Construction is one of the most material-intensive sectors of the economy. In the cost of an object put into operation, the share of material costs occupies a leading position. Therefore, their accounting during purchase, storage and release for construction is one of the highest priority accounting tasks of a legal entity. The reliability of information on these issues allows us to form an objective idea of the state of affairs in a construction company and promptly make management decisions. We will tell you in this article about accounting for building materials in construction.

Evaluation of building materials

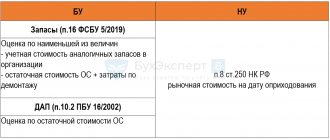

The assessment of building materials in accordance with legal requirements must be carried out at the actual price, which is understood as the amount of costs associated with their acquisition and delivery. The actual cost of material resources in construction consists of:

- the cost of their acquisition;

- costs for their delivery to the buyer’s warehouse;

- consulting expenses;

- customs duties and intermediary services.

The write-off of materials in construction can be carried out by:

- the cost of each unit (applicable to large, valuable equipment);

- average cost;

- FIFO method.

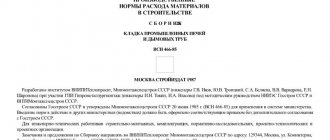

Philosophy of writing off materials according to the M-29 form

And God created a foreman and saw that it was good!

But the foreman is depressed, he has too much responsibility, even the preferential pension at 45 has ceased to motivate him, in general there is no life.

And God created the M-29 form and gave it to the foreman.

And the foreman saw that the M-29 was good!

And he began to live happily...

On the Internet you can find a bunch of materials on write-offs, articles from construction and accounting magazines, questions and answers from all sorts of newsletters. What will be described here is not the instructions, but rather the theory and philosophy of write-off.

What is it - write-off and form M-29?

Write-off is, at first glance, such an incomprehensible, frightening thing, because of which many do not want to become foremen, and once they do, they want to go to technical vocational training (the old illusion of foremen, like working in the Pension and Technical Department, sitting in the office doing nothing)

.

Simply put, it is the transfer of money spent on materials, equipment and products to the cost of construction. Even more simply put, the M-29 form takes into account what was purchased and where it went, i.e. not lost, not stolen, but used in accordance with the project and material consumption standards at a construction site with reference to completion (percentage, i.e., the M-29 is made in parallel with it). It’s even simpler than that: there is income, and there is expense, and our expense reduces our profit by the amount of overexpenditure.

This is why everything is done: to normalize and minimize costs and, accordingly, maintain profits. There is a physical movement of materials, and there is a movement of materials in accounting, in theory it should be parallel, but this is only in fairy tales. Of course, everything is much more complicated than described below, there are transactions, accounts, etc.

What is it for?

Actually, the system itself for writing off materials, in theory, should not allow the work contractor to build not according to the project, it should encourage him to monitor the economical consumption of materials, store it correctly so that it does not spoil, make sure that it is not whistled, and generally improve production standards, keep records , without which there will be no reporting. To understand the principle, you need to understand a little about accounting and the movement of materials. Those. even the write-off system indirectly, but often in the best possible way, participates in the quality control of construction; this must be understood and always remembered.

Where to begin?

To write off materials, you need, firstly, to keep records of what was accepted (collect invoices)

, then to keep records of what was being built (installed), how much was installed and for what project, understand the estimates, the consumption of materials and keep records of the interest. Those. you need to keep records and participate in reporting. Write down: what was ordered, delivered, received, transferred, returned, installed, where there was an overrun, what was lost or spoiled.

Ordering materials

First, materials are ordered. This is the very first and crucial moment when you can climb into a very “deep F”

and then heroically climb out of it. All materials at a construction site are considered from the project in accordance with consumption standards. Here you have a project (working documentation) for a house, there is a certain amount of brickwork. There may even be a quantity of bricks and mortar in the specification. In general, you can write it off as in the project specifications, but often there are no specifications, but only volumes (brickwork in cubes), then it is more reliable to refer to the estimate.

