Owning a business is always associated not only with profit, but also with expenses: to pay hired labor, pay salaries to employees, pay taxes - money is needed for everything. But in addition to these costs, which are still more related to the result of the work, there are those that are associated with the direct process of activity - these are the costs associated with the production and sale of products. What are they, what does the state say about such costs, and is it possible to optimize them in any way?

Article 264 of the Tax Code of the Russian Federation: who applies it?

Any commercial activity involves costs. It is impossible to make a profit without spending any resources (financial, labor, material). The cost of each company is different. For example, a large manufacturing enterprise for the manufacture of products is forced to purchase raw materials, pay wages to employees and fulfill its social obligations towards them, pay the costs of all types of energy used in production, and carry out a huge amount of various general and auxiliary expenses. Otherwise, the products produced will not meet the established requirements, and buyers will not be interested in them.

A small company, for example, providing real estate services, is limited to just a few cost items: office rent, utilities, staff salaries and office expenses.

But in both cases it is impossible to do without costs. If accounting requires recording them in full, then tax legislation imposes restrictions and stipulates the conditions under which a particular expense can reduce the income received by the company.

Article 264 of the NKRF, together with other articles of Chapter 25 of the Tax Code of the Russian Federation, is devoted to the formation of the tax base for income tax. It establishes a list of other expenses associated with the production and sale of products.

It is used by a variety of companies - not only Russian, but also foreign ones operating in our country through their permanent representative offices and (or) receiving income from sources in the Russian Federation (clause 1 of Article 264 of the Tax Code of the Russian Federation).

ConsultantPlus experts have prepared a review of recent judicial practice on the application of Article 264 of the Tax Code of the Russian Federation. If you don't have access to the system, get a free trial online.

You can learn about the nuances of calculating income tax from the article “How to correctly calculate corporate income tax?” .

The legislative framework

Let's start with the fact that costs associated with production and sales are subject primarily to the Tax Code, its Article 253, to be more precise. According to the Tax Code, this group includes costs for:

- Direct production (that is, manufacturing), storage and delivery of goods, as well as the performance of any work and provision of services, as well as the purchase and sale of works and services. That is, if a company produced, for example, a table, then the funds that were spent on its production (from purchasing raw materials to packing it in a box before sending it to a warehouse), renting storage space, transportation (logistics costs are calculated here) - all this considered production and selling expenses. The same group includes the costs of, say, nails that a handyman uses to provide his services.

- Maintaining the proper condition of equipment used in the production process or provision of services. This takes into account maintenance, timely repair work, and modernization if necessary - any costs associated with the tool.

- Development of natural resources - in this case they are considered as part of the tools of labor.

- Scientific and technical progress. Without it, it will be impossible to maintain the equipment in proper condition, as well as provide the most relevant services.

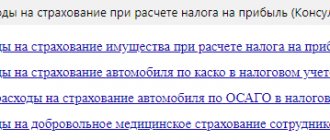

- Insurance. It is simply unreasonable to engage in business activities without ensuring the safety of not only employees, but also the safety of equipment. It is better to minimize all possible risks by insuring both human and technical resources.

- Other similar costs.

It is obvious that the costs associated with production and sales are divided into many groups. Almost everything that directly or indirectly relates to the provision of a service or the performance of some work, the production of a certain product and its preparation for sale can be classified in this large group. The only question is which particular cost category a particular product or service will fall into. The paradox is that the last mentioned categorization has no effect on taxation.

When is art needed? 264 of the Tax Code of the Russian Federation?

It is used when the company has other costs associated with production and sales. What are these expenses?

For example, an organization is engaged in the transport of goods. Its main expenses are driver salaries and material costs (gasoline, repairs and maintenance of vehicles). In addition, she pays office rent, purchases office supplies, and makes other similar payments - these are other expenses that are associated with her main activity. Other expenses will include taxes paid (for example, income tax or transport tax), various fees and other mandatory payments.

From time to time, a company needs the services of a notary, lawyer or auditor. Often you have to spend money on paying for information and consulting services. Such expenses are also included in other expenses under Art. 264 Tax Code of the Russian Federation.

It should be noted that certain types of other expenses can only be taken into account if certain conditions are met. For example, special conditions for recognizing expenses in Art. 264 of the Tax Code of the Russian Federation are provided for educational and entertainment services, advertising and standardization. If they are not taken into account, fines and additional charges cannot be avoided.

