Production accounting in 1C 8.3 Accounting is simplified, but has its own characteristics. Within the framework of the article, we will step by step consider the sequence of production of products in 1C 8.3:

- what settings need to be made if production is recorded in 1C;

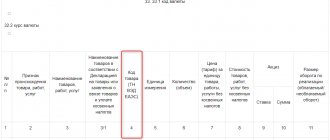

- sequence of registration of operations for production of products;

- what production transactions are generated in 1C 8.3.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

What are the production costs?

In any manufacturing enterprise, costs can be divided into two groups: direct and indirect. Despite the fact that each enterprise independently determines the list of expenses, there are still basic ones that are enshrined in the legislation of the Russian Federation.

Direct costs include:

- Raw materials and materials.

- Equipment depreciation.

- Workers' wages and insurance premiums accrued on them.

Indirect (overhead) costs include:

- General production.

- General economic (managerial).

Accounting and planning: why is it important

Before starting production of any scale, it is important to plan all processes. Without planning, you cannot be sure that the company will complete all orders within the given time frame.

Planning will help:

- Understand how tasks will be distributed between different departments.

- Assess whether the enterprise has enough material, financial and labor resources.

- Coordinate the work of the procurement and sales departments.

- Calculate the maximum load of equipment and avoid downtime.

To compare the amount of upcoming expenses with the expected profit, it is necessary to keep records. It will help you analyze all processes and draw up transparent financial statements.

MyWarehouse will become your faithful assistant at every stage of production. You can easily process the acceptance of goods, their movement between warehouses, and check for remaining stock. You will also be able to calculate the cost of production, distribute financial flows, and identify ways to reduce costs and increase profitability.

Try MySklad

Costing: which method to choose?

There are several methods for calculating the cost of finished products. Each of them depends on the products that the enterprise produces. There are 3 calculation methods:

- Custom-made is used when for each order a separate calculation of the cost of production is made. This includes: the production of technically complex products with a long production cycle (mechanical engineering, shipbuilding), construction, etc.

- Lateral is used when the feedstock goes through several stages of processing (food, oil industry). Costing is calculated at each intermediate stage.

- Boiler means that all costs are taken into account all together. The cost of production is obtained by dividing all costs by the volume of output.

Receipt of materials

In our step-by-step example, we will produce a product in 1C 8.3 - a chair.

Before we produce anything, we need to purchase materials (boards, nails and varnish). In 1C: Accounting, this operation is reflected in the document “Receipts (acts, invoices)”. The type of operation in this case will be “Goods (invoice)”. Materials arrive on the tenth count.

We will not fill out this document in detail. If you have any difficulties, we recommend reading Goods Receipt in 1C 8.3 or watching the video:

Our team provides consulting, configuration and implementation services for 1C. You can contact us by phone +7 499 350 29 00 . Services and prices can be seen at the link. We will be happy to help you!

How to account for and distribute production costs?

- DT 20 - CT 10 (60, 69, 70, 76, etc.). Direct costs are shown on account 20 “Main production” with accounts for materials, calculations, wages, etc.

- DT 25 (26) - CT 10 (60, 69, 70, 76). General production expenses (account 25) and general business expenses (account 26) during the month are taken into account in the same way as direct ones.

- DT 20 – CT 25. General production expenses at the end of the month are transferred to account 20.

- Distribution of general business costs: DT 20 – CT 26. General business costs can be distributed similarly to general production costs.

- DT 90 – CT 26. General business expenses can be transferred to the cost price.

How to take into account production costs?

The cost of production in production is formed in two ways:

- Actual accounting: DT 43 - CT 20. Production costs are transferred to “Finished products” (account 43).

- DT 90 – CT 43. After the products are sold, the cost is written off.

- DT 43 - CT 40. Finished products are accounted for at planned cost (within one month).

How to set up production accounting

Small businesses often start keeping records in Excel. This method works while the business is very small.

For example, there is only one workshop currently operating, employing several workers.

But the business is scaling up: warehouses and new workshops are appearing, and the range of products is expanding. And tabular accounting becomes cumbersome, time-consuming and uninformative.

“Difficulties arise, but people stubbornly try to keep track of production in Excel. Endless tables are compiled manually. Someone creates fancy macros and tries to automate all the calculations. This is terribly inconvenient, because Excel does not have a database. And as soon as production starts flowing, this accounting scheme breaks down: someone accidentally deleted the formula, did not update the prices, or copied something in the wrong place or from the wrong place.”

Therefore, it is easier to set up accounting in a special program that combines data on goods acceptance, shipment, balances in warehouses and contractors.

In MySklad you can keep records online. You won't need to fill in your details over and over again, and the risk of errors is minimized. A clear interface does not require employee training. Try it and appreciate how easy it is.

Try MySklad

How to account for manufacturing defects?

There is a separate column “Defects in production” (account 28) and is calculated as follows:

- DT 28 – CT 20. The cost of defects is transferred from 28 to 20 accounts.

- DT 10 – CT 28. The materials that went into the production of defective products were partially used, then they are registered as inventories.

