What do shipping costs include?

The essence of TR depends on the activities of the organization. For example, a company produces equipment, machinery, raw materials, and various goods. All product units are intended for sale to customers. When concluding a contract with a buyer, it is necessary to transport products from point A to point B. This is usually the responsibility of the seller. The company can also purchase raw materials for the production of its products. Its delivery will also require funds. So, transportation costs include:

- Expenses for the delivery of purchased items (products, raw materials, fixed assets).

- Costs for delivering products to customers.

- Costs for maintaining your own vehicle fleet (this includes costs for car rental, gasoline, repairs and diagnostics of cars).

Question: Can the buyer demand that the supplier compensate for losses in the form of payment for transportation costs for the return of low-quality goods and payment for its storage at a price higher than the market price? View answer

Transport costs can be very high. In this case, they immediately attract the attention of the company’s management and tax authorities. Therefore, an accountant needs to devote time specifically to accounting for expenses related to transportation.

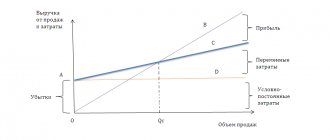

IMPORTANT! Typically, transportation costs are included in the cost of the final product. If the management team decides to reduce the cost of goods, then it makes sense to optimize transportation costs. This process is carried out based on information about expenses that can be obtained from accounting. All data is carefully analyzed, after which a decision is made to exclude certain sources of spending.

For example, an enterprise maintains its own fleet of vehicles, but the cars are used relatively rarely. However, their rare use does not exclude associated expenses. Therefore, the manager decides to disband the fleet. Delivery of products will be carried out under an agreement with a third-party company.

Question: Is a transport invoice required to confirm transport expenses in tax accounting if the buyer has entered into an agreement with a freight forwarder to deliver the goods? View answer

Transport costs for delivery to the buyer upon sale are indirect.

The Letter of the Ministry of Finance of Russia dated November 29, 2011 N 03-03-06/1/783 explains that when selling purchased goods, the costs associated with their purchase and sale must be formed on the basis of the provisions of Art. 320 Tax Code of the Russian Federation. According to this article, direct expenses can only include the costs of delivering purchased goods to the warehouse of the taxpayer - the buyer. In this case, the specified amounts of expenses should not be included in the purchase price of goods. All other expenses, including other transportation expenses (except for non-operating expenses, which are determined in accordance with the norms of Article 265 of the Tax Code of the Russian Federation), which were incurred in the current month, are considered indirect expenses and thus they must be taken into account in the current month.

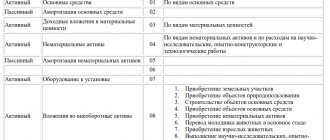

Features of accounting for transportation of fixed assets

Expenses for the delivery of fixed assets are taken into account as part of the costs of purchasing and producing products. This rule is fixed in paragraph 8 of the Accounting Rules. It concerns the following fixed assets (FPE):

- created by the enterprise;

- purchased under the relevant agreement;

- purchased under contracts that require payment other than cash;

- objects acquired free of charge (for example, under a gift agreement).

Question: Is it possible to recognize for income tax purposes expenses for transport services of third-party organizations if the taxpayer does not have waybills or are drawn up with violations (clause 1 of Article 252, clause 6 of clause 1 of Article 254 of the Tax Code of the Russian Federation)? View answer

This entire list will be taken into account as capital costs. That is, they increase the initial cost per unit of goods. The expenses in question must be reflected on the debit side of the capital investment account. Correspondence – expense accounts.

However, the listed rules are not relevant for all cases.

The costs of moving objects that do not need installation within the company's territory will be reflected in production costs.

Such objects may include vehicles, individual equipment, and construction sites. Mobile objects may include excavators, concrete mixers, etc. If equipment is moved to a construction site, its movement is associated with installation and dismantling work, expenses are taken into account in the costs of operating the equipment. Expenses will not be included in the original price.

Question: Is a transport invoice (waybill) needed to justify, for income tax purposes, expenses for transport services of third-party organizations (clause 1 of Article 252, clause 6 of clause 1 of Article 254 of the Tax Code of the Russian Federation)? View answer

Formula for calculating TRP for the remaining goods

Most companies use the methodology prescribed in Article 320 of the Tax Code of the Russian Federation. This formula for calculating TZR should apply exclusively to transportation costs. The remaining costs associated with the sale are written off in full. In this way, the company will be able to bring accounting and tax accounting at the enterprise as close as possible.