The list of other expenses is so large that the legislator did not limit it, but left it open. This means that if a company has expenses related to its core activities that are not listed in this article, but are economically justified and documented, it is possible to take such expenses into account when calculating income tax. Clause 49 of Art. will help to do this. 264 Tax Code of the Russian Federation.

The volume of other expenses can be very significant, and their list can be varied. And how competently the company uses this article will determine its financial well-being in the future. If, during a tax audit, all other expenses can be justified, you can avoid large expenses associated with the repayment of additionally accrued income taxes, penalties and fines.

Nuances of accounting for expenses under Art. 264 of the Tax Code of the Russian Federation, as well as the position of the Russian Ministry of Finance, tax authorities and judges, you will learn further.

other expenses

The above lists included other costs associated with production and sales. What is meant by them?

According to the Tax Code, this group includes taxes and fees that are levied on manufactured goods or services provided, as well as customs duties that exporters or importers of goods are forced to pay. Separately, it is worth noting that the law does not oblige entrepreneurs to include sales and production costs in the total amount of expenses, which will then be subject to taxes. Paying tax on them is a right, but not an obligation, so some entrepreneurs prefer to record such investments only in their own accounting departments, without informing the tax authorities about them. It is worth noting that with some effort, even these expenses can be attributed to income taxes, which will allow you to pay a much smaller amount for them.

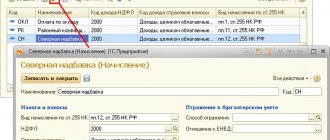

What taxes and fees are allowed to be included in expenses based on subparagraph. 1 clause 1 art. 264 of the Tax Code of the Russian Federation?

Example

Avtomobilist LLC provides transport services and uses OSNO. The organization pays all taxes and fees required by law (Article 23 of the Tax Code of the Russian Federation) and includes their amounts in the calculation of income tax (subclause 1, clause 1, Article 264 of the Tax Code of the Russian Federation).

After 3 years of activity, the company was visited by tax authorities and assessed additional income tax, and also imposed a fine and demanded to pay penalties. Inspectors removed the costs associated with paying for emissions of pollutants into the environment that exceeded the standard. Throughout the entire period of its activity, the company included the entire amount of payments in expenses, despite the fact that a significant part of them did not meet the standard.

IMPORTANT! Not all taxes and fees can be taken into account when calculating income tax (Article 270 of the Civil Code of the Russian Federation). Thus, it will not be possible to include as expenses VAT, excise taxes imposed by the taxpayer on the buyer, as well as income tax and payments for excess emissions of pollutants into the environment (letter of the Ministry of Finance of Russia dated December 6, 2006 No. 03-03-04/2/255).

In addition, inspectors assessed additional transport tax because errors were made in the company’s calculations. Additional charges turned out to be significant, but Avtomobilist LLC reduced this financial burden by following the explanations of officials. Thus, the Ministry of Finance of Russia in a letter dated 04/06/2015 No. 03-03-06/1/19158 indicated that according to sub. 1 clause 1 art. 264 of the Tax Code of the Russian Federation, you can take into account not only taxes and fees calculated by the company, but also taxes additionally accrued during the audit.

Find out whether it is possible to include the cost of state duty in the Standard Situation from ConsultantPlus. Learn the material by getting trial access to the system for free.

For information about who should include additional tax in the calculation of the profit base adjusted as a result of the audit, read the material “The Inspectorate itself must take into account the taxes additionally accrued during the audit as expenses.”.

Transport costs

Another type of expense associated with production and sales, rather indirectly, is the cost of motor transport. Some companies prefer to use their employees’ personal vehicles rather than purchase their own, “company” vehicles. In order for such actions to be correct from the point of view of law, it is necessary either to draw up an appropriate lease agreement, or once in a certain period (usually once a month) to pay the employee a certain amount of money as compensation for the use of his car in the company’s business.

Compensation is subject to income tax, which already reduces the tax burden on it. In addition, it depends on the engine power (it will be either 1,200 or 1,500 rubles).

But renting a car will be more economical: absolutely all costs associated with transport can be included in the income tax. And the amount that the employee will receive for giving his car for temporary use will not be subject to insurance deductions, as would be the case in the case of compensation, when the costs associated with production and sales would be subject to serious payments. According to experts, the savings will almost double, which plays a significant role in the modern world.

