In what cases does Article 100 of the Tax Code of the Russian Federation oblige tax authorities to draw up an audit report?

The report is always the result of an on-site tax audit (VNA) and is drawn up regardless of whether violations are found or not (see letter of the Federal Tax Service of Russia dated April 16, 2009 No. ШТ-22-2/299).

Based on the results of a desk tax audit (CTA), an act is drawn up only if during the audit, violations of the legislation on taxes and fees were identified.

If the outcome of the CNI is positive, the inspectorate is not obliged to inform the taxpayer about its completion (letter of the Federal Tax Service of Russia for Moscow dated May 21, 2009 No. 20-14/4/051403). An exception is checking the VAT return using the application procedure for tax refund. The inspection must report its completion without violations within 7 days after completion (Clause 12, Article 176.1 of the Tax Code of the Russian Federation).

For more information about the application procedure for refund, read the article “Features and terms for the general and application procedure for VAT refund.”

Acts of the tax authority

The tax authority accompanies the results of certain actions (tax audits, detection of tax violations) by issuing a report, which is handed to the taxpayer.

| Type of tax control | Presentation of results (note) | Deadlines for processing tax control results |

| Desk tax audit (CTA) | Tax audit report (drawed up only if inspectors identify violations - clause 5 of Article 88 of the Tax Code of the Russian Federation )* | 10 working days from the date of completion of the inspection ( paragraph 2, paragraph 1, article 100 of the Tax Code of the Russian Federation ) |

| On-site tax audit (VNP) | Tax audit report (drawn up regardless of the results of the audit) | Two months from the date of drawing up a certificate of on-site tax audit ( paragraph 1, clause 1, article 100 of the Tax Code of the Russian Federation ). |

| Detection of facts indicating violations of the legislation on taxes and fees, responsibility for which is established by the Tax Code of the Russian Federation** | Act on the discovery of facts indicating tax violations*** | 10 days from the date of detection of the specified violation ( clause 1 of article 101.4 of the Tax Code of the Russian Federation ) |

* The act is handed over to the person being inspected against signature or sent by registered mail within five working days from the date of drawing up the act ( clause 1, clause 3 , clause 5, article 100 of the Tax Code of the Russian Federation ). As a rule, along with the act, a notice of the time and place of consideration of the tax audit materials is given.

** With the exception of tax offenses, cases of detection of which are considered in the manner established by Art. 101 of the Tax Code of the Russian Federation ( clause 1 of article 101.4 ).

*** The act is handed over to the person who committed the tax offense against signature or transmitted in another way indicating the date of its receipt. If the specified person evades receiving the act, the tax authority official makes a corresponding note in the act ( clause 1 of article 101.4 of the Tax Code of the Russian Federation ) and the act is sent to this person by registered mail ( clause 4 of article 101.4 ). The date of delivery of the act sent by registered mail is considered to be the sixth day counting from the date of its dispatch.

If the KNP act has not been drawn up, how can you find out about its completion?

If 3 months have passed from the date of filing the declaration, and the inspection has not asked you for documents or explanations, or demanded that you make corrections to the reporting, consider that the desk audit ended successfully.

If you need accurate information, contact the Federal Tax Service with a request to inform you about the results of the KNI. The fact that tax officials do not have this obligation does not give them the right to ignore the taxpayer’s request (see, for example, Resolution of the Federal Antimonopoly Service of the Volga District dated February 18, 2009 No. A55-10190/2008).

Within what time frame must the inspection department draw up and submit an inspection report?

The inspectorate must prepare an on-site inspection report within 2 months from the date of drawing up the certificate of the inspection, and if a consolidated group of taxpayers was inspected, within 3 months.

For drawing up a desk inspection report, Art. 100 of the Tax Code of the Russian Federation allocates 10 days from the date of completion of the CNI.

The inspectors must hand over the report to the taxpayer within 5 days from the date of preparation.

ConsultantPlus experts spoke about the consequences of failure to deliver a tax audit report. If you don't have access to the system, get a free trial online.

