Withholding part of the money earned by a citizen is permitted in situations and amounts determined by certain federal laws and the Labor Code of the Russian Federation.

If deductions made from a citizen’s earned income are unlawful, the latter has the right to send a corresponding application to the court. Therefore, responsible employees of the organization must make all deductions from the income of workers in strict compliance with legislative norms, and information on possible options for deductions can be included in a document on the rules of remuneration or other internal act regulating issues of remuneration in the organization.

In what cases does an employer have the right to make deductions from wages ?

What are the grounds for salary deductions?

To withhold part of an employee's salary, there must be a legal basis. For example:

- Art. 137 of the Labor Code: reimbursement of advance payment unspent on a business trip, accounting error, unearned vacation pay.

- Art. 226 of the Tax Code of the Russian Federation - transfer of personal income tax by a tax agent.

- Art. 109 of the Family Code of the Russian Federation - withholding alimony from an employee.

- Art. 98 of the Federal Law “On Enforcement Proceedings” No. 229-FZ - foreclosure of the debtor’s income by a bailiff.

All grounds, except for personal income tax withholding, must be documented.

Loan deductions: no more than half

Based on the writ of execution, 1/3 of the employee’s salary is withheld to pay child support. Recently another writ of execution was received against this employee. This time we are talking about withholding 50% of income to repay the loan taken from the bank. What is the total withholding amount in this case?

As already mentioned, when collecting alimony for minor children, up to 70% of earnings can be withheld. But when collecting in favor of the bank - no more than half of the earnings. How to combine these two rules in the case under consideration? Let us turn to the provisions of paragraph 1 of Article 111 of Law No. 229-FZ. It says: if the amount collected from the debtor is not enough to satisfy in full all the requirements for all enforcement documents, a priority is established.

So, first of all, claims for alimony are paid off; compensation for harm caused to health; compensation for damage in connection with the death of the breadwinner; compensation for damage caused by the crime, as well as claims for compensation for moral damage. As for the demands of banks to collect debts under contracts, they are satisfied only in the fourth place. Further, paragraph 2 of Article 111 of Law No. 229-FZ states that each amount collected from the debtor is first used to pay off the first-priority claim. The requirements of each subsequent queue are satisfied after the requirements of the previous queue are fulfilled in full.

It turns out that in the situation under consideration, the employer first needs to fully “pay off” the alimony claims, since they fall under the first priority. To do this, it is enough to collect a third of your earnings. This means that this requirement will be fulfilled in full, even if 50% of earnings are withheld. Consequently, there are no grounds for recovery beyond 50% of earnings (up to 70%) in this case.

The remaining part of the withheld half of the earnings after the transfer of alimony must be transferred according to the second writ of execution in favor of the bank.

And in this way you need to do this until the corresponding requirement of the bank is fully satisfied (clause 2 of Art. Law No. 229-FZ). Provided, of course, that the collection of alimony does not stop during this period. Example

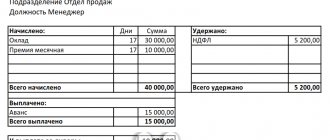

Let's assume that an employee's salary is 10,000 rubles. per month. He has two minor children, for whose maintenance alimony is collected (1/3 of his salary). The employee submitted an application and documents to the accounting department for a standard tax deduction (the amount of his income since the beginning of the year did not exceed 350,000 rubles). Additionally, there is a writ of execution for the recovery of 50% of income to repay the loan debt. Let's calculate the amount of deduction.

According to paragraph 1 of Article 99 of Law No. 229-FZ, the amount of withholding is calculated from the amount remaining after taxation. This means that in this case the amount of deduction will be determined based on 9,064 rubles. (10,000 – (10,000 – 1,400 × 2) × 13%). Accordingly, the total amount of deduction under writs of execution will be 4,532 rubles. (9,064 × 50%). Of these, 3,021.33 rubles will be transferred to fulfill the requirement to pay alimony. (9,064 × 1/3), and the remaining part (RUB 1,510.67) will be transferred to the bank to repay the loan debt.

