5253

04.10.2021

What is 6-NDFL? How to fill out 6-NDFL correctly? What are the penalties when filling out 6-NDFL in 2022?

Report 6-NDFL is a form that tax agents (employers) use to inform the inspectorate about the amount and payments of personal income tax.

Personal income tax is a tax on citizens’ income in the amount of 13% (for annual earnings up to 5 million rubles) or 15% (for large amounts). The rate for non-residents is 30%, and for highly qualified foreign specialists - 13%.

In 2022, a new format for reporting documentation has been developed. According to the Order of the Federal Tax Service No. ED-7-11 / [email protected] , from the first quarter of 2022 they will report according to a new model. The annual calculation is sent along with a certificate - the previous 2-NDFL. Let's take a closer look at all the changes and figure out who should report and when.

New format 6-NDFL 2022

Sample 6-NDFL 2022 includes several parts.

- Title.

- Section No. 1 is a generalized block on the obligations of the employer.

- Section No. 2 - basic information: taxes calculated, withheld, paid.

- Appendix No. 1 - “Certificate of income and taxes.”

The title format has been changed: the line “Submission Period” is now called “Reporting Period”. The line “Tax period” has been converted to “Calendar year”. The code reflection line previously contained “reorganization (liquidation) of divisions,” now the code for “termination of authority (closure) of a division” is written. A separate code designation has been introduced - 9.

In the updated format, section 2 of the old report came first. At the beginning, the dates of sending the money and the payment amount are placed. Be careful when creating documentation. By mistake, the number of individuals is often indicated rather than income. This distorts information and entails a fine. In Sect. 1 in line 010 and in section. On line 2 105 put the budget classification code.

Help: KBK are multi-digit values for grouping sources of financing of the Russian budget.

In the 1st section. provide the dates of payment (021) and money sent to the budget (022). There is no need to enter any other information. There is a place for returned personal income tax. Indicate the amount for the previous 3 months, deciphering by date.

In the 2nd section. put the economic benefit in monetary terms, paid under contracts (112) and under civil contracts (113). Line 180 is provided for over-deducted payments.

Who submits 6-NDFL

The reports are filled out and submitted by employers - legal entities and entrepreneurs who hire staff. They calculate and withhold tax payments from the income (wages and other payments) of employees. Tax agents also include:

- notaries in private practice;

- lawyers with offices;

- divisions of foreign companies.

Filling out 6-NDFL in 2022 is required when individuals work under a contract, provide movable and immovable property for use, or receive mat. assistance and other benefits in cash and in kind.

Do I need to submit 6-NDFL if there were no accruals?

According to Art. 226 of the Tax Code of the Russian Federation, all legal entities and self-employed persons paying income to individuals are agents for personal income tax (NDFL). The responsibilities of agents include calculation, withholding of personal income tax when paying income to an individual and transferring it to the budget.

Agents are required to keep records of accrued and paid income to “physicists”, as well as the amounts of calculated, withheld and transferred personal income tax (Article 230 of the Tax Code of the Russian Federation). At the end of each quarter, the tax agent is required to report to the Federal Tax Service on the “work done” by submitting a report in Form 6-NDFL.

But since the organization or individual entrepreneur did not accrue or issue money to individuals, then they do not have the status of a tax agent, and they do not need to submit the 6-NDFL calculation, including zero, to the inspectorate.

Tax authorities can block a company's current account if they do not receive a payment in form 6-NDFL (Clause 3.2 of Article 76 of the Tax Code). After all, they will not have information whether the employer is a tax agent or simply forgot to submit the calculation, so it is safer to warn them in advance. This can be done by sending a letter.

Let's look at how to arrange it.

Do I need to submit a zero report?

If there are no payments to employees, there is no income subject to taxation. Submitting 6-NDFL to the Federal Tax Service with zero indicators is not required. But it’s better to play it safe and fill it out anyway: this will avoid a situation in which the tax authorities decide that you did not submit the information on time. Instead of reporting, it is allowed to send a letter indicating that you are not acting as an agent during this period. Then the Federal Tax Service will not wait for the report and will not block the account.

For reference: In 2022, the Federal Tax Service can block bank accounts only if the deadline for submitting reports is exceeded by 20 days.

If payments were made to individuals in the past period of this year, the obligation to submit a new 6-NDFL remains. An example is presented in the letter of the Federal Tax Service No. BS-4-11 / [email protected] The reason for maintaining the obligation to fill out the report is recording on an accrual basis.

Do I need a sample for filling out a zero report?

