Do penalty liabilities reduce profits?

Provisions of paragraph 2 of Art. 270 of the Tax Code of the Russian Federation does not allow penalties and fines levied by budgetary organizations to be accepted as expenses that affect the final result of income tax. This applies to all government sources of fines - both budgetary organizations and non-budgetary ones.

Example

Istok LLC violated the procedure for complying with licensing conditions in accordance with the technical design when using subsoil. An administrative fine of 450,000 rubles was imposed on the company. (clause 2 of article 7.3 of the Code of Administrative Offenses of the Russian Federation). Does Istok LLC have the right to reduce income tax using this amount?

Since the fine accrued to a legal entity must be transferred to the budget of the Russian Federation, its amount is not considered when calculating the tax.

Costs associated with production and sales

As the name suggests, this type of cost is directly related to the company’s activities. The general list of such income tax expenses is regulated by Article 253 of the Tax Code, and a more detailed explanation, as well as accounting principles for specific types of costs, are deciphered in Articles 254-264 of the Code.

The main types of expenses associated with production and sales are material expenses, labor costs, accrued depreciation and other expenses.

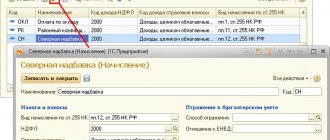

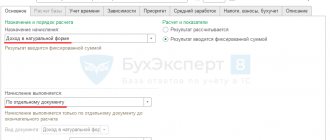

Is it possible to reduce the tax base for contributions to non-state pension provision?

Transferred contributions in favor of employees to the Pension Fund and when concluding relevant voluntary insurance agreements for non-state provision of pensions reduce the tax base.

However, the amount of these funds should not be more than 12% of wages. Amounts paid in excess of this established standard (clause 16 of Article 255 of the Tax Code of the Russian Federation) do not affect income tax.

When transferring contributions for your employees to their registered corporate accounts, these expenses also do not reduce profits. This provision is regulated by clause 7 of Art. 270 Tax Code of the Russian Federation.

Example

The Vostok organization transferred contributions to voluntary pension insurance for its employees under existing contractual obligations in June 2022 in the amount of 68,000 rubles. Total labor costs amounted to RUB 256,511. The policyholder can take into account only 6% of this amount for the costs of transferred voluntary insurance premiums, i.e. 15,390.66 rubles. The remaining amount of contributions, equal to RUB 52,609.34, is not taken into account as part of expenses that reduce the tax base.

ConsultantPlus experts explained how to correctly take insurance into account for the purpose of calculating income tax:

If you don't have access to the system, get a free trial online.

Tax classification of expenses

Income and expenses are included in the calculation of income tax.

The accuracy of the final amount of tax liability for this tax depends on the correct classification of income and expenses for income tax. There are several tax classifications of expenses for the purpose of calculating income tax. Let's list the main ones. Expenses are divided into:

- for those related to production and sales and non-sales (clause 2 of Article 252 of the Tax Code of the Russian Federation);

- accepted when calculating income tax and not accepted (clause 1, article 252, article 270 of the Tax Code of the Russian Federation).

The main groups of costs associated with production and sales are shown in the figure:

Income from sales, in turn, is grouped into direct and indirect (Clause 1, Article 318 of the Tax Code of the Russian Federation). This division is extremely important for income tax purposes. Namely:

- direct income tax expenses must be distributed between the balances of work in progress, sold and unsold products;

- indirect income tax expenses can be fully taken into account in tax calculations in the reporting period without any distribution.

The group of non-operating expenses for income tax includes reasonable expenses not directly related to the production and (or) sale of goods (work, services). These include the costs of maintaining leased objects, paying interest on debt obligations, and others. Their list is not closed, which means the following: the law allows any justified costs to be recognized as non-operating expenses (clause 20 of Article 265 of the Tax Code of the Russian Federation).

For the nuances of recognizing shortages as non-operating expenses, see the article “Negligence by a warehouse manager is not a reason to consider shortages as non-operating expenses.”

Expenses may be included in the income tax base or may be excluded from it. This applies equally to any expenses incurred, regardless of their purpose. We will explain below how to correctly draw the line between unrecognized and expenses taken into account when calculating income tax.

Are the costs of employee travel to their place of work taken into account as income tax expenses?

Under normal conditions, amounts paid by employees for travel on public transport to the place of performance of their work duties are not considered expenses for determining the taxable base (Clause 26, Article 270 of the Tax Code of the Russian Federation). The exception is cases in which the terms of delivery of employees are stipulated in labor or collective agreements (in this case, travel costs are taken into account as wages), or when workplaces are not accessible by transport.

Read more here.

If the employer organizes special flights for the delivery of employees for this purpose, then travel costs do not affect the reduction of income tax. This is evidenced by the letter of the Ministry of Finance dated January 21, 2013 No. 03-03-06/1/18.

Is it possible to take into account the expenses of employees on travel to their place of work for tax purposes?

This question is answered by paragraph 26 of the article under consideration. It states that payment for employee travel to their place of work cannot reduce the tax base, except in the following cases:

- The conditions for reimbursement of transportation costs are specified in the employment/collective agreement.

- The need for travel expenses is determined by the peculiarities of production. This means that there is no public transport to the place of work or traffic is difficult (lack of regularity, inconvenient schedule).

Example

Lesprom LLC has a wood processing plant in a village near Moscow. Buses run on schedule from 7.00 to 22.00. Due to the technological features of production, the plant practices a multi-shift working day. For night shift employees, a special night shuttle bus is organized, serviced by transport. The conditions for the delivery of employees are set out in the collective agreement. For September I issued an invoice for 60,000 rubles. Can such expenses be taken into account when calculating income tax?

Answer: yes, such expenses can be recognized for tax purposes, since 2 conditions for acceptance are met - the expenses are provided for in the contract, the expenses are justified by the technological features of production.

How does gratuitously transferred property affect the formation of income tax?

To recognize the validity of certain expenses, they must meet the criteria established by Art. 252 of the Tax Code of the Russian Federation. All expenses incurred must have documentary evidence and also be economically justified, i.e. their goal is to obtain certain benefits.

The gratuitous transfer of property, i.e. the transfer of ownership without subsequent remuneration, excludes the receipt of economic benefits. Therefore, paragraph 16 of Art. 270 of the Tax Code of the Russian Federation prohibits taking into account in expenses the cost of gratuitously transferred property (work, services, property rights), as well as expenses associated with such transfer.

If the transferred property is depreciable, then certain nuances should be taken into account. Until the beginning of 2022, the provisions of paragraph 3 of Art. 256 of the Tax Code of the Russian Federation stated that depreciation is not charged on fixed assets that are transferred with the conclusion of an agreement on free use. It was possible to resume its accrual after the expiration of the contract and the return of the objects to the organization.

But from 01/01/2020, clause 16.7 of Art. 270 of the Tax Code of the Russian Federation prohibits the calculation of depreciation on objects returned after the expiration of the agreement on gratuitous use. This is due to the fact that mention of fixed assets transferred under contracts for free use is also excluded from clause 7 of Art. 259.1 of the Tax Code of the Russian Federation, which established the procedure for resuming depreciation upon termination of a contract of gratuitous use and the return of depreciable property to the taxpayer.

Such rules do not apply to property transferred for free use to government bodies and government agencies, if this obligation of the taxpayer is confirmed by law.

