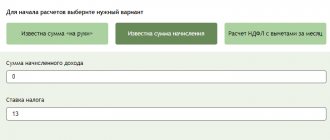

In the first block we indicate all income for the reporting period. Profitability includes the salary at the main place of work and other income, pensions, benefits, and social benefits. In addition, income from renting out an apartment, selling property, and interest on deposits are taken into account.

Section 2

In the second block we reflect all significant expenses for the reporting period - the purchase of land, housing, vehicles, securities, digital financial assets. We specify the transaction amount, source of funds and documentary basis.

Section 3

In section 3 we record information about the property owned. It consists of several subsections:

- 3.1 - real estate;

- 3.2 - vehicles;

- 3.3 - digital financial assets;

- 3.4 - utilitarian digital rights;

- 3.5 - digital currency.

The subsections must indicate the date of acquisition, the total number of assets and sources of funds.

Section 4

In the fourth section of information on the income of municipal employees for 2021, we indicate information about bank accounts and balances as of the reporting date. Data on balances is provided according to the bank statement. We write:

- Bank's name;

- account type and currency;

- the date of its opening;

- account balance;

- receipts.

Section 5

The fifth block is filled out by those who own securities. The section consists of two subsections:

- 5.1 - shares and other participation in commercial organizations and funds;

- 5.2 - other securities.

If there are securities, bills, bonds, the employee fills in the following information:

- name and OPF of the issuer;

- his address;

- authorized capital;

- basis for participation;

- for other securities - type, who issued it, nominal value, total quantity and total value.

Section 6

In the sixth section we reflect all property obligations - loans, borrowings, property leased under an agreement. Consists of two subsections:

- 6.1 - real estate objects in use: indicate the type of property, period and basis of use, location and area;

- 6.2 - urgent obligations of a financial nature: we state the content of the obligation, the creditor or debtor, the basis for its occurrence, the total amount of the obligation and the amount as of the reporting date, the terms of the obligation.

Section 7

Here we show all gratuitous transactions for the alienation of property of civil servants for the reporting year.

The completed income declaration certificate for civil servants - BC certificate in 2022 is saved in the program and printed. The civil servant signs the declaration and submits it to the personnel department of his department.

When and where do government employees submit income information?

For the first time, the obligation to provide a certificate of income, expenses and property arises when a civil servant is hired for the corresponding position. A candidate for a position from the list according to the Decree of the President of the Russian Federation submits a certificate along with other mandatory documents to the personnel service of the government agency in which he is employed. Civil servants already holding positions submit certificates annually to the government agency to which they belong.

The certificate should not be confused with regular reporting to the Federal Tax Service, for example, the 3-NDFL declaration. Some of the information from the certificates is almost always information to which access is limited in one way or another. The law provides for individual methods of verifying and storing such information, and they may differ in different government agencies. Therefore, certificates are submitted strictly to the government agency to which the position obliging them to submit them belongs.

Data from certificates of civil servants cannot be used to confirm (check) the solvency of a civil servant or members of his family (Clause 4 of Article 8 of the Law of December 25, 2008 No. 273-FZ “On Combating Corruption”).

Every year, civil servants are “declared” within the following deadlines:

- No later than April 1 of the year following the reporting year: President of the Russian Federation,

- members of the Government of the Russian Federation,

- Secretary of the Security Council of the Russian Federation,

- federal civil servants of the Administration of the President of the Russian Federation.

- civil servants,

Information for the year can be submitted by an employee (employee) at any time, starting from January 1 of the year following the reporting year.

The requirements of anti-corruption legislation do not provide for “valid reasons” in connection with which a civil servant’s income declaration may not be filed or filed late. Neither vacation (including parental leave), nor a business trip, nor sick leave cancels the official’s obligation to report on time.

If a government employee cannot submit the certificate in person on time, it is recommended to send it by mail. Certificates are considered submitted on time if they were submitted to the postal service organization before 24 hours of the last day of the established deadline.

Normative base

Methodological recommendations on the issues of submitting information on income, expenses, property and liabilities of a property nature and filling out the appropriate certificate form in 2022 (for the reporting year 2021)

Decree of the President of the Russian Federation of May 18, 2009 No. 559 “On the provision of citizens applying for federal positions civil service, and federal civil servants information on income, property and liabilities of a property nature"

Decree of the President of the Russian Federation dated June 23, 2014 No. 460 “On approval of the form of a certificate of income, expenses, property and property-related obligations and amendments to certain acts of the President of the Russian Federation”

Letter of the Ministry of Labor of Russia dated December 29, 2020 No. 18-2/10/B-12837 “Methodological recommendations on the provision of information on income, expenses, property and property-related obligations and filling out the appropriate certificate form in 2022 (for the reporting year 2020)”