SUBMITTING OBJECTIONS TO TAX INSPECTION ACTS

Information from the Federal Tax Service

Within one month from the date of receipt of the act in case of disagreement with the facts stated:

— In the tax audit report (clause 6 of Article 100 of the Tax Code of the Russian Federation),

— In the act on the discovery of facts indicating tax offenses (clause 5 of Article 101.4 of the Tax Code of the Russian Federation)

You can submit written objections to the specified act as a whole or to its individual provisions.

Within 10 days from the date of expiration of the period for additional tax control measures, you can submit written objections to the results of additional tax control measures in whole or in part (clause 6.1 of Article 101 of the Tax Code of the Russian Federation).

Objections are a written appeal to the tax authority expressing disagreement with the tax audit report (clause 6 of Article 100 of the Tax Code of the Russian Federation), the results of additional tax control measures (clause 6.1 of Article 101 of the Tax Code of the Russian Federation) or the act of discovering facts indicating tax offenses (clause 5 of article 101.4 of the Tax Code of the Russian Federation). When appearing for consideration of the act, as well as the results of additional tax control measures, you can give oral explanations, as well as submit supporting documents.

Methods for filing objections

— To the office of the tax authority or the window for receiving documents from the tax authority

- By mail

Objection options

— Personally

— Through a representative

Representatives (Chapter 4, Article 27, 29 of the Tax Code of the Russian Federation)

Legal representatives

- these are representatives of the organization by law or on the basis of constituent documents (clause 1 of article 27 of the Tax Code of the Russian Federation)

- these are representatives of an individual in accordance with civil legislation (clause 2 of article 27 of the Tax Code of the Russian Federation).

Authorized representatives

- these are representatives acting on the basis of a power of attorney (Article 29 of the Tax Code of the Russian Federation).

Procedure for filing objections to tax audit reports

Cases of filing objections

Within one month from the date of receipt of the act in case of disagreement with the facts stated:

- in the tax audit report (clause 6 of Article 100 of the Tax Code of the Russian Federation),

- in the act of discovery of facts indicating tax offenses (clause 5 of Article 101.4 of the Tax Code of the Russian Federation)

You can submit written objections to the specified act as a whole or to their individual provisions.

Objections are a written appeal to the tax authority expressing disagreement with the tax audit report (clause 6 of Article 100 of the Tax Code of the Russian Federation) or the act of discovery of facts indicating tax violations (clause 5 of Article 101.4 of the Tax Code of the Russian Federation).

Who to address objections to

Objections are sent to the tax authority that drew up the act.

You can find out the number, address and details of your tax office using the service: “Address and payment details of your tax office”

Methods for filing objections

— To the office of the tax authority or the window for receiving documents from the tax authority

- By mail

Objection options

— Personally

— Through a representative

Representatives (Chapter 4, Article 27, 29 of the Tax Code of the Russian Federation)

Legal representatives

- these are representatives of the organization by law or on the basis of constituent documents (clause 1 of article 27 of the Tax Code of the Russian Federation)

- these are representatives of an individual in accordance with civil legislation (clause 2 of article 27 of the Tax Code of the Russian Federation).

Authorized representatives

- these are representatives acting on the basis of a power of attorney (Article 29 of the Tax Code of the Russian Federation).

Consideration of objections

Before considering the tax audit materials, the head (deputy head) of the tax authority checks the appearance of the person in respect of whom the report has been drawn up.

If the person appears, the head (deputy head) of the tax authority considers the tax audit materials (or case materials) and the person’s objections (if any).

If a person fails to appear, the head (deputy head) of the tax authority determines whether the person has been notified of the date, time and place of consideration of the tax audit materials.

Upon proper notice:

— if the presence of a person is recognized as mandatory, a decision is made to postpone the consideration of the tax audit materials;

— if the presence of a person is not recognized as mandatory, a decision is made to consider tax control materials in the absence of the specified person.

In case of inadequate notification, a decision is made to postpone consideration of the tax audit materials.

When appearing for consideration of the act, you can give oral explanations, as well as submit supporting documents.