How to take into account the costs of purchasing equipment for taxation

According to clause 5 of the article under consideration, expenses associated with the acquisition of depreciable equipment (for example, expenses for modernization, completion) cannot be taken into account at a time for tax purposes. The same applies to participants in leasing transactions: the recipients’ expenses for the redemption of leased property do not reduce tax liabilities.

If the purchased equipment is depreciable, then its cost can be written off as depreciation accrues, that is, over the entire period of use.

Equipment is subject to depreciation if it is classified as fixed assets. Criteria for fixed assets in 2016:

- useful life exceeds one year;

- equipment purchased for the company’s business activities;

- the equipment was not purchased for the purpose of resale;

- the cost of the equipment exceeds 100,000 rubles. (for assets acquired after 01/01/2016)

If the equipment does not meet the listed criteria, then its value is written off in a slightly different order.

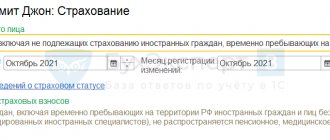

Do voluntary insurance premiums reduce profits?

Expenses incurred under VHI agreements can reduce taxable profit. The classification of these expenses is given in Art. 255, 263 and 291 of the Tax Code of the Russian Federation. Other voluntary insurance costs do not affect the calculation. This is stated in paragraph 6 of Art. 270 Tax Code of the Russian Federation. Such expenses include voluntary liability insurance, which is not a condition of international standards for the activities of the entity. Thus, the insurance premiums that an organization is forced to pay in connection with a violation of a civil liability contract do not reduce profits. Such costs are also not included in the closed list of expenses in accordance with Art. 255, 263, 291 Tax Code of the Russian Federation.

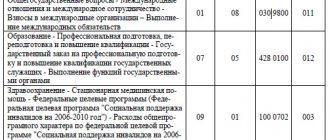

The following voluntary insurance expenses can be taken into account when reducing taxable profit:

- contributions to the Pension Fund under voluntary insurance contracts for their employees;

- insurance of transport, cargo, goods and materials, and other property used in the course of business activities;

- insurance of certain types of risks and liability of organizations;

- life and health insurance of bank borrowers.

Article 270. Expenses not taken into account for tax purposes

When determining the tax base, the following expenses are not taken into account:

1) in the form of amounts of dividends accrued by the taxpayer and other amounts of profit after taxation;

(as amended by Federal Laws dated May 29, 2002 N 57-FZ, dated June 6, 2005 N 58-FZ)

2) in the form of penalties, fines and other sanctions transferred to the budget (to state extra-budgetary funds), interest payable to the budget in accordance with Article 176.1 of this Code, as well as fines and other sanctions levied by state organizations, which are subject to the legislation of the Russian Federation the right to impose these sanctions has been granted;

(as amended by Federal Law dated December 17, 2009 N 318-FZ)

3) in the form of a contribution to the authorized (share) capital, a contribution to a simple partnership, to an investment partnership;

(as amended by Federal Law dated November 28, 2011 N 336-FZ)

4) in the form of a tax amount, as well as the amount of payments for excess emissions of pollutants into the environment;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

5) in the form of expenses for the acquisition and (or) creation of depreciable property, as well as expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets, with the exception of the expenses specified in paragraph 9 of Article 258 of this Code;

(as amended by Federal Laws dated 06.06.2005 N 58-FZ, dated 22.07.2008 N 158-FZ)

6) in the form of contributions for voluntary insurance, except for the contributions specified in ARTICLES 255, 263 and 291 of this Code;

(as amended by Federal Law dated 06.06.2005 N 58-FZ)

7) in the form of contributions to non-state pension provision, except for the contributions specified in Article 255 of this Code;

in the form of interest accrued by the taxpayer-borrower to the creditor in excess of the amounts recognized as expenses for tax purposes in accordance with Article 269 of this Code;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

9) in the form of property (including funds) transferred by a commission agent, agent and (or) other attorney in connection with the fulfillment of obligations under a commission agreement, agency agreement or other similar agreement, as well as in payment of expenses made by the commission agent, agent and ( or) by another attorney for the principal, principal and (or) other principal, if such costs are not subject to inclusion in the expenses of the commission agent, agent and (or) other attorney in accordance with the terms of the concluded agreements;

(Clause 9 as amended by Federal Law No. 57-FZ dated 29.05.2002)

10) in the form of amounts of deductions to the reserve for depreciation of investments in securities created by organizations in accordance with the legislation of the Russian Federation, with the exception of amounts of deductions to reserves for depreciation of securities made by professional participants in the securities market in accordance with Article 300 of this Code;

11) in the form of guarantee contributions transferred to special funds created in accordance with the requirements of the legislation of the Russian Federation, intended to reduce the risks of non-fulfillment of obligations under transactions when carrying out clearing activities or activities for organizing trading on the securities market;

12) in the form of funds or other property that are transferred under credit or loan agreements (other similar funds or other property, regardless of the form of registration of borrowings, including debt securities), as well as in the form of funds or other property that are used to repay such borrowings ;

(Clause 12 as amended by Federal Law No. 57-FZ dated 29.05.2002)

13) in the form of amounts of losses for objects of service industries and farms, including objects of housing, communal and social and cultural spheres in part exceeding the maximum amount determined in accordance with Article 275.1 of this Code;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

14) in the form of property, work, services, property rights transferred in advance payment by taxpayers determining income and expenses on an accrual basis;

15) in the form of amounts of voluntary membership fees (including entrance fees) to public organizations, amounts of voluntary contributions from participants in unions, associations, organizations (associations) for the maintenance of these unions, associations, organizations (associations);

16) in the form of the cost of gratuitously transferred property (work, services, property rights) and expenses associated with such transfer, unless otherwise provided by this chapter;

(as amended by Federal Laws dated May 29, 2002 N 57-FZ, dated July 17, 2009 N 161-FZ)

17) in the form of the value of property transferred within the framework of targeted financing in accordance with subparagraph 14 of paragraph 1 of Article 251 of this Code;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

18) in the form of a negative difference resulting from the revaluation of precious stones when the price lists were changed in accordance with the established procedure;

19) in the form of amounts of taxes presented in accordance with this Code by the taxpayer to the buyer (acquirer) of goods (work, services, property rights), unless otherwise provided by this Code;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

20) in the form of funds transferred to trade union organizations;

21) in the form of expenses for any types of remuneration provided to management or employees in addition to remuneration paid on the basis of employment agreements (contracts);

22) in the form of bonuses paid to employees from special-purpose funds or targeted revenues;

23) in the form of amounts of financial assistance to employees;

(as amended by Federal Law No. 158-FZ of July 22, 2008)

24) to pay additional vacations provided under the collective agreement (in excess of those provided for by current legislation) to employees, including women raising children;

25) in the form of bonuses to pensions, one-time benefits to retiring labor veterans, income (dividends, interest) on shares or contributions of the organization’s workforce, compensation charges in connection with price increases made in excess of the income indexation according to decisions of the Government of the Russian Federation, compensation increasing the cost of food in canteens, buffets or dispensaries or providing it at reduced prices or free of charge (with the exception of special food for certain categories of workers in cases provided for by current legislation, and with the exception of cases where free or reduced-price meals are provided for in employment agreements (contracts) and (or) collective agreements;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