How to correctly account for the costs of coolers and drinking water?

Let's continue the example

The director of Avtomobilist LLC ordered the purchase and supply of coolers in the office and auto repair shops. As a result, he not only provided workers with drinking water, but also fulfilled his duties to create appropriate working conditions (Articles 22, 163, 223–224, 226 of the Labor Code of the Russian Federation, clause 18 of the order of the Ministry of Health and Social Development of the Russian Federation dated March 1, 2012 No. 181n).

The company's accountant took into account the contents of subparagraph. 7 clause 1 art. 264 of the Tax Code of the Russian Federation, opinion of officials (letters of the Ministry of Finance of Russia dated November 21, 2013 No. 03-03-06/1/5213, dated October 3, 2012 No. 03-03-06/2/112, dated May 25, 2012 No. 03-03-06 /1/274) and tax authorities (letters from the Federal Tax Service for Moscow dated July 31, 2012 No. 16-15/ [email protected] , dated October 17, 2012 No. 16-15/ [email protected] ) on this issue and boldly included these costs in other expenses.

See also “Water and coolers reduce income taxes” .

IMPORTANT! If a cooler costs more than 100,000 rubles, then for tax accounting purposes it will be recognized as depreciable property, and the costs of its acquisition and installation must be taken into account evenly over its useful life (Clause 1 of Article 256 of the Tax Code of the Russian Federation).

How to take into account expenses when changing accounting policies?

This question may arise if:

- the expenses collected on account 25 are then decided to be considered indirect rather than direct;

- expenses for services are intended to be written off without leaving them in the work in progress.

These changes can be applied only to costs generated already during the period of validity of the new provisions of the accounting policy. WIP created before the introduction of the new accounting policy will have to be written off according to the old rules (letters of the Ministry of Finance of the Russian Federation dated September 15, 2010 No. 03-03-06/1/588 and May 20, 2010 No. 03-03-06/1/336).

Read about the basic principles of drawing up accounting policies in the material “How to draw up an organization’s accounting policies (2020)?”

What nuances arise with rental and leasing costs?

Rent payments are the most common type of expense for many income tax payers. In the absence of financial resources to purchase or maintain your own property, renting real estate and equipment allows you to carry out commercial activities.

To find out whether expenses for renting residential premises for an office are included in expenses, read the material “Can expenses for renting residential premises for an office be recognized in tax accounting?”

Rental expenses reduce the tax base for profits on the basis of subclause. 10 p. 1 art. 264 Tax Code of the Russian Federation. The following documents will be required for documentary evidence:

- lease contract;

- documents confirming payment of rental payments;

- act of acceptance and transfer of leased property.

Let's continue the example

Avtomobilist LLC rented cars and leased several trucks with special equipment. The company's accountant reflected the costs of paying rent on the basis of acts of services rendered, and when such acts were not received from the lessors, he did not take into account the costs. Thus, he increased the tax burden on the company: the transport lease agreements did not provide for monthly registration of acts of services rendered, so expenses could be recognized without these documents (letter from the Ministry of Finance of Russia dated June 15, 2015 No. 03-07-11/34410, dated March 24 .2014 No. 03-03-06/1/12764).

With regard to leasing payments, the accountant also played it safe. Due to the fact that several units of special transport were leased, which cannot be used at low temperatures, it was idle in the winter, and leasing payments were not taken into account in expenses. Or they could - officials are not against such expenses (letters from the Ministry of Finance of Russia dated August 13, 2012 No. 03-03-06/1/409, dated January 21, 2010 No. 03-03-06/1/14).

In this case, it is better for companies to document the fact of downtime: draw up an OS-3 act, if the object is transferred for repair or is being modernized, or an OS-15 act, when installing it. If the property is not in use due to the seasonal nature of the work, you can issue an order from the manager to suspend the operation of the facility, indicating the reason for the downtime.

For information on how to correctly fill out the OS-15 act, see the article .

“Unified form No. OS-3 - form and sample” will help you fill out the OS-3 form .

How is compensation for the use of personal transport taken into account?

Cases when a company specialist has to perform work duties using a personal car are not that rare. Employers cannot always fully provide their employees with transport, and the specifics of their work may require this.

