When sending any employee on a business trip, the head of the company is obliged to pay daily allowance. They are intended to pay for food, accommodation and other mandatory expenses.

Their size is regulated by federal legislation and also depends on whether the work trip takes place in Russia or other countries. The director of the company has the right to increase this payment. Insurance premiums must be paid on excess daily allowance, and these payments are certainly recorded in the official documentation of the company.

What it is

If an employee of an enterprise goes on a business trip, he receives a daily allowance. They are represented by a fixed amount of funds, which allows a citizen to provide optimal living conditions in another city or country.

The daily allowance covers the specialist’s expenses associated with his residence in the territory of another state or region of the Russian Federation.

Money is paid not only for weekdays, but also for weekends or holidays. Additionally, days that a citizen spends traveling or during forced stops along the way are paid. Attention! Daily allowances are not assigned only for one-day business trips carried out within the territory of Russia, but other rules may be recorded in the internal documentation of the company, so some specialists receive compensation for food costs even for one work trip.

According to Art. 168 of the Labor Code, organizations have the right to independently decide on the amount of daily allowance, which is enshrined in internal local acts. Typically, travel provisions are used for these purposes. Other features of the assignment of daily allowance include :

- The minimum payment amount is 700 rubles. when traveling around Russia and 2.5 thousand rubles. when traveling to other countries;

- personal income tax and insurance premiums are not paid on the minimum payments, and income tax will have to be paid on the excess;

- insurance premiums are paid in excess of the daily allowance established at the federal level;

- there are no maximum limits on these payments, so any company can increase them at its own discretion;

- The law does not contain information about the minimum duration of a business trip, but if it is a one-day trip, then company managers may not pay daily allowances, but only when traveling within the territory of the Russian Federation.

Although, according to the law, there is no need to compensate an employee’s expenses during a one-day work trip, many company managers prefer to pay specialists funds intended to pay for food, travel, etc.

It is also useful to read: What contributions is an individual entrepreneur required to make to the Pension Fund of Russia?

Are daily allowances subject to insurance contributions?

Insurance premiums are not charged on daily allowances if such daily allowances do not exceed the above limits (clause 2 of Article 422 of the Tax Code of the Russian Federation). Accordingly, daily allowances in excess of the norm are subject to insurance premiums in 2022.

In other words, when traveling within the Russian Federation for daily allowances over 700 rubles, insurance premiums will need to be calculated. And for business trips abroad, insurance premiums are calculated from daily allowances exceeding 2,500 rubles per day of business trip.

Please note that for one-day business trips, insurance premiums must be calculated from the entire amount. This is due to the fact that payments for one-day business trips cannot be recognized as daily allowances, and therefore they are not exempt from contributions (clause 11 of the Regulations, approved by Government Resolution No. 749 dated 13.10.2008, Letter of the Ministry of Finance dated 02.10.2017 No. 03- 15-06/63950).

Although, if such payments for one-day business trips are formalized not as daily allowances, but as reimbursement of expenses associated with the business trip, they will not be subject to contributions. But the expenses incurred will need to be confirmed with primary documents.

Speaking about insurance premiums up to this point, we meant contributions for compulsory health insurance, compulsory medical insurance and VNIM, paid in accordance with the requirements of the Tax Code of the Russian Federation. As for insurance premiums for injuries, daily allowances are not fully subject to them. In this case, it does not matter whether the daily allowance threshold established by the employer exceeds 700 rubles or 2,500 rubles (Clause 2 of Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ, Letter of the Social Insurance Fund of November 17, 2011 No. 14-03-11/ 08-13985).

Are travel allowances subject to payment?

Until 2016, you did not have to pay insurance premiums on daily allowances, regardless of their amount. But now accountants must transfer funds to state funds from any amount that is given to the employee during work trips and exceeds the minimum indicators.