Calculate wages with deduction of alimony and standard deductions for personal income tax

Types of deductions

All deductions can be grouped into mandatory by law, optional at the initiative of the employer, or voluntary at the request of the employee.

The first group of withholdings is mandatory - withholding 13% of the personal income tax, the amounts specified in the court decision, writ of execution or order of the bailiff.

The employee’s consent or the employer’s permission is not required to produce them.

The second group of deductions - at the initiative of the employer - can be in 6 cases.

1. The employee received an advance, but did not work the allotted time and quit . Some employers pay a fixed advance - 50% of the salary. They take into account the actual number of shifts worked only when calculating at the end of the month. If an employee worked few shifts, received an advance and immediately quit, he received too much.

The employer can withhold the money during the final payment or reclassify it as compensation for unused vacation.

2. The employee received advance travel allowances, but did not spend them all and did not return them upon returning from the business trip . For example, Ivanov was given 10,000 rubles in advance to cover the cost of paying for a hotel room. But Ivanov finished his business earlier, returned home, and from 10,000 rubles he still had 1,500 rubles unspent.

The employer can withhold 1,500 rubles from the next salary.

3. A counting error has occurred . This is a very controversial basis, since the law does not define the concept of “counting error”. There is an opinion from Rostrud that the counting error is an arithmetic one.

Whether a technical error is considered a counting error is also unclear - the law does not say anything, the courts say different things (see the ruling of the Sverdlovsk Regional Court dated 04/21/2016 in case No. 33-7642/2016, the Samara Regional Court ruling dated 01/18/2012 No. 33-302/ 2012).

In any case, the law has such a basis, which means the employer has the right to use it to withhold, for example, overpaid wages.

4. The employee did not fulfill the work standard through his own fault, and the labor dispute commission or court confirmed this . For example, an employee must produce 50 products a week, for which he is paid 5,000 rubles. For unknown reasons, he produced only 40 items.

The employer organized a commission on labor disputes, at the meeting they recorded the fact of shortcomings, and the manager had the right to withhold wages from the employee on account of unmanufactured products.

5. The employee took 28 days off, but did not work for a full year . For example, Ivanov got a job in March, worked for six months and went on full leave. After his vacation, Ivanov worked for another 2 months and quit. He received 4 months of vacation pay in excess, so the employer can withhold this money when calculating.

6. The employee caused material damage to the employer . For example, an employee spilled coffee on the keyboard and it stopped working. He caused damage to the employer, so the latter can deduct wages.

The third group of deductions is at the request of the employee. For example, an employee asked an accountant to send part of his salary to the bank to pay off a loan. The Ministry of Labor believes that this cannot be done: the law allows deductions only in certain cases, and this is not on the list.

Possible options for deductions from wages

Cases of non-payment to an employee of funds from his salary are determined in accordance with the Labor Code of the Russian Federation (Article 137) and are divided into deductions:

- mandatory;

- initiated by the enterprise;

- at the request of the employee.

Question: The organization that booked a room for a posted worker, in accordance with the contract, transferred to the hotel the amount of damage caused by the guest. Can an employer recover damages from an employee if, by a court decision, he is already withheld 70% of his wages in the form of child support? View answer

Mandatory types of non-payment of funds from an employee’s earnings include:

- tax payment on the income of a citizen as an individual (NDFL), determined by the Tax Code of the Russian Federation (Chapter 23);

- penalties under enforcement documents (sheets) in accordance with the Federal Law on enforcement proceedings (No. 119, 07/21/1997), made after payment of mandatory taxes in accordance with the Tax Code of the Russian Federation.

For your information! Any types of deductions are made from the funds earned by the citizen after the primary deduction in the form of personal income tax. Penalties under writs of execution are not applicable to certain types of income, for example, for work in extreme or harmful conditions (Article 69 of Federal Law No. 119).