Where can I find out the quantity of materials and their consumption?

The estimate indicates all volumes and all materials that are used according to consumption standards.

Roughly speaking, the consumption rate is the rate for waste and other losses. For example, if you recalculate the volume of concrete in cubes, then the consumption of this concrete will be 2% more. Those. The volume of the concrete structure is 100 m3, and the concrete consumption will be 102 m3. And so on for almost everything. Once upon a time, the technical department did not sit on the site and do the execution, but prepared and maintained a limit map and a list of materials. More precisely, this is the left side of the M-29 write-off form, where all structures are listed in pieces, cubes or complexes, volumes and materials in accordance with consumption standards from the same estimates, or they themselves counted according to the standards (according to the same ones as these standards estimates have been developed)

. This greatly simplifies the work of the foreman and foreman.

All he has to do is order materials according to this plate, then note how much came where and write off these materials monthly along with the completion (percentage). Nowadays, often the PTO of the left part of the M-29 is simply not done, but the foreman does not know about it and suffers himself, making the M-29 as best he can. As a result of PTO, or accounting (if there is no PTO or they do not check M-29)

he deals with the same chaos.

If the order of materials is carried out chaotically, by different people, “doubled”, then the material may arrive more than what is included in the project, it may arrive, firstly, at the wrong time and the work contractor will simply take what he finds (is in stock)

, often not designed. Secondly, when ordering, you can incorrectly calculate the consumption rate and put in “your percentage” to insure yourself, there is 20-30%, it even happens. And thirdly, when there is a mess or delays in wages, hard workers, or even engineers, trying to fight off their stay at work, begin to endure everything that is bad.

Supply work

Let’s assume that we have made an application for that and in the required quantity. Next, the supplier must place the order. There may be problems here too. Suppliers in small companies may not be paid wages at all, because they live on “ agency fees

” in the region of 2-10% of the order amount,

in common parlance - a kickback

. If a company has several suppliers and they are not friends with each other, then when calling a plant that is already working with this supplier, they will most likely be refused, well, that’s their ethics, they work with one person. And you need to buy the material and get your agency fees.

What to do if the required material is only available at this plant, which can quickly send it out, because it was needed yesterday and all deadlines have been missed? You need to order an analogue! So, suppliers often do this, they call or don’t even inform you and then they say that it’s impossible to buy this, but let’s do something else.

If you go online, you can easily find the material you need, and the price and timing suit you, but your supplier stubbornly cannot find it.

This only means that the supplier wants a rollback from his trusted factory and slips you what is available there. Otherwise, he needs to re-establish connections, negotiate and other risks.

Arrival of material

Let's assume that the supplier has ordered what is needed.

But the factory may send the wrong thing. From this point on, the quality control department should work and check what comes and whether it corresponds to the project. If there is no one at the site to check, then the material is unloaded at the warehouse, it can lie there for some time and when the moment of its installation comes, then the same rooster pecks at “F” and the foreman runs around and doesn’t know what to do. Or he also doesn’t give a damn and just uses this non-design or low-quality G... for work. But we got a little ahead of ourselves. When the material arrives at the warehouse, it is taken into account and, according to accounting, it begins to “hang” in the warehouse. Receipt documents – consignment note form TORG-12. If it is signed, the supplier is paid for the order and his problems end, but begin at the warehouse (if something goes wrong). There may be more than one warehouse and then all sorts of movements from one to another begin... But these are already details.

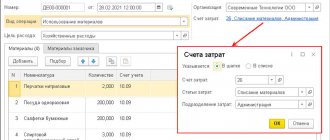

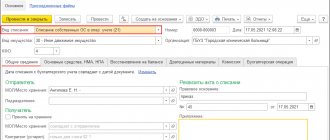

This is where the movement of materials through the papers begins. The material is in the warehouse, it must be processed by accountants or storekeepers, and put on balance in the 1C program based on incoming documents. This is where a problem can arise when the material is needed very quickly, but the accountants need to process a lot, stacks of invoices lie on the table or cabinet and are waiting in line. In short, the material is being dragged to the construction site, but the material has not yet arrived on the balance sheet (it has not been posted according to the papers)

.

