Account 40 in accounting to reflect production output

Account 40 is used to record the amounts of the planned cost of production (PlanSS) of products produced by the enterprise, as well as to reflect transactions on the actual cost of production (FactSS). Due to its specificity, the use of account 40 is carried out, as a rule, in enterprises that are engaged in mass production of products and goods with a large number of different items (wide range).

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

When calculating the actual cost indicator, carried out on account 40, use data on:

- consumption of materials and semi-finished products;

- cost of services (work) of third-party organizations;

- wage costs for production workers;

- fuel consumption;

- costs of maintaining production facilities, etc.

To find out what the planned cost will be, an organization can use data on similar products produced in the previous reporting period. Also, the planned cost can be calculated based on average consumption indicators.

Interaction with other accounts

By debit, account 40 corresponds with accounts 20, 23, 29, and by credit - with account 43. The positive balance at the end of the month is written off to accounts 20, 23, 29. The income of account 43 is written off to the costs of account 40. The write-off of the planned cost of production is transferred from the debit of account 90 “Sales” to the costs of account 40.

At the end of the month, the account balance reflects the real picture of profit from production. At the same time, the account is active-passive, and if the balance is positive, this indicates that the actual cost exceeded the planned one (and vice versa).

Account 40: typical postings

The actual cost of manufactured products is reflected according to Dt 40. Kt 40 is used to reflect the write-off of cost calculated on the basis of planned indicators.

The operation of posting PlanSS amounts upon receipt of products from production is reflected in the following entry:

| Debit | Credit | Description | Document |

| 43 | 40 | Products produced from our own production are taken into account (PlanSS) | Certificate of release of finished products |

Read more about account 43 in the article: “Account 43. Finished products: postings, example.”

The write-off of FactSS is reflected in the following records:

| Debit | Credit | Description | Document |

| 40 | 20 | Write-off of the amount FactSS of manufactured products (main production) | Costing |

| 40 | 23 | Write-off of the amount FactSS of manufactured products (auxiliary production) | Costing |

| 40 | 29 | Write-off of the amount FactSS of manufactured products (service production) | Costing |

Read about the accounts used in the relevant articles: account 20 (production costs), account 23 (auxiliary production), account 29 (production services).

The use of products for production needs is reflected in the following entries:

| Debit | Credit | Description | Document |

| 20 | 40 | Manufactured products are written off for production needs (main production) | Limit fence card |

| 21 | 40 | Manufactured products are written off for production needs (use as semi-finished products) | Limit fence card |

| 23 | 40 | Manufactured products are written off for production needs (auxiliary production) | Limit fence card |

| 10 | 40 | Manufactured products are written off for production needs (use as materials) | Limit fence card |

If a defective product is detected, the following entry is made into accounting:

| Debit | Credit | Description | Document |

| 28 | 40 | Products released from production and rejected are written off | Write-off act |

Branches that the organization has placed on a separate balance sheet can use account 40 when recording the following transactions:

| Debit | Credit | Description | Document |

| 40 | 79.1 | The branch received products released from production from the head office | Transfer and acceptance certificate, invoice |

| 79.1 | 40 | The branch transferred products released from production to the head office | Transfer and acceptance certificate, invoice |

If the amount of excess of FactSS over PlanSS is identified, the amount of the difference is reflected in expenses. Also, the amount of previously written off expenses can be reversed based on the results of the reporting month:

| Debit | Credit | Description | Document |

| 90.2 | 40 | Overexpenditure is reflected: the difference between the actual SS of manufactured products and its planned indicator | Accounting certificate-calculation |

| 90.2 | 40 | Savings are reflected: the difference between the actual SS of manufactured products and its planned indicator is reversed | Accounting certificate-calculation |

When is the account used? 40

Accounting for finished products without account 40 is carried out on account 43 at actual costs. The count of 40 can be used in different ways: consider four cases.

First case. To reflect product output at planned cost

On the account 40 summarizes information about manufactured products, completed works, and services provided for the month. The actual cost (c/st) of production is reflected as a debit, and the standard (planned) cost is reflected as a credit. By comparing debit and credit turnover at the end of each month, you will determine the deviation of the fact from the plan. If we receive a debit balance, this means that actual costs exceeded the planned ones, such excess is written off by posting Dt 90 Kt 40. If the plan exceeded the actual figures, the credit balance of the account is written off with a reversal entry Dt 90 Kt 40. Closing is carried out monthly, the balance at the beginning of each month is zero.

