Changes in payments from 2020

In 2022, families for their first and second child will be able to receive payments until they turn 3 years old. The amounts of all other child and pregnancy benefits will increase, since from 2022 the minimum wage amount has increased to 12,130 rubles. New rules for compensation payments:

- Parents of children born after January 1, 2022 will be paid monthly payments if the average family income does not exceed two minimum wages established in their region of residence. In this case, the minimum wage for the second quarter of the previous year is taken as a basis. In 2022, these benefits were received only by those families whose average income was less than 1.5 times the minimum income. Now the number of families applying for payments and meeting the conditions will be many times greater.

- In 2022, payments for children will be received until they reach the age of 3. But to qualify for these benefits, you need annual proof of income for all family members. Payments for the first child are issued by the social protection authorities, and for the second - by the Pension Fund. When calculating the amount of cash assistance, the cost of living for children in the second quarter of the previous year is taken as a basis.

In 2022, payments were issued only for children up to the age of 1.5 years.

One-time benefit for the birth of a child

This is a one-time payment provided to one of the parents. When two or more children are born, this benefit is paid for each child. If the child was stillborn, no benefits are provided.

Methods of obtaining:

- paid by the employer if the woman is employed;

- paid to the employed father of the child if the woman is not employed;

- is paid by the USZN if the parents are not officially employed.

The benefit amount in 2022 was 17,479 rubles 73 kopecks.

What other innovations came into force in 2022

Innovations for other payments for children, which were adopted by legislators and have already entered into force in 2022:

- Raising the minimum income . The minimum wage has increased since 2022, and on its basis the amount of other benefits, for example, for pregnancy and childbirth, is calculated. This year, the lowest average daily income, which is taken as the basis for calculating benefits, is 398.79 rubles, and last year this amount was 370.85 rubles.

- New maximum average income. The maximum amount of financial assistance for pregnant and postpartum women is also increasing. For 2019 and 2022, the highest insurance premiums were 865 and 815 thousand rubles. Based on these numbers, the average daily maximum income will be 2301.37 rubles. The largest benefit during maternity leave will be 322,191.80 rubles. In 2022, the maximum benefit was 21 thousand rubles less.

Also, from February 1, 2022, the amounts of other fixed payments will change. They depend on the coefficient, which this year is 1030.

Who is eligible to receive benefits?

Unemployed pregnant women do not receive benefits from the state. But there are several conditions under which an unemployed pregnant Russian woman will be able to receive financial assistance from the budget:

- Women who were fired due to the cessation of the company's activities or the complete liquidation of the employer's company can count on maternity payments;

- benefits are paid to girls who are studying full-time in secondary specialized, vocational or higher educational institutions.

In all other cases, unemployed women are not paid benefits.

The amount of payments to an unemployed pregnant woman depends on individual conditions and the income she currently receives:

| Conditions | Payment amount |

| Upon dismissal due to termination of the enterprise, as well as former notaries and lawyers | 300 rubles per month |

| When studying full-time | In the amount of the scholarship |

This procedure and types of payments are approved in Articles 6 and 8 of Federal Law No. 81.

Conditions of receipt

In order to receive payments for a small child to expectant mothers who are unemployed, the following conditions must be met:

- must be declared unemployed;

- provide a package of relevant documents to the social security authorities;

- be citizens of the Russian Federation.

These three conditions are mandatory and must be met by every woman who is temporarily unemployed or has unemployed status.

Where to apply for payments to the unemployed

In order for a non-working woman to receive maternity benefits, she must contact the social security department at her place of residence. Full-time students must visit the accounting office at their place of study.

To apply for maternity leave and benefits, you must submit the following documents:

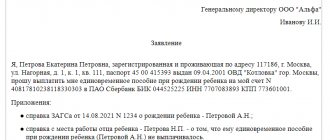

- a statement written by hand or with a handwritten signature;

- sick leave, which is filled out by a medical institution according to established requirements;

- an extract from the work book, if available, indicating the last place of work;

- confirmation from the tax office that the enterprise has been liquidated or the individual entrepreneur has ceased work;

- a document confirming the fact of absence of work, it is provided at the employment center;

- a certificate from an educational institution stating that the pregnant student is a full-time student.