Before considering the materials of a tax audit on the merits, the head (deputy head) of the tax authority must (clause 3 of Article 101 of the Tax Code of the Russian Federation):

— announce who is considering the case and which tax audit materials are subject to review;

— establish the fact of attendance of persons invited to participate in the consideration;

— in the case of the participation of a representative of the person in respect of whom the tax audit was carried out, check the powers of this representative;

— explain to persons participating in the review procedure their rights and obligations (Articles 21, 23 of the Tax Code of the Russian Federation);

— make a decision to postpone the consideration of tax audit materials in the event of failure to appear by a person whose participation is necessary for the consideration.

Based on the results of consideration of the tax audit materials, the head (deputy head) of the tax authority makes one of the following decisions:

— decision to carry out additional tax control measures (clause 6 of Article 101 of the Tax Code of the Russian Federation);

— on bringing to responsibility for committing a tax offense (clause 7 of Article 101 of the Tax Code of the Russian Federation);

— on the refusal to bring to justice for committing a tax offense (clause 7 of Article 101 of the Tax Code of the Russian Federation);

— on bringing a person to justice for a tax offense (clause 8 of Article 101.4 of the Tax Code of the Russian Federation);

— on the refusal to hold a person accountable for a tax offense (clause 8 of Article 101.4 of the Tax Code of the Russian Federation).

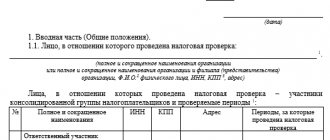

Approximate form

Name of the tax authority that compiled

act, and its address

_____________________________________________

Name of the person filing the objection

TIN (if available), address of its place

location (place of his residence)

OBJECTIONS

according to the tax audit report

from "__" _____________ 20__ N _______

_______________________________________ in a relationship __________________

Name of the tax authority name of the person

___________________________________________________________________________

in respect of which a tax audit was carried out

______________________________ tax audit was carried out, based on the results

(office, offsite)

which drew up the tax audit report dated __ _________ 20__ N ___.

The taxpayer does not agree with the facts stated in the tax report

inspection, as well as with the conclusions and proposals of the inspectors, in connection with which the

based on paragraph 6 of article 100 of part one of the Tax Code of the Russian Federation

presents its objections to the tax audit report.

The facts stated in the tax audit report do not correspond to the following

circumstances:

__________________________________________________________________________.

(circumstances are stated with references to documents confirming them)

Thus, the inspectors’ conclusions do not correspond to ________________________

___________________________________________________________________________

(laws and other regulatory legal acts are indicated, which, in the taxpayer’s opinion,

__________________________________________________________________________.

the inspectors’ conclusions do not correspond)

Considering the above, in accordance with Articles 100, 101 of the Tax Code

Code of the Russian Federation, based on the results of consideration of the tax audit materials, I ask:

1) make a decision to refuse to prosecute for

committing a tax offense;

2) do not charge additional tax and do not charge penalties for its untimely

payment.

Applications:

1. Documents (duly certified copies thereof) confirming

validity of objections.

2. Documents confirming the authority of the representative in the event

signing of objections by a representative by proxy.

Position, full name _____________ ______________________________

(signature)

__ _________ 20__

date

What happens if the deadline for delivery of the act is missed?

Nothing. It will not be possible to use the tax authorities’ violation of the deadline for delivering the audit report to turn its results in their favor. In itself, the delay in delivery of the act is not a basis for canceling the decision on the inspection, since it does not relate to significant violations of the procedure for considering its materials (clause 14 of Article 101 of the Tax Code of the Russian Federation).

This is also confirmed by the courts (see the resolution of the 9th Arbitration Court of Appeal dated December 16, 2013 No. 09AP-40446/2013 in case No. A40-76732/13, which was upheld by the resolution of the Federal Antimonopoly Service of the Moscow District dated April 9, 2014 No. F05-2601/ 2014).

UrDela.ru

Part 1. Based on the results of an on-site tax audit, within two months from the date of drawing up a certificate of an on-site tax audit, authorized officials of the tax authorities must draw up a tax audit report in the prescribed form.