As we have already found out, you do not need to submit zero 6-NDFL reporting, so you do not need a sample for filling it out. A sample is needed to fill out a report with numbers. You can find the latest one here. And we want to remind you of the rules for filling out 6-NDFL.

So, section 1 shows the data from the last quarter of the reporting period:

- in specific figures, if payments and tax accrued on them take place;

- putting a zero instead of a digital value if there is no information about payments and tax accruals for these payments.

How to correctly fill out section 2 in the 6-NDFL calculation, read here.

Section 2 is filled in with data that includes values corresponding to the entire reporting period. At the same time they:

- will coincide with the data in section 1 for the first payment period, including if this period did not occur at the beginning of the year;

- will remain the same as in the previous reporting period if there were no payments in the last quarter of the reporting period.

Read about common errors in filling out 6-NDFL in the publication “Errors in 6-NDFL (full list).”

We’ll tell you how to correctly correct errors in 6-NDFL here.

Deadlines for submitting 6-NDFL in 2022

| Last date of submission | Reporting period |

| March 1 | 2020 (old format) |

| April 30 | 6-NDFL for the 1st quarter of 2022 (updated format) |

| July 30 | half year |

| Nov. 1 | 9 months |

| March 1, 2022 | 6-NDFL for 2022 + Appendix No. 1 |

Reporting period - quarter. The deadlines are the same for those reporting on paper and electronically. Legal entities send information to the inspectorate at the location of the business, entrepreneurs - upon registration. If separate divisions operate, then reports are submitted for each.

Should I submit 6-NDFL zero if there are no employees?

You wanted to know how to fill out the zero 6-NDFL, and the request “6-NDFL zero sample filling” in a search engine led you to this material.

So let's figure out whether the zero 6-NDFL, a sample of which you are looking for, is submitted, or in this situation you can do without submitting a report. 6-NDFL is the reporting of a tax agent, which:

- It is compiled quarterly and includes data on an accrual basis. Moreover, section 2 in 6-NDFL forms data for the period from the beginning of the year, and section 1 - only data from the last quarter of the reporting period.

- Contains generalized figures of accruals in relation to employee income and related personal income tax.

Note! As of reporting for the 1st quarter of 2022, a new report form 6-NDFL, approved. by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected] Now it includes information from form 2-NDFL. 2-NDFL certificates, as an independent report, have been cancelled. In addition, the annual calculation of 6-NDFL has been adjusted. It is drawn up on the form as amended by the order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11/ [email protected] Read more about this in our article.

ConsultantPlus experts sorted out the rules for filling out the new form for 2022. Sign up for trial demo access to the K+ system and get free expert explanations.

Read more about the form in this section.

It must be submitted by employers who have hired workers to whom they pay income (clause 2 of Article 230 of the Tax Code of the Russian Federation). Thus, the obligation to submit 6-NDFL in the absence of payment of income to individuals (and, accordingly, in the absence of tax on them) during the reporting period does not arise for the employer.

Therefore, form 6-NDFL with zero indicators does not need to be submitted to the Federal Tax Service. Although, if such a report is sent, the inspection will be obliged to accept it (letter of the Federal Tax Service of Russia dated May 4, 2016 No. BS-4-11/7928). To avoid questions from tax authorities, it is advisable to send them a letter explaining the reasons for not submitting this report.

You will find our recommendations for drawing up such a letter and its sample in the material “Filling out an explanation to the tax office for 6-NDFL - sample.”

What income is reflected in 6-NDFL

The report indicates the receipts from which personal income tax is withheld. Partially taxable income is included. These include rewards, assistance, gifts, and benefits. Non-taxable minimum - 4,000 rubles per year. Any amount over the limit is subject to tax.

The calculation does not indicate:

- payments that are not subject to tax in any case. These are state benefits, compensation for harm, compensation for unfulfilled vacations and other things specified in Art. 217 Tax Code of the Russian Federation;

- income of entrepreneurs and other persons working for themselves and independently calculating taxes;

- receipts, rewards, winnings specified in clause 1 of Art. 228 Tax Code of the Russian Federation;

- income in the Russian Federation received by foreigners, but not taxed according to international treaties.

Where to submit 6-NDFL calculations for organizations and individual entrepreneurs

6-NDFL calculations are submitted to the tax office at the place of registration of the tax agent (clause 2 of Article 230 of the Tax Code of the Russian Federation). The organization is “rented” at its location, the entrepreneur - at the place of residence (Clause 1, Article 83, Article 11 of the Tax Code of the Russian Federation).

