Principles for choosing KVR and KOSGU

As noted above, travel expenses are considered in the context of the Labor Code of the Russian Federation as reimbursements (compensations) related to the employee’s performance of work duties. In international statistical practice, such payments are not considered as payments in the interests of employees, but belong to the category of expenses made by the employee for the purpose of performing work duties. In this regard, reimbursement of expenses associated with business trips (travel, accommodation, other expenses related to the performance of official assignments on a business trip), starting in 2022, were transferred to subarticle 226 “Other work, services” of KOSGU. Previously, they were taken into account under subarticle 212 “Other payments” * (3) of the KOSGU (clause 7, clause 10.2.6, clause 10 of Procedure No. 209n, clause 2.1.4 of the Methodological recommendations for the procedure for applying the KOSGU, communicated by a letter from the Ministry of Finance of Russia dated June 29 .2018 No. 02-05-10/45153).

What does the law guarantee when sending an employee on a business trip?

2. A budgetary institution sends an employee on a business trip. He is reimbursed for daily allowance, expenses for travel, accommodation, telephone conversations for official reasons during a business trip. Telephone reimbursement is included in the established list of reimbursed travel expenses.

220 Purchase of goods, works and services to provide special fuel and fuels and lubricants, food and clothing supplies to bodies in the field of national security, law enforcement and defense

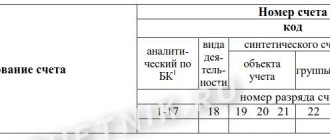

In the budget, KOSGU is a classification of operations of the general government sector. A specific codifier allows you to group operations that are similar in content. Assignment to KOSGU significantly simplifies accounting and reporting of the public sector.

What is KOSGU

Accountants often get confused in KOSGU codes when reflecting expenses for the acquisition of fixed assets and inventories. Before determining the exact sub-item of KOSGU and KVR, it is necessary to understand which group of non-financial assets the acquired objects belong to.

Regarding mandatory payments and fees paid outside the territory of the Russian Federation in foreign currency (taxes and fees paid to the budget system of the host country (foreign state))

In terms of payment of material assistance as part of social support for students at the expense of the scholarship fund, as well as material assistance to unemployed citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities

Subsidies to autonomous institutions for financial support of state (municipal) tasks as part of the execution of state (municipal) social orders for the provision of state (municipal) services in the social sphere

a) payment for heating services, hot and cold water supply, sewerage, provision of gas and electricity, thermal energy, solid fuel in the presence of stove heating under contracts for the provision of utility services, management of municipal solid waste:

What will change in KOSGU from November 21, 2022 and in 2022

- to purchase non-exclusive rights to use the results of intellectual activity under license agreements and other documents that confirm rights;

- for material incentives for people's vigilantes;

- to compensate the cost of food for freelance sports judges, volunteers, and supervisors who were involved in sports events

+ reimbursement of expenses for renting housing to the victim, witness, legal representatives, expert, specialists, translator, witnesses, lawyer appointed by the inquirer, investigator or court

+ remuneration for work during a criminal, civil or administrative case to a translator, expert, expert institution, lawyer appointed by the inquirer, investigator or court

- to carry out architectural and archaeological measurements;

- for the development of general plans combined with the territory planning project;

- for standard design work;

- for the development of territorial planning schemes, urban planning and technical regulations, urban zoning, territory planning;

- to develop technical conditions for connecting to engineering support networks, increasing power consumption

+ costs of dismantling work, including demolition of buildings, relocation of communications, if the work:

- to carry out architectural and archaeological measurements;

- on the conditions for connecting to engineering support networks, increasing power consumption;

- for engineering and geodetic surveys;

- to perform cadastral works

+ expenses for dismantling work, including demolition of buildings, relocation of communications, if the work is carried out for the purpose of capital investment in capital construction projects

352 “Increase in the value of non-exclusive rights to the results of intellectual activity with a certain useful life”

353 “Increase in the value of non-exclusive rights to the results of intellectual activity with an indefinite useful life”

For these codes they specified:

- KVR 122 “Other payments to personnel of state (municipal) bodies, with the exception of the wage fund” with subarticle 296 “Other payments of a current nature to individuals” of KOSGU - in terms of compensation to officials for damage caused to their property in connection with official activities;

- KVR 730 “Service of municipal debt” with subarticle 232 “Service of external debt” of KOSGU - regarding the obligations of municipalities on budget loans attracted from the Russian Federation in foreign currency as part of the use of targeted foreign loans (clause 3, clause 2, article 100 of the Budget Code of the Russian Federation ).