For the distribution of TZR, it would be fair to use the following calculation option:

K = (TP0 + TR1) / (T1 + T2) * 100%, where:

- K is the average percentage of transportation costs for the remaining goods at the end of the month;

- TP0 are those transportation costs that fall on the balance of unsold products at the beginning of the period;

- TP1 – transport costs incurred in the month under review;

- Т1 – purchase price of products sold in this period;

- T2 – the cost of purchasing products that remained unsold.

After which, transportation costs for the remaining goods are calculated by multiplying the indicators T2 and K.

Example. calculates transportation costs for the remaining goods. In April 2022, products were sold with a total cost of 800,000 rubles. Goods worth 200,000 rubles remained unsold. The balance of TRP at the beginning of the month was 25,000 rubles, and the total amount of TRP for April was 45,000 rubles. How to calculate the TRP for the balance in this case?

Let's use the previously given formula:

P = (25,000 + 45,000) / (800,000 + 200,000) * 100% = 7%. Therefore, transportation costs for the remainder will be: 200,000 * 0.07 = 1,400 rubles.

Moreover, the remaining expenses from last month and the expenses incurred, minus those that fall on the balance, can be written off as cost. That is, you first need to calculate the TZR for write-off: 25,000 + 45,000 – 1,400 = 68,600 rubles.

Posting examples

The company sold products worth 900,000 rubles. VAT amounted to 150,000 rubles. The purchase price of the products was 700,000 rubles (VAT – 100,000 rubles). Transportation costs are 20,000 rubles. Let's look at the main wiring:

- Purchase of products by the seller: DT19 KT60, DT68 KT19 100,000 rubles.

- Purchase of products by the buyer: DT62 KT90-1,900,000 rubles, DT90-3 KT68 150,000 rubles.

These postings are relevant when the seller contacts intermediary companies.

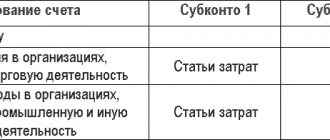

What are indirect and direct transport costs in trade

They are divided in accordance with Article 318 of the Tax Code of the Russian Federation. The former are fully and immediately reflected in the process of making expenses, the latter are included in the cost price, but can only be confirmed upon sale of the product/service.

The nature of their occurrence is clearly visible in the following table:

When talking about how to take into account transport costs in trade, you need to remember the following points:

- Direct costs must be allocated for the current month only in the case of the sale of those goods or services in the price of which they are included.

- Indirect costs are reflected in the reporting period in their entirety, regardless of the date of actual sale of the object or completion of any work.

In cases where certain types of costs are incurred with predetermined restrictions - in accordance with the goals - the base for accrual must be selected on an accrual basis. If we talk about voluntary insurance, you need to act by analyzing the terms of concluded contracts and focusing on their effective dates.

Calculation of transport costs

The rules for determining transport expenses are contained in Article 320 of the Tax Code of the Russian Federation. The amount of direct expenses related to transportation is calculated based on the average percentage for the current time. In this case, you need to take into account the balance at the beginning of the period. To carry out the necessary calculations you will need:

- Determine the amount of direct expenses for the balance of unsold products at the beginning of the month, as well as sold goods for the current period.

- Determine the cost of purchased products that were sold in the current period. It is also necessary to take into account the value of the balance of unsold objects.

- Calculate the average percentage. It represents the ratio of the amount of direct spending to the cost of production.

- Calculate the amount of expenses that will apply to the balance of unsold goods. It is the product of the average percentage and the value of the balance of objects at the end of the reporting period.

IMPORTANT! Direct expenses, which belong to the balance of unsold products, include all goods to which the enterprise has rights. These include objects that are in the process of being transported to the buyer.

Example of calculations and postings

The company has the following indicators:

- Balance at the beginning of the reporting period for transportation costs: 1000 rubles.

- Costs for transporting products from the supplier: 1,400 rubles.

- Balance at the beginning of the reporting period for goods: 4 thousand rubles.

- Cost of goods supplied: 12 thousand rubles.

- Amount of products sold: 14,000 rubles.

The balance of unsold products at the end of the reporting period will be 2 thousand rubles (4 thousand + 12 thousand – 14 thousand). There is a point in the company’s accounting policy according to which the cost of a unit of goods is formed without taking into account the costs of its acquisition. At the end of the reporting period, the accountant makes the following calculations:

- 1000 + 1,400 = 2,400 (TR balance amount).

- 14,000 + 2,000 = 16 thousand rubles (amount of goods).

- 2,400/16,000 * 100% = 15% (average percentage).

- The TR amount is 300 rubles (2 thousand * 15%).

- The size of the TR with a reduction in the tax base is 2,100 (2,400 – 300).

The postings will be as follows:

- DT 41 CT 60. Amount: 12,000 rubles.