However, depending on the status of the organization or individual entrepreneur (or source of income), the procedure for submitting 6-NDFL may be different. Details are presented in the table:

| Who receives income and where? | Where to submit 6-NDFL |

| Head office employees | To the inspectorate at the location of the head office |

| Employees of separate departments | Inspectorate for the location of units. Form 6-NDFL is drawn up for each separate division, even if they are registered with the same inspectorate. If the “separate division” was liquidated (closed), provide at the place of its registration the calculation for the last tax period: for the period of time from the beginning of the year until the day the liquidation (closure) of the separate division was completed |

| Employees simultaneously receive income at the head office and in separate divisions: | |

| – based on income for time worked at the head office | To the inspectorate at the location of the organization’s head office (indicate its checkpoint and OKTMO) |

| – based on income for time worked in separate units | To the inspectorate at the location of each separate unit (indicate the checkpoint and OKTMO of the corresponding unit) |

| Employees of “separate units” receive income in units that are located in the same municipality, but in the territories of different tax inspectorates | To the inspectorate where the units are registered. A separate calculation is filled out for each department |

| Employees of the largest taxpayers, including separate divisions | In the Federal Tax Service in the same order as “regular” organizations |

| Employees of the entrepreneur on UTII or PSN | To the inspectorate at the place where the entrepreneur operates UTII or PSN. If the activity in the special mode is terminated, the calculation is submitted for the period from the beginning of the year until the day the business ceases |

| Employees of an entrepreneur who combines UTII and simplified tax system | For employees engaged in activities on UTII - to the inspectorate at the place of such activity. For employees engaged in activities on the simplified tax system - to the inspectorate at the place of residence of the entrepreneur |

How to fill out 6-NDFL: instructions

1. Title page

Fill out in the same way as the old form. Only the names of a few lines have changed; code “9” has been introduced for closed and no longer authorized OPs.

2. Section 1

010: KBK. 020: tax deducted from all personnel for the past three months. 021: date of payment of tax payments. 022: final tax to be sent before the due date from line 021.

Test yourself:

Compare the numbers on lines 020 and 022 - the amounts should be equal. You can similarly check the returned personal income tax (030 and 032).

030: returned personal income tax for the previous three months. 031: return execution date. 032: Tax amount refunded to taxpayers.

In the new 6-NDFL, the dates of actual income and withholding payments are not written. Previously, these indicators caused confusion. Now filling out reports has become easier.

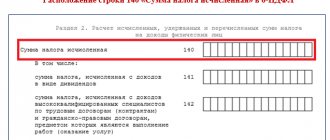

3. Section 2

100: tax rate.

Be careful! If you calculate personal income tax at several rates, then for each you need to create its own section.

105: digital budget classification code. 110: combined income of all personnel from the beginning of the reporting year. 111: total dividend amount. 112: income from concluded employment contracts. 113: income from concluded civil contracts.

Test yourself:

the reporting is completed correctly if the added sums 111 - 113 equal the value of 110.

120: number of recipients of payments at different tax rates. 130: the total amount of deductions generated from the beginning of the year. 140: total calculated tax since the beginning of the reporting year. 141: tax on dividends. 150: Added sum of advances, reducing tax (140). 160: added tax withheld from the beginning of the year. 170: taxes not yet withheld by the employer. 180: the total amount of taxes that the employer over-withheld. 190: folded amount of tax refund (Article 231 of the Tax Code of the Russian Federation).

4. Appendix No. 1

The certificate is provided only with the annual report. For the first time it will be filled out by agents for 2022, submitted to the Federal Tax Service by the end of March 2022. The document consists of four sections:

- Information about individuals. You must indicate your full name, tax identification number, date of birth, and passport details. In the “Status” line, enter code 1 - these are residents and citizens of the Russian Federation, 2 - non-residents, 3 - highly qualified foreign specialists.

- Total amounts of payments and calculated tax for the reporting period. For each bet, its own second section is formed. The total amount of income before deduction, taxes calculated, withheld from salary and paid to the budget are also indicated. Excessively (erroneously) withheld payments, if any, are indicated separately.

- This section includes the deductions provided. The amounts are entered along with the codes.

- Income on which tax has not yet been withheld, and the calculated tax, indicating the rate.

If corrections need to be made, the corrective Calculation is submitted without a certificate. If it is necessary to change the data in Appendix No. 1, a complete Calculation and certificate is sent to the tax office.

Important clarifications!