Employees have to bear costs (to maintain the technical condition of the car, fuels and lubricants, etc.), which are subject to compensation by the employer (Article 188 of the Labor Code of the Russian Federation). The taxpayer is given the right to take this compensation into account when calculating income tax (subclause 11, clause 1, article 264 of the Tax Code of the Russian Federation).

IMPORTANT! The amount of compensation for the use of personal transport for business trips is determined by Decree of the Government of the Russian Federation dated 02/08/2002 No. 92: for passenger cars - 1,200 rubles/month. (with an engine displacement of no more than 2,000 cc) and 1,500 rubles/month. - if this volume is exceeded.

Let's continue the example

Despite the fact that Avtomobilist LLC specialized in transportation, official transport was not provided for the financial director. He used his own car for business purposes, and the company’s accounting department included expenses associated with its operation, repairs and fuel payments as part of other expenses.

At the same time, the company paid all costs based on supporting documents. During the tax audit, inspectors removed all expenses exceeding the standard amount of compensation. The company's attempt to defend them in court was unsuccessful. According to the inspectors, the amount of compensation specified in Resolution No. 92 is the maximum that can be taken into account in expenses (letter from the Federal Tax Service of Russia for Moscow dated March 4, 2011 No. 16-15 / [email protected] ), and excess amounts cannot be accepted .

Neither officials (letter of the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39239) nor judges argue with this position (clause 4 of the Review of the practice of resolving disputes related to the application of Chapter 25 of the Tax Code of the Russian Federation, approved by the Presidium of the FAS Ural district 05/29/2009).

But compensation can only be paid if there is a whole package of documents, which must include (letter of the Ministry of Finance of Russia dated June 27, 2013 No. 03-04-05/24421):

- vehicle passport and registration certificate;

- documents confirming the amount of expenses (receipts for gasoline, maintenance, etc.);

- waybills confirming the actual use of transport in the interests of the employer.

The Ministry of Finance of Russia insists on the need to fill out waybills (letter dated September 23, 2013 No. 03-03-06/1/39406), and the courts consider their preparation in this case optional (resolution of the Federal Antimonopoly Service of the Volga District dated May 30, 2012 No. A12-15477/2011 , FAS Central District dated May 25, 2009 No. A62-5333/2008).

To find out whether it is possible to take into account the costs of maintaining transport in addition to compensation to an employee, read the material “Is it possible to take into account the costs of operating an employee’s vehicles if he is paid compensation for a car?”

Land question

The costs associated with production and sales also include the costs of maintaining land plots. When purchasing it, the company must decide whether it will pay the income evenly (that is, the amount will be divided into equal parts and paid over a certain period) or unevenly (in amounts that will not exceed 30% of the income tax for the last reporting period. That is amount will vary until tax liability is paid in full). It is worth noting that the right to choose to pay taxes applies only to those land plots that belonged to the state before their acquisition and were purchased from 2007 to 2011; similar rules do not apply to other plots.

| Uniform method | Uneven way |

|

|

How to take into account the costs of processing and issuing visas, passports, vouchers and invitations?

Many taxpayers have to from time to time send their employees on various business trips abroad (to establish contacts with foreign partners, expand their scope of activities, etc.). A business trip abroad is always associated with expenses such as obtaining visas, international passports and other similar documents.

The company has the right to take into account such costs in full (subclause 12, clause 1, article 264 of the Tax Code of the Russian Federation). Officials do not object to this (letter of the Ministry of Finance of Russia dated 06/03/2014 No. 03-03-Р3/1/26511).

We publish reports and conduct audits: is it possible to recognize expenses?

The costs of audit services are provided for in sub-clause. 17 clause 1 art. 264 Tax Code of the Russian Federation. It does not matter whether the taxpayer spent money on a mandatory audit of statements or paid for an initiative audit. The main thing is that these expenses meet the criteria of Art. 252 of the Tax Code of the Russian Federation (were economically justified and documented).

To justify the costs, you will need an audit agreement, a certificate of work performed (services provided) and a report (written information) based on the audit results. If the audit is mandatory, an auditor's report is added to them.

If a company is required by law to publish its reports, then the funds spent on this procedure can also be included in expenses (subclause 20, clause 1, article 264 of the Tax Code of the Russian Federation).

IMPORTANT! The company is obliged to publish its reports in the media in cases established by law (clause 9 of Article 13 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”).