26) to pay for travel to the place of work and back by public transport, special routes, departmental transport, with the exception of amounts to be included in the costs of production and sale of goods (work, services) due to the technological features of production, and with the exception of cases when the cost of travel to and from work is provided for by employment agreements (contracts) and (or) collective agreements;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

27) to pay price differences when selling goods (work, services) to employees at preferential prices (tariffs) (lower than market prices);

28) to pay price differences when selling products from subsidiary farms at preferential prices for the organization of public catering;

29) to pay for vouchers for treatment or recreation, excursions or travel, classes in sports sections, circles or clubs, visits to cultural, entertainment or physical education (sports) events, subscriptions not related to subscriptions to normative-technical and other used for production purposes literature, and payment for goods for personal consumption of employees, as well as other similar expenses made for the benefit of employees;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

30) is excluded. — Federal Law of May 29, 2002 N 57-FZ;

30) in the form of expenses of taxpayers-organizations of the state stockpile of special (radioactive) raw materials and fissile materials of the Russian Federation on operations with material assets of the state stockpile of special (radioactive) raw materials and fissile materials associated with the restoration and maintenance of the specified stock;

31) in the form of the value of shares transferred by the taxpayer - issuer, distributed among shareholders by decision of the general meeting of shareholders in proportion to the number of shares owned by them, or the difference between the par value of new shares transferred in exchange for the original ones and the par value of the initial shares of the shareholder when distributing shares among shareholders with an increase the issuer's authorized capital;

32) in the form of property or property rights transferred as a deposit or pledge;

33) in the form of amounts of taxes accrued to budgets of various levels in the event that such taxes were previously included by the taxpayer as expenses, when writing off the taxpayer's accounts payable for these taxes in accordance with subparagraph 21 of paragraph 1 of Article 251 of this Code;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

34) in the form of amounts of targeted contributions made by the taxpayer for the purposes specified in paragraph 2 of Article 251 of this Code;

36) is excluded. — Federal Law of May 29, 2002 N 57-FZ;

35) became invalid on January 1, 2011. — Federal Law of July 27, 2010 N 229-FZ;

36) became invalid on January 1, 2008. — Federal Law of July 24, 2007 N 216-FZ;

37) in the form of amounts of paid allowances in excess of the norms established by the legislation of the Russian Federation;

38) for compensation for the use of personal cars and motorcycles for business trips, for payment of food rations for the crews of sea, river and aircraft in excess of the norms for such expenses established by the Government of the Russian Federation;

(as amended by Federal Laws dated May 29, 2002 N 57-FZ, dated July 22, 2008 N 158-FZ)

39) in the form of a fee to a state and (or) private notary for notarial registration in excess of the tariffs approved in the prescribed manner;

40) in the form of fees, deposits and other obligatory payments paid to non-profit organizations and international organizations, except for those specified in subparagraphs 29 and 30 of paragraph 1 of Article 264 of this Code;

41) to replace defective, out-of-marketable and missing copies of periodicals, as well as losses in the form of the cost of out-of-marketability, defective and unsold media products and book products, in addition to the costs and losses specified in subparagraphs 43 and 44 of paragraph 1 Article 264 of this Code;

42) in the form of entertainment expenses to the extent that they exceed the amount provided for in paragraph 2 of Article 264 of this Code;

43) in the form of expenses provided for in paragraph six of paragraph 3 of Article 264 of this Code;

44) for the purchase (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns, as well as for other types of advertising not provided for in paragraphs two to four of paragraph 4 of Article 264 of this Code, in excess of those established by paragraph five of paragraph 4 of Article 264 of this Code Code of Limits;

(as amended by Federal Law dated May 29, 2002 N 57-FZ)

45) in the form of amounts of deductions for the formation of funds to support scientific, scientific-technical and innovative activities, created in accordance with the Federal Law “On Science and State Scientific and Technical Policy”, in excess of the amounts of deductions provided for by subparagraph 6 of paragraph 2 of Article 262 of this Code;

(Clause 45 as amended by Federal Law dated 06/07/2011 N 132-FZ)

46) negative difference resulting from the revaluation of securities at market value;

47) in the form of expenses of the trust management founder related to the execution of the trust management agreement, if the trust management agreement stipulates that the beneficiary is not the founder;

(Clause 47 introduced by Federal Law dated May 29, 2002 N 57-FZ)

48) in the form of expenses incurred by religious organizations in connection with the performance of religious rites and ceremonies, as well as in connection with the sale of religious literature and religious items;

(Clause 48 introduced by Federal Law dated May 29, 2002 N 57-FZ)

48.1) in the form of funds transferred to medical organizations to pay for medical care to insured persons in accordance with the agreement for the provision and payment of medical care under compulsory medical insurance, concluded in accordance with the legislation of the Russian Federation on compulsory medical insurance;

(clause 48.1 as amended by Federal Law dated November 29, 2010 N 313-FZ)

48.2) in the form of expenses, including remuneration to the management company and the specialized depository, incurred at the expense of organizations acting as insurers for compulsory pension insurance when investing pension savings formed in accordance with the legislation of the Russian Federation;

(clause 48.2 introduced by Federal Law dated December 29, 2004 N 204-FZ, as amended by Federal Law dated November 30, 2011 N 359-FZ)

48.3) in the form of amounts that are sent by organizations acting as insurers for compulsory pension insurance to replenish pension savings formed in accordance with the legislation of the Russian Federation, and which are reflected in the pension accounts of the funded part of the labor pension;

(clause 48.3 introduced by Federal Law dated December 29, 2004 N 204-FZ, as amended by Federal Law dated November 30, 2011 N 359-FZ)

48.4) in the form of pension savings formed in accordance with the legislation of the Russian Federation, transferred in accordance with the legislation of the Russian Federation by non-state pension funds to the Pension Fund of the Russian Federation and (or) other non-state pension fund, which act as an insurer for compulsory pension insurance;

(clause 48.4 introduced by Federal Law dated December 29, 2004 N 204-FZ, as amended by Federal Law dated November 30, 2011 N 359-FZ)

48.5) expenses of shipowners for maintenance, repairs and other purposes related to the maintenance, operation, sale of ships registered in the Russian International Register of Ships;

(clause 48.5 as amended by Federal Law dated November 7, 2011 N 305-FZ)

48.6) expenses of a development bank - a state corporation;

(clause 48.6 introduced by Federal Law dated May 17, 2007 N 83-FZ)

——————————————————————

The provisions of paragraph 48.7 of Article 270 apply until January 1, 2017 (Federal Law dated December 1, 2007 N 310-FZ).

——————————————————————

48.7) incurred by taxpayers who are Russian organizers of the Olympic Games and Paralympic Games in accordance with Article 3 of the Federal Law “On the organization and holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games of 2014 in the city of Sochi, the development of the city of Sochi as a mountain climatic resort and amendments in certain legislative acts of the Russian Federation,” including costs associated with engineering surveys during construction, architectural and construction design, construction, reconstruction and organization of operation of Olympic facilities;

(clause 48.7 introduced by Federal Law dated December 1, 2007 N 310-FZ)

48.8) in the form of amounts of remuneration and other payments made to members of the board of directors;

(clause 48.8 introduced by Federal Law dated July 22, 2008 N 158-FZ)

——————————————————————

The provisions of paragraph 48.9 of Article 270 apply until December 31, 2012 inclusive.