What happens when material is taken from the warehouse?

We will assume that the material has been placed on balance in the warehouse. Next, the foreman comes and, upon request for receipt from the warehouse, the material is written to him (if such an application form is even established in the company)

. Another place to go. In theory, whoever ordered the material should receive it, this is ideal. Then everything is simple and clear. But in practice, he ordered one, takes another and begins... The material was taken in the wrong place and the wrong one.

If, nevertheless, the material was taken in the required quantity and there, then the following movement should occur - the material should be moved from the warehouse (signed off) to the materially responsible person (MRP). This person (master, foreman) must have a MOL agreement. Naturally, here, too, if the material has not been put on balance at the warehouse, then it cannot be sent to the MOL, but then they complained to the director there or the chief engineer, he calls the warehouse manager, curses at him, and he orders the storekeeper to give the material to the person behind him came.

If this is done, then serious problems begin already at the warehouse, not a single MOL wants to take on the materials, the less it takes, the less money can hang on it, the less it needs to monitor these materials, go check, security is there, hemorrhoids in short. And the less you have to write off later. Although, in this situation, materials often appear on the foreman’s balance sheet even without his signature or knowledge.

That is why the warehouse tries to transfer as much material to work as quickly as possible, to the site, so that they are no longer responsible for it, and if, God forbid, it was dragged away or broken, they would not be responsible for it either.

In addition, here you need to very carefully monitor the actions of the storekeepers, because some very cunning ones can cunningly write one quantity on the invoice, but in fact transfer less. This is often done out of ignorance or when you do not understand units of measurement. For example, according to the invoice, one piece is a package, i.e. Take one piece of electrical tape and sign for the packaging.

Therefore, you need to check everything with the waybills. Or they often blatantly hang it up like at a bazaar, when there is no time and/or desire to thoroughly count and check everything.

You also need to remember who was lent what materials, sometimes a colleague didn’t have enough for another construction site, sometimes at the same construction site on another

. In short, as a last resort, it will be possible to rewrite the material on the invoice so that this friend will write it off (if you are from the same organization).

When and what to write off?

Next comes the most interesting part: the material begins its journey with the foreman - it is taken to work and installed or used for something.

The reporting date arrives, usually the 25th of the month, the foreman considers what has been done and how much, the technical department collects forms KS-2, KS-3, KS-6a for completion (interest) and here he must write off the amounts (money) used materials in form M-29. Often the accountants did not carry out the transfer from the warehouse to the MOL, and some material was also not included in the list, and there is no need to rejoice, it will definitely appear later! Go to the warehouse, show copies of the invoices and demand that the materials be processed, so that you can show them with completion. Copies of invoices must be kept! What you didn’t use - give it to the warehouse and the invoice in the same folder.

Of course, it often happens that we spend a lot more of something than normal for objective reasons. This provides for a write-off act outside the consumption norms; a reference is made to it in M-29. Well, in all companies the attitude towards write-offs is very different. Somewhere they try to write everything off as zero and loyally accept the forms, somewhere the accounting department does not allow a pipe to pass with a difference in wall thickness of 0.5 mm. Somewhere, the accounting department generally makes write-offs without the M-29 form, and somewhere they are taken to restaurants and drunk with expensive cognac, so that Their Majesty would simply deign to at least look at the documents.

If the foreman ordered the material correctly, then it was purchased correctly by the supplier, it arrived correctly and was posted on time, it was correctly taken from the warehouse and installed there, then that’s half the battle! The material must go through the accounting department in a large circle: WAREHOUSE BALANCE – MALL – CONSTRUCTION (TORG-12 – invoice for the MOL – M-29 – write-off act).

How to write off?

I’ve often seen some comrades at construction sites simply unload materials from the estimate (Grand Estimate has such a function), in the M-29, and like, we made a form. This is crap, although if there is no way out, then sometimes things like that happen.