Amounts withheld at the initiative of the enterprise relate to its right, but not its obligation, and contain:

- compensation for previously provided and unreturned advance payment received by the worker against future earnings;

- repayment within the prescribed period of an unreturned, unspent advance payment received by an employee due to a business trip, transfer to work in another locality;

- return of the excess part of the money paid to the employee due to accounting errors;

- return of money overpaid to a citizen upon recognition of his guilt or unlawfulness of actions by a labor dispute commission or a court decision (Articles 155, 157 of the Labor Code of the Russian Federation);

- deduction for labor leave time not worked by the employee, depending on the reasons for the employee’s dismissal (Articles 77, 81, 83 of the Labor Code of the Russian Federation);

- coverage of material damage incurred by the organization due to the fault of the employee (Chapter 39 of the Labor Code of the Russian Federation).

Question: How to record the deduction of alimony for the maintenance of a minor child from payments made to an employee in the form of wages and sick leave? In the billing month, the employee was accrued temporary disability benefits in the amount of RUB 13,808.28. (of which 3,452.07 rubles are paid at the expense of the organization, 10,356.21 rubles - at the expense of the budget of the Federal Social Insurance Fund of the Russian Federation) and wages in the amount of 19,090.91 rubles. The employee has an only minor child. There was no agreement on the payment of alimony between the child’s parents; alimony is collected from the employee on the basis of a court decision and court order. They are transferred to the bank account of the claimant (the child’s mother). Payment of amounts accrued to the employee is made by transferring funds to the employee’s bank account. Temporary disability benefits are paid simultaneously with wages for the billing month. The costs of transferring alimony to the claimant, as well as subsequent reimbursement of these costs by the employee, are not considered in this consultation. For profit tax purposes, income and expenses are accounted for using the accrual method. View answer

Failure to pay a portion of earnings by order of the company’s management must comply with the following conditions:

- the cost of the harm caused does not exceed the average monthly earnings of the perpetrator (Article 248 of the Labor Code of the Russian Federation);

- the order to recover money was issued by the management of the organization no later than 1 month from the date of final identification of the amount of damage caused (Article 248 of the Labor Code of the Russian Federation).

At the end of the month, in the absence of the employee’s voluntary consent to compensate for the damage, recovery is made by the employer only if there is a court decision.

For your information! If an overpayment of an excess amount of labor wages occurred due to incorrect or incorrect interpretation of legislative norms or other regulations, a reduction in the amount of earnings by the established excess is not allowed (Article 137 of the Labor Code of the Russian Federation).

Any deductions from earnings at the initiative of the employee (payment of a bank loan, trade union or insurance dues, utility bills) are made by the company's accounting department only upon receipt of a written application from the employee.

Question: What type of income code should I indicate in the payment order when transferring child support deducted from the employee’s salary to the employee’s ex-wife? View answer

When deduction from salary is not possible

An accountant withholds tax or debt from a salary by order of a bailiff without completing other documents. He only needs to remember the restrictions from Art. 138 Labor Code of the Russian Federation.

In all other cases, two conditions must be met:

- The one-month period established for debt repayment has not expired (Part 3 of Article 137 of the Labor Code of the Russian Federation).

- The employee gave written consent to the deductions.

If at least one of these conditions is not met, the employer will have to go to court to return the overpaid money.

There is no need to obtain consent from the resigning employee to withhold for unworked vacation days. But if there is not enough money to cover overpaid vacation pay, the employer will not be able to recover the remaining amount through the court. Because there is no such basis in the law.

Amount and procedure for deductions from earnings

The Labor Code of the Russian Federation (Article 138) determines the maximum values for the amount of deductions, regardless of their type, including for each payment of earnings:

- the total amount of funds earned but not transferred to the citizen cannot exceed 20% of accrued earnings;

- if several payments are necessary under enforcement documents, the total amount of deductions cannot be more than 50% of earnings;

- the amount of the deduction can reach up to 70% of earnings if deductions are made from the income of a person serving a sentence in a correctional colony, when compensating for damage to the health of another citizen, when compensating for damage in connection with the death of a breadwinner or caused by a crime.