After submitting the documentation, the institution reviews the application and attached papers. Before the expiration of 10 days, a decision is made on the accrual of payments or refusal if the papers contain errors.

Women who were fired due to the liquidation of the company are paid maternity benefits by postal order or into a bank account. To do this, in the text of the application you will need to indicate the bank card number or bank account where to transfer the money. The deadline for receiving payments is the 26th of the next month.

general information

According to current legislation, every woman in a position can receive various types of benefits if she is a citizen of the Russian Federation.

In this case, all programs are conditionally divided into three categories:

- for workers;

- for unemployed people;

- as part of medical care.

The latter apply to both working and non-working women. As part of health care, pregnant women are provided with a number of privileges and benefits that they can use.

Important! The main document giving the right to benefits and allowances is a certificate from a medical consultation. If a woman does not register, then she does not have rights to benefits.

Federal benefits for all women in 2022

Benefits for children and pregnant women are paid from the federal and regional budgets. All Russians can count on federal payments, while regional ones are set by local authorities for residents of their territorial district.

Federal payments and benefits that pregnant women and postpartum women receive:

- When registering up to 12 weeks - 675 rubles from February 1, 2022. These payments should motivate young mothers to register with the antenatal clinic as early as possible to monitor the health of the baby and the expectant mother. This amount is fixed, it is the same for residents of the entire country.

- Maternity payments - in the amount of 100% of average income. Working young mothers are given maternity benefits when they provide sick leave. The duration of maternity leave depends on several parameters. Such as the complexity of childbirth or postpartum consequences, surgical intervention, the number of children born at the same time. Sick leave for childbirth can last from 140 to 194 days.

- Payments at birth - 18,004 rubles from February 1, 2020. This is a benefit for one child. If twins are born, the amount is doubled; if triplets are born, the amount is tripled, that is, the amount is paid for each child born.

- Payments to the wives of military personnel - 28,511 rubles from February 1, 2022. You can apply for this payment if your pregnancy is at least 180 days old. After the end of the spouse’s service, the woman in labor has the right to apply for payments within 6 months.

- Maternity capital - 453,025 rubles for children born after January 1, 2007. This benefit was adopted to improve the demographic situation and stimulate childbearing in Russia, since payments are issued only after the birth of a second child.

An officially unemployed pregnant woman will be able to qualify for all types of payments listed, except for the second, if the described conditions are met.

Monthly payments

In addition to the payments listed in the previous section, women can receive:

- Payments for child care up to 1.5 years old - 40% of average income for the last 2 years. But, as when calculating maternity payments, the average minimum and maximum amount is calculated for them.

- Compensation for children under 3 years old is in the amount of the subsistence minimum for the second quarter of the previous year.

These payments are financed from the budget of the Russian Federation. All mothers, including unemployed women, can receive them, but under certain conditions. The following are not entitled to payments from the state:

- citizens of Russia, foreigners or stateless persons who have been deprived of their parental rights;

- Russian citizens who have moved for permanent residence to another country;

- foreigners, citizens of Russia or stateless persons whose children are supported entirely at the expense of public funds.

All other women who are not on this list may qualify for benefits. If the expectant mother is single, then she is provided with other types of government payments.

Which non-working women are not entitled to maternity benefits?

Maternity pay is a benefit for pregnancy and childbirth. The rules for assigning maternity benefits and the list of recipients of payments are listed in the following laws:

- Federal Law No. 81-FZ of May 19, 1995 “On state benefits for citizens with children”;

- Order of the Ministry of Labor of Russia dated September 29, 2020 No. 668n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children.”

Russian legislation gives the right to maternity benefits only to officially employed women. The state compensates them for lost earnings for the entire period of maternity leave (in the amount of 100% of average income for the past 2 years). The duration of maternity leave is:

- 140 days – with a normal pregnancy;

- 156 days – for complicated childbirth;

- 184 days – for multiple pregnancy.

Why aren’t unemployed women entitled to maternity benefits? This is due to the order of their formation. Benefits are paid from the Social Insurance Fund through contributions made monthly by the employer. Unemployed people do not pay contributions to the Social Insurance Fund, so they are not entitled to maternity leave.