The fact is that M-29 is a monthly report of the MOL (foreman, foreman), and they are written off by a decommissioning act. In general, this M-29 form is not necessary, i.e. The company must approve it for itself or even change what it wants. In fact, accountants can look at this report as a hint, then make a write-off act and then post it themselves, and in this case, maybe unloading from the Grand Estimate will be enough for them.

Or they may look at the M-29 as a clear document and a step to the right or left - they simply won’t write it off. Unloading from the Grand Estimate will never give an accurate understanding of what went where and the most interesting things instead of what, because in the estimates even the main materials (not to mention consumables) may not coincide with the project by brand.

There is also the M-19, but it is often not made at all and is not used as unnecessary. They actually write off the accountant's M-15 form, and they need the M-29 as help and confirmation.

You need to write off specifically purchased materials, take them from the MOL's list and distribute them, put down the invoice numbers on which it all arrived. When you deliver it, that’s when you see the difference in the name of the materials, in the quantity. Some things get scattered, but some remain. If the foreman does not do this, then the accountant will do this work for him, but does she need it? Here you need to remember or look for where else you can write off these balances. It’s better to write it off the way it’s written in the accounting department, even if it’s written clumsily, because the girls in the accounting department don’t care about correctness at all, and they focus on how it’s written specifically in their 1C. If one letter doesn’t match, they won’t write it off. Therefore, exactly how it is there, or according to the primary accounting documents, if you don’t know how they do it in 1C.

And here is the main problem: the movement (physical) of material from the application to installation is much ahead of the accounting movement. In fact, the material can be assembled, but not put on the balance sheet, then it cannot be written off. Sometimes construction ends, and material appears like mushrooms on the warehouse balance sheet. The construction site has already been completed, all the money has been allocated, and it still comes out even after a year or two. It’s the accountants and storekeepers who find invoices that haven’t been posted, or they make reconciliations with suppliers and it turns out to be such surprises. Usually they make a memo indicating the reason “ due to the late processing of incoming documents, I ask you to accept form M-29 for execution for November...

».

Ideally, when a foreman is preparing volumes for execution, he should check whether the material that he wants to pick up with the volumes for execution is hanging on it; if not, then he needs to go along the chain and push the warehouse so that it is put on balance and then to the MOL. Well, if the foreman also left for another construction site, then the technical department usually does this for him.

It happens the other way around, the material is delivered on time, everything is assembled, you can write it off, but there is no executive!!! And you can’t apply for interest, or rather, you can submit it, but you can’t sign it. And sometimes the estimate is crooked and the KSK cannot be signed on it, only much later after adjusting the estimates, re-passing the state examination and concluding an additional agreement. In such cases, the company can introduce a system of “internal” fulfillment, when we do not take a percentage from the customer, but show what and how much we have completed in order to write off the materials so that the foreman can go on shift duty without debt or quit.

Form M-29 is needed only for our delivery and is submitted to the accounting department. This is done only for basic materials; for low-value materials (low value) one-time write-off statements are made.

How to write off a customer's delivery?

When almost the entire supply is your own, that’s one thing, you can mess up, buy the same thing several times and then write it off.

But if the delivery is from the customer, then everything is much worse. Therefore, whenever possible, all sorts of hard-to-count items, consumables and other small items are given away, and the contractor tries to supply them, because in fact it will never match the quantity of the project. The order of movement of materials and what forms are signed may be quite different for each company, but the principle is always the same. It’s about the same with customer supplied materials. Only there, instead of M-29, there is often a VPDM - a statement of processing of customer-supplied materials, which is submitted to the customer along with forms KS-2, KS-3 and KS-6a. And there, for sure, if the customer has not delivered the equipment (materials) to your company, then it is better not to pay interest this month, but to pay interest later, when everything appears. Because if you did not submit the VPDM, then (it happens) the customer does not accept this form later and may try to withdraw money from you for the cost of this equipment. Read the contract!

What happens if you don't write it off?