According to these changes, in addition to codes 263 and 265, purchases for social security purposes can also be carried out under KOSGU 226, 261, 341 and 342, only now the updated links with these subarticles have a specific purpose indicated in the notes to them. And if we talk about the acquisition of material reserves for distribution to the population, it turns out that, based on the links and rules proposed by the Russian Ministry of Finance, they can be taken into account according to CVR 323 in different ways:

From 2022, the procedure for applying KOSGU will undergo major changes. Most of the clarifications of the Russian Ministry of Finance on the use of KOSGU, presented earlier in letters, will be included in Procedure No. 209n and will gain legal force. The procedure for applying the CSC will also be adjusted, including in relation to the CVR. The Financial Department has already prepared draft amendments to both documents. In addition, the order of the Ministry of Finance of Russia dated June 8, 2022 No. 98n with amendments to Procedure No. 85n is being registered with the Ministry of Justice of Russia. So institutions will have to keep records and prepare reports next year in accordance with the updated requirements for the use of CVR and KOSGU.

From 01/01/2021, public sector employees will have to work according to updated rules. The Ministry of Finance of the Russian Federation introduces types of expenses of the budget classification for 2022 - 246 “Purchase of goods, works, services for the purpose of creation, development, operation and decommissioning of state information systems” and 247 “Purchase of energy resources” (clause 48.2.4.6 of the Procedure No. 85n).

If we are not talking about reimbursement of expenses, but about providing the employee with everything necessary before a business trip (when the institution independently purchases tickets, pays for a hotel, etc.), then the institution’s expenses will include, in particular:

As noted above, travel expenses are considered in the context of the Labor Code of the Russian Federation as reimbursements (compensations) related to the employee’s performance of work duties. In international statistical practice, such payments are not considered as payments in the interests of employees, but belong to the category of expenses made by the employee for the purpose of performing work duties. In this regard, reimbursement of expenses associated with business trips (travel, accommodation, other expenses related to the performance of official assignments on a business trip), starting in 2022, were transferred to subarticle 226 “Other work, services” of KOSGU. Previously, they were taken into account under subarticle 212 “Other payments” * (3) of the KOSGU (clause 7, clause 10.2.6, clause 10 of Procedure No. 209n, clause 2.1.4 of the Methodological recommendations for the procedure for applying the KOSGU, communicated by a letter from the Ministry of Finance of Russia dated June 29 .2018 No. 02-05-10/45153).

Accountants often get confused in KOSGU codes when reflecting expenses for the acquisition of fixed assets and inventories. Before determining the exact sub-item of KOSGU and KVR, it is necessary to understand which group of non-financial assets the acquired objects belong to.

Regarding mandatory payments and fees paid outside the territory of the Russian Federation in foreign currency (taxes and fees paid to the budget system of the host country (foreign state))

In terms of payment of material assistance as part of social support for students at the expense of the scholarship fund, as well as material assistance to unemployed citizens during the period of professional training, retraining and advanced training in the direction of the employment service authorities

consumed energy and (or) utility resources under contracts for the supply of electricity, gas, heat supply, including payment of overdue debt for the specified consumed energy and (or) utility resources;

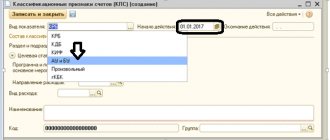

- Select the correct KOSGU for the operation being performed.

- Determine the CVR in accordance with the selected OSGU code.

- Check the data linking KVR and KOSGU according to the approved correspondence table.

- Include the verified CWR in planning or reporting documentation.

Until 2016, decoding of schedules and procurement plans was compiled in the context of KOSGU. But now the old codifier has been replaced by new ciphers - a code for the type of expenses according to the budget classification. It is a mistake to believe that KOSGU articles are not involved in procurement activities. To plan any purchase, an institution needs to correctly determine the CWR and only then reflect the operation in planning documentation. But it is impossible to choose the correct KVR without first determining the KOSGU. This is the key principle of using codifiers and their direct relationship.

