Who is eligible for a replacement?

Women who received maternity leave, as well as persons who were on leave to care for a newborn, can change the years for calculating benefits.

If everything is clear with the first group of employees - only female employees - mothers of children - are included in it, then both women and men can be included in the second group. This is due to the fact that, according to the current legislation of the Russian Federation, a small child can be cared for by his mother, father or guardian (but only one).

When to contact

Based on the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, maternity benefits are assigned provided that the employee applied for it no later than six months from the date of the end of the vacation on pregnancy and childbirth.

A similar period, but from the moment the child is born, is provided for applying for child care benefits. The employee asks not only to assign a benefit, but also to change the payment period so that the amount of the benefit paid is maximum. There are situations when the employee does not know about his right to change the calculation period for sick leave, and the employer pays the minimum amount. In this case, the recipient can apply for recalculation later. The law does not stipulate when. But in some regional branches of the Social Insurance Fund they believe that recalculation is possible if the application to change the years for calculating sick leave was received within 3 years from the date of the end of maternity leave or within 3 years from the moment the child reaches the age of one and a half years.

Can I reapply for replacement years? Based on judicial practice, it is possible. Thus, the Appeal Determination of the Investigative Committee for Civil Cases of the Samara Regional Court dated October 09, 2018 in case No. 33-12257/2018 states that it is the employee’s right to ask for a change in the pay period. And the employer has the obligation to explain to the subordinate which period should be chosen in order for the benefit to be maximum. Otherwise, it violates the rights of the insured person. If an employee applies twice to receive a larger amount, the employer must grant his request.

Why are these changes needed?

Russian legislation firmly guards the interests of employees. The transfer of years is one of the measures that follows this principle, since it is needed for the correct calculation of benefits for temporary disability, pregnancy and childbirth, and for caring for a child up to one and a half years of age.

By law, all these benefits are calculated taking into account the employee’s average earnings for the two years (according to the calendar) preceding the year in which the event covered by insurance occurred. Thus, if a person did not work for the reasons stated above, his insurance payment is significantly reduced, and recalculation with the replacement of years leads to a reasonable increase in the amount of benefits.

At the same time, the employer does not have the legal right to refuse an employee to receive an increased material payment, and if such a recalculation leads to its reduction, then this castling should not be carried out.

Principle for calculating benefits in 2019

Benefits for temporary disability, maternity benefits, and monthly child care benefits are calculated based on the average earnings of the insured person. Such average earnings are calculated for 2 calendar years preceding the year of temporary disability, maternity leave, parental leave, incl. while working for another employer (Part 1, Article 14 of Federal Law No. 255-FZ of December 29, 2006).

For example, an employee goes on maternity leave in September 2022. Then the default calculation period is 2022 and 2018 in full.

When calculating average earnings to pay for maternity leave and parental leave, the following periods must be excluded from the calculation period (Part 3.1 of Article 14 of Law No. 255-FZ):

- temporary disability;

- maternity leave;

- maternity leave;

- releasing an employee from work while maintaining wages, if they were not subject to insurance contributions for VNiM.

Example: an employee brought a sick leave note with the start date of maternity leave being September 25, 2022. The billing period is from January 1, 2017 to December 31, 2022. In 2022, the employee was on sick leave from April 5 to April 13. She was paid benefits during these days, so do not take this period into account when calculating average earnings. There were no other periods to be excluded from the calculation period. The number of calendar days in 2022 is 365; in 2022 – 365 days. The duration of the billing period is 721 days (365 days + 365 days – 9 days).

When calculating average earnings for sick pay, there is no need to exclude any periods from the calculation period.

When calculating benefits for an employee who was on maternity leave and (or) parental leave during the calculation period, the calendar year (years) of the calculation period, upon his application, can be replaced by another calendar year (years).

Periods that can be used when replacing years

As already mentioned, the replacement of years should not occur more than two years before the insured event occurs.

An employee of an organization can request either a replacement of one year taken for calculation, or two years at once (even if the second year included only a couple of days from the above-mentioned vacations).

Moreover, if leave for pregnancy and the birth of a baby or to care for a newborn fell on only one of them, it is impossible to ask for the replacement of both years for recalculation.

To complete the picture, let's give an example.

Let’s assume that an employee of the organization was on official maternity leave in 2015 and 2016, and she fell ill in 2022. Then the years 2015 and 2016 are not considered, and the years 2013-2014 are taken into account.

