Types of personal income tax deductions A deduction is the amount by which the tax base is allowed to be reduced

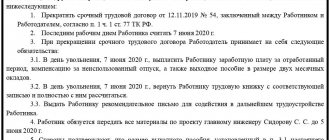

What is a fixed-term employment contract? The hiring of new employees is confirmed by the execution of employment contracts,

One of the mandatory information and statistical elements necessary for entrepreneurs and companies to register a business with the Federal Tax Service

General recommendations Recruiting departments process more than a dozen applications received by the company every day. Majority

The environmental fee was introduced by amendments to Federal Law No. 89-FZ of June 24, 1998.

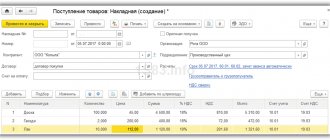

Production accounting in 1C 8.3 Accounting is simplified, but has its own characteristics. Within the article

Partial exemption of citizens from personal income tax is an effective instrument of state support. The right to suspend contributions to

Composition of form 6-NDFL Quarterly form 6-NDFL was approved by Order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11/450.

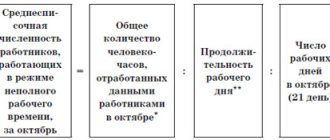

General procedure and formula for calculating the average number of employees The result of calculations of the average number of employees is entered into

The law establishes the employer's obligation to pay employees wages twice a month. In addition to remuneration