To which reporting period should “carrying over” vacation pay be attributed (clause 7 of Article 255 of the Tax Code of the Russian Federation)?

Let's look at an example.

Manager Ivankov S.S., who works at , is going on vacation from 06/29/2020 to 07/26/2020. As it should be according to the norms of the Labor Code of the Russian Federation, vacation pay was paid until the employee went on vacation on June 25, 2020 in the amount of 25,000 rubles. The frequency of filing profit declarations at Clarisa LLC is quarterly. This means that 2 days of vacation pay fall in the 2nd quarter of 2022, and 26 days in the 3rd quarter. That turns out to be 26 days of “rolling over” vacation pay. To what period for profit taxation should they be classified?

In accordance with paragraph 7 of Art. 255 of the Tax Code of the Russian Federation, labor costs taken into account in the tax base include vacation pay payments in the form of average earnings. This means that vacation pay in the amount of 25,000 rubles. Ivankova S.S. should be provided for when calculating the base as part of expenses. But in what period to take them into account, the letter of the Federal Tax Service dated 03/06/15 No. 7-3-04/ [email protected]

According to these explanations, expenses in the amount of 25,000 rubles. must be taken into account during the period of their formation and payment, i.e. in the profit tax return for the 2nd quarter of 2022. According to the fiscal authority, there is no need to divide vacation pay, although the Ministry of Finance of the Russian Federation has a different opinion.

We recommend that you read the material “On the eve of summer, the Ministry of Finance spoke about how to take into account “rolling” vacations for profit .

Are annual remunerations under Article 255 of the Tax Code of the Russian Federation included in taxable expenses?

Consider the following situation.

Gloria LLC plans to provide annual rewards. What should be the company's action algorithm?

1. In accordance with paragraph 1 of Art. 324.1 of the Tax Code of the Russian Federation, Gloria LLC must establish in a document such as an accounting policy an equal method of reserving for the payment of annual remuneration, set a limit on such a reserve and the subsequent percentage of monthly deductions. To do this, an estimate is drawn up, in which the size of the annual reserve is determined, based on the ratio of the annual payroll and the percentage deduction from it to the reserve for the annual remuneration. Next, the annual reserve is broken down monthly (in the monthly amounts it is also necessary to take into account payments for insurance premiums in the amount of the annual remuneration).

Let's say that Gloria LLC has planned that labor costs in 2022 will be 7,000,000 rubles, and the percentage of reservation for annual remuneration will be 10% of them. At the same time, the amount of insurance premiums (including contributions for “injuries”) is 30.2%. This means that the estimated annual reserve limit for annual remuneration will be: 7,000,000 × 1,302 × 10% = RUB 911,400.

ATTENTION! From April 1, 2020, the organization has the right to apply reduced insurance premium rates. See here for details.

2. At the second stage, a reserve is directly formed in a monthly format for the annual remuneration. To do this, the amount of labor costs and accrued insurance premiums should be multiplied by the established monthly percentage of contributions to the reserve. The received reserve amounts should be taken into account in expenses for income tax in accordance with clause 24 of Art. 255 Tax Code of the Russian Federation.

IMPORTANT! The amount of the reserve accumulated during the year using the calculation method should not exceed the limit that was specified in the accounting policy.

Please note: compliance with the reserve limit for annual remuneration should be monitored by year. Let’s say that from January to December 2022, labor costs at LLC Gloria amounted to 6,890,000 rubles. This means that during this period a reserve was formed: 6,890,000 × 1,302 × 10% = 897,078 rubles. That is, in December the reserve will be formed in the amount of: 911,400 – 897,078 = 14,322 rubles, so as not to exceed the limit.

3. An inventory of the annual remuneration reserve should be made at 31 December 2022. This means that you need to compare the amount of the formed reserve for the year with the amount of remuneration accrued to employees, taking into account insurance premiums, and identify any shortfalls or overruns.

Voluntary payment of alimony

The responsibility of parents to support minor children is spelled out in paragraph 1 of Art.

80 IC RF. Alimony can be paid voluntarily. Moreover, both on the basis of an agreement concluded between the parents, and without it. The agreement must be in writing and certified by a notary. In this case, it has the force of a writ of execution. If the established form is not observed, the agreement is considered void.

The agreement can be changed or terminated at any time by mutual agreement of the parties, which must also be notarized. This follows from Art. 100 - 101 IC of the Russian Federation. If the agreement is presented at the place of work, the employer is obliged to withhold alimony from the salary or other income of the employee paying the alimony and transfer it to the recipient.