Attention! All deductions made by the employer from the employee’s earnings must be reflected on payslips. The employee must be notified in writing about the size and reasons for reducing the amount paid (Article 136 of the Labor Code of the Russian Federation).

Before making a deduction, the employer must:

- obtain a legal basis for performing the procedure (order, instruction, memo with the resolution of the manager);

- carry out an inspection, establishing the cause, determining the exact amount of damage caused and drawing up an act, if there is a need to compensate the employer for damage (Articles 246, 247 of the Labor Code of the Russian Federation);

- monitor compliance with the established period for preparing a decision on withholding funds from earnings;

- obtain the employee’s written consent to reduce the amount of earnings (if necessary).

How to withhold money from an employee

For mandatory deductions, orders from the manager or statements from the employee are not needed; a writ of execution or a copy of it with the order of the bailiff is sufficient.

For deductions initiated by the employer, the list of documents depends on the situation. For example, when withholding an overpaid advance, written consent must be obtained from the employee and an order from the manager to withhold. If a shortage occurs, in addition to these documents, a deficiency report must be drawn up, signed by the commission, and an explanatory note from the financially responsible employee.

Refund of erroneously paid amounts due to an accounting error

This situation arises when, as a result of a counting error, the employee was paid more wages than expected. Please note that Rostrud relies on the opinion that a counting error is an error that was made during arithmetic operations (Rostrud letter dated October 1, 2012 No. 1286-6-1). Well, for example, at an enterprise an employee works according to a tariff, that is, payment is rubles per hour. The salary calculator incorrectly multiplied the cost of an hour by the time worked; as a result, the person was overpaid.

What to do?

To withhold overpaid amounts, the employee's written consent is required. If there is no agreement, the employer is forced to either forgive him this amount or go to court, where he will need to prove that a calculation error occurred.

Another example:

The employee resigned voluntarily. The final settlement with him has been made. It turned out that his wages were calculated incorrectly and he was given extra money. As a result of the check, it turned out that the error occurred due to a glitch in the 1C program.

A letter was sent to the former employee asking him to return the overpayment, but he ignored it. Then the employer went to court and proved that the reason for the overpayment was a calculation error. The court accepted the employer's position and ordered the former subordinate to return the money.

The situation was considered in case No. 2-1879/2015 dated 07/07/2015 of the Kiselevsky City Court.

When can employees challenge wage deductions?

Let us once again draw your attention to the fact that money must be withheld from an employee’s salary strictly in accordance with labor laws.

This applies not only to the registration of the employee’s consent and the employer’s order to withhold; it is necessary to correctly draw up the documents that form the basis of these withholdings.

If the employer incorrectly prepares the supporting documents, there is a high probability that the employee will challenge all “deductions”.

For example, you need to prove that this particular employee is to blame for the breakdown of this particular item, or that there was a shortage, and it occurred precisely because of this employee. For each case, the employer should carry out a number of activities and prepare the necessary documents. Otherwise, the deductions are illegal.

Income from which deductions cannot be made

At the everyday level, the concept of earnings includes all payments made by the employer, but part of this income is not subject to deduction. Deductions cannot be made from funds received as:

- compensation for injury to health or death of an employee;

- compensation for business trips and transfers, wear and tear of the employee’s personal tools;

- payments on the occasion of marriage, birth of a child and death of loved ones;

- insurance coverage for compulsory insurance, except for amounts paid on sick leave;

- one-time financial assistance in cases of natural disasters and similar emergency circumstances;

- compensation for the cost of a trip to a sanatorium, as well as travel to and from the place of treatment.

If we are talking about the payment of alimony, then amounts compensating for harm to health and benefits for temporary disability are excluded from this list. Withholding of alimony payments can be made from them.

Employee-initiated retention

In practice, it happens that the employee himself asks the organization to withhold money from his salary and use it to pay off loans, goods, works and services. Let us say right away that it is not forbidden to meet an employee and withhold money from his salary. Moreover, there are no limits on the amount of deduction in this case. After all, the organization, in fact, only transfers money at the request of the employee himself, who has the right to dispose of it as he wants (letter of Rostrud dated September 16, 2012 No. PR/7156-6-1).