- 110 “Tax revenues, customs payments and insurance contributions for compulsory social insurance”;

- 120 “Income from property”;

- 130 “Income from the provision of paid services (work), compensation of costs”;

- 140 “Fines, penalties, penalties, compensation for damage” and others.

614 “Subsidies to budgetary institutions for the financial support of state (municipal) assignments as part of the execution of the state (municipal) social order for the provision of state (municipal) services in the social sphere”

In 2022 and the planning period 2022-2023. income and expenses will need to be reflected in accordance with the new lists of the KBK of the federal budget, as well as the adjusted Procedures for the application of the KBK and KOSGU. We have already talked about planned innovations in the use of the BCC, and also reported on a number of comparative tables prepared by the financial department. In addition to them, the Russian Ministry of Finance has prepared a comparative table of CVR and KOSGU for 2021 (information from the Ministry of Finance dated July 19, 2022). It has several differences from the current one, which we mentioned the other day. For example, the table includes links between sub-articles of KOSGU and new types of expenses, including in connection with the new legislation on social procurement:

The definition of the concept of “business trip” is given in Art. 166 of the Labor Code of the Russian Federation is a trip of an employee by order of the employer for a certain period of time to carry out an official assignment outside the place of permanent work.

When sending an employee on a business trip, the institution is obliged (Articles 153, 167, 168 of the Labor Code of the Russian Federation):

- retain the employee’s place of work (position);

- pay the employee the average salary for the time he is on a business trip (including travel days);

- in case of employment on weekends or non-working holidays, pay for such work in the manner prescribed by labor legislation;

- reimburse, in the prescribed manner, travel expenses related to the business trip, rental of accommodation, pay daily allowance, and also compensate for other expenses incurred with the permission or knowledge of the head of the institution.

Please note that an employer can send only persons associated with him through labor relations (permanent employees and part-time workers) on a business trip. This is stated in paragraph.

2 of Regulation No. 749[1], which guides all employers, without exception, when sending their employees both within the country and abroad. Persons involved in work under a civil contract cannot be seconded.

The amount and procedure for reimbursement of travel expenses to employees who have entered into an employment contract to work in federal government institutions, in state institutions of constituent entities of the Russian Federation, in municipal institutions are determined accordingly by regulatory legal acts of the Government of the Russian Federation, state authorities of constituent entities of the Russian Federation, and local governments (Part 2, 3, Article 168 of the Labor Code of the Russian Federation).

The standards for reimbursement of expenses associated with business trips on the territory of the Russian Federation to employees of institutions financed from the federal budget are established by Decree of the Government of the Russian Federation No. 729[2]. Let's list them:

Type of expensesReimbursement rates for travel expenses*

| Fare payment | Not higher than the cost of travel: a) by rail - in a compartment carriage of a fast branded train; b) by water transport - in a cabin of a group V sea vessel of regular transport lines and lines with comprehensive passenger services, in a cabin of a category II river vessel of all lines of communication, in a cabin Category I ferry vessel; c) by air - in an economy class cabin; d) by road - in a public vehicle (except taxis) | In the amount of the minimum cost of travel: a) by rail - in a reserved seat carriage of a passenger train; b) by water transport - in the cabin of the X group of a sea vessel of regular transport lines and lines with comprehensive passenger services, in the cabin of the III category of a river vessel of all lines of communication; c) by road – in a public bus |

| Daily payments | 100 rub. for each day of being on a business trip | |

| Payment for rental premises | No more than 550 rub. per day | 12 rub. per day |

* Travel expenses can be reimbursed in a larger amount on the basis of an order from the head of the institution, through savings from budgetary funds (subsidies) or from funds received from the income-generating activities of a budgetary (autonomous) institution (clause 3 of Government Decree No. 729 of the Russian Federation).

The maximum amounts for reimbursement of expenses to employees of federal government institutions for business trips abroad are determined by Decree of the Government of the Russian Federation dated December 26, 2005 No. 812 and Order of the Ministry of Finance of the Russian Federation dated August 2, 2004 No. 64n.