- From the guilty person who made the defect, you can recover: DT 73 - CT 28. The amount will be charged to the employee’s calculations.

- DT 70 – CT 73. The amount will be deducted from the employee’s salary.

Production process accounting

The main task of commercial enterprises is to make a profit. Organizations that produce any type of product must correctly and timely determine associated costs. Based on the results of the work, a financial result is formed, designed to reflect the real picture of the economic condition of the organization.

The production processes at the enterprise are varied. In addition to the current costs of main production, other types of expenses are also relevant in accounting, including:

- accounting for industrial accidents - payments in favor of employees as a result of occupational diseases or accidents are reflected, insurance contributions are charged to extra-budgetary funds for employees involved in the main production;

- expenses for auxiliary production - combines data from servicing production, takes into account current transportation costs, reflects the cost of producing spare parts, repairing fixed assets and other costs;

- accounting for downtime in production - determining the costs that accompany a temporary suspension of work, calculating the organization's losses;

- accounting for semi-finished products of own production is relevant for enterprises that go through several stages in the production of products, during which the cost of intermediate products is determined.

- general economic - expenses not directly related to the main production, including costs for the management needs of the organization;

- general production - generalized information on maintenance of main and auxiliary production is collected. auxiliary works;

- accounting for production waste in accounting (costs of defects) - information on raw material losses is generated.

How to maintain a balance sheet for an enterprise.

Assets are all the property of an enterprise that it can dispose of for its activities and make a profit from it (Table 1).

Table 1

| Enterprise assets | |

| I. Non-current assets | These are assets that are on the balance sheet and have been used for more than 1 year |

| Intangible assets (IMA) | business reputation, know-how, patents, licenses |

| Fixed Assets (Fixed Assets) | land, buildings, structures, machinery and equipment, etc. |

| Capital investments | investments in material assets that generate income |

| Long-term financial investments | long-term loans and investments issued |

| II. Current assets | These are those assets that are in constant circulation, their useful life is no more than 1 year |

| Inventory and costs | raw materials, materials, goods |

| VAT on purchases | value added tax |

| Finished products | |

| Accounts receivable | debts of other persons to your company |

| Short-term financial investments | short-term loans to companies |

| Cash | cash and non-cash, in domestic and foreign currencies |

Liabilities are a set of sources for the formation of enterprise funds (Table 2).

table 2

| Liabilities of the enterprise | |

| III. Capital and reserves | This is the property of the company |

| Authorized capital | the amount of money invested by the owners to make the business work |

| Extra capital | receipts aimed at replenishing current assets or equity capital of the enterprise |

| Reserve capital | part of the enterprise’s property used to place retained earnings in this section, to cover losses, etc. |

| retained earnings | accounting account of retained earnings that a company received as a result of all its activities in the reporting period |

| IV. long term duties | This is the debt of an enterprise on long-term loans (over 1 year) to banks and other organizations from which the loan was taken |

| Loans | |

| Loans | |

| V. Current liabilities | This is debt on short-term loans (less than 1 year) to banks and other organizations providing loans |

| Credits and loans | |

| Accounts payable | |

Why consider work in progress?

Sometimes, to avoid downtime, the company makes preparations.

For example: he cuts out dresses in reserve to keep the sewing shop workers busy when there are no orders.

And if an order is subsequently received for another type of product made from the same material, it may not be enough.

“There is a risk of overstocking. When a company loads a warehouse with supplies and, as a result, transfers resources. The blanks take up storage space and consume funds. The volume of work in progress is growing. To avoid such problems, incompleteness must be controlled.”

It is important to understand at what stage work in progress occurs and how to calculate it.

MyWarehouse will help you estimate and analyze the volume of work in progress. All the data is in the production task: you can see what is in progress from the work in progress, and what settled at a specific stage and did not move on to the next one. The manager can quickly understand the situation and fix the problem. This approach will reduce costs and increase profitability.

How to conduct accounting in 2022: recommendations from the Federal Tax Service.

The organization of accounting in 2022 should be carried out in accordance with the changes that occurred this year. Let's look at them:

- Accounting statements are submitted to the Federal Tax Service in electronic form (formerly there was Rosstat).

- The manager can sign the accounting statements using an electronic digital signature.

- Tax authorities maintain GIBRO (state information resource for financial statements).

- You can get information from GIBRO about any organization for money (in Rosstat it used to be free, reports until 2022 in Rosstat can still be obtained for free).

- The form of financial statements has changed (filling out forms only in thousand rubles, OKVED was replaced by OKVED2, and other amendments).

- All requirements of the chief accountant must be fulfilled by employees.

- Rent is accounted for according to the new rules.

- A new procedure for accounting for state aid has been introduced.

- The rules for accounting for differences in income tax in PBU 18/02 have changed.

- Supplemented by PBU 16/02 “Information on discontinued activities”.

Business accounting is an integral element of effective business management. This activity requires painstakingness, attentiveness, constant verification of the entered information and deep knowledge of accounting and Russian legislation.