If violations of the legislation on taxes and fees are identified during a desk tax audit, the tax authority officials conducting the audit must draw up a tax audit report in the prescribed form within 10 days after the end of the desk tax audit.

Part 2. The tax audit report is signed by the persons who conducted the relevant audit and the person in respect of whom this audit was carried out (his representative).

A corresponding entry is made in the tax audit report regarding the refusal of the person subject to the tax audit or his representative to sign the act.

Part 3. The tax audit report shall indicate:

1) date of the tax audit report. The specified date means the date of signing of the act by the persons who carried out this inspection;

2) full and abbreviated name or last name, first name, patronymic of the person being checked. In the case of an inspection of an organization at the location of its separate subdivision, in addition to the name of the organization, the full and abbreviated name of the inspected separate subdivision and its location are indicated;

3) surnames, first names, patronymics of the persons conducting the audit, their positions, indicating the name of the tax authority they represent;

4) date and number of the decision of the head (deputy head) of the tax authority to conduct an on-site tax audit (for an on-site tax audit);

5) date of submission of the tax return and other documents to the tax authority (for desk tax audit);

6) list of documents submitted by the audited person during the tax audit;

7) the period for which the inspection was carried out;

the name of the tax in respect of which the tax audit was carried out;

9) start and end dates of the tax audit;

10) address of the location of the organization or place of residence of an individual;

11) information on tax control measures carried out during a tax audit;

12) documented facts of violations of legislation on taxes and fees identified during the audit, or a record of the absence of such;

13) conclusions and proposals of inspectors to eliminate identified violations and references to articles of this Code, if this Code provides for liability for these violations of the legislation on taxes and fees.

Part 4. The form and requirements for drawing up a tax audit report are established by the federal executive body authorized for control and supervision in the field of taxes and fees.

Part 5. The tax audit report must be delivered to the person in respect of whom the audit was carried out, or his representative against signature, within five days from the date of this act, or transferred in another way indicating the date of its receipt by the specified person (his representative).

If the person in respect of whom the audit was carried out, or his representative evades receiving a tax audit report, this fact is reflected in the tax audit report, and the tax audit report is sent by registered mail to the location of the organization (separate division) or place of residence individual. If a tax audit report is sent by registered mail, the date of delivery of this report is considered to be the sixth day counting from the date of sending the registered letter.

Part 6. The person in respect of whom the tax audit was carried out, confirming the validity of their objections.

‹ Article 99 (Tax Code of the Russian Federation). General requirements for the protocol drawn up during tax control actions Up Article 100.1 (Tax Code of the Russian Federation). Procedure for considering cases of tax offenses ›

Who signs the inspection report?

The act must be signed by 2 parties: the Federal Tax Service employees who conducted the inspection, as well as the person being inspected or his representative.

Note that sometimes tax officials violate the procedure for signing the act. For example, it can be endorsed by an employee who was not indicated in the decision to conduct a GNP and did not participate in it. Or vice versa, the act will not contain the signature of one of those who carried out the inspection.

Neither one nor the other will most likely affect the outcome of the audit and will not help challenge its results. This is evidenced by arbitration practice (see, for example, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 24, 2012 No. 12181/11, FAS Moscow District dated June 27, 2014 No. F05-6192/2014 in case No. A40-188140/13, FAS West Siberian District dated September 12, 2013 in case No. A81-2308/2012, etc.).

How to write objections

If you do not agree with the facts stated in the tax audit report or in the tax violation report, you have one month to submit written objections. The period begins to run from the day you received the act.

Before writing objections, you need to decide what exactly you disagree with: will you challenge the act in its entirety or some parts of it; whether your objections relate to procedural actions or the essence of the act. You can challenge any act: an audit report, a report containing the results of additional tax control measures, or a report on the discovery of facts indicating a tax violation.

There are points that can and should be appealed when you disagree. This is all about paperwork, accounting and taxes.

note

All your arguments in the objection must be carefully and in detail explained, indicating the circumstances that led to this or that defect. References to legislation are required. The more competent your objections, the more difficult it will be for tax officials to argue with you.