The territories of the constituent entities of the Russian Federation and municipalities have their own regulations that should be followed when determining the amount of travel expenses subject to compensation (see, for example, Resolution of the Government of St. Petersburg dated August 25, 2016 No. 755, Resolution of the Council of Ministers of the Republic of Crimea dated December 26. 2014 No. 624).

It should be noted that reimbursement of travel expenses to employees should be made only on the basis of documentary evidence of the fact of a business trip, which is also a necessary condition for the recognition of travel expenses in both accounting and tax accounting.

The accounting reports of government institutions under KVR 112 contain funds that are not included in the wage fund and are allocated to pay for travel and other expenses, as well as payment of compensation to the organization’s employees, if this is stipulated in the employment contract or established by the current legislation of the Russian Federation and municipal legal acts.

Sometimes expenses that must pass under CVR 112 are classified as 113 or 244. However, there is a significant difference between them.

CVR 113, in contrast to code 112, must be used only to reflect funds used for payments to individuals who cooperate with an institution without a civil law agreement or an employment contract: for example, payment for the participation of athletes and coaches in physical education and sports events. Also, this category should cover the cost of travel for students to the place of study and practical training.

CVR 244, according to the Directives of the Ministry of Finance of the Russian Federation dated 08/19/2016 “02-05-10/48951”, denotes the expenditure of budget money on remuneration of individuals who were involved in the work of a state (municipal) institution on the basis of a civil law contract.

If a medical examination of employees is provided for in the work plan of a state (municipal) institution, then funds are allocated for it according to the code of types of expenses 244. And KVR 112 is used when compensating expenses for employees who have undergone this procedure on their own.

If an organization has entered into an agreement with an educational institution, then payment for employee training in the accounting reports is recorded under KVR 244, but compensation for travel tickets is recorded under KVR 112.

Order No. 65n states that the payment of severance pay in the event of the dismissal of an employee, which is not related to the reorganization or liquidation of a state (municipal) institution, must be carried out according to KVR 112. According to the same type of expense code, a lump sum benefit is allocated to an employee who is dismissed if the reason is not related to staff reduction. Otherwise, KVR 111 or 133 are used.

Linking KOSGU with KVR

For your information: the table of correspondence between the types of expenses of the classification of budget expenditures and the articles (sub-items) of the classification of operations of the general government sector, applied in 2021, is posted on the official website of the Ministry of Finance (www.minfin.gov.ru).

We reflect utility costs in accounting

consumed energy and (or) utility resources under contracts for the supply of electricity, gas, heat supply, including payment of overdue debt for the specified consumed energy and (or) utility resources;

- Select the correct KOSGU for the operation being performed.

- Determine the CVR in accordance with the selected OSGU code.

- Check the data linking KVR and KOSGU according to the approved correspondence table.

- Include the verified CWR in planning or reporting documentation.

You may be interested:: What is required for 3 children in 2022 in KhMAO

The application of VKR 244 “Other procurement of goods, works and services” occurs when expenses are incurred to meet the needs of state (municipal) organizations, which are carried out unscheduled and are necessary directly to maintain and improve the functioning of an already established information and communication infrastructure.

Who is required to apply KVR 242?

In the groups of receipt and disposal of financial assets, increase and decrease of liabilities in 2022, it will be necessary to apply detailed KOSGU depending on the type of asset or liability, category of debtor or creditor.

It is specified that subsection 224 of KOSGU must also include reimbursement to the lessor (owner, balance holder of the property) for the costs of paying corporate property tax and land tax under a lease agreement or gratuitous use of real estate. The Ministry of Finance mentioned this earlier.

Many clarifications will be made to subarticle 226 of KOSGU. It will indicate the following expenses: payment for dismantling work (demolition of buildings, relocation of communications, etc.) if these works were not carried out for the purpose of capital investments in capital construction projects (reconstruction, including elements of restoration, technical re-equipment) and they are not included in the volume of capital investments that form the cost of fixed assets; material incentives for people's vigilantes for participating in the protection of public order; compensation payments for meals to sports judges, volunteers, controllers who are not full-time employees of the institution and involved in participation in sports events; payment for services for transportation, storage and dispensing through the pharmacy network to citizens of free and preferential medications concluded with pharmaceutical companies under a single contract (agreement); payment for the services of a translator and specialist involved in the arbitration process by the arbitration court; payment for the services of lawyers providing free legal assistance to citizens; payment of remuneration to the bankruptcy trustee, as well as compensation for the bankruptcy trustee’s expenses for conducting bankruptcy proceedings for the absent debtor.