Maternity benefits are not provided:

- a pregnant woman involved in a civil contract;

- an employee who works unofficially and receives a salary “in an envelope”;

- a woman who quit her job during pregnancy of her own free will;

- self-employed and individual entrepreneurs (in some cases, individual entrepreneurs may receive maternity benefits).

True, a separate category of unemployed pregnant women has the right to receive maternity leave as an exception.

Regional payments

Each federal subject has its own regional benefits. In some regions, the government has established maternity capital for 2 and 3 children born after January 1, 2011. In the Moscow region, for example, the amount of this payment is 100 thousand rubles.

The authorities in Nizhny Novgorod also pay regional capital. It is received by families in which the second child was born after September 1, 2011. But the amount of this monetary compensation is less than in Moscow. It is 25 thousand rubles. And for the third and subsequent children, maternity capital increases to 100 thousand rubles. The procedure for receiving regional payments is established separately for each constituent entity of Russia.

Regional payments are assigned simultaneously with federal ones. Therefore, residents of the regions receive double subsidies from the state. However, not everywhere regional authorities decide on additional incentives for families.

4 / 5 ( 2 voices)

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 188

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- NADEZHDA MIKHAILOVNA

12/03/2021 at 22:42 HELLO! THE BRIDE IS UNEMPLOYED. CAN SHE APPLY FOR BIR BENEFIT IF SHE IS DESIGNED AND CARING FOR AN 80 YEAR OLD GRANDMOTHER? HOW MUCH WILL SHE RECEIVE CHILD CARE BENEFITS?

Reply ↓ Anna Popovich

04.12.2021 at 18:45Dear Nadezhda Mikhailovna, citizens who constantly care for the elderly who need constant assistance, as well as people who have reached the age of 80, have the right to receive compensation for care. The amount of compensation payment is 1200 rubles monthly. The unemployed are not entitled to maternity benefits. But the daughter-in-law can receive a one-time payment for the child, as well as a monthly allowance.

Reply ↓

09.15.2021 at 23:21

Hello! I’m busy at the center, I’m almost 30 weeks pregnant, can I get benefits under the BIR on sick leave? The status has been assigned to the unemployed f CZN. Where to go?

Reply ↓

- Anna Popovich

09.19.2021 at 17:57

Dear Ksenia, no, only women who have taken maternity leave have the right to receive benefits; maternity leave is not paid to unemployed women.

Reply ↓

08/31/2021 at 16:26

Good afternoon, tell me, I have this question: I worked officially for two years and now I’ve been working for a year under a contract, not officially. I’m pregnant. Does it make sense to get a job for 5 months in order to receive all the payments and how will the money be calculated if they look at the last two years?

Reply ↓

- Anna Popovich

08/31/2021 at 21:09

Dear Anastasia, getting a job would be the best option. It is likely that maternity benefits will be paid to you in a larger amount. The amount of payments will be calculated based on average earnings over the last two years. If you do not work officially, social security will provide you with payments. In this case, they will be equal to the cost of living in your region.

Reply ↓

06/03/2021 at 19:08

Hello, I am currently unemployed, please tell me if I should be paid a lump sum payment for registering my pregnancy before 12 weeks? If so, who? Social protection?

Reply ↓

- Anna Popovich

06/04/2021 at 00:19

Dear Svetlana, a lump sum benefit is assigned and paid at the place of destination and payment of maternity benefits based on the submitted certificate from the antenatal clinic or other medical organization that registered the woman in the early stages of pregnancy.

Reply ↓

05/01/2021 at 18:21

Good afternoon. My daughter is a group 2 disabled person and receives a disability pension. Childbirth at the end of June. What payments is she entitled to? And can I, as a grandmother, leave to care for my grandson? Or apply for part-time work. If so, what payments can I count on myself?

Reply ↓

- Anna Popovich

05/01/2021 at 19:27

Dear Nina Mikhailovna, grandmother can take maternity leave to care for a child. You have the right to receive benefits from the Social Insurance Fund. As for payments to a woman in labor, they are standard - the article provides a complete list of them, and you can get additional advice from the social service of your locality.