Example:

Dt 20 Kt 10, 60, 69, 70, 76 - expenses of the main production for production

Dt 20 Kt 23, 25, 26 - expenses of other departments

Dt 43 Kt 40 - shows the planned cost Dt 62 Kt 90 - for the sales amount

Dt 90 Kt 43 - the planned cost is written off as expenses

Dt 40 Kt 20 - shows the fact of costs

Dt 90 Kt 40 - written off as a decrease in sales, excess of the plan from the actual

REVERSE Dt 90 Kt 40 - actual savings from plan written off to increase sales

An example of accounting for finished products without account 40:

Dt 20 Kt 10, 60, 69, 70, 76 - expenses of the main production for production

Dt 20 Kt 23, 25, 26 - expenses of other departments

Dt 43 Kt 20 - expenses were written off for the cost of the GP

It is not entirely convenient to reflect production output without using account 40, since with WIP balances on the account. 20 writing off the cost of GP requires additional calculations and/or developed methods. Otherwise, write-off of the account. 20 in the total balance at the end of the month on the account. 43 may lead to an overestimation of the cost of production and the costs of its sales.

Second case: to account for GP produced not by the main one, but by auxiliary or servicing industries, which can also be involved in its production

The accounting entries are similar to those given in the first case, except for the use of the account. 20:

Dt 23 Kt 10, 60, 69, 70, 76 - expenses of the main production for production

Dt 43 Kt 40 - the planned cost is shown

Dt 62 Kt 90 - for the sales amount

Dt 90 Kt 43 - the planned cost is written off as expenses

Dt 40 Kt 23 - shows the fact of costs

Dt 90 Kt 40 - written off as a decrease in sales, excess of the plan from the actual

REVERSE Dt 90 Kt 40 - actual savings from plan written off to increase sales

GP issued by service industries is taken into account in a similar way.

Third case: the processing of semi-finished products and the production of products from them is reflected

This accounting option is applicable when semi-finished products are an independent accounting object in terms of quantity and cost. In this case, an account is used to reflect “unfinished” products. 21.

Accounting for account 40 in this case involves reflecting

- according to his loan, the standard assessment of semi-finished products: Dt 21 Kt 40;

- according to its debit, the actual s/st: Dt 40 Kt 20.

Fourth case: to reflect work performed, services provided in planned indicators

It is advisable to use this option if, at the time of implementation of such work or services, accounting does not have time to collect information on actual costs, and also if there are no documents confirming expenses, and financial indicators need to be generated for reporting. And again the planned indicator and account 40 are applied:

As of the date of implementation:

Dt 62 Kt 90 - reflects the implementation of works and services

Dt 90 Kt 40 - we show the planned cost of completed work and services

As of the date the accounting department received documents confirming expenses:

Dt 20 Kt 10, 60, 69, 70, 76 - actual production costs are reflected

Dt 40 Kt 20 - actual s/st is shown

Dt 90 Kt 40 - written off as a decrease in sales exceeding the plan from the actual

REVERSE Dt 90 Kt 40 - actual savings from the plan are written off

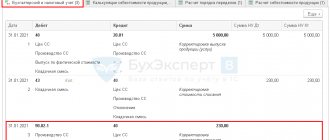

Account 40 when accounting for product costs

At the end of January 2016, Syndicate JSC sold 124 sets of crystal tableware:

- sales price – 1040 rub./unit, VAT 159 rub.;

- PlanSS set of dishes - 825 rubles;

- FactSS set of dishes - 843 rubles.

According to the accounting policy, Syndicate JSC keeps records of finished products according to PlanSS.

The accountant of Syndicate JSC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 43 | 40 | Sets of crystal glassware were received at the warehouse of Syndicate JSC (RUB 825 * 124 units) | 102,300 rub. | Certificate of release of finished products |

| 40 | 20 | The fact of the dishes is taken into account (843 rubles * 124 units) | RUR 104,532 | Costing |

| 62 | 90.1 | Revenue from the sale of tableware is taken into account (RUB 1,040 * 124 units) | RUR 128,960 | Packing list |

| 90.2 | 43 | PlanSS of sold crystal sets is reflected in expenses | 102,300 rub. | Costing |

| 90.3 | 68 VAT | VAT charged on sales (RUB 159 * 124 units) | RUR 19,716 | Invoice |

| 51 | Funds from the buyer are credited as payment for sold sets of dishes | RUR 128,960 | Bank statement | |

| 90.2 | 40 | The difference between FactSS and PlanSS of sold utensils is reflected in expenses (RUB 104,532 – RUB 102,300) | RUB 2,232 | Accounting certificate-calculation |

| 90.9 | The received profit was taken into account based on the results of January 2016 (RUB 128,960 – RUB 19,716 – RUB 102,300 – RUB 2,232) | RUB 4,712 | Turnover balance sheet |

Typical accounting entries

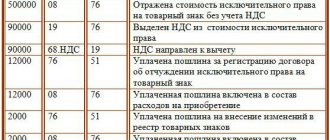

Let's consider the features of compiling accounting records subject to the conclusion of a commission agreement.