For example, public joint-stock companies are required to post annual accounting reports in open sources (clause 1 of Article 66.3, clause 6 of Article 97 of the Civil Code of the Russian Federation, clause 1.1 of Article 1 and Article 92 of the Law “On Joint-Stock Companies” dated December 26, 1995 No. 208 -FZ). This obligation applies to an LLC only if it places bonds or other equity securities (Clause 2, Article 49 of the Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ).

In other cases, the company will have to defend its position in court. There are court decisions in which it was possible to defend the costs of voluntary publication of reports as part of advertising expenses (clause 4 of Article 264 of the Tax Code of the Russian Federation). Thus, in the resolution of the Federal Antimonopoly Service of the North-Western District dated May 20, 2004 in case No. A56-22319/02, the judges came to the conclusion that if the published material, in addition to the accounting records itself, also contains information about the taxpayer, designed to create or maintain interest in him, his goods (works, services), then this publication can be recognized as advertising.

What non-standard expenses does subclause allow to take into account? 49 clause 1 art. 264 of the Tax Code of the Russian Federation?

At times, taxpayers must pay for a wide variety of services and goods in order for their business operations to continue uninterrupted.

Example

It was important for Avtomobilist LLC to open an office in the city center in order to attract more clients to expand the business. But there were no free offices; even in the office center under construction, spaces were quickly sold out.

In order not to lose the coveted place, it was decided to incur additional costs - pay monthly under the option agreement, according to which Avtomobilist LLC became the owner of the right to conclude a lease agreement in the building under construction after its construction. If these expenses are incurred for the purpose of carrying out commercial activities by the taxpayer, officials do not object to their recognition (letter of the Ministry of Finance of Russia dated January 26, 2011 No. 03-03-06/2/16).

For example, a bakery can take into account the costs of repurchasing its expired products from the retail network (if there is an agreement with the seller for such repurchase). If the disposal of loaves and loaves entails additional costs, they are also taken into account (letter of the Ministry of Finance of Russia dated May 22, 2014 No. 03-03-R3/24238) on the basis of subclause. 49 clause 1 art. 264 Tax Code of the Russian Federation.

Often, companies attempt to justify their expenses using subclauses. 49 clause 1 art. 264 of the Tax Code of the Russian Federation ends in court proceedings.

Let's continue the example

Avtomobilist LLC installed alarms and car radios on vehicles used to provide transport services. The tax authorities did not agree with this; it was possible to prove the right to such expenses only in court (a similar court decision was the resolution of the Federal Antimonopoly Service of the West Siberian District dated 09.10.2006 No. F04-3191/2005(27129-A27-26) in case No. A27-2885/ 05-2).

Sometimes only in court it is possible to defend certain types of other expenses. For example, taxpayers managed to convince judges of the justification of expenses for fresh flowers (resolution of the Federal Antimonopoly Service of the Moscow District dated May 23, 2011 No. KA-A40/4531-11 in case No. A40-51743/10-90-293) or payment for the services of the airport luxury lounge for the head of the company (resolution of the FAS Moscow District dated May 28, 2009 No. KA-A40/4428-09 in case No. A40-62816/08-117-268, FAS West Siberian District dated October 23, 2006 No. F04-7102/2006(27676 -A67-40) in case No. A67-4841/05).

When deciding on the legality of accounting for non-standard expenses under sub. 49 clause 1 art. 264 of the Tax Code of the Russian Federation, it is necessary to take into account the position of officials. Thus, the Russian Ministry of Finance does not object to the expenses:

- for payment for early termination of the lease agreement (letter dated May 14, 2012 No. 03-03-06/2/61);

- for the payment of remuneration under contracts for the performance of a specific task (letter dated September 21, 2012 No. 03-03-06/1/495);

- for technological connection of devices to networks (letter dated 06/08/2011 No. 03-03-06/1/335);

- to pay daily allowances for one-day business trips (letter dated May 27, 2013 No. 03-03-06/1/18953).

Is a buffet with alcohol entertainment expenses?

Representation expenses are discussed in subsection. 22 clause 1 art. 264 of the Tax Code of the Russian Federation, and they must be recognized taking into account clause 2 of Art. 264 Tax Code of the Russian Federation.

Their difference from other other expenses under Art. 264 of the Tax Code of the Russian Federation is to limit the amount that can be taken into account when calculating income tax (4% of “salary” costs).