Material not written off can not only cause hemorrhoids for the foreman, he simply will not be able to quit. Taxes are charged on unwritten material, so everyone is interested in timely write-off. Therefore, foremen are often friends with everyone, storekeepers, bookkeepers, accountants, and constantly bring them chocolates and cognacs so that the process does not stall.

What should VET check?

In theory, for this purpose the foremen should always be checked by the technical department:

- at the stage of ordering materials (to order what you need and how much you need).

This is where there will be the most mistakes; this is where the very first quality control should begin, so that later there will be fewer rework or approvals) ; - at the stage of materials arriving at the warehouse (more of a quality control department than a technical department)

; - at the stage of receiving from the warehouse (so that they don’t take it to the wrong place, although who will stop them?)

; - at the write-off stage (so that unnecessary things are not written off, although tasks may change and you need to write off the other way around, everything that remains hanging in the warehouse)

.

Well, or they often do it themselves for the foremen, otherwise - J.

What problems with write-off may arise due to working documentation and changes?

If everything is not done according to the project, in the wrong way, then one hundred percent of F will increase tenfold. This is precisely why builders have a golden rule: “ To avoid problems , do everything according to the drawing

.” That is why a bad project, poorly designed and calculated, or a constantly changing project with a lot of changes, can be a problem both when ordering materials and subsequently with their write-off.

It often happens something like this: the work has been changed, the materials and quantities have changed, but the estimate remains the same. Accordingly, the actual work performed will correspond to the current project (work), although it is not a fact that they will not correspond to the estimate and forms KS-2, KS-3 and KS-6a, respectively, they will not correspond to your form M-29. When a project is forced to change, this is understandable, but when the foreman changes something himself, not because he can’t, but because he is lazy, then he dooms himself to a bunch of hassle: approving changes that may not be agreed upon; executive, which may not be signed; execution, which may be cut down and, finally, write-off, which may not occur due to everything previous. And of course, if the PTO does all this instead of the foreman, then he dooms not himself, but the PTO.

That is why, where the top management does not understand the entire chain, connives with the foremen, as long as they provide volumes, by the end of construction they together drive everything into such a deep well, from which it is very, very difficult and time-consuming to get out.

What else can you do with the M-29?

All my life, the report on the M-29 has been a treasure trove of money

! And competent foremen always steal from profits, not from losses. At a construction site, something is always not used, something can be used less than the percentage of consumption, or it can be replaced with something as a last resort. They simply calculate this very expense in more detail and order less, exactly as much as needed, or then they still add up to the total volume with consumption. They negotiate with the supplier so that the invoices contain more (everything is according to the norms), the difference is halved (the law!). Well, or it’s just superfluous - build yourself a dacha. It happens that foremen have excess in their warehouse from previous objects in order to cover the overexpenditure at the current one. If the foreman does not make all these notes, then he will not be able to cover all these overruns, due to defects, poor organization of work, theft, vandalism and other unpleasant things, he will not write off anything and will remain in debt. And so, of course, this is not cutting a cable or draining gasoline, here you need to move the earth.

If they give money for purchases, they simply collect receipts from stores for materials that they will not use, but which are included in the estimates, and then calmly write them off. For this you need to be friends with the VET.

Of course, if they are particularly stubborn, they may not remove 10 cm of soil so that there is less concrete, or scrap bricks into concrete, but this is to the detriment of the quality and safety of what was built.

Who should and who can write off?

This must be done by the foreman with the foreman (head of the section), then, based on the M-29 form, the accountant or technical maintenance engineer makes a write-off report.

Who is good at what, where accountants are fully involved in write-offs, somewhere a foreman and an accountant, somewhere, as it should be, a foreman-technical department-accountant. It all depends on who can do what, can, wants, and allows himself to be forced. On large construction sites, the main problem is not that the foreman has not been written off, but that there will be a lot of things hanging in the warehouse at the end of the construction. And here you can’t do without VET. It is advisable that this be a neat, painstaking girl with work experience or knowledge of accounting and 1C. You need to know the movement of materials and documents, be able to use 1C, know consumption rates or where to look for them, collect your own databases with all sorts of reference books and write-off standards.