Vesna LLC entered into a commission agreement with Zima LLC for the sale of inventory and materials in the amount of 500,000 rubles. The final sales price is 826,000 rubles, including VAT of 126,000 rubles. According to the terms of the commission agreement, the remuneration amount is 20%. The accountant of Vesna LLC compiled the following entries:

| Operation | Debit | Credit | Amount, rub. |

| Inventory assets have been transferred for sale. | 45 | 41 | 500 000 |

| VAT charged | 76 | 68 | 126 000 |

| Revenue from the sale of inventory items transferred to the commission is reflected in accounting | 62 | 90-01 | 826 000 |

| The debt of the recipient of goods and materials is reflected | 76 | 62 | 826 000 |

| VAT charged on goods sold | 90-3 | 68 | 126 000 |

| VAT is accepted for deduction | 68 | 76 | 126 000 |

| The cost of valuables sold through the seller has been written off | 90-02 | 45 | 500 000 |

| Remuneration accrued to the seller | 44 | 76 | 165 200 (826 000 × 20 %) |

| Payment received from the seller company | 51 | 76 | 660 800 (826 000 – 165 200) |

Account 40 when reflecting the cost of contract work performed

JSC “Advertising Project” is engaged in the installation and installation of advertising structures. Based on the results of July 2015, Advertising Project JSC:

- provided installation work to Modelier LLC in the amount of 54,200 rubles, VAT 8,268 rubles;

- The plan for installation work amounted to 33,250 rubles;

- Fact SS of completed installation work – RUB 36,420.

When recording transactions, the accountant of Advertising Project JSC made the following entries:

| Debit | Credit | Description | Sum | Document |

| 62 | 90.1 | Revenue from installation work provided by Modeller LLC is taken into account | 54,200 rub. | Certificate of completion |

| 90.2 | 40 | PlanSS of installation work is reflected in expenses | RUB 33,250 | Costing |

| 90.3 | 68 VAT | The amount of VAT calculated on the cost of installation work carried out | RUR 8,268 | Invoice |

| 51 | Funds have been credited from “Modelier” LLC as payment for installation work performed | 54,200 rub. | Bank statement | |

| 40 | 20 | The amount of FactSS work on the installation of advertising structures is taken into account | RUR 36,420 | Costing |

| 90.2 | 40 | The difference between the actual and standard cost of installation work is reflected in expenses (RUB 36,420 – RUB 33,250) | 3,170 rub. | Accounting certificate-calculation |

| 90.9 | The profit received based on the results of July 2015 is taken into account (RUB 54,200 – RUB 8,268 – RUB 33,250 – RUB 3,170) | RUR 9,512 | Turnover balance sheet |

Reflection of finished products in the balance sheet of the enterprise

Finished products are reflected in the balance sheet at the actual or standard (planned) production cost (clause 59 of the Regulations on accounting and financial reporting in the Russian Federation, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n).

In the balance sheet, the value of balances of finished products not sold and not shipped to customers as of the reporting date is indicated on line 1210 “Inventories”.

Organizations independently determine the details of this indicator.

For example, the balance sheet may separately contain information on the cost of materials, finished products and goods, costs in work in progress, if such information is recognized by the organization as significant.

If in current accounting finished products are reflected at actual production cost, then in the balance sheet they are reflected at actual production cost (debit account balance).

When recording the production of finished products at standard (planned) production cost using an account in the balance sheet, they show the standard (planned) production cost of finished products.

Account 40: accounting for sold products and warehouse balances

As of 08/01/2015, the Borodinsky bakery records the balance of finished products in the amount of 243,500 rubles. During August 2015:

- The bakery warehouse received products (bakery products) in the amount of 761,200 rubles. (normative cost);

- expenses incurred for bakery shops (main production) - 918,400 rubles;

- balance of work in progress – 123,500 rubles;

- products sold according to PlanSS - 514,700 rubles.

