How is account 02 maintained in the accounting of a Russian enterprise? To answer the question, you must refer to the Chart of Accounts, approved by Order No. 94n dated October 31, 2000. In accordance with the instructions for its use, account. 02 “Depreciation of fixed assets” is intended to summarize information on depreciation accumulated during the use of fixed assets. Let's figure out how to close an 02 account and make postings for basic standard transactions.

Characteristics of account 02

In the company's accounting, all operations of financial and economic activities are carried out in the appropriate accounts. The accountant approves the working chart of accounts of the enterprise in the annex to the accounting policies, depending on the economic sector of the business. To account for accrued depreciation amounts, account 02 is used - active or passive? Since depreciation is calculated on the loan in correspondence with cost accounts, and written off by debit, account. 02 is passive, unlike, for example, account 68. 02 – in accounting it is considered active-passive.

Account structure 02:

- Credit opening balance - the amount shows the amount of depreciation accumulated at the beginning of the period.

- Debit turnover means the amount of depreciation written off upon disposal/write-off of fixed assets.

- Loan turnover means the amount of accrued depreciation on fixed assets.

- Credit opening balance - the amount shows the amount of depreciation accumulated at the end of the period

At the same time, it is necessary to organize reliable analytical accounting of inventory items of property in order to obtain complete information about the wear and tear on the OS. To do this, sub-accounts are opened, then a balance sheet is generated for account 02, and the balance at the end of the reporting/tax period is reflected in the organization’s balance sheet in a special way. Despite the fact that 02 – passive, when filling out accounting statements, the account balance does not fall into the liability side of the balance sheet. The balance of the “Depreciation” account is taken into account when calculating the residual value of fixed assets = Initial cost (balance of account 01) – depreciation (balance of account 02).

Analysis of account 02 is also carried out for the purpose of calculating property tax when determining average annual value indicators (Article 375 of the Tax Code). In this case, the main register is the SALT for account 02 or the order journal.

Note! The count should not be confused. 02 and MC account 02. These are two different accounts. The first is intended to reflect depreciation, the second is considered off-balance sheet and is used to summarize information on workwear transferred into service. Keeping such additional records is due to the need to control the organization’s property, which has already been written off from the balance sheet, but is still used in its activities.

Typical transactions for off-balance sheet account 002

| Account Dt | Kt account | Transaction amount, rub. | Wiring Description | A document base |

| 002 | — | 10 000 | Received for safekeeping goods and materials that were found to be defective, non-compliant with quality, assortment and subject to return due to violation of contractual obligations | Invoices TORG-12, 1-T, M-15, certificate of discovery of defects in goods, accounting certificate |

| — | 002 | 10 000 | Inventory items returned to the supplier are written off off-balance sheet | Invoice TORG-12, act of discovery of defects in goods |

| 002 | — | 12 000 | Received for safekeeping of goods and materials, with special conditions for the transfer of ownership, for example, after payment | Invoices TORG-12, 1-T |

| — | 002 | 12 000 | Inventories written off off-balance sheet due to the transfer of ownership to the buyer | Bank statement |

| 002 | — | 15 000 | Goods and materials, paid for but not removed by the buyer, were accepted for safekeeping | Invoice TORG-12 |

| — | 002 | 15 000 | Inventories left by the buyer for safekeeping are written off from off-balance sheet accounting. | Consignment note 1-T |

| 002 | — | 18 000 | Received goods and materials under a storage agreement | Transfer and acceptance certificate MX-1, accounting certificate |

| — | 002 | 18 000 | Return of goods and materials to the owner under a storage agreement | Act MX-3, accounting certificate |

| 002 | — | 20 000 | Inventory and materials were accepted for safekeeping due to the pledgor’s failure to fulfill obligations under the pledge agreement | Pledge agreement, accounting certificate |

| — | 002 | 20 000 | Inventory and materials received under a pledge agreement were sold | Invoice TORG-12 |

Account 02 – typical transactions:

- D 20 (25, , 26, 44, 91) K 02 - depreciation was accrued on fixed assets used for production purposes (general production; auxiliary production; for management or general economic needs; in trading companies; for leased objects).

- D 02 K 01 – reflects the write-off of depreciation accrued during the operation of the fixed assets.

- D 02 K 83 - reflects the increase in the company’s additional capital due to the depreciation of fixed assets.

- D 02 K 84 - reflects the restoration of depreciation accrued in previous periods.

- D 02 K 91.1 – reflects the write-off of depreciation upon disposal of fixed assets.

- D 83 K 02 – additional depreciation accrual due to revaluation of fixed assets is reflected.

Loan transactions

After the acquisition of fixed assets, depreciation is charged. 02 account acquires credit turnover. But according to the principle of double entry, simultaneously with this process an equal debit turnover arises. What accounts are involved in the relationship? Most often, they are collective synthetic ones, containing information about the amount of overhead costs and distribution costs.