Reply ↓

04/13/2021 at 14:51

Good afternoon I would like to clarify what payments I can receive if I don’t work, I quit on March 3, 2022. and can I get maternity and postnatal benefits, and where can I apply, and will I receive child benefits? This turns out to be a 3rd pregnancy. and can I get maternity capital for 3 children? I didn’t receive it before because I didn’t get into this program.

Reply ↓

- Anna Popovich

04/13/2021 at 18:57

Dear Olga, all payments that are not made at the expense of the employer are entitled to you on general terms. You can exercise your right to maternity capital in connection with the birth (adoption) of a second or third child and subsequent children without regard to whether you previously received benefits.

Reply ↓

04/05/2021 at 15:32

Good afternoon I came across information on the Internet that from June 2020, the amount of childcare benefits for children up to 1.5 years has been increased to 13.5 thousand for those who were left without work during maternity leave due to the liquidation of the organization. Is this true? I haven’t received a payment yet, but social security hasn’t answered this question.

Reply ↓

- Anna Popovich

04/05/2021 at 15:40

Dear Alena, as a general rule, the amount of child care benefits is 40% of average earnings. In some cases, the payment is made in a fixed amount. From January 1, 2022, the maximum amount of care allowance is 29,600 rubles 48 kopecks. Mothers dismissed during pregnancy due to the liquidation of the organization are entitled to benefits in the specified amount. A social security employee will help you calculate the amount of benefits on the basis of Federal Law No. 255-FZ “On Compulsory Social Insurance in Case of Temporary Disability and in Connection with Maternity”, Federal Law No. 81-FZ “On State Benefits for Citizens with Children” and the Order of the Ministry of Labor of Russia No. 668n “On approval of the Procedure and conditions for the appointment and payment of state benefits to citizens with children.”

Reply ↓

03/06/2021 at 00:56

Hello. I have a total experience of 4 years and 1 month, I am pregnant, but for the last two years in 2019-2020 I was not officially employed. I was registered as unemployed in 2022. What to do ?

Reply ↓

- Anna Popovich

03/06/2021 at 03:39

Dear Yesenia, if you mean what payments you are entitled to and how to get them, then if you did not have an official job, then you are not entitled to maternity benefits. But there are other measures of financial support - in particular, a lump sum payment at the birth of a child or for child care. You will receive them in any case, even without official employment.

Reply ↓

02/25/2021 at 18:21

Good afternoon, if I am unemployed and registered at the Employment Center, and I am also pregnant, what payments am I entitled to before and after birth?

Reply ↓

- Anna Popovich

02/25/2021 at 19:52

Dear Anastasia, you can only receive those payments that do not concern the employer (since you are not employed). Accordingly, you can count on a lump sum payment at the birth of a child and for child care. They can be obtained in any case, even without official work. You can check with the social service of your city for a complete list of financial support options. You will continue to receive benefits as a non-worker for up to 30 weeks.

Reply ↓

02/12/2021 at 01:34

Good afternoon Please tell me if I have the right to receive maternity benefits if I am not currently working, but before the onset of Pregnancy I have official income for two years. Is it possible to get an official job now? Will this help me get benefits?

Reply ↓

- Anna Popovich

02/12/2021 at 20:44

Dear Natalya, you can only receive those payments that do not concern the employer (since you are not employed). Accordingly, you can count on a lump sum payment at the birth of a child and for child care. They can be obtained in any case, even without official work. You can check with the social service of your city for a complete list of financial support options.

Reply ↓

Natalya

02.13.2021 at 17:12

Anna, Thank you for your answer. If I get an official job now, will this help me get benefits?

Reply ↓

Anna Popovich

02/13/2021 at 21:22

Dear Natalya, yes, if you have fulfilled all other criteria for its registration.

Reply ↓

02/10/2021 at 19:22

If I don’t work anywhere and haven’t worked, will I be able to receive monthly maternity benefits from the state?

Reply ↓

- Anna Popovich

02/11/2021 at 01:12

Dear Elmira, no, if you did not have an official job, you are not entitled to maternity benefits. But there are other benefits - for example, one-time benefits for the birth of a child or for child care. They can be obtained in any case, even without official work.

Reply ↓

01/26/2021 at 17:28

Hello, I would like to ask why there are still no payments in January?

