Patent tax rate

The tax rate for a patent is set by the constituent entities of the Russian Federation.

Rate 0%

According to paragraph 3 of Art. 346.50 of the Tax Code, regions can provide tax holidays for 2 years for individual entrepreneurs who registered for the first time to provide household services to the population or work in the scientific, social and industrial spheres.

Rate 6%

If such a law applies in your region and you have registered an individual entrepreneur for the first time, then you do not need to pay for a patent for two years. Otherwise, the patent rate will be 6%.

Rate 4%

Patent tax payment will be less in the Republic of Crimea and Sevastopol. For these entities in the period from 2022 to 2022, a rate of up to 4% applies.

PSN: who has the right?

According to the wording of subclause 15 of clause 2 of Article 346.43 of the Tax Code of the Russian Federation, applied in 2020, PSN can be used when teaching the population in courses and tutoring.

At the same time, the special PSN regime must be legally introduced on the territory of the corresponding constituent entity of the Russian Federation and applied in this region.

Healthy

On the use of PSN in the development, adaptation and modification of software

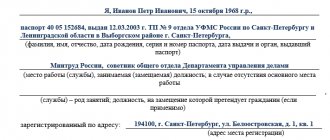

The right to use the PSN of each individual entrepreneur is certified by a patent. In 2020, a patent form was used for this, which was approved by order of the Federal Tax Service of Russia dated November 26, 2014 No. ММВ-7-3 / [email protected]

Important

The patent form for the use of PSN has been updated

It does not matter to which customer educational services are provided in accordance with the contract - an individual or a legal entity. It does not matter whether he has the status of a tax resident of the Russian Federation or not, as well as the form in which these services are provided - in person or through, for example, Skype.

How to calculate tax according to PSN

Individual entrepreneurs do not need to calculate the tax amount themselves. The tax office does this.

The patent indicates the total amount of tax that must be paid to the budget, the amount and timing of payments.

The tax office determines the tax amount in two ways:

- If the patent is issued for 12 months, then when calculating the tax base is multiplied by 6%.

- If the patent validity period is shorter, then the tax base is divided by 12 months and first multiplied by the number of months the patent is valid, and then multiplied by 6%.

You can calculate the cost of a patent using the calculator on the tax website.