For the production sector, these are primarily accounts for accounting for the costs of manufacturing products: 20, 23, 25, 26, 29. Credit to account 02 in correspondence with the account. 44 may indicate the acquisition by the enterprise of property used in the sales process. Trade organizations can also use account 44 to reflect depreciation expenses.

If the property was acquired and used in the current period, and the costs of the work will be taken into account in future periods, account 97 is used to calculate depreciation: Dt 97 Kt 02.

How to close account 02 “Depreciation”

Account 02 is closed only when an asset is written off from the balance sheet, that is, when property is sold, transferred free of charge, liquidated and other disposals. Earlier than the specified moment. 02 will always have a balance, since the initial cost of the fixed asset is transferred to the company’s expenses not at once, but gradually. Since this account is passive, closing is carried out by debiting account 02 in correspondence with accounts 01 (if depreciation is fully charged) or 91 (if the object is not fully depreciated).

Conclusion - in this article we have decided which account 02 is active or passive, and how entries for depreciation of fixed assets are generated in the organization.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Active or passive account 02

According to the Chart of Accounts, approved.

by order of the Ministry of Finance dated October 31, 2000 No. 94n, account 02 - Depreciation of fixed assets - is used to collect and systematize information about depreciation accrued during the use of fixed assets. Since depreciation charges are calculated on the credit of the account, the question of whether account 02 is active or passive has a simple answer. This is, of course, a passive account in which depreciation charges are accumulated, reducing the book value of the asset. In accounting, accounts in which expenses are recorded correspond to account 02, thus these expenses increase.

Depending on where and for what purpose the fixed assets are used during the economic activity of a business entity, the amount for the reporting period of depreciation is included in certain expenses:

- production (Dt 20, 23, 25, 29),

- implementation (Dt 44),

- general economic (Dt 26),

- others (Dt 91),

- capital investments (Dt 08).

And the fact that account 02 is passive does not mean that it will be reflected in the liability side of the balance sheet. According to clause 35 of PBU 4/99, approved. By order of the Ministry of Finance dated July 6, 1999 No. 43n, the balance sheet must contain indicators made in the net assessment. And this means that the amount accumulated according to Kt 02 is the value that regulates the residual value of the fixed assets.

1) Linear method.

The straight-line method of calculating depreciation involves evenly accruing depreciation over the useful life of the fixed asset.

CJSC Almaz purchased the machine for use in its main production. The initial cost of the machine is 120,000 rubles. Useful life - 5 years.

When using the straight-line depreciation method, 1/5 of the cost of the machine must be depreciated annually.

First you need to determine the annual depreciation rate. To do this, we will take the initial cost of the machine as 100%.

The annual depreciation rate will be 20% (100%: 5).

Therefore, the annual depreciation amount will be 24,000 rubles. (RUB 120,000 x 20%).

The amount of monthly depreciation charges will be 2000 rubles. (RUB 24,000: 12 months).

Every month for 5 years the accountant will make the following entries:

- Debit 20 Credit 02 2000 rub. — depreciation of the machine was accrued for the reporting month.

Features of transferring amounts to account 02

Fixed assets can be used in a variety of ways. However, regardless of this, when calculating amounts, a number of rules established by regulations must be followed. In particular, the charge to account 02:

- Starts with the month that follows the period in which the object was capitalized.

- Performed regardless of the results of the enterprise.

- Terminates on the 1st day of the month following the month of final repayment of the cost or write-off of the object.

- It is not interrupted during the period of useful operation, except for the cases provided for by regulatory enactments.

general description

Depreciation is “a portion of the original cost of an asset” that is transferred monthly to “period expenses.”

A situation describing why depreciation is needed:

An organization (with monthly revenue of 200,000 rubles) purchases a machine costing 700,000 rubles. It is known from the machine manufacturer that within 5 years the “base of the machine” will be destroyed by 100%. That is, it will no longer be possible to return the machine to operation through repairs.

Knowing that in 5 years we will completely lose the machine, we need to reflect this “expense” on the financial result, that is, write off the operating system as “period expenses”. The question arises: how to take into account this expense: “immediately, in its entirety” or “in parts”?

If you write off the machine for the entire amount at once, at the time of acceptance of the machine (posting D90 - K.02), then the financial result in the month of write-off will be negative (200 thousand - 700 thousand = minus 500 thousand).

Shareholders will question whether the organization really suffered a loss (the machine is still new). Such a financial result does NOT reflect the real state of affairs, i.e. writing off a machine as a “period expense” at the “moment of acceptance” of the machine for accounting is NOT economically justified.