The composition of entertainment expenses is varied: expenses for breakfasts and lunches during an official reception, transportation of negotiators to the venue of the event, etc. In addition, entertainment expenses can also include expenses for negotiations with individuals - both actual and potential clients of the company (letter Ministry of Finance of Russia dated 06/05/2015 No. 03-03-06/2/32859).

For more information about the costs of negotiations with individuals, see the article “Costs of negotiations with individuals are also representative” .

But it is unsafe to interpret this list in an expanded manner. So, if you take into account the costs associated with a corporate party as part of entertainment expenses, you will have to defend them in court (letter of the Ministry of Finance of Russia dated September 11, 2006 No. 03-03-04/2/206). It is also risky to include payment for the services of invited artists, rental of bowling lanes and a buffet after the official part of the negotiations (letter of the Ministry of Finance of Russia dated December 1, 2011 No. 03-03-06/1/796, resolution of the 13th Arbitration Court of Appeal dated April 18. 2013 No. A56-55481/2012).

It will be difficult to justify the costs of decorating the premises (letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/176), although there are positive court decisions (resolution of the Federal Antimonopoly Service of the Moscow District dated September 3, 2010 No. KA-A40/10128-10 ).

But “alcoholic” expenses can be safely reflected as part of representative expenses - officials and judges do not object to this (letter of the Ministry of Finance of Russia dated March 25, 2010 No. 03-03-06/1/176, resolution of the Federal Antimonopoly Service of the Volga District dated January 15, 2013 No. A55- 14189/2012).

It should be noted that the recognition of entertainment expenses does not depend on the result of negotiations, that is, it does not matter whether their goal is achieved (deals are concluded, agreements are signed, etc.). What matters is only the direction of costs to generate profit (letter of the Ministry of Finance of Russia dated April 18, 2013 No. 03-07-11/13330).

The fact that the company’s expenses for organizing entertainment and recreation cannot be taken into account as part of representative expenses is stated in paragraph 2 of Art. 264 of the Tax Code of the Russian Federation, and officials confirm this (letter of the Ministry of Finance of Russia dated 06/03/2013 No. 03-03-06/2/20149).

Do not forget about the justification of entertainment expenses. You will have to prepare a report on the negotiations, which lists all those present, as well as an advance report. Other confirmations (an order for the event, an estimate, etc.) will not be needed (letter of the Ministry of Finance of Russia dated April 10, 2014 No. 03-03-R3/16288).

Accounting Basics

In order to control all costs, careful accounting is necessary. It occurs according to such cost items as:

- Direct and distributed material costs associated with production and sales (those that relate to resources used in the process of manufacturing a product or providing services, depreciation of equipment, etc. - non-human factors).

- Direct and distributed employee costs (any payments directly or indirectly related to personnel).

- Indirect production costs.

At the same time, when performing accounting, it is necessary to take into account the total cost of resources that were spent in the process of work, and the costs of employee wages, and insurance premiums, and the cost of technical factors - absolutely all costs associated with production and sales are included in financial report.

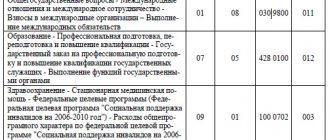

How to account for training costs?

It is a rare company that does without training its employees. In order for the company’s work to be stable and meet modern requirements, its employees must not only have certain qualifications, but also regularly improve them.

Taxpayers spend money to pay for the education of employees under various educational programs - from regular advanced training to mastering new professions at universities (subclause 23, clause 1, clause 3, article 264 of the Tax Code of the Russian Federation). But in order to reasonably take into account all educational expenses when calculating income tax, the following conditions of paragraph 3 of Art. 264 of the Tax Code of the Russian Federation (letter of the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39249):

- the employee studies in the interests of the company;

- an agreement has been concluded between the company and the educational institution;

- the educational institution has a license or appropriate status (if it is foreign);

- An employment contract or agreement has been concluded between the employee and the company, which provides for the obligation of the individual, no later than 3 months after graduation, to draw up an employment contract with this company and work for it for at least 1 year.

You will also need other documents: an order to send you to study, a curriculum, a certificate of services performed, as well as a document on completion of training (letter of the Ministry of Finance of Russia dated February 28, 2007 No. 03-03-06/1/137).