——————————————————————

48.9) expenses of a non-profit organization performing the function of providing financial support for major repairs of apartment buildings and relocation of citizens from emergency housing stock in accordance with the Federal Law “On the Fund for Assistance to the Reform of Housing and Communal Services”, incurred in connection with the placement of temporarily available funds;

(clause 48.9 introduced by Federal Law dated December 1, 2008 N 225-FZ)

48.10) in the form of payments to the victim made in the form of direct compensation for losses in accordance with the legislation of the Russian Federation on compulsory insurance of civil liability of vehicle owners by the insurer that insured the civil liability of the victim;

(clause 48.10 introduced by Federal Law dated December 25, 2008 N 282-FZ)

48.11) expenses of state institutions in connection with the performance of state (municipal) functions, including the provision of state (municipal) services (performance of work);

(Clause 48.11 introduced by Federal Law dated 05/08/2010 N 83-FZ)

——————————————————————

The provisions of clause 48.12 of Article 270 apply until January 1, 2017 (clause 6 of Article 12 of the Federal Law of July 30, 2010 N 242-FZ).

——————————————————————

48.12) incurred by taxpayers who are Russian marketing partners of the International Olympic Committee in accordance with Article 3.1 of the Federal Law of December 1, 2007 N 310-FZ “On the organization and holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games of 2014 in the city of Sochi, development the city of Sochi as a mountain climatic resort and amendments to certain legislative acts of the Russian Federation", in connection with participation in the organization and holding of the XXII Olympic Winter Games and XI Paralympic Winter Games in 2014 in the city of Sochi during the organization of the XXII Olympic Winter Games and XI Paralympic Winter Games 2014 in the city of Sochi, established by part 1 of article 2 of the said Federal Law;

(clause 48.12 introduced by Federal Law dated July 30, 2010 N 242-FZ)

48.13) expenses related to ensuring safe conditions and labor protection during coal mining, incurred (incurred) by the taxpayer and accepted by him for deduction in accordance with Article 343.1 of this Code, with the exception of expenses provided for in paragraph 5 of Article 325.1 of this Code;

(clause 48.13 introduced by Federal Law dated December 28, 2010 N 425-FZ)

48.14) in the form of funds transferred by a participant in a consolidated group of taxpayers to a responsible participant in this group for payment of tax (advance payments, penalties, fines) in the manner established by this Code for a consolidated group of taxpayers, as well as funds transferred by a responsible participant in a consolidated group of taxpayers to a participant this group in connection with clarification of tax amounts (advance payments, penalties, fines) payable for this consolidated group of taxpayers;

(clause 48.14 introduced by Federal Law dated November 16, 2011 N 321-FZ)

——————————————————————

The provisions of paragraph 48.15 of Article 270 (as amended by Federal Law No. 47-FZ dated 03.05.2012) apply one hundred and eighty days after the official publication of Federal Law No. 47-FZ dated 05.03.2012.

——————————————————————

48.15) incurred by the association of tour operators in the field of outbound tourism at the expense of the compensation fund of the association of tour operators in the field of outbound tourism, created in accordance with Federal Law of November 24, 1996 N 132-FZ “On the fundamentals of tourism activities in the Russian Federation”;

(clause 48.15 introduced by Federal Law dated May 3, 2012 N 47-FZ)

49) other expenses that do not meet the criteria specified in paragraph 1 of Article 252 of this Code.

Previous article

Next article

Does Article 270 of the Tax Code of the Russian Federation allow taxes charged to buyers to be classified as expenses?

Clause 19 Art. 270 of the Tax Code of the Russian Federation does not recognize taxes presented to its counterparties as expenses. This also applies to trade taxes and excise taxes. The latter is indicated by the letter of the Ministry of Finance of the Russian Federation dated 08/06/2012 No. 03-07-06/209, which states that excise tax amounts presented to buyers or owners of customer-supplied raw materials cannot be taken into account as expenses when taxing profits.

If taxes were presented to the payer in the territory of other states, then these amounts are also not considered as expenses when determining the income tax base. This norm is confirmed by the letter of the Federal Tax Service of Russia for the city of Moscow dated July 31, 2012 No. 16-15/ [email protected]

From here it should be concluded that the amounts of those taxes (VAT, excise taxes, trade taxes) that were presented to the business entity as a buyer are not taken into account for the subsequent calculation of taxable profit.

The situation with VAT is different in the case of providing goods as a gift or bonus to the buyer as an incentive. Tax authorities believe that the amounts of indirect taxes in this case are included in the cost of the property transferred free of charge, and therefore are not considered expenses (clause 16 of Article 270 of the Tax Code of the Russian Federation).

However, judicial practice does not recognize bonuses and other incentives as gratuitously transferred goods and materials, because this requires the purchase of a certain amount of goods.

Provisions of paragraph 19 of Art. 270 of the Tax Code of the Russian Federation also does not include the amount of VAT on bonuses in the list of expenses that do not affect the tax base, since the sale of property in this case does not occur.

The seller himself must decide whether to take into account VAT amounts on bonuses and gifts as expenses when calculating income tax. But at the same time, you need to be prepared for questions from the tax authorities.

See also “Tax paid for a third party: can it be taken into account as expenses?”

Which expenses reduce income tax and which do not?

Expenses in the income tax return are the amounts of costs that, in the taxpayer’s opinion, legally reduce the tax base, that is, comply with the requirements of tax legislation. These requirements are quite strict, and inspectors cling to literally every little detail: the expense is not economically justified, is not aimed at generating income, there are shortcomings in its documentary evidence, etc. Tax authorities are also trying to exclude expenses from the tax base due to their irrationality, ineffectiveness or inexpediency, although the Ministry of Finance does not support them in this (letter dated 04/19/2019 No. 03-03-07/28232).

Thus, any expense, after being examined by controllers, can instantly move from the group of recognized to the category of unrecognized tax expenses. In paragraph 49 of Art. 270 of the Tax Code of the Russian Federation directly states that when determining the tax base, expenses that do not meet the legally established criteria are not taken into account. The remaining 48 positions of this article contain specific types of expenses not recognized for income tax purposes - for charity, payment of dividends, fines and other sanctions transferred to the budget or extra-budgetary funds, payment of other similar obligations and expenses. All these expenses can be made exclusively from net profit.

Some expenses are included in tax calculations only occasionally (for example, VAT). The other part is recognized when calculating income tax according to the norms strictly established in the code, that is, not always in the full amount (read more about this below).

Is it possible to reduce profits due to expenses for material incentives for employees?

The costs of paying employees include all payments that are stipulated in the employment or collective agreement. Other bonuses and compensation payments, the possibility of accrual of which is not provided for by an employment or collective agreement, do not reduce taxable profit (clause 21, clause 23 of Article 270 of the Tax Code of the Russian Federation). A similar position is shared by the Ministry of Finance of the Russian Federation in letter dated February 26, 2010 No. 03-03-06/1/92 and the Federal Tax Service of the Russian Federation for the city of Moscow in letter dated August 13, 2012 No. 16-15/074028/@.

The same amounts that are paid to employees by organizations in addition to their work activities are taken into account as expenses if their accrual is provided for in the employment contract (letter of the Federal Tax Service dated April 1, 2011 No. KE-4-3/5165).