Metal write-off

Many people do not know what KMD is - metal detailing structures. In theory, when structures are ordered from a plant according to a KM design, then the plant itself designs the KMD, as a result of which all weights are clarified and changed. They order one weight, but the KMD comes out to be more or less, the hardware (bolts, nuts and washers) is specified and this is what needs to be written off, and not what was according to the KM. Often KMD is not developed and metal is brought in as profiles, and everything is molded on site. Of course, it’s better to adjust the estimates; this can be a treasure trove of additional supplements. If the KMD is developed properly, then there will even be a type of seam with a length, broken down into assembly and factory, so that you can count the electrodes and then even pay the laboratory for checking the seams.

Why is all this necessary?

When you imagine, along with the physical movement of materials, their accounting movement, then you will understand where the blockage occurred, who needs to be pushed, or constantly invigorated, who to ask to take over the materials in order to immediately write off, etc., and to whom to bring cognac or a chocolate bar is enough.

So, if the reports on M-29 are taken from the foreman, then a mess begins, and most importantly, the very quality that everyone is chasing is deteriorating, because only money hanging on the back sheet can properly motivate the foreman to build exactly what is needed according to the project and spend everything carefully.

Author: Alexander Vasiliev

, sent to the editors of

the Telegram channel “Simply about estimates”

.

Published without adjustments with the consent of the author and permission of the channel editors. Do you have anything to add, comment, or say? Write!

Documentation of storage and movement of materials

Materials in a construction organization can be stored in closed warehouses and open areas. Regardless of the storage location, all inventories are assigned to the materially responsible person. The movement of materials between warehouses is documented with an internal movement invoice. An invoice is issued and material assets are released for construction to the foremen with the permission of the foreman. Read also the article: → “Form OS-2. Invoice for internal movement of fixed assets."

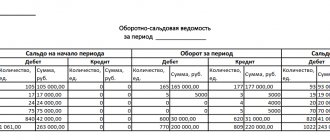

At the end of the month, storekeepers submit reports on inventory balances to the central warehouse. Based on this information, a summary report is compiled at the central warehouse with a breakdown of information about the movement of inventory by facility, which is transmitted to the accounting department. Superintendents provide monthly material reports to the accounting department, according to which materials are written off from the warehouse.

The acquisition of material resources by a construction enterprise involves the preparation of the following documents:

- purchase and sale agreements for materials;

- supplier invoices;

- certificates and other similar documents confirming the quality of purchased materials.

If, upon receipt of goods and materials, any quantitative or qualitative discrepancies with the data of primary documents are detected, or if they are received without documents, an inventory acceptance report is drawn up. Based on it, you can later file a claim with the supplier.

If materials come from the customer, then a separate contract for their supply does not need to be drawn up.

An additional agreement or annex to the contract is sufficient, which should reflect in detail the quantity, cost and timing of the transfer of inventories to the contractor. When releasing goods from the warehouse, limit and intake cards, requirements, and invoices are drawn up. When materials are issued in excess of the norms, demands or exculpatory acts are drawn up.

How to keep records of construction materials

The specificity of working with building materials is that their volume and price must be known in advance. Their cost estimate is included in the overall cost estimate at the design stage. The accounting data should include the actual price of building materials. It includes the costs incurred in the purchase and sale transaction and the amounts transferred to counterparties for the delivery of purchased values. The cost may include mandatory customs duties and funds spent on consulting services for the selection of materials. In tax accounting, the valuation of incoming materials is derived based on the total amount of expenses incurred for the purchase of specific resources.