Payment of child support can occur voluntarily and in the absence of a notarized agreement on the payment of alimony, but only on the basis of an application from the employee with a request to withhold alimony from him.

Editor's note: at the request of the employee, it is allowed to withhold any amounts without restrictions, but only after withholding personal income tax and amounts under executive documents (Letter of Rostrud dated September 26, 2012 No. PG/7156-6-1).

Free food for employees under clause 1 of Art. 255 of the Tax Code of the Russian Federation - are these taxable expenses?

Next example.

Lira LLC organized free meals for its employees. The organization does not have a specialized canteen, but all the necessary conditions have been created in the room for meals, and food is also purchased, from which lunches are prepared by a specially hired employee. Can such expenses be included in the item “Payment”?

In order to include such expenses in the “Payment” item, you need to reflect the conditions for providing free food in employment contracts with employees. After all, in accordance with Art. 131 of the Labor Code of the Russian Federation, you have every right to partially pay wages in kind. Free meals for employees in this case will be qualified as payment of wages in kind.

In this case, the salary will consist of the accrued salary (piece rate) and the cost of organized free meals. The basis for attributing the costs of free food to wages in such a situation will be clause 1 of Art. 255 of the Tax Code of the Russian Federation, according to which such costs can include amounts accepted from the employer in accordance with various types of settlements with employees. However, according to the Ministry of Finance of the Russian Federation, it is possible to take into account the cost of free food in labor costs only on the condition that the organization keeps records of the income received by each employee, and personal income tax is withheld from the employee from the cost of food (letter of the Ministry of Finance of Russia dated January 09, 2017 No. 03 -03-06/1/80065, dated 02/11/2014 No. 03-04-05/5487).

Accounting entries for dividend payments

In accounting, dividend payments are recorded by postings on the date when the participants’ decision to pay them was made.

The recipient and the payer have accounting entries reflected in different accounts.

Accounting of transactions for recipients is documented by the date of the decision - Dt76 Kt91, and upon payment - Dt51 Kt76.

The payer's postings are indicated depending on whether the recipient has an employment relationship with the company, and whether NP or personal income tax is due.

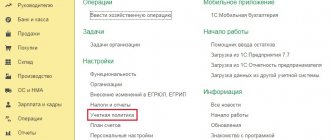

Calculation of dividends in 1C:Accounting 8

To enter information about dividends into the 1C: Accounting 8 program, a basis is required. This is the decision of the founders adopted at the general meeting or the sole decision of the sole participant.

Postings from the payer are made on different accounts based on the status of the founder:

- for a participant who is not in an employment relationship with the company - Dt84 Kt75;

- for an employee – Dt84 Kt70.

Accordingly, depending on whether the recipient works for the payer or not, the postings are also broken down.

For accrued and withheld taxes: Dt75 Kt68 - for non-working shareholders and Dt70 Kt68 - for employees.

For the listed dividends: for non-workers - Dt75 Kt51, for employees - Dt70 Kt51.

Paid taxes are indicated on Dt68 and Kt51.

How to record the accrual and payment of dividends in accounting

To reflect accruals in 1C, on the “Operations” tab, select “Accrual of dividends”, where they indicate all the information about the operation being carried out:

- date;

- name of the payer and recipient;

- accrual period;

- sum;

- necessary explanations.

To reflect the transaction in accounting, all you have to do is select “Record” and “Post”.

The payment is reflected using the same operation. To create a payment document, you must click “Create based on” and select the appropriate method: “Cash withdrawal” or “Payment order”.

How can a tax agent calculate personal income tax at a rate of 13 percent?

The rate of 13% applies to individuals – residents of Russia. The calculation of personal income tax is influenced by whether the tax agent himself received income from participation in the activities of another legal entity. If not, then the tax is calculated as dividends accrued to an individual × 13 percent.

If the tax agent received income from participation in the activities of another organization in the past or present year, then it is necessary to establish whether such income was taken into account when making payments to its founders. If yes, then personal income tax is calculated as in the first paragraph.

Otherwise, first calculate the personal income tax deduction using the formula:

Resident dividends / Total amount of dividends for all participants × Payments received by the payer

Now the tax is calculated at a rate of 13%:

(resident dividends – deduction) × 13%.

How can a tax agent calculate personal income tax at a rate of 15 percent?

The personal income tax rate of 15% is established for non-residents of the Russian Federation, unless otherwise approved by an international treaty (clause 3 of Article 224 of the Tax Code of the Russian Federation).

In this case, the tax for non-residents is calculated using the same formula as for residents of Russia, only with a corresponding coefficient of 15%.

When must a tax agent withhold and transfer personal income tax?