- DT 44 CT 76. Amount: 1,400 rubles.

- DT 90.7 CT 44. Amount: 2,100 rubles.

Postings reflecting the distribution of transportation costs in accounting

In accounting, the costs of transporting goods to the place of storage (resale) can be taken into account in 2 ways:

- in the cost of goods (clause 11 of FSBU 5/2019, until 2022 - clause 6 of PBU 5/01);

- in distribution costs (clause 21 of FSBU 5/2019, until 2022 - clause 13 of PBU 5/01).

The first method will be preferable if the inclusion of transport costs in the price of the goods is provided for in the contract. In this case, tax and accounting (hereinafter referred to as TA and BU) will not need to deal with their distribution to the balance of goods. This means that there will be no difference between NU and BU transport costs. When choosing the latter option, transportation costs can be written off:

- in full in the month of their actual implementation (clause 9 of PBU 10/99);

- in the part attributable to goods sold.

The method of writing off the costs of transporting goods specified in the Guidelines for accounting of inventories is considered optimal. When using it, there will be no differences between NU and BU transport costs. But it is permissible only with a significant amount of transportation and procurement costs - more than 10% of the proceeds from the sale of goods.

In any case, the chosen option for writing off transportation costs must be recorded in the accounting policy.

Let's look at examples of postings for various options for reflecting transportation costs in accounting.

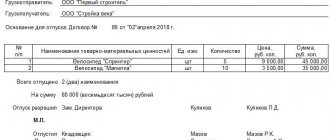

Example

To simplify the example, let’s assume that on 01.09. 41, 44 there are no remains.

During September the following operations were performed:

- goods were purchased for the amount of RUB 86,945.00. (including VAT RUB 14,490.83);

- expenses for transporting goods to the place of storage (resale) - RUB 12,642.00. (including VAT RUB 2,107);

- goods sold for the amount of RUB 92,769.00;

- the purchase price of goods sold was written off: when transport services are taken into account in the cost of goods - RUB 56,263.84;

- with separate accounting of transport services on the account. 44 - 49 121.47 rub.

| Operations | In the cost of the goods (according to the terms of the contract) | In distribution costs | |||||||

| In full | In terms of goods sold | ||||||||

| Dt | CT | Sum | Dt | CT | Sum | Dt | CT | Sum | |

| Product purchased | 41 | 60 | 72 454,17 | 41 | 60 | 72 454,17 | 41 | 60 | 72 454,17 |

| 19 | 60 | 14 490,83 | 19 | 60 | 14 490,83 | 19 | 60 | 14 490,83 | |

| The costs of transporting goods to the place of storage (sale) are reflected. | 41 | 60 | 10 535 | 44 | 60 | 10 535 | 44 | 60 | 10 535 |

| 19 | 60 | 2 107 | 19 | 60 | 2 107 | 19 | 60 | 2 107 | |

| Product sold | 62 | 90-1 | 92 769,00 | 62 | 90-1 | 92 769,00 | 62 | 90-1 | 92 769,00 |

| 90-3 | 68 | 15 461,50 | 90-3 | 68 | 15 461,50 | 90-3 | 68 | 15 461,50 | |

| The cost of purchasing goods has been written off | 90-2 | 41 | 56 263,84 | 90-2 | 41 | 49 121,47 | 90-2 | 41 | 49 121,47 |

| Transportation costs written off (according to BU data) | — | — | — | 90-2 | 44 | 10 535 | 90-2 | 44 | 7 995,30 = 10,535 – 2,539.70 (balance of transport costs - calculation below) |

| Transportation costs written off (according to NU data) | 10 535 Expenses for the delivery of goods to the place of storage (resale), included in the price of the goods under the terms of the contract, are not subject to distribution and are written off in full at the time of their implementation | 7 142,37 = 10 535 – (10 535 / (49 121,47 + 23 332,70)) × 23 332,70 | |||||||

| The difference between BU and NU in terms of transportation costs is reflected | — | — | — | 77 | 68 | 513,32 = (10,535 (BU) – 7,968.40 (NU)) × 20% | — | — | — |

| Cost of remaining goods as of September 30 | 41 | — | 26 755,33 = 72 454, 17 + 10 565 – 56 263,84 | 41 | — | 23 332,70 = 72 454,17 – 49 121,47 | 41 | — | 23 332,70 = 72 454,17 – 49 121,47 |

| Balance of transportation expenses as of September 30 | 44 | — | — | 44 | — | — | 44 | — | 2 539,70 = (10 535 / (72 454,17 + 23 332,70)) × 23 332,70 |

You can find other examples of reflecting transactions for transportation expenses in accounting in the article “What transactions are reflected in transportation expenses?”