Question: How to reflect in the accounting records of the contractor organization the receipt of construction materials and equipment from the customer for the performance of work under a construction contract, as well as the return of the equipment after completion of the work? According to the construction contract, the customer provides the construction with equipment and materials. The cost of the construction equipment provided to the contractor, indicated by the customer, is RUB 3,600,000. The cost of construction materials received from the customer for the work is 500,000 rubles. Upon completion of construction, the customer accepted from the contractor the work performed using all materials transferred by the customer. The contractual cost of accepted work does not include the cost of customer materials. There is no charge to the contractor for the use of construction equipment. View answer

NOTE! The choice of methodology for writing off building materials should be made at the stage of drawing up accounting policies.

One of the write-off methods is documented at the level of an individual enterprise:

- with reference to the cost of each unit of raw materials (relevant when using valuable resources or assets that cannot be replaced by other raw materials);

- by average cost - the total cost for a group of materials subject to write-off is displayed and divided by the number of resource units taken into account in the sample;

- FIFO method (materials are written off for construction projects in compliance with the strict chronological sequence of receipt at warehouses; the earlier the raw materials were received, the sooner they will be transferred to construction).

How to organize warehouse and accounting of building materials ?

Losses of building materials within the established standards can be shown in accounting as losses due to natural loss. The reason may be shrinkage, loss in volume due to changes in temperature during storage, leakage when pouring into another container, or accidental damage. Losses corresponding to standard indicators can be written off as expenses of the organization. If losses exceeding the limit occur, then it is necessary to identify the reasons for what happened and identify the perpetrators. Deficiencies in such a situation must be attributed to the culprit and repaid by him.

When organizing the accounting of construction materials, for each resource it is necessary to indicate its exact name and key characteristics. For example, for cement you need to register its brand, for crushed stone - its fraction, for paint - its type and color. For liquid materials, it is necessary to use a special mechanism for release into construction. If opened containers of paint, varnish or other raw materials have not yet been emptied, it is not recommended to open new cans.

BY THE WAY, the consumption rates included in the estimate documentation cannot be adjusted. Excess of planned expenses is compensated by the developer company.

Document flow system for building materials

In the tax accounting system, companies must comply with the requirement for economic and documentary justification of all expenses incurred for construction materials. All materials available to the organization must be assigned to financially responsible persons. Each case of movement of assets between objects within the same enterprise or between counterparties is recorded in the primary documentation.

If construction materials are transferred from one storage location to another warehouse, but the owner of the resources does not change, then the transaction will be recorded using an internal movement invoice. Invoices with limit-fence cards are used when sending materials to construction sites. If the approved standards for the consumption of materials are exceeded, then a demand act and supporting documentation justifying the increased need for resources are drawn up for the excess volume.

To carry out the purchase of materials, the company must complete the following set of documentation:

- purchase and sale agreement;

- invoice issued by the supplier;

- certificates, references, technical documents confirming the quality class of the acquired assets.

If, in the process of receiving building materials from the supplier, the receiving person identifies discrepancies between the actual availability and the primary data or the declared quality level does not correspond to the real one, then a materials acceptance certificate must be drawn up. Such a document may become the basis for starting claim activities.

Every month, storekeepers prepare reporting forms for the remaining construction materials stored in their warehouses. If an enterprise has several warehouse facilities, all reports are collected by the chief warehouseman, and a summary report is generated on their basis. The final document should contain an object-by-object breakdown of the balances and movements of assets.

FOR REFERENCE! In accounting, the write-off of building materials is carried out on the basis of the monthly material reports of the superintendents.

It is impractical to store some types of building materials in warehouses remote from construction sites. For such resources, open storage areas are used on the construction site. This category of materials includes sand and crushed stone. Their peculiarity is that during consumption it is impossible to accurately identify the amount of raw materials consumed and primary documentation is not drawn up for each collection of materials. For this reason, inventory checks of the remains of such building materials are carried out on the last days of each month. Inventory results help to establish and record in accounting the exact volumes of raw material consumption.

The basis for write-off may be the following forms of documents:

- raw material consumption standards approved by local regulations;

- estimates for construction projects;

- magazines of the KS-6a form;

- reports on actual costs for construction materials.

IMPORTANT! A report on the actual consumption of materials is prepared separately for each construction project.