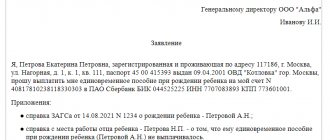

Features of the document, general points

If you are faced with the task of drawing up an application for replacement years to calculate temporary disability benefits, read the recommendations below - they will give you an accurate idea of the document. Please also take a look at the application example below - you can easily draw up your own form based on it.

Let's start with general information. Today, there is no generally applicable, unified sample of such an application, so you can write it in free form, based on your own vision of this document or, if the employer provides your application template, according to its type.

When creating a form, it is important to ensure that its composition and content meet certain standards of business documentation. This means that the document must include three parts:

- the beginning contains information about the employing company and the applicant;

- the main section is the actual request to change the years;

- the conclusion contains a list of attached documents (if any), a signature and date.

There are no special requirements for the design of the document, just like for its text, i.e. The application can be written in your own hand or typed on a computer. For a printed document, an ordinary blank sheet of paper of any convenient format (A4 or A5 are mainly used) and the company’s letterhead (if such a condition is stated by the employer) are suitable.

The application must be written in two copies , one of which should be given to the employer, the second should be kept with you, having previously secured a mark on it that a copy was received by a representative of the organization.

When can I change the calculation period for maternity leave?

The calculation period for the B&R benefit is two calendar years that precede the year of registration of the maternity leave.

If sick leave due to pregnancy is filed in 2022, then 2022 and 2022 are taken for calculation.

In some cases, the period can be replaced by an earlier one, when income was higher, but not all employees have this right.

When can you select years for benefit calculation:

- there was a previous maternity leave in the billing period;

- in the billing period there was leave to care for the previous child.

Calculation of maternity leave when moving from maternity leave to maternity leave.

It is not necessary that the whole year consists of maternity leave. One maternity day a year is enough to replace it with an earlier one.

It is important that replacement can only be made for the year preceding the billing period. If it also included maternity days, then you can take the year preceding it, in which there was no maternity leave for pregnancy and care up to 3 years.

Years can be changed only at the request of the employee and only in the event of an increase in the amount of maternity benefits.

If the employee does not submit an application, the employer does not have the right to independently change the pay period.

If a woman wants to choose other years, then she must write an application about this and submit it along with other documents for registration of maternity leave under the BiR.

If there is a right to a replacement, but there is no application, the employer calculates the benefit based on income for the previous two years. If later the maternity leaver realizes that she could have chosen a more favorable period for the calculation, when her maternity benefits would have been greater, then she can contact the employer with an application to recalculate the payment.

The employer is obliged to recalculate and pay additional funds in the event of an increase in benefits.

Read more about replacing years for calculating maternity benefits here.

How to write correctly?

When applying for maternity leave, a woman submits the following documents to the employer:

- application requesting leave and granting benefits -;

- certificate of incapacity for work regarding pregnancy;

- an application to replace the years of the billing period, if there is such a right;

- certificate of income for the years for which the replacement is made.

The employer will be able to take into account actual earnings in the selected years only if he has documentary evidence of the amount of these incomes. If a woman worked in the same organization, then nothing needs to be confirmed. If the pregnant woman worked in another organization in the selected years, then the income is confirmed by a certificate of earnings for 2 years from the previous employer.

The application for choosing a billing period is written in free form and must contain the following details:

- information about the manager;

- personal data;

- link to article of Law 255-FZ, which states the right to change years - Part 1 of Article 14 of Law 255-FZ;

- please replace the period - indicate which years are changing and which are being chosen instead;

- reason for replacement;

- signature and date.

Download an application for changing the years of the calculation period for maternity leave - sample.

Selection rules

In the application, the employee can indicate which years are to be replaced and which ones she wishes to choose.

The employer’s task is to calculate benefits based on the billing period (the last 2 years) and based on the selected years. You need to choose a case where the payment amount will be larger.

Replacement of years by the employer must take into account the following mandatory requirements:

- only those women who had a previous maternity leave in the billing period can change;

- You can only select those years that precede the billing period;

- as a result of the choice, the payment amount should increase;

- It is necessary to calculate benefits with and without replacement for comparison.

Sample application for replacing years when calculating sick leave

At the top of the document (right or left - it doesn’t matter) the position, full name of the manager, and the name of the company - employer are indicated. Then information about the applicant is entered in the same way: his position and full name are indicated. Below in the middle of the form, write the word “Application” and put a dot.

The main part of the application contains the actual request to change the years. Here you need to indicate the articles of the legislation of the Russian Federation justifying the replacement of years, as well as the years that are subject to replacement. If necessary, the application can be supplemented with other information (depending on individual circumstances).

Finally, the document is signed and dated.