The main thing is that the employee’s initiative is confirmed by an application (for more information, see “Writing an application to withhold alimony on a voluntary basis (sample)”).

Alimony for children and spouses

The employee received three retention orders. The first is to support a spouse in the amount of 0.6 times the subsistence minimum for the working-age population in our region every month. The second is to support my son in the amount of 1/4 of my monthly income. And third - to support my daughter in the amount of 1/6 of my monthly income. What will be the maximum amount of deductions in this situation? How to distribute the recovered money among three dependents?

As already mentioned, when collecting alimony for minor children, the amount of withholding can reach 70% of wages. As follows from the article of the Family Code of the Russian Federation, amounts paid for the maintenance of a former spouse are also recognized as alimony. But since they are not child support, no more than half of the earnings can be withheld to satisfy these requirements.

At the same time, while establishing the order of repayment of claims under several writs of execution, the legislator did not separate child support from other alimony. This means that penalties for all three writs of execution will relate to one priority - the first (Clause 1, Article 111 of Law No. 229-FZ). Therefore, in this case, it is necessary to apply the rule of paragraph 3 of Article 111 of Law No. 229-FZ. It states: if the amount of money collected from the debtor is insufficient to satisfy the demands of one line in full, then they are repaid in proportion to the amount due to each collector specified in the writ of execution.

This means that the algorithm of actions in this case will be as follows. First, the amount of alimony for the maintenance of the spouse and both children must be withheld within 50% of the employee’s earnings. The resulting amount is distributed among all claimants in proportion to the amount due to each of them. After this, you need to make additional withholding of child support, but so that the collection does not exceed 70% of earnings. The additional amount withheld is distributed only among the children in proportion to the amount due to each of them.

Example

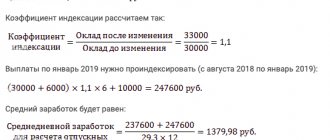

Let's assume that an employee's salary is 10,000 rubles. 1/4 of the income is collected for the maintenance of a son, and 1/6 for the maintenance of a daughter. Since the employee has the right to a standard deduction for two children, the amount of wages from which deductions are possible will be 9,064 rubles. (10,000 – (10,000 – 1,400 × 2) × 13%). Now, based on this amount, we will determine the payments due to the children: the son should receive 2,266 rubles. (9,064 × 1/4), and the daughter - 1,510.67 rubles. (9,064 × 1/6).

For the maintenance of a spouse, 0.6 of the subsistence minimum for the working population in the region is charged (currently this is 11,907 × 0.6 = 7,144.20 rubles).

We retain half of the earnings (4,532 rubles) and distribute this amount among all three claimants. The spouse's share will be (4,532 ∕ (7,144.2 + 2,266 + 1,510.67)) × 7,144.2 = 2,964.74 rubles. The son's share will be (4,532 / (7,144.2 + 2,266 + 1,510.67)) × 2,266 = 940.36 rubles. The daughter's share will be (4,532 ∕ (7,144.2 + 2,266 + 1,510.67)) × 1,510.67 = 626.90 rubles.

As we can see, the children received less than their due. So, let's move on to additional deductions. To do this, we first determine the amount that can be withheld for child support (within 70% of earnings). It is equal to 1,812.8 rubles. (9,064 × 70% – 4,532). We keep it and distribute it between the two children in proportion to their shares. The son’s share is (1,812.8 ∕ (2,266 + 1,510.67)) × 2,266 = 1,087.68 rubles, and the daughter’s share is (1,812.8 ∕ (2,266 + 1,510.67)) × 1,510.67 = 725.12 rub.

In total, the spouse will receive 2,964.74 rubles, the son - 2,028.04 rubles. and daughter - 1,352.02 rubles.

Calculate salary taking into account “northern” coefficients and bonuses