Cells are not left empty. If they are not filled in, a dash is added. Lines 110 and 112 do not take into account the December salary; the payment takes place in January. The 1st section shows the amount and date of personal income tax payment, the 2nd section shows the withheld tax.

How to fill out a blank form

The format and procedure for filling out 6-NDFL are contained in the appendices to the order of the Federal Tax Service dated October 14, 2015 N MMV-7-11/ (hereinafter referred to as order No. 450).

In this case, we can talk about complete filling only for the title page. Data in this section of the report is entered regardless of whether its “main” part contains any information or not.

- Identification tax codes - INN and KPP (the latter is only for legal entities).

- The correction number has the format “000”, “001”, “002”, etc. It shows whether changes have been made to the report and, if so, how many times.

- The delivery period is reflected in two fields: year (2018) and reporting period. It is selected from Appendix 1 to Order No. 450, for 9 months - “33”

- Federal Tax Service code.

- Location code (Appendix 2 to Order No. 450). This indicator allows you to determine the reason for submitting the report to this particular tax office. For a Russian legal entity, code 214 is used.

- Name (full name) of the tax agent. The company name must be abbreviated, and the full name, on the contrary, must be indicated without abbreviations.

- The code of the reorganization form (from Appendix 4 to Order No. 450) and the TIN/KPP of the reorganized organization is used only by the legal successor submitting the form for the reorganized company.

- The OKTMO code can show the place of residence, registration, business, etc. It must be “linked” to the location code.

- Contact number. Usually indicate the contact details of the person responsible for preparing the form.

- Number of report sheets and supporting documents (if any).

- Full name, signature of the responsible person and date of filling out the form. If the report is submitted by proxy, then you must also indicate its details.

- Information about receipt of the report is filled out by the tax inspector.

Sections 1 and 2 of the form in this case do not contain significant information.

The data in them can be classified into two categories - numerical and temporary (i.e. dates of payments, tax transfers, etc.)

In the “numeric” fields you need to enter zeros and dashes (clauses 1.8, 1.9 of the Procedure), and the “temporary” fields must be filled in in the format “00.00.0000” (letter of the Federal Tax Service of Russia dated April 25, 2016 No. 11-2-06/).

Analysis of difficult situations

Dividends in 6-NDFL.

The profit received from a business entity by a citizen is reflected in the column “Amount of Income” in the certificate appendix to 6-NDFL. Enter the code appropriate for the payment - 1010. The deduction column is not filled in and remains empty. More details in Letter of the Federal Tax Service No. BS-4-11/4999.

Progressive rate.

Section 1 shows the amount of withholding and tax payment dates. In the 2nd section. enter information about the income of individuals from the beginning of the year when making payments for each bet separately. Federal Tax Service Order No. ED-7-11/ [email protected]

Phys. the person has lost his resident status.

In this case, it is necessary to recalculate the entire personal income tax at a rate of 30%. Previously withheld amounts of 13% and 15% count toward the new rate. In the 2nd section, the amounts are indicated at a 30% rate. There is no need to submit an adjustment.

What rewards are not displayed.

In 6-NDFL we fill in only those amounts from which personal income tax was withheld. There is no need to show payments that do not affect the amount of tax. For example paid:

- under agreements concluded with entrepreneurs and self-employed;

- for property purchased from individuals (except for transactions with securities).

This is due to the fact that in these cases, individuals themselves report to the Federal Tax Service on the income received.

Sick leave and recalculated vacation pay.

In 6-NDFL, sickness benefits are reflected only if paid. If an additional payment is made for vacation pay, then in the 2nd section the total amounts are shown, including additional payments. The filling procedure is similar to regular vacation pay. The amount is reflected in the period in which the additional payment was made.

Do I need to submit zero 6-NDFL?

The need to submit zero for 6-NDFL depends on the specific situation:

- Individual entrepreneurs do not have employees to whom income is paid.

In this case, you do not need to submit 6-NDFL, nor do you need to send an explanatory note to the Federal Tax Service. This is due to the fact that individual entrepreneurs without employees are not tax agents and do not pay personal income tax. And since they did not submit this report earlier, there is nothing to warn the tax office about.

- For 9 months, the employee was paid income, but he did not receive it for the entire 4th quarter.

The report must be submitted, since the data in it is reflected on an accrual basis from the beginning of the year. In this case, only the Title Page and Section 1 are completed.

- The employee's income was paid only in the first quarter, and he did not receive it again until the end of the year.

6-NDFL will have to be submitted throughout the year: at the end of each quarter. In the report for the 1st quarter, you need to fill out the title page, sections 1 and 2, and in the remaining reports - only the title page and Section 1.