For each type of organizational form of a company, tax legislation establishes different terms for withholding and transferring personal income tax:

- If the payer is a joint-stock company, then personal income tax must be transferred within one month after the payment of dividends (subclause 3 of clause 9 of Article 226.1 of the Tax Code of the Russian Federation).

- If it is an LLC, then the deadline for transferring the tax is one day, not counting the day when dividends are paid (clause 6 of Article 226 of the Tax Code of the Russian Federation).

Are uniform costs included in labor costs?

Let's look at another example.

plans to buy uniforms for employees and give them to them free of charge. How to factor this into labor costs?

In paragraph 5 of Art. 255 of the Tax Code of the Russian Federation states that the cost of uniforms given to employees free of charge and remaining for their personal use can be taken into account as part of labor costs for tax purposes. But remember that in this case you will have to pay VAT on the gratuitous transfer, as well as personal income tax (since this will be considered a payment to the employee in kind) and insurance premiums. Agree that these are significant additional costs.

IMPORTANT! To account for uniform costs as part of labor costs, the following conditions must be met:

- issuing uniforms for employees once has an economic justification;

- by uniform you can determine affiliation with the company;

- the issuance of such clothing is provided for by a collective or labor agreement or other local document of the company;

- expenses for the purchase of clothing are documented.

As an alternative, we propose to use the provisions of Art. 254 of the Tax Code of the Russian Federation and try to reclassify clothing from uniform to special clothing. To do this, you need to conduct an assessment of working conditions. If it is impossible to classify clothing as special clothing, then it is worth transferring it not into ownership, but only for temporary use, in order to avoid the above-mentioned burdensome additional costs.

How much alimony is collected?

If agreement on the payment of alimony is not reached between the parents, alimony is collected by the court.

Their size is determined in paragraph 1 of Art. 81 of the RF IC: for one child – 1/4, for two children – 1/3, for three or more children – 1/2 of the earnings or other income of the parents. The size of these shares may be reduced or increased by the court, taking into account the financial or family situation of the parties and other noteworthy circumstances (clause 2). Collection of alimony for the maintenance of minor children in court can be carried out not only in shares of the earnings of the parent from whom alimony is collected, but also in a fixed sum of money.

According to paragraph 1 of Art. 83 of the RF IC, the court has the right to determine the amount of alimony collected monthly in a fixed sum of money (or simultaneously in shares and a fixed sum of money), if the parent obligated to pay alimony:

- has irregular, fluctuating earnings or other income;

- receives earnings or other income wholly or partially in kind or in foreign currency;

- has no earnings or other income;

- in other cases, when the collection of alimony in proportion to the earnings or other income of the parent is impossible, difficult or significantly violates the interests of one of the parties.

Is financial assistance for vacation an expense?

The following situation:

Igrostek LLC pays its employees financial assistance for vacation according to the applications received from them. Is it possible to take such a payment into account as part of salary costs in accordance with Art. 255 of the Tax Code of the Russian Federation?

In accordance with the provisions of paragraph 23 of Art. 270 of the Tax Code of the Russian Federation, an organization has no reason to take into account the costs of paying financial assistance to employees as part of the costs that take part in the formation of income tax. However, the Ministry of Finance of the Russian Federation spoke on this matter in a letter dated 09/02/2014 No. 03-03-06/1/43912, indicating that these expenses should be taken into account under Art. 255 of the Tax Code of the Russian Federation is prohibited only if they do not relate to the fulfillment of labor obligations. According to the department, the payment of financial assistance for vacation is precisely related to the employee’s fulfillment of work obligations. Only here you need to take into account compliance with the conditions for classifying financial assistance as labor costs:

- this type of material support must be enshrined in one of the documents: an employment or collective agreement;

- the amount of assistance depends on the amount of wages;

- payment must be interconnected with the implementation of labor discipline.

How to calculate dividends in 1C

The LLC is obliged to accrue dividends no later than 60 days after the decision on their accrual is made (Clause 3, Article 28 of Federal Law No. 14-FZ of 02/08/1998).

Dividends are income, and, therefore, they are subject to either personal income tax or income tax, regardless of the taxation system of the company that pays or receives them. The company is a tax agent and is obliged to pay taxes on dividends when they are paid.

Go to the Salaries and Personnel and enter the document Accrual of dividends for each LLC participant.

LLC participant is an individual (not an employee)

The personal income tax rate depends on the conditions:

- whether the individual is a resident - 13%; whether the recipient's income from dividends 5 million rubles. (Letters of the Federal Tax Service of the Russian Federation dated 06/22/2021 N BS-4-11/ [email protected] , Ministry of Finance of the Russian Federation dated 06/07/2021 N 03-04-05/44556) did not exceed - 13%;

- exceeded - 15%;

- is not - 15%.

