How is account 02 maintained in the accounting of a Russian enterprise? To answer the question you need to contact

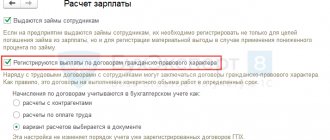

What is registration under a GPC agreement and how does it differ from an employment contract? Agreement

Who is required to report on insurance premiums and how? Calculation of insurance premiums is transmitted

Features of working in hazardous working conditions Working conditions that can lead to

List of relaxations In 2022, the transition period continues, on the basis of which the age when

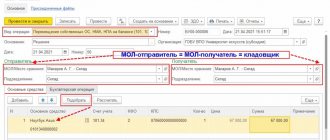

Organizations daily face situations where it is not possible to reflect property on balance sheet accounts.

Depreciation of fixed assets in accounting and tax accounting In the process of use, fixed assets lose their

KND form 1110021 is a standard unified form of document that is submitted to the territorial tax service

Modern electronic document management technologies can significantly reduce the burden on business, significantly reducing time costs

Many have already heard that from July 1, the Federal Tax Service began issuing electronic signatures for free, and