Amounts paid to employees as financial aid are not included in expenses that form profit (clause 23 of Article 270 of the Tax Code of the Russian Federation). This rule does not affect the amounts of payments that are not recognized as financial assistance, which is confirmed by the provisions of employment contracts. This position is supported by the Ministry of Finance of the Russian Federation in letter dated 06/03/2014 No. 03-03-06/4/26582.

It is customary for some companies to pay raises to their employees. Is it possible to count on certain tax benefits in such cases?

Organizations have the right to compensate some of the expenses of their employees when they move in connection with a new place of work. In relation to civil servants (employees of government agencies, extra-budgetary funds and other federal institutions), the standards for such payments are determined by law.

In private organizations, accountants often wonder how to protect themselves in this case from attention from inspection bodies? For employees of commercial organizations, the total amount of possible compensation payments should be specified in local regulations. These are labor and collective agreements, as well as provisions on remuneration. Amounts spent on payments in excess of the established lifting standards are not included in expenses reducing income tax (clause 37 of Article 270 of the Tax Code of the Russian Federation).

The following question often arises: how do the organization’s expenses for the needs of employees determine the profit of the enterprise?

Expenses of legal entities aimed at organizing leisure time for their employees do not reduce the tax base (Clause 29, Article 270 of the Tax Code of the Russian Federation). This includes payment for employee vouchers for recreation or treatment, events for organizing cultural leisure (excursions, sports clubs, competitions), costs for subscriptions to non-production literature and for personal consumption goods for the needs of employees. The organization carries out all these expenses at its own discretion.

Attention! From 01.01.2019, under certain conditions, it is possible to expense the payment of travel vouchers to employees.

And if there was a fact of gratuitous transfer of property to employees, is it possible to take these transactions into account when calculating income tax?

Example

The organization provided free financial assistance to its employee who was injured in a fire in his own home. Is it possible to reduce the tax base by this amount?

Freely transferred property refers to material assets, the transfer of which for the benefit of recipients is not the responsibility of the organization. The same applies to associated costs.

Regulations of paragraph 16 of Art. 270 of the Tax Code of the Russian Federation excludes the cost of such property from the list of necessary expenses. That is, if the employer voluntarily provides assistance to both its employees and other persons affected by force majeure (natural disasters), the value of the freely provided assets and the expenses incurred in connection with this do not affect the decrease in profit.

Thus, the desire to improve the financial situation of employees, not related to official relations, will not always be a reason for reducing the final amount of profit.

What to do if unaccounted expenses are discovered

If an organization has identified the presence of expenses classified as unaccounted for, operations must be carried out to recognize these expenses in accounting and tax accounting. Errors made in previous periods are allowed to be corrected in the reporting year in accordance with the standards of Art. 54 Tax Code of the Russian Federation:

- erroneous actions did not result in an understatement of the tax liability (written explanations of the Ministry of Finance dated August 4, 2022 No. 03-03-06/2/50113);

- the recalculation period cannot be more than 3 years;

- the financial result of the reporting year does not contain signs of unprofitability (the requirement was voiced in the Letter of the Ministry of Finance dated March 24, 2017 under No. 03-03-06/1/17177).

Rules for reflecting unaccounted expenses

There can be two options for action when unaccounted costs are detected:

- Correction of the situation during the current period.

- Making changes to the year in which the inaccuracy occurred.

The first case is relevant if the organization cannot reliably determine at what stage the transactions for the expenses incurred were missed. It is allowed to use this technique if the tax base was overestimated and the budget was not damaged in the form of underpayment of income tax. Tax authorities do not recommend making adjustments during the reporting period if it is unprofitable for the organization. The use of this method is not recommended in situations where there was a loss in the period in which the expenses were actually incurred.

Question: Is it possible to take into account the unaccounted part of membership fees in income tax expenses when terminating membership in an SRO? In tax accounting, membership fees were recognized evenly and were taken into account quarterly as expenses that reduce the taxable base for income tax. View answer

The opportunity to return overpayments of tax deductions arises only if changes are made to the approved reporting documentation of previous periods. The option of clarifying the data by the date of occurrence of expenses is based on the rules for correcting errors in tax accounting.

ON A NOTE! Making adjustments to the tax reporting of previous years in order to reduce the tax base attracts increased attention from regulatory authorities to the business entity. After this procedure, it is possible to initiate an on-site audit by the tax office.

The provisions of PBU 22/2010 indicate that the lack of information in accounting about a specific transaction due to the unavailability of information and documents about the event for the organization cannot be considered an error. If you follow this rule, then changes do not need to be made in the previous period; it is enough to reflect the costs in the current year. The statement is also consistent with the content of Resolution No. 09AP-6639/2013 of March 26, 2013, drawn up by the arbitration court of appeal.

Discrepancies regarding the choice of method for correcting the situation with discovered unaccounted expenses are due to the fact that:

- there is no legislative definition of the term “errors” in tax legislation;

- the absence of underestimated tax deductions does not cause damage to the state budget, therefore, clarification of information in declarations of previous years cannot be the responsibility of the taxpayer, this is his right.

Such conclusions are confirmed by the Ministry of Finance in a Letter dated October 16, 2009 under No. 03-03-06/1/672. If during the period in which expenses were incurred, tax was not actually accrued for payment, then this forgotten part of the expenses cannot be reflected by the current date. The requirement is violated, which presupposes the presence of an excessively transferred tax in favor of the budget. The Letter of the Ministry of Finance dated April 23, 2010 No. 03-02-07/1-188 states that if you want to increase the expenditure base due to unaccounted expenses in the absence of tax payments, it is necessary to submit clarifying declarations.

NOTE! The Ministry of Finance insists that if the activity is unprofitable, unaccounted expenses cannot be reflected in the current year; they must be shown in the clarifying statements of previous years.

It is impossible to do without adjusting the reporting data of previous years in situations where there were unaccounted expenses and income transactions. Even if the amounts that overstate and understate the taxable base are equal, they are not allowed to be summed up in the current year. To minimize risks, it is recommended to submit an updated declaration.

Consequences of identifying unaccounted costs

Unaccounted expenses may cause an enterprise to overpay its tax obligations. The budget will not suffer from the absence of one or more expense transactions in the accounting of a business entity, but this will negatively affect the financial condition of the institution. The occurrence of an overpayment of income tax does not mean that the possibility of underestimation of accruals for other types of taxes is excluded.

FOR EXAMPLE. If you forget to take into account the costs associated with the acquisition of a fixed asset, the income tax will be overestimated, but the absence of data on the new asset in the accounting will lead to an underpayment of property tax.

For arrears, a fine may be imposed on the company and a late payment penalty will be charged.

Are amounts paid to a notary taken into account when determining income tax?

The state has established fixed tariffs for fees that are charged for performing certain notarial acts. Expenses include expenses incurred when using the services of public and private notaries.

Clause 39 art. 270 of the Tax Code of the Russian Federation, the list of costs that do not participate in the formation of taxable profit also includes excess costs for notary services. This usually applies to actions that do not require an established notarial form. The calculation of tariffs in this case is based on the requirements of Art. 22 Fundamentals of the legislation of the Russian Federation “On notaries”.

Expenses for repairs of leased property

The next dispute that the tax authorities won concerns the inclusion in expenses of the costs of major repairs of leased municipal property.