Reply ↓

- Anna Popovich

01/27/2021 at 21:53

Dear client, you can check the payment schedule with the department to which they are assigned.

Reply ↓

Inna

04/13/2021 at 03:43

Hello Anna, I have this situation: in February 2022, I quit my job when the individual entrepreneur was closed, in April I registered with the employment center and in June I became pregnant, I registered with the antenatal clinic in weeks, then in weeks I was given a sick leave and can I submit a certificate with the sick leave? for maternity leave or what will I be entitled to?

Reply ↓

Anna Popovich

04/13/2021 at 18:53

Dear Inna, speaking about “maternity” payments, you need to understand that you can only qualify for the financial support that depends on the employer. Thus, you can receive a lump sum payment at the birth of a child and for child care. There are also regional payments, a full list of which can be found in the social service of your locality.

Reply ↓

01/22/2021 at 02:14

I work officially under an employment contract. After I go on maternity leave, I will be officially fired. What payments and benefits can I count on?

Reply ↓

- Anna Popovich

01/22/2021 at 10:22

Dear Eleanor, even if you worked under a fixed-term employment contract and its term expires during pregnancy, your employer is obliged, upon written application and upon provision of a medical certificate confirming the state of pregnancy, to extend the term of the employment contract until the end of pregnancy, and if provided in the prescribed manner maternity leave - until the end of such leave. If you resign on other grounds, you can count on all payments that are not made at the expense of the employer. In particular, a one-time payment at the birth of a child, child care benefits up to 1.5 years old and regional payments (if they are established).

Reply ↓

01/12/2021 at 14:31

I am 18 years old, I do not work or study, and am I now in a position where I should apply to social security after childbirth or before childbirth to receive maternity benefits?

Reply ↓

- Anna Popovich

01/12/2021 at 16:14

Dear Anastasia, the bulk of social support for families with children is provided after the birth of a child, but there is, in particular, benefits for registration in the early stages of pregnancy. You need to clarify the required payments and the procedure for their registration in the social security of your city.

Reply ↓

01/05/2021 at 10:41

Good afternoon. The eldest son was born in 2010. Married, husband does not work officially. Now I’m pregnant, almost 30 weeks, registered at 9 weeks. For two years I have been registered to care for an elderly person, 1200 remain with my grandmother, and I only get points. Please tell me what payments I can expect?

Reply ↓

- Anna Popovich

01/05/2021 at 21:56

Dear Olga, you can count on a number of child care benefits and social payments when the baby reaches a certain age.

Reply ↓

12/27/2020 at 05:10

I do not officially work, according to the purpose of the elements, if the father is included in the birth certificate but we were not officially married and do not live together, can I count on benefits from the state? And which ones? If I receive items

Reply ↓

- Anna Popovich

12/27/2020 at 19:54

Dear Lyusya, you can count on all payments, except those made at the expense of the employer. You can check the comprehensive list of payments due to you at the social security department of your locality.

Reply ↓

12/27/2020 at 01:17

If I open an individual entrepreneur at 28 weeks of pregnancy, will I be paid maternity benefits? I'll close it when I give birth in a month.

Reply ↓

- Anna Popovich

12/27/2020 at 19:51

Dear Inna, no, in order to receive maternity benefits in 2020, you had to register and pay contributions back in 2019.

Reply ↓

12/27/2020 at 00:34

Please tell me, I officially worked a year ago, now I’m pregnant, I don’t work and I registered at 20 weeks, will they at least pay me something before giving birth?

Reply ↓

- Anna Popovich

12/27/2020 at 19:52

Dear Ilona, yes, you will receive benefits until the 30th week of pregnancy.

Reply ↓

12/25/2020 at 15:30

Good afternoon. I have one child (4 years old), since for medical reasons we are not allowed to go to kindergarten until we are 5 years old, in September 2019 I was forced to resign from my previous job. After that I didn’t work officially. Now (Dec. 2020) we are waiting for the second one (almost 30 weeks). What payments can I expect besides mat capital (and where can I get each of them). No matter who I ask, no one can give a clear answer, they send me everywhere to different places. Thank you in advance for your complete answer.