The structure of the monthly raw material consumption report template should include two sections:

- A block displaying the regulatory need for building materials.

- Section for comparing standard consumption values with actual ones.

Accounting for losses in construction

MH losses in construction can be classified as:

- within the limits of natural loss;

- and beyond them.

Shrinkage, volatilization of particles when the storage temperature changes, leakage when pouring into containers, broken bricks, etc. are within the norms. The norms for the natural loss of materials are approved by law. Such losses are attributed to the organization's expenses.

If the shortage of building materials occurs at the expense of the financially responsible person, then it is attributed to him.

Reflection of movement on accounts

Displaying the movement of materials at the customer's location

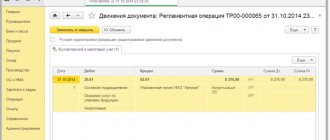

The customer may display materials at actual cost or at book price. In the first case, their movement is taken into account on account 10 (for building materials, regardless of their type, in the “Building Materials” sub-account). If materials are transferred to the contractor for processing, then at the time of transfer they are not written off from the balance sheet, but internal postings are made within the 10th account.

Upon completion of construction, the cost of these MCs will be included in the cost of the finished facility. Materials purchased by the developer not for construction purposes are accounted for in account 10 in other subaccounts.

Accounting in construction for the customer

- Construction for own needs.

If the customer builds an object for himself, then this is an investment in non-current assets, which is reflected in account 08. The customer takes into account costs on the basis of forms KS-2 and KS-3.

The customer can independently carry out some of the necessary work. For example, develop design documentation or order it from a third party. Also, the customer can buy the materials himself and ship them to the contractor on a toll basis. All these costs also increase the cost of the facility being built.

DT 08 – KT 60 – reflects the cost of work performed by the contractor

DT 08 – KT 70 (69.76, 10...) – reflects the customer’s costs associated with construction

DT 01 – KT 08 – the facility was put into operation

As part of construction, landscaping is often carried out. This type of work must be taken into account as follows:

- If improvement work is carried out before the construction project is put into operation, then the costs are reflected in the following entries:

DT 08 – KT 60 (10, 69, 70...)

- if the work is postponed until after the facility is put into operation, you need to create an expense reserve in account 96 according to the estimated cost.

DT 08 – KT 96 – reserve created

DT 96 - CT 60 (10,69,70...) - actual costs of performing work are written off at the expense of the reserve.

- Construction for investors

Often, the customer hires a contractor and organizes construction work not for himself, but for another organization - the investor. In this case, account 76 is used in accounting, on which a special sub-account “Settlements with investors” should be opened.

DT 51 – KT 76 – advance received from investor

DT 26 (25) – KT 70 (69.60...) + DT 20 – KT 26 (25) – customer costs for organizing construction

DT 08 – KT 60 (70, 69, 76, 10...) – customer costs for the construction of the facility

DT 76 – KT 08 – the object was transferred to the investor (cost excluding VAT)

DT 76 – KT 19 – transferred to the investor VAT included in the cost of the object (according to the consolidated invoice)

DT 76 – KT 90.1 – customer’s remuneration reflected

DT 90.2 – KT 20 – the customer’s own costs are taken into account.

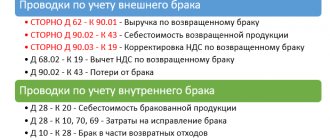

Accounting for returnable materials

During the construction of a facility, it is possible that materials may be generated that are reused. Returnable MCs are the property of the person who owns the dismantled object. The conditions for documentation and their use must be reflected in the contract .

The transfer of such materials to the owner of the dismantled object is shown on account 002 “Inventory and materials accepted for safekeeping” at the price that is reflected in the estimate or conditional valuation. If the contractor will use these material assets in the future for construction, then they must be taken into account by analogy with customer-supplied materials. When transferred into the ownership of the contractor, they must be capitalized on the terms of purchase or gratuitous receipt and valued at market value. When transferring free of charge, the cost limit for returnable MCs is set at 3,000 rubles.