According to the general requirement of the Civil Code of the Russian Federation, the company is obliged to maintain the leased property in good condition and carry out routine repairs at its own expense (clause 2 of Article 616 of the Civil Code of the Russian Federation).

Let us remind you that according to Art. 260 of the Tax Code of the Russian Federation, costs incurred by the company for the repair of fixed assets are classified as other expenses and are recognized for tax purposes in the reporting (tax) period in which they were incurred in the amount of actual costs.

The tenant's expenses are taken into account in tax accounting only if, according to the agreement, the lessor does not reimburse them (clause 2 of Article 260 of the Tax Code of the Russian Federation). The norms of tax legislation do not differentiate between the repair of fixed assets by their type - current and capital, while industry regulations imply such a distinction.

Under the terms of the agreement, the tenant is obliged to use depreciation deductions for the restoration, renewal and replenishment of fixed assets of the leased municipal property and provide the lessor with information about the use of these depreciation deductions. The amount of rent generated from depreciation deductions, in the event that the amount of accrued depreciation exceeds the costs actually incurred by the tenant for the restoration, replacement and replenishment of municipal property, which are formed at the end of the reporting year, is subject to contribution to the city budget.

Based on the fact that the company, being a tenant of municipal property, did not submit documents confirming the costs of the capital repairs made, and also did not obtain approval for repair work from the institution, senior judges considered the position of the tax authorities to be legitimate ( decision of the Supreme Court of the Russian Federation dated September 26, 2019 No. 304-ES19-16859 ).

If the company had received consent to reimburse the costs of major repairs, it would still not be able to take into account the costs of repairs on the basis of clause 2 of Article 260 of the Tax Code of the Russian Federation. And if the lessor himself does not carry out major repairs and the tenant is forced to do it himself, then he has the right to demand compensation for repair costs from the owner of the property (Clause 1 of Article 616 of the Civil Code of the Russian Federation). But when compensating costs at the expense of the landlord, the tenant will also not be able to take into account the costs of repairs.

Is it possible to include payments for environmental pollution in the costs of forming the tax base?

Amounts of taxes and fees are included in expenses that reduce the income tax base (subclause 1, clause 1, article 264 of the Tax Code of the Russian Federation). This may also include payment for negative impact on the environment. However, when excess emissions are committed, payments in amounts exceeding the established limit are not classified as expenses that reduce the taxable base (clause 4 of Article 270 of the Tax Code of the Russian Federation).

Example

The production organization Saturn LLC makes payments for negative impacts on the environment. Over the past year, she transferred 108,930 rubles for these purposes, including 90,775 rubles. for emissions in excess of established standards. When determining the taxable base, Saturn LLC takes into account only the amount of the fee, equal to 108,930 – 90,775 = 18,155 rubles. for emissions into the environment within established limits.

Read about the procedure for calculating payments for negative environmental impact in this article.

Reserves

In accounting, a company can create the following reserves:

- to reduce the cost of material assets (this is taken into account in account 14);

- for depreciation of financial investments (accounting is kept on account 59);

- for the formation of estimated liabilities, for example, for legal proceedings, a reserve for vacation pay, as well as for warranty service and warranty repairs of sold goods (accounting is kept on account 96);

- doubtful debts (it is recorded in account 63).

Contributions to these reserves reduce accounting profit.

In tax accounting it is allowed to create the following reserves:

- to pay for vacations and benefits for long service (Article 255 of the Tax Code of the Russian Federation);

- for long and expensive repairs of fixed assets (clause 3 of Article 260 of the Tax Code of the Russian Federation);

- for warranty repairs and warranty service (clause 9, clause 1, article 264 of the Tax Code of the Russian Federation);

- doubtful debts (clause 7, clause 1, article 265 of the Tax Code of the Russian Federation) (in accounting, the creation of such a reserve is mandatory. Accounting is kept on account 63).

From a comparison of these lists, it follows that permanent positive differences appear if the company creates reserves in accounting:

- to reduce the cost of material assets;

- for depreciation of investments in securities;

- for the formation of estimated liabilities, with the exception of warranty repairs and warranty service of goods sold;

- doubtful debts, if they are not formed in tax accounting.

In these cases, it is also necessary to charge additional income tax in the amount of the permanent tax liability.

EXAMPLEAccording to the accounting policy, a trading company creates a reserve for reducing the value of material assets.

The amount of contributions to it is 40,000 rubles. This reserve is not provided for by the Tax Code. Therefore, a constant positive difference arises in accounting: DEBIT 91-2 CREDIT 14

- 40,000 rubles.

– a reserve has been accrued for reducing the cost of goods; DEBIT 99 subaccount “Continuous tax liabilities” CREDIT 68 subaccount “Calculations for income tax”

- 8000 rubles.

(RUB 40,000 × 20%) – a permanent tax liability has been accrued (additional income tax has been accrued).

Does prepayment increase expenses in terms of income tax calculations?

If business entities use the accrual method, then their expenses as an advance payment for work or services do not affect the total amount of expenses when determining the taxable base (clause 14 of Article 270 of the Tax Code of the Russian Federation).

Letter of the Ministry of Finance dated June 30, 2011 No. 07-02-06/115 determines the taxpayer’s right to create reserves for doubtful debts. When creating reserves, the listed advance payments are not recognized as expenses even in the absence of delivery of the paid goods.

Can the costs of purchasing equipment be classified as expenses?

Equipment purchased by an organization should be classified as a receipt of fixed assets if this property meets the following requirements:

- intended for long-term use (more than 12 months);

- operation of the equipment is aimed at generating profit for the enterprise;

- subsequent resale of the object is not expected;

- the cost of the acquired property is not less than RUB 100,000.

Fixed assets are classified as depreciable assets. Acquisition costs are written off over the entire period of use, gradually reducing the taxable profit base.

Initial costs for the purchase (creation, modernization, reconstruction) of equipment, which is classified in accounting as a fixed asset, do not reduce the tax base (clause 5 of Article 270 of the Tax Code of the Russian Federation). The same provision also applies to lessees. Their expenses in the form of repurchase of the subject of the leasing agreement are considered as expenses for the acquisition of depreciable property.

Received equipment costing less than RUB 100,000. can be taken into account in costs when determining the taxable base at a time.

From 01.01.2018 to 31.12.2027, clause 5.1 of art. 270 of the Tax Code of the Russian Federation also prohibits taking into account for profit expenses for the acquisition, creation, completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets in respect of which the taxpayer exercised the right to apply an investment tax deduction.

Registration

The list of costs not taken into account when calculating income tax is constantly updated by federal laws.

Federal Law No. 305-FZ of July 2, 2022 introduced a rule into Article 270 of the Tax Code of the Russian Federation that excludes damage compensation payments transferred to the budget from the income tax base. It came into force on January 1, 2022. This formulation no longer allows organizations to include compensation for environmental damage as part of tax expenses (see letter from the Ministry of Finance dated June 21, 2022 No. 03-03-07/48698).

Federal Law No. 121-FZ of April 22, 2022 prohibits taking into account expenses incurred through subsidies received by small and medium-sized businesses affected by coronavirus infection, specified in subparagraph 60 of paragraph 1 of Article 251 of the Tax Code of the Russian Federation (new paragraph 48.26 Article 270 of the Tax Code of the Russian Federation).