It will be economically justified to rely on “calculation”. In my work, when compiling “management” reporting, for equipment I use a depreciation scheme of 30% - 30% - 20% - 10% - 10% per year of the original cost.

In regulated “accounting” statements, depreciation is most often used calculated according to the formula (linear method):

Depreciation (amount/month) = First cost of fixed assets (amount)/Months of Use (number).

For our example, the “amount of monthly depreciation” will be 700,000 / 5*12 = 11,667 rubles per month. We will write off this amount monthly to “period expenses” by posting (D.90-K.02), until we completely write off the entire “initial cost” of the machine to the financial result.

When writing off the “initial cost” of fixed assets using the “depreciation method”, the financial result is in the month of capitalization of the fixed assets (200,000 - 11,667 rubles = 188,333 rubles). will not raise any questions among our shareholders.

Why do you need to record “information” about depreciation on a separate accounting account - 02:

People often ask why it is impossible to calculate the depreciation amount immediately by posting (D.90-K.01) and thereby see the residual value of fixed assets in account 01. This is due to the fact that the “chart of accounts” was written back in the days when there was no automation of accounting Therefore, to manage the organization, they separated “information” about the “initial cost of fixed assets” and “information” about “accrued depreciation on fixed assets” using separate accounting accounts.

Currently, this problem is solved by opening an additional sub-account to the account (for example, “depreciation”) and collecting information on depreciation using such a sub-account inside account 01 (this is what I do when maintaining “management” accounting). In regulated accounting, I, of course, adhere to the general rule and reflect depreciation in account 02.

Summary of account 02: (see all bookmarks)

— on the account we collect “information” about the accrued “depreciation for each fixed asset.” — depreciation is a “part” of the original cost of the asset. - the depreciation method - is necessary in order to economically correctly write off the initial cost of fixed assets as “period expenses”.

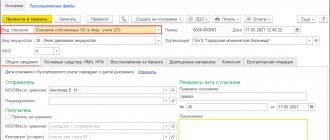

— postings to account 02 are mainly generated by the document:

doc. Depreciation and depreciation of fixed assets (writing off from the account)

GLAVBUKH-INFO

Account 02 “Depreciation of fixed assets” is intended to summarize information on depreciation accumulated during the operation of fixed assets.The accrued amount of depreciation of fixed assets is reflected in accounting under the credit of account 02 “Depreciation of fixed assets” in correspondence with the accounts of production costs (sales expenses). The lessor organization reflects the accrued amount of depreciation on leased fixed assets as a credit to account 02 “Depreciation of fixed assets” and a debit to account 91 “Other income and expenses” (if rent forms operating income).

Upon disposal (sale, write-off, partial liquidation, transfer free of charge, etc.) of fixed assets, the amount of depreciation accrued on them is written off from account 02 “Depreciation of fixed assets” to the credit of account 01 “Fixed assets” (sub-account “Disposal of fixed assets.” Similar an entry is made when writing off the amount of accrued depreciation for missing or completely damaged fixed assets.

Analytical accounting for account 02 “Depreciation of fixed assets” is carried out for individual inventory items of fixed assets.

At the same time, the construction of analytical accounting should provide the ability to obtain data on the depreciation of fixed assets necessary for managing the organization and drawing up financial statements. Operation

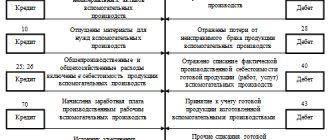

| Source documents | Debit | Credit | |

| Accrued depreciation of fixed assets: | |||

| industrial purposes | accounting card OS-6 | 20, 25, 44 | 02 |

| general economic, managerial purposes | accounting card OS-6 | 26 | 02 |

| leased (if rental income relates to non-operating income | accounting card OS-6 | 91-2 | 02. Rent |

| housing facility | accounting card OS-6 | 010 | — |

| Depreciation is written off upon disposal of fixed assets | accounting card OS-6 | 02 | 01.Disposal |

| Adjustment of depreciation of fixed assets during revaluation: | |||

| when the value of fixed assets increases | calculation | 83 | 02 |

| when the value of fixed assets decreases | calculation | 02 | 83 |

Account 02 “Depreciation of fixed assets” corresponds with the accounts:

| 01 Fixed assets | 02 Depreciation of fixed assets |

| 02 Depreciation of fixed assets | 08 Investments in non-current assets |

| 03 Profitable investments in material assets | 20 Main production |

| 79 On-farm settlements | 23 Auxiliary productions |

| 83 Additional capital | 25 General production expenses |

| 26 General expenses | |

| 29 General service production and facilities | |

| 44 Selling expenses | |

| 79 On-farm settlements | |

| 83 Additional capital | |

| 91 Other income and expenses | |

| 97 Deferred expenses |

Source: Correspondence of accounts E. Kholodenko, A. Rostovtsev

| < Previous | Next > |