Reply ↓

- Anna Popovich

12/25/2020 at 17:41

Dear Victoria, you are entitled to several types of payments. In particular, a one-time payment at the birth of a child, child care benefits up to 1.5 years old and regional payments (if they are established). In addition, you can receive benefits based on your average per capita income for the 12 months that elapsed 6 months before the date of application, which does not exceed two regional subsistence minimums. Detailed advice will be provided to you by the social security service of your city.

Reply ↓

Evgeniya

01/19/2022 at 08:18

Can I apply for maternity leave for my sister? She is not pregnant yet, but is planning a child too. And is it possible, after my sister’s maternity leave is issued, for her to immediately go to work? And work at full capacity?

Reply ↓

Anna Popovich

01/21/2022 at 02:09

Dear Evgenia, yes, your sister can go on maternity leave, but she will not be able to work full time; the right to a monthly child care allowance is retained only if the person on parental leave works part-time or at home, as well as in case of continuing education.

Reply ↓

12/23/2020 at 11:37 pm

Hello! I would like to clarify, compensation for children under 3 years old is in the amount of the subsistence minimum for the second quarter of the previous year, is this paid monthly if the woman did not work? Or did I misunderstand?

Reply ↓

- Anna Popovich

12/24/2020 at 21:22

Dear Elena, this type of state support can be received by families with an income of no more than two regional subsistence minimums for each family member. From 2022, payments can be received until the child’s third birthday on the basis of Federal Law No. 418-FZ dated December 28, 2017.

Reply ↓

Anna

10.29.2021 at 14:08

Hello, please tell me if I can apply for Putin’s payments for up to 3 years, if I was not officially employed, my husband works officially

Reply ↓

Anna Popovich

10/31/2021 at 10:32 pm

Dear Anna, yes, you can apply for these payments.

Reply ↓

12/23/2020 at 11:25 pm

Good evening! Where should a full-time vocational school student apply for pre- and postpartum sick leave payments? And is it necessary to take academic leave during childbirth?

Reply ↓

- Anna Popovich

12/24/2020 at 21:28

Dear Natalya, mothers who are full-time students are paid from the funds of the Federal Social Insurance Fund of Russia, which are allocated to the educational institution in accordance with the established procedure. The benefit is accrued based on the application of the student mother and the decision of the educational institution to grant academic leave. The law does not establish a student’s obligation to take an academic course; this does not affect the payment of benefits.

Reply ↓

12/23/2020 at 07:15

Hello, I didn’t work anywhere and got pregnant, please tell me I am entitled to any payments, if so, what is their size and how to get them

Reply ↓

- Anna Popovich

12/23/2020 at 14:28

Dear Lyubov, yes, you are entitled to a one-time payment at the birth of a child, childcare benefits up to 1.5 years old and regional payments (if they are established). You can also qualify for payments based on the average per capita income for 12 months that expired 6 months before the date of application, which does not exceed two regional subsistence levels. You can get detailed advice taking into account the nuances of your particular situation from the social security service of your city.

Reply ↓

12/22/2020 at 16:33

I haven’t worked for 2 years now and I haven’t contacted the Labor Center. Now I’m pregnant and what benefits will I receive?

Reply ↓

- Anna Popovich

12/22/2020 at 21:18

Dear Nastya, you can contact the employment center up to 30 weeks of pregnancy. Your benefits will be calculated based on your previous work experience and average earnings. Benefits will also be paid for up to 30 weeks.

Reply ↓

12/16/2020 at 20:23

What payments can I count on if I haven’t registered for up to 12 weeks, I don’t work, my employer fired me, I was at the labor exchange, but 30 weeks were taken away.

Reply ↓

- Anna Popovich

12/17/2020 at 17:09

Dear Daria, you are entitled to: - A non-working woman is entitled to a lump sum benefit of 15,512 rubles. — 2908 rubles is the allowance for the first child, 5817 rubles for subsequent ones, up to the age of 1.5 years. — Maternity payments in the amount of 613.14 rubles. per month.