Fixed assets transferred for free use can be depreciated from January 1, 2022. However, depreciation amounts cannot be taken into account for tax purposes. The exception is the OS transferred (provided) for free use in cases where such an obligation is established by the legislation of the Russian Federation (Federal Law of September 29, 2019 No. 325-FZ).

From January 1, 2022, tax agents can pay personal income tax from their own funds. But there is only one case. If the inspection discovers during the audit that the tax agent could have withheld personal income tax from the employee’s income, but did not do so, then the additional accrued tax must be paid to the company at its own expense. Changes were made to paragraph 9 of Article 226 of the Tax Code of the Russian Federation (Federal Law of September 29, 2022 No. 325-FZ).

Expenses in the form of personal income tax amounts, additionally accrued and collected from the tax agent’s own funds based on the results of the audit, are economically unjustified and cannot be taken into account in the tax base (Letter of the Ministry of Finance dated January 29, 2022 No. 03-11-09/5344, sent by letter to the Federal Tax Service dated March 10, 2022 No. SD-4-3/4109).

From January 1, 2022, Federal Law No. 335-FZ of November 27, 2022 introduced expenses for the acquisition, creation, completion, retrofitting, reconstruction, modernization and technical re-equipment of an object for which an investment deduction was applied into non-income tax expenses. This is stated in the new subclause 5.1 of Article 270 of the Tax Code of the Russian Federation. It is valid from January 1, 2022 until December 31, 2027.

From January 1, 2022, Federal Law No. 303-FZ of August 3, 2022 increased the VAT rate from 18% to 20%. In this regard, there were clarifications on how to take into account the additional payment of tax at the expense of own funds if the price under the contract does not change in 2022, and the buyer does not pay for the increase in the total cost of delivery due to an increase in the tax rate. This amount of VAT for profit tax purposes is not taken into account in expenses (letter of the Ministry of Finance of Russia dated October 31, 2022 No. 03-07-11/78170).

Is it possible to include in expenses the amounts paid to the lender under the loan agreement?

Receipt of borrowed funds is not classified as taxable income of the organization. Accordingly, the amounts for repayment of loans and credits cannot be taken into account in expenses when determining the amount of profit (clause 12 of Article 270 of the Tax Code of the Russian Federation). That is, neither the borrowed funds received nor the amounts returned to repay them are considered as affecting the result of economic activity. The only expenses will be interest on the use of borrowed funds.

Find out how recent judicial practice is developing on the application of Art. 270 of the Tax Code of the Russian Federation, available from the analytical selection from ConsultantPlus. Learn the material by getting trial access to the system for free.

Is it possible to include accrued dividends as expenses for the final determination of profit?

Dividends accrued after taxation cannot be recognized as expenses, as evidenced by clause 1 of Article 270 of the Tax Code and letter of the Ministry of Finance of the Russian Federation dated July 24, 2015 No. 03-03-06/1/42780. Dividends are part of the net profit remaining after taxation and subject to further distribution among participants. In this regard, these accrued amounts cannot be qualified as expenses.

Read about the rates applied to the income of legal entities in the form of dividends in this material.

Sources: Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

UrDela.ru

When determining the tax base, the following expenses are not taken into account:

1) in the form of amounts of dividends accrued by the taxpayer and other amounts of profit after taxation;

2) in the form of penalties, fines and other sanctions transferred to the budget (to state extra-budgetary funds), interest payable to the budget in accordance with Article 176.1 of this Code, as well as fines and other sanctions levied by government organizations that are granted the right by the legislation of the Russian Federation imposition of said sanctions;

3) in the form of a contribution to the authorized (share) capital, a contribution to a simple partnership;

4) in the form of a tax amount, as well as the amount of payments for excess emissions of pollutants into the environment;

5) in the form of expenses for the acquisition and (or) creation of depreciable property, as well as expenses incurred in cases of completion, additional equipment, reconstruction, modernization, technical re-equipment of fixed assets, with the exception of expenses specified in paragraph 9 of Article 258 of this Code;

6) in the form of contributions for voluntary insurance, except for the contributions specified in Articles 255, 263 and 291 of this Code;

7) in the form of contributions to non-state pension provision, except for the contributions specified in Article 255 of this Code;

in the form of interest accrued by the taxpayer-borrower to the creditor in excess of the amounts recognized as expenses for tax purposes in accordance with Article 269 of this Code;

9) in the form of property (including money) transferred by a commission agent, agent and (or) other attorney in connection with the fulfillment of obligations under a commission agreement, agency agreement or other similar agreement, as well as in payment of expenses made by the commission agent, agent and (or) by another attorney for the principal, principal and (or) other principal, if such costs are not subject to inclusion in the expenses of the commission agent, agent and (or) other attorney in accordance with the terms of the concluded agreements;

10) in the form of amounts of deductions to the reserve for depreciation of investments in securities created by organizations in accordance with the legislation of the Russian Federation, with the exception of amounts of deductions to reserves for depreciation of securities made by professional participants in the securities market in accordance with Article 300 of this Code;

11) in the form of guarantee fees transferred to special funds created in accordance with the requirements of the legislation of the Russian Federation, intended to reduce the risks of non-fulfillment of obligations under transactions when carrying out clearing activities or activities for organizing trading on the securities market;

12) in the form of funds or other property that were transferred under credit or loan agreements (other similar funds or other property, regardless of the form of registration of borrowings, including debt securities), as well as in the form of funds or other property that were used to repay such borrowings;

13) in the form of amounts of losses for objects of service industries and farms, including objects of housing, communal and socio-cultural spheres in part exceeding the maximum amount determined in accordance with Article 275.1 of this Code;

14) in the form of property, work, services, property rights transferred in advance payment by taxpayers who determine income and expenses on an accrual basis;

15) in the form of amounts of voluntary membership fees (including entrance fees) to public organizations, amounts of voluntary contributions from members of unions, associations, organizations (associations) for the maintenance of these unions, associations, organizations (associations);

On the extension of the effect of paragraph 16 of Article 270 as amended by Federal Law No. 161-FZ of July 17, 2009 to legal relations for the provision of services for the provision of free air time and (or) free print space that arose in the period from January 1, 2006 to August 1, 2009 , see parts 2 and 3 of Article 2 of the Federal Law of July 17, 2009 N 161-FZ.