- Revenue was paid in the second quarter. The employee did not receive any payments either before or after it.

If an employee received income, for example, dividends only in the 2nd quarter, then there is no need to submit a report for the 1st quarter, but starting from the 2nd quarter until the end of the year, it is necessary (Letter of the Ministry of Finance of the Russian Federation dated March 23, 2016 No. BS-4-11 / [ email protected] ).

- Over the past year, the employee received income, but at the beginning of the new year he went on unpaid leave, and no income was paid to him.

In this case, you are not required to submit 6-NDFL, but the tax authorities may think that you forgot to submit the report and will block your account until the circumstances are clarified.

Therefore, it is advisable to send an explanatory letter to the Federal Tax Service, in which you need to explain that the report was not sent legally, since the employee was not paid income in the 1st quarter.

You can, of course, pass the 6-personal income tax zero, but there’s not much point in that. However, if you still decide to submit a zero report, the Federal Tax Service will be obliged to accept it (Letters of the Federal Tax Service of the Russian Federation dated November 16, 2018 No. BS-4-21/ [email protected] , dated May 4, 2016 No. BS-4-11/ [email protected] ] ).

Fill out the 6-NDFL adjustment form

The “clarification” is filled out if the report was submitted, but the accountant found errors or some of the information was not reflected. The Adjustment Calculation is also submitted when recalculating the tax for the previous year. Use a report format that is relevant for the period that needs adjustment. The “updated form” for the new 6-NDFL is filled out according to the following rules:

- In the “Adjustment number” field, enter “1” if corrections are made for the first time, “2” - when resubmitting, and then in order.

- Where incorrect numbers were indicated, put the correct ones, the rest are indicated as before.

- If there is an inaccuracy in the checkpoint or OKTMO, two calculations are submitted: in the first, the number “0” is entered with the correct numbers, the remaining terms are written off from the primary document. In the second “clarification” they put the number “1”, registering erroneous details, in the remaining sections they put zeros.

Fines according to the 6-NDFL report

Late submission of report

will entail a fine of 1,000 rubles for a full and partial month. The countdown starts from the first day of delay, but as a rule, the tax authorities impose a fine within the first 10 days. If the reporting is not provided, the Federal Tax Service may “freeze” current accounts. Legal entities may receive an additional sanction - a fine of 500 rubles to the official responsible for submitting reports.

Mistakes made

will also entail a penalty of 500 rubles for one “damaged” document. If you file a corrective report before the inspector discovers the error, there will be no penalty. Since 2022, a rule has been introduced - no fines for errors that do not affect the amount of tax and do not violate the rights of individuals.

Incorrect type of report submission.

Reports can be submitted on paper and in electronic format. But only legal entities and individual entrepreneurs with less than 10 employees can independently choose the method of sending the report. Others are required to complete documentation digitally. An electronic signature will be required to submit. If you fill out 6-NDFL in 2022 on paper, and not electronically, as required by law, you will be fined 200 rubles.

Get rid of routine work by outsourcing your accounting to our company. Reports will be submitted on time and without errors. You can get professional advice from our experts. Moreover, we plan the tax burden and introduce legal ways to reduce taxes. Working with us is more profitable than having an accountant on staff.

What to write in a letter about the absence of a tax agent’s obligation to submit 6-NDFL

The letter is written in free form:

sample letter to the Federal Tax Service about the absence of the tax agent’s obligation to submit 6-NDFL calculations.

The letter must be submitted to the Federal Tax Service before the deadline for submitting the report. For reporting for 2022, this is 04/01/2019.

Read about the deadlines for submitting 6-NDFL in 2022 here.

You can submit a letter:

- In person or through a representative acting on the basis of a power of attorney. Be sure to submit 2 copies of the letter to the Federal Tax Service, on one of which ask for a stamp indicating acceptance of the document and the date of receipt, as well as the name of the receiving inspector. In case of claims, this will allow you to prove that the letter was submitted on time.

- By mail.

- Via telecommunication channels.

On its own initiative, an organization or individual entrepreneur can submit a zero calculation, and inspectors are obliged to accept it (paragraph 3, paragraph 2, article 230 of the Tax Code of the Russian Federation, letters of the Federal Tax Service dated 08/01/2016 No. BS-4-11/13984, dated 03/23/2016 No. BS -4-11/4901, dated 05/04/2016 No. BS-4-11/7928).

Let's look at how to fill out the “zero” correctly.