Therefore, if, according to a collective labor agreement or other regulatory act, an employee of an enterprise receives more than 700 rubles for one day of business trip. (when traveling around Russia) or 2.5 thousand rubles. (when traveling to foreign countries), then you will have to pay insurance premiums for the excess.

Such conditions for calculating and transferring insurance premiums are similar to the rules for paying personal income tax. Therefore, accountants are required to take into account the provisions of Art. 217 NK. Contributions are not charged exclusively for daily allowances, which are paid from the Social Insurance Fund when an employee receives an industrial injury.

Daily allowance in 4-FSS: nuances

Per diem is the employee’s income received within the framework of the employment relationship. In what order are daily allowances reflected in 4-FSS in 2020?

This question requires a separate explanation. Let's start with the legal requirements for daily allowance:

We'll tell you whether to pay daily allowances on weekends.

The most common option is for the employer to set in a local act the maximum amount of daily allowance that is not subject to personal income tax (paragraph 12, paragraph 1, article 217 of the Tax Code of the Russian Federation):

- no more than 700 rub. for each day of a business trip to the Russian Federation;

- no more than 2,500 rub. for each day of a business trip abroad.

Although the company may set any other daily allowance amount.

Read more about the tax nuances of reimbursement of business travel expenses for contractor (performer) employees.

As a result, the algorithm for reflecting daily allowances in 4-FSS in 2022 is as follows:

- The amount of daily allowance is reflected in lines 1 and 2 of Table 1 of the 4-FSS calculation.

- If daily allowance is paid to an employee in an amount not exceeding that specified in the collective agreement or other local act, the amount of daily allowance will be reset to zero and contributions will not be assessed.

- If daily allowances are issued in excess of the norms established by the employer, contributions are imposed on the amount in excess of the actual daily allowance paid over the norm.

Important! Reflection of daily allowances in 4-FSS must be done in the reporting period in which they are accrued in favor of the employee in accounting, and not on the day of actual issue. This day is determined by the date of approval by the head of the advance report for the business trip.

How are business travel expenses reflected in the DAM?

If daily allowances are assigned to a person who goes on a business trip, then their issuance must be correctly recorded by the company’s accountant.

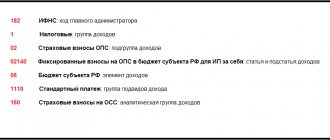

To correctly reflect daily allowances in the calculation of insurance premiums, fill in the following lines:

- in subsection 1.1 of Appendix 1 to Section 1 there is line 030, intended to reflect the total amount of daily allowance;

- the amount of payments that do not exceed the established standard values is reflected on line 040, and there is no need to pay insurance premiums or personal income tax on this amount;

- line 050 is for taxable payments;

- subsection 3.2.1 of section 3 includes on line 210 the total amount of daily allowance, which may be the norm or exceed it, and line 220 contains exclusively payments in excess of the norm, so insurance premiums must be paid from them.

Reference! If an accountant makes mistakes when filling out the DAM, which reduces the contribution base, this leads to the entire company being brought to administrative liability.

Travel expenses within the limits of the norms in the DAM using the example of 1C: ZUP

Published 08/31/2020 22:47 Author: Administrator Did you know that travel expenses must be reflected in the calculation of insurance premiums? "For what? After all, this is essentially income that is completely free of insurance premiums and personal income tax (within the norms),” you will answer in bewilderment. However, Letter of the Ministry of Finance of the Russian Federation dated March 24, 2020 No. 03-15-06/22936 states the opposite: they must be reflected in this report (despite the exemption), since they participate in determining the base for calculating contributions. In this material we will analyze how in 1C: ZUP ed. 3.1 reflect travel expenses within the limits so that they are correctly included in the calculation of insurance premiums. How the program behaves when travel expenses exceed the norms and in what reports, in addition to the DAM, they are reflected next time.