More details:

- Changes to personal income tax 2022: progressive scale (from the broadcast recording dated February 26, 2022)

- 15% personal income tax has been introduced: the law has been signed

- The Federal Tax Service gave an example of how to show dividends over 5 million rubles in 6-personal income tax.

Select the founder, fill in the period for calculating dividends and their amount. Personal income tax will be calculated automatically.

How is the status of an individual determined - resident or non-resident for personal income tax purposes?

The status of an individual is set on the date of the event (dividend payment) by the user manually, depending on how many days the individual is actually in Russia for the next 12 consecutive months (clause 2 of Article 207 of the Tax Code of the Russian Federation): go to the individual’s card and go Click on the link Income Tax .

Postings

How to calculate and pay dividends to the founder - employee of an LLC

LLC participant - legal entity

The income tax rate depends on the ownership of the organization (Russian, foreign) and the volume of the share of the authorized capital:

- Russian organization: 0% - ownership share in the management company of at least 50% for 365 consecutive days;

- 13% - for other organizations.

- foreign organization:

15% except for organizations for which other rates are established, defined in clause 3 of Art. 284 Tax Code of the Russian Federation.

Draw up a document for a legal entity in the same way.

Please note that, unlike personal income tax, the amount of calculated income tax can be edited. Change it if necessary: the tax is automatically calculated based on the rate for Russian organizations - 13%.

Postings

Is it possible to include the payment of an anniversary bonus as an expense?

One more example.

One of the employees, engineer T.R. Krusov, turns 50 years old. In connection with the anniversary, the management decided to pay him a bonus for the anniversary. Is it possible to take such a payment into account as part of the taxable labor costs under Art. 255 of the Tax Code of the Russian Federation?

According to Art. 255 of the Tax Code of the Russian Federation, expenses include bonus payments that are directly related to the employee’s labor obligations and work activities. The anniversary is in no way connected with the employee’s fulfillment of his labor powers (obligations).

In Art. 252 of the Tax Code of the Russian Federation clearly states that only bonus payments for production results, achievement of target indicators and excellent work can be associated with labor obligations. An anniversary does not fit any of these formulations. Therefore, the anniversary bonus cannot be classified as a labor cost for income tax purposes.

Income tax

Payment of income tax

Read more Payment of income tax on dividends.

Postings

Income tax return

If the members of an LLC include only individuals, dividends are not reflected in the declaration.

Sheet 3 Section A of the income tax return is filled out automatically based on the document Accrual of dividends . Data on all dividends paid is indicated here, regardless of whether the founder is a legal entity or not. If dividends were paid to an employee during the reporting period, enter this data into the declaration manually.

In the breakdown of amounts, indicate data only for legal entities. Fill in the yellow fields manually.

Don't forget about Subsection 1.3 of Section 1. Fill it out according to the deadline for paying income tax on dividends.

In our example, the transfer is from 07/24/2021 to 07/26/2021, since the day following the payment is a day off.

Can gym memberships for employees be included in expenses?

Let's look at the following situation.

compensates employees for purchasing gym memberships. Can these expenses be classified as taxable labor costs in accordance with Article 255 of the Tax Code of the Russian Federation?

By compensating employees for the cost of gym memberships, the organization can spend these costs under Art. 255 of the Tax Code of the Russian Federation (wages) or under Art. 264 of the Tax Code of the Russian Federation (ensuring normal working conditions). As for accounting for such expenses as taxable expenses, there is a direct prohibition in paragraph 29 of Art. 270 of the Tax Code of the Russian Federation, which states that such expenses are not taken into account for tax purposes. The same opinion is expressed in letters of the Ministry of Finance of the Russian Federation dated December 16, 2016 No. 03-03-06/1/75464, dated December 1, 2014 No. 03-03-06/1/61234 and dated October 17, 2014 No. 03-03-06/ 1/52376.

Composition of the wage fund

The wage fund is the totality of the wage fund and all other types of personnel costs. Includes the following categories:

- premium;

- “thirteenth” salary;

- sick leave;

- vacation pay of all types;

- business trips;

- bonuses for length of service;

- amounts for time that was not actually worked, but is legally subject to payment (for example, downtime);

- additional payments for part-time work, for odd or overtime work, for dangerous or harmful working conditions, etc.;

- employee compensation;

- expenses for providing the employee with discounted or free uniforms;

- preferential working hours for employed minors;

- medical examination costs;

- social payments;

- compensation (for example, for food, travel to work, etc.)