16) in the form of the cost of gratuitously transferred property (work, services, property rights) and expenses associated with such transfer, unless otherwise provided by this chapter;

17) in the form of the value of property transferred within the framework of targeted financing in accordance with subparagraph 14 of paragraph 1 of Article 251 of this Code;

18) in the form of a negative difference resulting from the revaluation of precious stones when the price lists were changed in accordance with the established procedure;

19) in the form of amounts of taxes presented in accordance with this Code by the taxpayer to the buyer (acquirer) of goods (work, services, property rights), unless otherwise provided by this Code;

20) in the form of funds transferred to trade union organizations;

21) in the form of expenses for any types of remuneration provided to management or employees in addition to remuneration paid on the basis of employment agreements (contracts);

22) in the form of bonuses paid to employees using special-purpose funds or targeted revenues;

23) in the form of amounts of financial assistance to employees;

24) to pay for additional vacations provided under the collective agreement (in excess of those provided for by current legislation) to employees, including women raising children;

25) in the form of bonuses to pensions, one-time benefits to retiring veterans of labor, income (dividends, interest) on shares or contributions of the organization’s workforce, compensation charges in connection with price increases made in excess of the amount of income indexation according to decisions of the Government of the Russian Federation, compensation for cost increases food in canteens, buffets or dispensaries, or provision of it at reduced prices or free of charge (with the exception of special food for certain categories of workers in cases provided for by current legislation, and with the exception of cases where free or reduced-price meals are provided for in employment agreements (contracts) and (or ) collective agreements;

26) to pay for travel to the place of work and back by public transport, special routes, departmental transport, with the exception of amounts to be included in the costs of production and sale of goods (work, services) due to the technological features of production, and with the exception of cases where costs for payment of travel to the place of work and back are provided for in employment agreements (contracts) and (or) collective agreements;

27) to pay price differences when selling goods (work, services) to employees at preferential prices (tariffs) (lower than market prices);

28) to pay price differences when selling products from subsidiary farms at preferential prices for the organization of public catering;

29) to pay for vouchers for treatment or recreation, excursions or travel, classes in sports sections, clubs or clubs, visits to cultural, entertainment or physical education (sports) events, subscriptions not related to subscriptions to normative, technical and other literature used for production purposes, and for payment of goods for personal consumption of employees, as well as other similar expenses made for the benefit of employees;

30) excluded. — Federal Law of May 29, 2002 N 57-FZ;

30) in the form of expenses of taxpayers-organizations of the state stockpile of special (radioactive) raw materials and fissile materials of the Russian Federation on operations with material assets of the state stockpile of special (radioactive) raw materials and fissile materials associated with the restoration and maintenance of the specified stock;

31) in the form of the value of shares transferred by the taxpayer - issuer, distributed among shareholders by decision of the general meeting of shareholders in proportion to the number of shares owned by them, or the difference between the par value of new shares transferred in exchange for the original ones and the par value of the initial shares of the shareholder when shares are distributed among shareholders when increasing the authorized capital issuer;

32) in the form of property or property rights transferred as a deposit or pledge;

33) in the form of amounts of taxes accrued to budgets of various levels in the event that such taxes were previously included by the taxpayer as expenses, when writing off the taxpayer's accounts payable for these taxes in accordance with subparagraph 21 of paragraph 1 of Article 251 of this Code;

34) in the form of amounts of targeted contributions made by the taxpayer for the purposes specified in paragraph 2 of Article 251 of this Code;

36) excluded. — Federal Law of May 29, 2002 N 57-FZ;

35) to carry out fruitless work on the development of natural resources in accordance with paragraph 5 of Article 261 of this Code;

36) no longer in force on January 1, 2008. — Federal Law of July 24, 2007 N 216-FZ;

37) in the form of amounts paid in excess of the norms established by the legislation of the Russian Federation;

38) for compensation for the use of personal cars and motorcycles for business trips, for paying for food rations for the crews of sea, river and aircraft in excess of the norms for such expenses established by the Government of the Russian Federation;

39) in the form of a fee to a public and (or) private notary for notarial registration in excess of the tariffs approved in the prescribed manner;

40) in the form of fees, deposits and other obligatory payments paid to non-profit organizations and international organizations, except for those specified in subparagraphs 29 and 30 of paragraph 1 of Article 264 of this Code;

41) to replace defective, out-of-marketable and missing copies of periodicals, as well as losses in the form of the cost of out-of-marketability, defective and unsold media products and book products, in addition to the costs and losses specified in subparagraphs 43 and 44 of paragraph 1 of Article 264 this Code;

42) in the form of entertainment expenses in the part exceeding their amounts provided for in paragraph 2 of Article 264 of this Code;

43) in the form of expenses provided for in paragraph six of paragraph 3 of Article 264 of this Code;

44) for the purchase (production) of prizes awarded to the winners of drawings of such prizes during mass advertising campaigns, as well as for other types of advertising not provided for in paragraphs two to four of paragraph 4 of Article 264 of this Code, in excess of the limits established by paragraph five of paragraph 4 of Article 264 of this Code normal;

45) in the form of contributions to the Russian Foundation for Basic Research, the Russian Humanitarian Science Foundation, the Fund for Assistance to the Development of Small Enterprises in the Scientific and Technical Sphere, the Federal Fund for Manufacturing Innovation, the Russian Fund for Technological Development, as well as to other industry and inter-industry funds for financing research and development development work registered in the manner prescribed by the Federal Law “On Science and State Scientific and Technical Policy”, in excess of the amounts of deductions provided for in paragraph 3 of Article 262 of this Code;

46) negative difference resulting from the revaluation of securities at market value;

47) in the form of expenses of the trust management founder associated with the execution of the trust management agreement, if the trust management agreement stipulates that the beneficiary is not the founder;

48) in the form of expenses incurred by religious organizations in connection with the performance of religious rites and ceremonies, as well as in connection with the sale of religious literature and religious objects;

48.1) in the form of the value of the property at the expense of the specified funds, including during the further sale of this property;

48.2) in the form of expenses, including remuneration to the management company and the specialized depository, made at the expense of organizations acting as insurers for compulsory pension insurance, when investing pension savings intended to finance the funded part of the labor pension;

48.3) in the form of amounts that are sent by organizations acting as insurers for compulsory pension insurance to replenish pension savings intended to finance the funded part of the labor pension, and which are reflected in the pension accounts of the funded part of the labor pension;

48.4) in the form of pension savings funds to finance the funded part of the labor pension, transferred in accordance with the legislation of the Russian Federation by non-state pension funds to the Pension Fund of the Russian Federation and (or) other non-state pension fund, which act as an insurer for compulsory pension insurance;

48.5) expenses of shipowners for maintenance, repairs and other purposes related to the maintenance and operation of ships registered in the Russian International Register of Ships;

48.6) expenses of a development bank - a state corporation;

The provisions of paragraph 48.7 of Article 270 apply until January 1, 2017.

48.7) incurred by taxpayers who are Russian organizers of the Olympic Games and Paralympic Games in accordance with Article 3 of the Federal Law “On the organization and holding of the XXII Olympic Winter Games and the XI Paralympic Winter Games of 2014 in the city of Sochi, the development of the city of Sochi as a mountain climatic resort and amendments in certain legislative acts of the Russian Federation,” including costs associated with engineering surveys during construction, architectural and construction design, construction, reconstruction and organization of operation of Olympic facilities;

48.8) in the form of amounts of remuneration and other payments made to members of the board of directors;

The provisions of paragraph 48.9 of Article 270 apply until December 31, 2012 inclusive.

48.9) expenses of a non-profit organization performing the function of providing financial support for major repairs of apartment buildings and relocation of citizens from emergency housing stock in accordance with the Federal Law “On the Fund for Assistance to the Reform of Housing and Communal Services”, incurred in connection with the placement of temporarily available funds;

48.10) in the form of payments to the victim made in the form of direct compensation for losses in accordance with the legislation of the Russian Federation on compulsory insurance of civil liability of vehicle owners by the insurer that insured the civil liability of the victim;

49) other expenses that do not meet the criteria specified in paragraph 1 of Article 252 of this Code.

‹ Article 269 (Tax Code of the Russian Federation). Peculiarities of classifying interest on debt obligations as expenses Up Article 271 (Tax Code of the Russian Federation). Procedure for recognizing income using the accrual method ›