Income from granting the right to conclude an agreement (contract) will be added to subarticle 129 of KOSGU. In particular, these are amounts received by the customer after an electronic auction in the case when the contract price is reduced to half a percent of the NMCC and below. The Ministry of Finance previously recommended that the fee for the right to conclude an agreement be reflected under this sub-article.

- KVR 119 is applied with subsection 222 of KOSGU - for calculating insurance premiums for compensation to employees of the cost of travel for business purposes, established by a local act;

- KVR 323 correlates with subarticles 226 and 261 of KOSGU - to take into account remuneration under a guardianship or trusteeship agreement and the costs of the Federal Compulsory Medical Insurance Fund for the payment of medical care under the territorial compulsory medical insurance program.

Changes in the procedure for applying KOSGU

Many accountants are faced with how to correctly indicate in reporting the expenses of funds allocated to pay severance pay, travel allowances and other payments that are not related to the salaries of employees of municipal (state) institutions. In most cases, KVR 112 is used for these purposes. But in some cases, specialists may use other codes, so it is necessary to strictly follow the requirements of the Ministry of Finance Directive.

In paragraph 5.1.1 of Section III of the Order of the Ministry of Finance of the Russian Federation dated July 1, 2013 No. 65n, the decoding states that the CVR “Other payments to personnel of institutions, with the exception of the wage fund” is used to designate payments that are not related to the wage fund.

It should be noted that expense type code 112 is often used with several additional codes:

- KVR 122 “Other payments to personnel of state (municipal) bodies, with the exception of the wage fund”;

- KVR 133 “Expenses for payments to military personnel and employees with special ranks, depending on the amount of monetary allowance”;

- KVR 142 “Other payments to personnel, with the exception of the wage fund, are used to make payments in favor of employees of state extra-budgetary funds”

The accounting reports of government institutions under KVR 112 contain funds that are not included in the wage fund and are allocated to pay for travel and other expenses, as well as payment of compensation to the organization’s employees, if this is stipulated in the employment contract or established by the current legislation of the Russian Federation and municipal legal acts.

Sometimes expenses that must pass under CVR 112 are classified as 113 or 244. However, there is a significant difference between them.

CVR 113, in contrast to code 112, must be used only to reflect funds used for payments to individuals who cooperate with an institution without a civil law agreement or an employment contract: for example, payment for the participation of athletes and coaches in physical education and sports events. Also, this category should cover the cost of travel for students to the place of study and practical training.

CVR 244, according to the Directives of the Ministry of Finance of the Russian Federation dated 08/19/2016 “02-05-10/48951”, denotes the expenditure of budget money on remuneration of individuals who were involved in the work of a state (municipal) institution on the basis of a civil law contract.

If a medical examination of employees is provided for in the work plan of a state (municipal) institution, then funds are allocated for it according to the code of types of expenses 244. And KVR 112 is used when compensating expenses for employees who have undergone this procedure on their own.

If an organization has entered into an agreement with an educational institution, then payment for employee training in the accounting reports is recorded under KVR 244, but compensation for travel tickets is recorded under KVR 112.

Are you here

A note has been added to the link between KVR 247 and KOSGU code 223. This compliance applies when paying tariffs for heat supply, as well as for the supply and transportation of electricity and gas through electric and gas distribution networks.

The correspondence table between KVR and KOSGU has been updated for 2022

All correspondence under subarticles 352 and 353 of KOSGU are excluded from the table. Let us note that in the amendments to the KOSGU the Ministry of Finance plans to provide that these sub-items are not used to reflect cash receipts and disposals.

The Ministry of Finance has published a new table of correspondence between CVR and KOSGU for 2021. Below is presented only the KVR 200 group, which is most often used in procurement activities. The full version with all codes is attached in the file.

The type of expense code, or KVR, is a special numeric code that allows you to group homogeneous types of expense transactions according to their content in order to manage the budget process in terms of spending funds and control over its execution in accordance with the current requirements of budget legislation.