Let's continue the example

Avtomobilist LLC paid for its employee’s postgraduate studies, and the accountant’s training and certification in the program for professional accountants. The company took into account the expenses in full as part of other expenses, but the tax authorities tried to remove them. The company had to prove its case in court, and positive court decisions in similar cases were used as arguments (resolutions of the Federal Antimonopoly Service of the West Siberian District dated July 2, 2008 No. F04-3910/2008(7317-A81-14) in case No. A81-1660 / 2007), FAS East Siberian District dated January 15, 2007 No. A33-32437/05-F02-7147/06-S1 in case No. A33-32437/05).

Can all advertising expenses be taken into account under clause 4 of Art. 264 of the Tax Code of the Russian Federation?

Advertising, as we know, is the engine of trade. Selling profitably means getting a good income, and making a profit is the main goal of any commercial activity. The more sellers of the same product there are on the market, the more complex the choice consumers face. And if you help them a little in this painful process (for example, it is advantageous to emphasize some properties of the product), then you can attract more buyers.

Taxpayers choose a variety of ways to promote their products, from media advertising to tastings. Sometimes advertising costs constitute one of the major items of their expenses. The Tax Code of the Russian Federation allows you to reduce income by the amount of such expenses.

In the list of expenses under clause 1 of Art. 264 of the Tax Code of the Russian Federation is devoted to advertising expenses. 28, which applies taking into account paragraph 4 of Art. 264 Tax Code of the Russian Federation.

Basically, advertising costs can be taken into account when calculating income tax not in full, but only in an amount not exceeding 1% of sales revenue, determined in accordance with Art. 249 of the Tax Code of the Russian Federation.

There are few cases when a taxpayer’s advertising expenses can be recognized in full, and all of them are listed in paragraph. 2–4 p. 4 tbsp. 264 Tax Code of the Russian Federation:

- for advertising events through the media (paragraph 2, paragraph 4, article 264 of the Tax Code of the Russian Federation);

- for illuminated and other outdoor advertising, including the production of advertising stands and billboards (paragraph 3, paragraph 4, article 264 of the Tax Code of the Russian Federation);

- for participation in exhibitions, fairs, expositions, design of shop windows, sales exhibitions, sample rooms and showrooms, production of advertising brochures and catalogues, markdown of goods that have lost their original properties during exhibition (paragraph 4, paragraph 4, article 264 of the Tax Code of the Russian Federation) .

In order not to make a mistake and correctly include advertising costs in expenses, you should take into account the position of tax authorities and officials of the Russian Ministry of Finance:

- Expenses for materials necessary for registration of points of sale (POSM) in the standardized expenses under clause 4 of Art. 264 of the Tax Code of the Russian Federation are not listed, but help to increase the interest of buyers and are taken into account within the limits of the standard (letter of the Federal Tax Service of Russia for Moscow dated December 23, 2009 No. 16-15/136079.1).

- Expenses for leaflets and flyers. Such names in paragraph 4 of Art. 264 of the Tax Code of the Russian Federation is also not found, however, since we are talking about types of brochures with advertising information, the costs of their design and printing can be taken into account in full (letter of the Ministry of Finance of Russia dated December 6, 2006 No. 03-03-04/2/254).

- Expenses for advertising placed on the vehicle. Based on the provisions of paragraph 1 of Art. 19 Federal Law “On Advertising” dated March 13, 2006 No. 38-FZ, this type of advertising is not external, and costs for it are subject to rationing (letter of the Ministry of Finance of Russia dated February 3, 2006 No. 03-03-04/1/83, Federal Tax Service of Russia for Moscow dated June 17, 2005 No. 20-12/43630).

- The costs of conducting a tasting in order to attract the attention of buyers to the products are regulated expenses (letter of the Ministry of Finance of Russia dated 08/04/2010 No. 03-03-06/1/520).

- The cost of purchasing, delivery and transfer of packaged spring water containing company symbols. Such expenses should also be normalized (letter of the Ministry of Finance of Russia dated July 9, 2009 No. 03-03-06/1/452).

- The costs of maintaining and filling the company’s website and registering a domain name are not standardized (Resolution of the Federal Antimonopoly Service of the Moscow District dated April 4, 2011 No. KA-A40/2332-11-P), as well as the costs of placing products containing advertising on the Internet information about the company and its services (letter of the Ministry of Finance of Russia dated January 29, 2007 No. 03-03-06/1/41).