The following entries were made in the accounting of the Borodinsky plant:

| Debit | Credit | Description | Sum | Document |

| 20 | 10 (70, 69, 25, 26) | Costs for the production of bakery products in August 2015 are reflected as expenses | RUR 918,400 | Limit cards, payroll statements, invoices, certificates of services rendered, etc. |

| 40 | 20 | FactSS of bakery products is taken into account (918,400 rubles - 123,500 rubles) | RUR 794,900 | Costing |

| 43 | 40 | Bakery products (standard cost) were received at the Borodinsky warehouse warehouse | 761.200 | Certificate of release of finished products |

| 90.2 | 43 | PlanSS of sold bakery products is reflected in expenses | RUB 514,700 | Costing |

| 90.2 | 40 | The amount of identified overexpenditure between FactSS and PlanSS is reflected (RUB 794,900 – RUB 761,200) | 33,700 rub. | Accounting certificate-calculation |

Release of products without 40 invoices (postings)

Dt 43 Kt 20 - GP arrived at the warehouse according to the regulatory standards

Dt 90 Kt 43 - written off upon sale or other disposal of state enterprise according to regulatory standards

At the end of the month, after determining expenses, it is recommended to take into account the deviation of the fact from the plan in a separate subaccount. 43 in analytics for finished products or for the organization as a whole. By debit account 43 reflects the excess of the fact over the plan; otherwise, a reversal entry is applied. At the same time, the cost of the GP accepted for accounting is adjusted for the entire amount of the deviation and the cost of products sold in the part attributable to the volume sold.

***

The need to use account 40 in accounting depends on the specifics of the company’s activities. If a large number of items are produced, and the production cycle is short, then it is difficult to organize accounting immediately at actual cost. Therefore, the use of account 40 when releasing products in this case is necessary. In case of piece production with a long cycle, you can do without it and take into account costs only in fact after the end of the reporting period.

The purpose of the account is to collect the planned cost of manufactured products (by credit) and compare it with the actual cost (by debit). The difference between debit and credit turnover reflects savings or overspending compared to the plan. At the end of the month, this difference is subject to write-off to the cost of products sold, defects or stock balances.

Using account 40 for cost planning

The need for account 40 in accounting is associated with the need to determine the cost of finished products (hereinafter referred to as the CGP) in real time.

A significant part of the costs can be taken into account only at the end of the month. These are wages with accruals, costs for energy supply, various periodic services of third-party organizations (for example, information and consulting services, communication services), etc. Consequently, the actual SGP can be accurately determined only once a month. And if we are talking about production with a large range and a short production cycle (substantially less than a month), then taking into account costs only in fact can be very inconvenient. Indeed, in this case, finished products have to be released to the warehouse almost every day.

Therefore, the transferred products need to be evaluated somehow. In this situation, intermediate account 40 is used. During the month, the transferred products are accounted for there according to the planned SGP. Then, when complete data for the period is received, deviations between plan and actual are taken into account.

The use of this account, at first glance, complicates accounting, since the number of transactions increases. But in fact, its use allows you to establish the rhythmic work of accounting services and makes it possible to receive timely information about production and inventory. In order for this information to reflect the real state of affairs, it is necessary to plan costs as accurately as possible.

Examples of transactions and postings on account 45

Example. Accounting for goods accepted for commission under account 45

In the accounting of Leto LLC, the following entries are made to account 45 for accounting for consignment goods:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 45 | 41 | 30 000 | Goods shipped | TTN, Invoice |

| 76 | 68 VAT | 9 000 | VAT calculation | TORG-12, Invoice |

| 76 | 90.01 | 59 000 | Reflection of sales proceeds | Commissioner's report + primary documentation |

| 90.02 | 45 | 30 000 | Write-off of cost of goods sold | Bank account statement, Accounting certificate |

| 76 | 68 VAT | 9 000 | VAT (reversal) | Invoice |

| 90.03 | 68 VAT | 9 000 | VAT accrual on revenue | |

| 51 | 76 | 59 000 | Receipt of funds from Vesna LLC | Bank statement |

| 44 | 60 | 5 000 | Calculation of remuneration for Vesna LLC | Certificate of completion of work, Invoice |

| 19 | 60 | 900 | VAT on remuneration is taken into account | |

| 68 VAT | 19 | 900 | Tax deduction | Invoice, Accounting statement, Purchase book |

| 60 | 51 | 5 900 | Remuneration has been paid | Payment order |

| 90.02 | 44 | 5 000 | Write-off of the remuneration amount | Certificate of completion |

| 90.09 | 99 | 15 000 | Reflection of the financial result from the sale of goods (profit) | Accounting information |