KOSGU: application in work

Until 2016, decoding of schedules and procurement plans was compiled in the context of KOSGU. But now the old codifier has been replaced by new ciphers - a code for the type of expenses according to the budget classification. It is a mistake to believe that KOSGU articles are not involved in procurement activities. To plan any purchase, an institution needs to correctly determine the CWR and only then reflect the operation in planning documentation. But it is impossible to choose the correct KVR without first determining the KOSGU. This is the key principle of using codifiers and their direct relationship.

You may be interested in:: Payments at the birth of a child in the Moscow region in 2021

In 2022 and the planning period 2022-2023. income and expenses will need to be reflected in accordance with the new lists of the KBK of the federal budget, as well as the adjusted Procedures for the application of the KBK and KOSGU. We have already talked about planned innovations in the use of the BCC, and also reported on a number of comparative tables prepared by the financial department. In addition to them, the Russian Ministry of Finance has prepared a comparative table of CVR and KOSGU for 2021 (information from the Ministry of Finance dated July 19, 2022). It has several differences from the current one, which we mentioned the other day. For example, the table includes links between sub-articles of KOSGU and new types of expenses, including in connection with the new legislation on social procurement:

614 “Subsidies to budgetary institutions for the financial support of state (municipal) assignments as part of the execution of the state (municipal) social order for the provision of state (municipal) services in the social sphere”

624 “Subsidies to autonomous institutions for financial support of state (municipal) tasks as part of the execution of state (municipal) social orders for the provision of state (municipal) services in the social sphere”

The procedure for applying KOSGU by government agencies and the details of the codes are described in Order of the Ministry of Finance No. 209n. To accurately classify transactions and link the CVR and KOSGU codes, the Ministry of Finance recommends using the code correspondence table, which is published on its website and updated periodically.

KOSGU stands for classification of operations of the general government sector. These are alphanumeric codes with the help of which budgetary organizations group income and expenses according to their economic content.

Decoding the abbreviation KOSGU

- 110 “Tax revenues, customs payments and insurance contributions for compulsory social insurance”;

- 120 “Income from property”;

- 130 “Income from the provision of paid services (work), compensation of costs”;

- 140 “Fines, penalties, penalties, compensation for damage” and others.

614 “Subsidies to budgetary institutions for the financial support of state (municipal) assignments as part of the execution of the state (municipal) social order for the provision of state (municipal) services in the social sphere”

In 2022 and the planning period 2022-2023. income and expenses will need to be reflected in accordance with the new lists of the KBK of the federal budget, as well as the adjusted Procedures for the application of the KBK and KOSGU. We have already talked about planned innovations in the use of the BCC, and also reported on a number of comparative tables prepared by the financial department. In addition to them, the Russian Ministry of Finance has prepared a comparative table of CVR and KOSGU for 2021 (information from the Ministry of Finance dated July 19, 2022). It has several differences from the current one, which we mentioned the other day. For example, the table includes links between sub-articles of KOSGU and new types of expenses, including in connection with the new legislation on social procurement:

624 “Subsidies to autonomous institutions for financial support of state (municipal) tasks as part of the execution of state (municipal) social orders for the provision of state (municipal) services in the social sphere”

Some codifier links have been completely eliminated as of 01/01/2021. For example, KVR 123 and subarticle 212 of KOSGU, KVR 313 and subarticles 265–266, expense type code 323 and subarticles of KOSGU 220, 261 and 300 are no longer used in budget accounting.

Travel expenses in 2022 kosgu and kvr

- Select the correct KOSGU for the operation being performed.

- Determine the CVR in accordance with the selected OSGU code.

- Check the data linking KVR and KOSGU according to the approved correspondence table.

- Include the verified CWR in planning or reporting documentation.

Travel on a business trip to Kosgu and KVR 2020

It is worth separately identifying the level of responsibility that is provided for violation of budget legislation. In fact, the level of punishment for incorrectly reflecting CVR and KOSGU in the accounting records of institutions directly depends on their type. Now we analyze the type of planned equipment repair and the type of equipment itself. For example, equipment does not belong to information and communication areas. Then you should select KVR 244. If ICT equipment, then the code is 242 (BU and AU are not used). The type of repair also affects the type of costs. For example, current repairs are classified into groups 244 or 242, and if major repairs are carried out, then KVR - 243.