But there are also small details that are not advisable to appeal. For example, the specific start and end date of the audit, spelling errors, blots in the preparation of protocols, conclusions that you think are illiterate. The fact is that this will most likely be considered a technical error. And if it doesn’t change anything essentially, there’s no point in writing objections.

But pay attention to the date of signing the act.

Controllers often “sin” and indicate in it not the current date, but the past one. Here you can argue. EXAMPLE.

DETERMINING THE “STARTING POINT” LLC “Rom” was sent by mail a report from a desk tax audit on February 1st. According to paragraph 5 of Article 100 of the Tax Code of the Russian Federation, the act will be considered received on the sixth day from the date of dispatch, that is, February 8. In fact, the act was received on February 10. Believing that the act was received on February 7, the tax authorities set the last day for filing objections - March 1. On March 2, the director of Rom LLC was invited to review the materials, but did not appear. The inspection recorded the fact of notification of Rom LLC about the date of consideration of the case and the failure of company representatives to appear. The inspectorate immediately decided to review the act without representatives of the company and hold the taxpayer accountable. But, since the act was actually received on February 10, the last day for filing objections will be March 3. Consequently, consideration of the materials should take place no earlier than March 5 and a decision can be made no earlier than this date. The decision of March 2 is a violation of the essential conditions of the procedure for considering the case. Most likely, a higher tax authority or court may conclude that the company was deprived of the opportunity to fully protect its interests. The decision may be reversed on formal grounds.

All your arguments must be explained carefully and in detail, and the circumstances that led to this or that shortcoming must be indicated. References to legislation are required. The more competent your objections, the more difficult it will be for tax officials to argue with you.

What information should be included in the inspection report?

The requirements for the content of the inspection report are established in paragraph 3 of Art. 100 Tax Code of the Russian Federation. So, it states:

- date of the act (date of its signing by the inspectors);

- full and abbreviated name or last name, first name and patronymic of the person being inspected; if a separate unit was checked, its full and abbreviated name, as well as its location, are additionally indicated;

- last names, first names and patronymics of the persons conducting the audit, their positions, indicating the name of the tax authority they represent;

- date and number of the decision to conduct an on-site inspection (for VNP) or date of submission of the declaration and other documents (for KNP);

- a list of documents submitted during the inspection by the person being inspected;

- the period for which the inspection was carried out;

- name of the tax verified;

- start and end dates of the audit;

- address of the location of the organization (members of the consolidated group of taxpayers) or place of residence of the individual;

- information about tax control measures carried out during the audit;

- documented facts of tax offenses, if they have been identified, or a record of the absence of such;

- conclusions and proposals of inspectors to eliminate identified violations, substantiated by references to the norms of the Tax Code of the Russian Federation.

Currently, the form of the inspection report and the requirements for its preparation are used, approved by order of the Federal Tax Service of Russia dated November 7, 2018 No. ММВ-7-2/ [email protected]

If you have access to ConsultantPlus, check whether all requirements for the tax audit report are met. If you don't have access, get a free trial of online legal access.

More information about the acts of GNP and KNP can be found on our website in the articles:

- “On-site tax audit report—sample and features”;

- “Desk tax audit report—sample”.

Article 100. Registration of tax audit results

Article 100. Registration of tax audit results

[Tax Code] [Tax Code of the Russian Federation, Part 1] [Section V] [Chapter 14]

. Based on the results of the on-site tax audit, within two months from the date of drawing up the certificate of the on-site tax audit, authorized officials of the tax authorities must draw up a tax audit report in the prescribed form.

If violations of the legislation on taxes and fees are identified during a desk tax audit, the tax authority officials conducting the audit must draw up a tax audit report in the prescribed form within 10 days after the end of the desk tax audit.

Based on the results of an on-site tax audit of a consolidated group of taxpayers, within three months from the date of drawing up a certificate of an on-site tax audit, authorized officials of the tax authorities must draw up a tax audit report in the prescribed form.

. The tax audit report is signed by the persons who conducted the relevant audit and the person in respect of whom this audit was carried out (his representative). When conducting a tax audit of a consolidated group of taxpayers, the tax audit report is signed by the persons who conducted the relevant audit and the responsible member of this group (his representative).