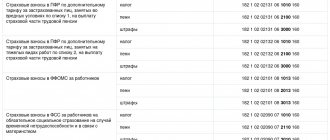

Payment of travel expenses to an employee is reflected in the calculation of insurance premiums as follows (see also letter of the Ministry of Finance of the Russian Federation dated March 24, 2020 No. 03-15-06/22936):

• according to lines 030 of subsection 1.1 and subsection 1.2 of Appendix 1 to section 1;

• according to line 020 of Appendix 2 to section 1;

• according to line 140 of subsection 3.2.1 of section 3.

These lines indicate the payment of travel expenses within and above the norm (subject to insurance contributions and personal income tax).

Next, payment of travel expenses, which is not subject to insurance contributions, must be reflected:

• according to lines 040 of subsection 1.1 and subsection 1.2 of Appendix 1 to section 1;

• according to line 030 of Appendix 2 to section 1.

Line 150 of subsection 3.2.1 of section 3 will reflect the base for calculating insurance contributions for compulsory pension insurance for the employee minus payment of travel expenses not subject to insurance contributions (line 040 of subsection 1.1 of Appendix 1 to section 1).

Travel expenses are within normal limits.

First, we need to create a new accrual and make some settings.

Step 1. Go to the “Settings” - “Accruals” section.

Step 2. Click the "Create" button.

Step 3. In the accrual card, indicate:

• name – “Travel expenses within the limits”;

• purpose and calculation procedure – “Income in kind”;

• accrual is carried out – “according to a separate document”;

• calculation and indicators “The result is output as a fixed amount.”

Step 4. Go to the “Personal Income Tax, Contributions, Accounting” tab.

Set the switch to the “Personal income tax exempt” position.

Type of income for calculating insurance premiums – “Income completely exempt from insurance premiums...”.

Step 5. “Record and close”; the “Travel expenses within the limits” accrual has been created.

Let's give a conditional example.

Employee Pastukhov A.F. sent on a business trip to the Progress equipment exhibition in Moscow on August 27-28, 2020. Hotel accommodation costs 2800 rubles. Daily allowances are paid for 2 days. During the business trip, Pastukhov A.F. you are supposed to accrue daily allowance in the amount of 1,400 rubles (700 rubles * 2 days). Total travel expenses amounted to 4,200 rubles.

Step 1. Open the “Salary” - “Income in Kind” section.

Step 2 . Create a new document - “Create” or the “Ins” button on the keyboard.

Specify the month of accrual, the date of receipt of income and select the employee “Selection”, “Add” or the “Ins” button on the keyboard. Enter the calculation result.

Step 3. Click the “More” button at the top of the document and select the “Document Movements” command. The report shows which registers the document generated movements in. Based on these records, reports are generated, including DAM reports.

Let's see how the accrual of travel expenses within the norms was reflected in the calculation of insurance premiums.

Step 1. Open the “Reporting, references” section “1C-Reporting”.

Step 2. Click “Create” and in the “Tax reporting” section select the “DAM” report - “Calculation of insurance premiums”.

Step 3. Select the report generation period using the control buttons and click “Create”.

Let's take a look at the report we created.

We see that travel expenses within the norms, as expected, are reflected in subsections 1.1 and 1.2 of Appendix 1 to Section 1 on lines 030 and 040.

In Appendix 2 to Section 1, in line 020, right-click on the “Amounts of payments and other remunerations...” cell and select “Decrypt”. In the window that opens, you can see the details of the cell and the amount of travel expenses within the limits accrued to A.F. Pastukhov.

The transcript of line 030 of Appendix 2 to Section 1 reflects the amounts not subject to insurance premiums. These include our calculation of daily allowances for employee A.F. Pastukhov.

Section 3 (line code 140) also displays the amount of travel allowance paid to the employee, and the “Base for calculating insurance premiums” cell is empty, because They are not subject to this charge.

We examined the accrual of travel expenses within the normal limits and their reflection in the calculation of insurance premiums.