The wage fund does not include:

- annual bonuses;

- targeted payments in favor of employees;

- bonuses paid from special funds;

- separate pension benefits;

- reimbursement of vouchers, travel, etc.;

- gifts from the company;

- dividends;

- all types of financial assistance.

Is remuneration under civil contracts included in expenses?

Liros LLC entered into a contract for commissioning of production equipment with E. N. Efremov. Is it possible to include these payments in taxable costs in accordance with Art. 255 of the Tax Code of the Russian Federation?

We turn to clause 21 of Art. 255 of the Tax Code of the Russian Federation, which states that payments to individuals who are not on the company’s staff if they perform work under contract agreements can be taken into account as part of labor costs. But at the same time the conditions of Art. 252 of the Tax Code of the Russian Federation stating that such expenses must be confirmed and that they are aimed at generating income from the organization’s business activities.

At the same time, the concluded contract must fully comply with the established norms of the Civil Code of the Russian Federation. Another significant circumstance is that all expenses included in the article “Payment” (Article 255 of the Tax Code of the Russian Federation) must imply the performance of certain work by an individual. In this case, the rental or use of machinery and equipment is excluded. If such expenses are present, then they should be included in the item “Other expenses” (Article 264 of the Tax Code of the Russian Federation).

Do additional payments up to average earnings during a business trip count as expenses?

And the last situation.

Technologist Ivashkin G.N. was sent on a business trip, and his actual earnings for this period were below average. Is it possible to make an additional payment up to the average salary of an employee and take it into account as part of the salary costs involved in taxation?

When an employee goes on a business trip, then according to Art. 167 of the Labor Code of the Russian Federation, he is guaranteed an average salary. In accordance with paragraph 25 of Art. 255 of the Tax Code of the Russian Federation, other expenses that were provided for by the organization in the labor or collective agreement are recognized as part of labor costs. Therefore, in order to make such additional payments to the employee and take them into account in taxable expenses, the employer must stipulate these payments in the employment contract with the employee, and best of all, in the collective agreement. Then there will be no problems if the actual earnings on a business trip turn out to be lower than the employee’s average earnings, and the employer decides to compensate for this difference.

ConsultantPlus has answers to certain taxpayer questions:

If you don't have access to the system, get a free trial online.

If compensation is established by law, alimony cannot be withheld from it

An employee of the Murmansk sea trade port filed a claim against the employer for the recovery of funds and compensation for moral damage.

In terms of recovery of funds, the court satisfied his demands. The reason for the claim was the illegal deduction of alimony from the amount of compensation for travel expenses to the vacation spot and back. According to the plaintiff, these actions of the employer violate his rights, since the said compensation payment does not relate to the employee’s income and compensation from which alimony can be withheld by force of law.

The port, in turn, decided to file an appeal to overturn the court decision. The appeal upheld the decision. The court justified the illegality of deduction from compensation amounts with the following arguments:

- in accordance with Part 4 of Art. 138 of the Labor Code of the Russian Federation, deductions are not allowed from payments that are not subject to foreclosure in accordance with federal law;

- the list of income from which alimony is withheld for minor children is determined by the Government of the Russian Federation;

- despite the fact that this compensation is not named in the specified list, it is indicated in another legislative document - Law of February 19, 1993 No. 4520-1 “On state guarantees and compensation for persons working and living in the regions of the Far North and equivalent areas” . Therefore, compensation is a measure of state support for citizens living in extreme climatic conditions of the north, and not income at all.

Moreover, according to Art.

325 of the Labor Code of the Russian Federation, persons working in organizations located in the regions of the Far North and equivalent areas have the right to pay once every two years at the expense of the employer the cost of travel and luggage transportation within the territory of Russia to the place of vacation use and back. This right arises for the employee simultaneously with the right to receive annual paid leave for the first year of work in this organization. Thus, the deduction of child support from the specified payment is illegal and violates the plaintiff’s rights to receive compensation for travel expenses incurred to the place of use of the vacation and back in full.

Appeal ruling of the Murmansk Regional Court dated May 20, 2015 No. 33-1457/2015.

Results

This article examined a number of topical issues regarding labor costs for tax purposes. The main conclusion arising from the presented materials is that many payments in favor of employees can be justified and taken into account under the article “Wages” as participating in taxation.

It is very important to correctly process such payments and pay special attention to documents such as labor and collective agreements, as well as other local acts of the organization. Remember that even if the norms of Art. 255 of the Tax Code of the Russian Federation allows expenses to be included in labor costs, it is worth carefully studying the conditions under which this will be legal and justified.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.