The refusal of the person subject to the tax audit, or his representative (responsible participant in the consolidated group of taxpayers) to sign the act, is made accordingly in the tax audit report.

. The tax audit report shall indicate:

- 1) date of the tax audit report. The specified date means the date of signing of the act by the persons who carried out this inspection;

- 2) full and abbreviated names or last name, first name, patronymic of the person being audited (members of the consolidated group of taxpayers). In the case of an inspection of an organization at the location of its separate subdivision, in addition to the name of the organization, the full and abbreviated name of the inspected separate subdivision and its location are indicated;

- 3) last names, first names, patronymics of the persons conducting the audit, their positions, indicating the name of the tax authority they represent;

- 4) date and number of the decision of the head (deputy head) of the tax authority to conduct an on-site tax audit (for an on-site tax audit);

- 5) date of submission of the tax return (calculation) and other documents (for desk tax audit) to the tax authority;

- 6) a list of documents submitted by the audited person during the tax audit;

- 7) the period for which the inspection was carried out;

- the name of the tax in respect of which the tax audit was carried out;

- 9) start and end dates of the tax audit;

- 10) address of the location of the organization (members of the consolidated group of taxpayers) or place of residence of an individual;

- 11) information about tax control measures carried out during a tax audit;

- 12) documented facts of violations of the legislation on taxes and fees identified during the inspection, or a record of the absence of such;

- 13) conclusions and proposals of inspectors to eliminate identified violations and references to articles of this Code, if this Code provides for liability for these violations of the legislation on taxes and fees.

3.1. The tax audit report is accompanied by documents confirming the facts of violations of the legislation on taxes and fees identified during the audit. In this case, documents received from the person in respect of whom the inspection was carried out are not attached to the inspection report. Documents containing information that is not subject to disclosure by the tax authority, constituting banking, tax or other legally protected secrets of third parties, as well as personal data of individuals, are attached in the form of extracts certified by the tax authority.

. The form and requirements for drawing up a tax audit report are established by the federal executive body authorized for control and supervision in the field of taxes and fees.

. The tax audit report, within five days from the date of this act, must be delivered to the person in respect of whom the audit was carried out, or his representative against a receipt, or transferred in another way indicating the date of its receipt by the specified person (his representative), unless otherwise provided by this paragraph .

If the person in respect of whom the audit was carried out, or his representative evades receiving a tax audit report, this fact is reflected in the tax audit report, and the tax audit report is sent by registered mail to the location of the organization (separate division) or place of residence individual. If a tax audit report is sent by registered mail, the date of delivery of this report is considered to be the sixth day counting from the date of sending the registered letter.

When conducting a tax audit of a consolidated group of taxpayers, the tax audit report, within 10 days from the date of this act, is handed over to the responsible participant of the consolidated group of taxpayers in the manner established by this paragraph.

The tax audit report is sent to a foreign organization (with the exception of an international organization, a diplomatic mission, a foreign organization subject to registration with the tax authority in accordance with paragraph 4.6 of Article 83 of this Code) that does not operate on the territory of the Russian Federation through a separate division, by registered mail by letter to the address contained in the Unified State Register of Taxpayers. The date of delivery of this act is considered to be the twentieth day counting from the date of sending the registered letter.

. A person in respect of whom a tax audit was carried out (his representative), in case of disagreement with the facts set out in the tax audit report, as well as with the conclusions and proposals of the inspectors, within one month from the date of receipt of the tax audit report, has the right to submit written objections to the relevant tax authority on the said act as a whole or on its individual provisions. In this case, the person in respect of whom the tax audit was carried out (his representative) has the right to attach to written objections or, within the agreed period, submit to the tax authority documents (certified copies thereof) confirming the validity of his objections.

Written objections to a tax audit report of a consolidated group of taxpayers are submitted by the responsible member of this group within 30 days from the date of receipt of the said report. In this case, the responsible participant of the consolidated group of taxpayers has the right to attach to written objections or, within the agreed period, submit to the tax authority documents (certified copies thereof) confirming the validity of their objections.