Finally, I would like to warn you about possible questions from tax inspectors after sending reports about why employees have income that is not subject to insurance premiums and personal income tax. Be prepared to provide appropriate explanations.

We will talk about accrual of travel expenses above the norm in the next article.

Author of the article: Olga Kruglova

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 Dmitry 01/27/2022 18:18 Quoting Victoria:

Tell me, should I include in the RSV on line 030, 040 the calculation of the amount that the employer paid directly to the supplier by bank transfer for tickets and a hotel?

I am also interested in this question.

Answer please! Quote -1 Elena 07/08/2021 21:25 Nothing is clear. A classic example is shown, which is rare in life. In reality, it happens that 10 thousand rubles are transferred, but the employee spent more; or the tickets were purchased by the employee with his own money; or the commission didn’t take place at all, etc. Whoever came up with the idea of showing non-taxable income in the RSV, in my opinion, does not understand at all what a huge amount of work this is if there are more than 100 people.

Quote

+1 Victoria 04/20/2021 02:47 Tell me, should I include in the RSV on line 030, 040 the calculation of the amount that the employer paid directly to the supplier by bank transfer for tickets, hotel?

Quote

0 Irina Plotnikova 01/18/2021 00:28 I quote Margarita:

Tell me, should this income in kind be included in the reflection of salaries in accounting?

Margarita, good afternoon. I quote Margarita:

Tell me, should this income in kind be included in the reflection of salaries in accounting?

Margarita, good afternoon.

No, these incomes are already reflected in your advance report. If you enable their reflection in the control unit, the data will be duplicated. Quote 0 Margarita 01/14/2021 22:45 Tell me, should this income in kind be included in the reflection of salaries in accounting?

Quote

0 Galina 09/11/2020 01:59 Thank you very much for the article. Written in great detail, specifically and clearly. Everything worked out right away.

Quote

Update list of comments

JComments

Important news from the Federal Tax Service

Representatives of the tax service ask that ]in 2021[/anchor] submit updated calculations regarding the payment of insurance premiums. But this applies only to companies that did not reflect non-taxable payments during the preparation of the document. Many accountants, when preparing calculations, simply forget that they need to indicate the daily allowance.

According to Art. 217 Tax Code legally establishes limits for these payments . They do not have to pay mandatory payments, which include insurance premiums and personal income tax. Therefore, such payments do not affect the amount of contributions. But according to the calculation rules, it is necessary to indicate them when filling out the DAM. This information is included in line 040 of subsections 1.1 and 1.2, and they are also transferred to line 030 of Appendix 2 of the first section.

Representatives of the Federal Tax Service do not have the authority to impose fines on company managers, even if, when filling out the DAM, the daily allowance is not indicated or its incomplete amount is given. This is due to the fact that the taxpayer still pays the correct amount of insurance premiums, and also does not reduce the tax base.

There are no fines for employers who refuse to fill out and submit the updated calculation. But if such actions led to an underestimation of the base used when calculating the amounts, then this is grounds for bringing the employer to administrative liability.

Is it necessary to reflect daily allowances above the norm in 4FSS in 2022?

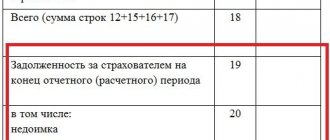

In form 4-FSS, daily allowance must be shown twice (Procedure for filling out, approved by FSS Order No. 381 dated September 26, 2016):

- as part of the amounts of payments in line 1 of table 1 “Calculation of the base for calculating insurance premiums” of form 4-FSS;

- as part of amounts not subject to insurance premiums, according to line 2 of table 1.

Excess daily allowances in 1C ZUP 8.3 must be reflected in order to account for personal income tax and insurance premiums. Today we will look at how to calculate and reflect daily allowances in the 1C 8.3 ZUP 3.1 program step by step.

For more details, see the online course “ZUP 3.1 HR and payroll accounting from A to Z”