Reply ↓

12/14/2020 at 20:54

Hello, I joined the labor market, I’m already pregnant, no one told me that I need a certificate for 30 weeks, now I owe the state 57 thousand rubles, my child is 2 months old, documents up to 1.5 years old are not accepted until I pay off the debt to the state, how can I go to state if I don’t work, please advise what to do

Reply ↓

- Anna Popovich

12/14/2020 at 23:01

Dear Antonina, if it is discovered that the receipt of social benefits for unemployment was groundless or that the order of receipt has been violated, the funds paid to the citizen must be returned. You can voluntarily return illegally received social payments by setting a deadline for repayment of the resulting debt. But if you refuse to repay the money, the employment service has the right to collect the debt in court.

Reply ↓

11/30/2020 at 7:08 pm

01/13/2020 She was laid off due to the liquidation of the enterprise and immediately registered with the employment center. I still haven’t found a job; I’m still registered with the center. I am now 15 weeks pregnant. Therefore, it is not possible to find a seisas job, because... no one wants to employ a pregnant woman. In such cases, payments are due for sick leave before and after childbirth, which is 140 days.?

Reply ↓

- Anna Popovich

11/30/2020 at 11:01 pm

Dear Albina, if you did not have an official job, then you are not entitled to such a maternity benefit. But you have the right to count on other benefits - a lump sum for the birth of a child or for child care.

Reply ↓

26.11.2020 at 20:05

you have one answer - contact social protection

Reply ↓

- Anna Popovich

11/29/2020 at 01:04

Dear client, we do not have information about your social status, financial situation and regional support programs at your place of registration. It is for this reason that we recommend contacting the social security authorities to receive the most detailed advice.

Reply ↓

26.11.2020 at 15:00

I'm pregnant and unemployed, can I get prenatal benefits?

Reply ↓

- Anna Popovich

26.11.2020 at 15:16

Dear Natalya, you need to seek advice from the social security service of your city. Some payments may be established at the local level.

Reply ↓

10/12/2020 at 12:27 pm

Hello, I wanted to clarify, I got pregnant, and I don’t work, my husband only works unofficially, can I get some money before the baby is born?

Reply ↓

- Anna Popovich

10/12/2020 at 12:35 pm

Dear Alina, it is possible that in your region payments are provided for early registration. Contact your local social services office for advice.

Reply ↓

2

Payments through social security before and after childbirth

If a woman is unemployed, she has two ways to apply for government assistance.

If she is an individual entrepreneur, then all payments are made by the Social Insurance Fund. In other cases, you need to contact the social security authorities.

Conditions for receiving EDV at the birth of a child

A one-time benefit under the BIR is provided by law only to officially employed women or students.

If a woman does not have a job, she can count on receiving a payment if:

- was fired within a year;

- the dismissal was carried out at the initiative of the employer or as a result of its bankruptcy;

- the woman does not receive unemployment benefits.

The amount of benefit for an unemployed woman is different from that paid by the employer.

It depends on the woman's stipend or her earnings for a certain period. Registration can begin at 30 weeks of pregnancy or after the birth of the baby. The payment will still be made upon delivery, that is, after the birth.

Amount of monthly care payments

Both employed and unemployed women are entitled to maternity benefits, provided for the first 1.5 years after the birth of a baby.

If there is no official place of work, then you should contact the social security authorities at your place of residence.

In this case, the benefit amount cannot be calculated based on wages, so a fixed amount is used.

It is established at the legislative level, therefore it is indexed annually.

- From May 2022, the amount of the monthly benefit for the first child is 4 thousand 465 rubles.

- For the second and subsequent children, 6 thousand 284 rubles are paid.

- If the benefit is issued through the employer, then 40% of the average monthly salary is calculated.

If the family is low-income, and the woman gave birth to a child in 2022, then you can apply for the “Putin Allowance”.

This is an additional payment that is provided regardless of the receipt of federal benefits and the presence (or absence) of work. Paid for 1.5 years for the first or second child.

The amount for the first-born is fixed and amounts to 10 thousand 500 rubles.

Regional multiplying factors are taken into account in the final calculation. For the second child they pay only the subsistence minimum. capital.

They apply for benefits from the social security authorities.

In addition to low family income, another condition is important. It consists in the presence of a registered marriage between the parents of the baby.

The indicated amounts are provided throughout the entire period. Also, a young mother has the opportunity to extend maternity leave and receive payments for another 1.5 years. But the amount of the monthly benefit will be only 50 rubles. It has not been indexed since 2001.