What taxes do individuals pay on December 1?

The following taxes must be paid by December 1, 2022:

Land tax is paid by individuals who own a land plot by right of ownership, perpetual use or lifelong inheritable possession.

Transport tax is paid by citizens whose property is registered: cars;

- motorcycles;

- aircraft;

- yachts;

- boats and other vehicles.

Property tax must be paid for:

- Houses;

- apartments;

- rooms;

- dachas;

- garages and parking spaces;

- other capital construction projects.

Property tax is charged only to the owners indicated in the ownership document for the listed objects. And its size depends on the cadastral value of the taxable object.

When does the payment receipt arrive?

The transport tax notice is issued by the tax office. She is also responsible for calculating the amount of the fee for each vehicle owner. After notifications are generated, they are sent to the owners' address. The notice specifies the amount and due date for payment.

Tax receipts arrive by October 1st (with a possible delay of a few days). You should expect completed notifications from the end of summer until the specified date. However, there are often cases when the car owner does not receive a notification.

Why am I not receiving a transport tax receipt?

There are several reasons why the car tax is not received:

- Delay of postal items, which is directly related to the work of Russian Post. Failures in the delivery of letters are not uncommon for this institution. If a taxpayer suspects that their letter has been lost, they must contact the post office at their residential address directly. In this case, you should check with the tax office whether the letter was sent to the addressee.

- Receiving benefits. Each region is characterized by the presence of several categories of beneficiaries. If the payer falls into one of these categories, no notification will be sent to him.

- Registration in the taxpayer’s personal account on the website. Each taxpayer is provided with an electronic platform where he can see his payments and make various transactions. After the first login to the Personal Account, sending mail notifications to such a citizen is canceled. It is considered that if the client has entered the electronic system, it means that he will track all payments independently.

- Errors during transmission from the traffic police. When registering a car, it is the traffic police that transfers information about the car to the tax office. If for some reason the transfer does not take place, a receipt will not be received.

- Changing of the living place. A citizen must notify the tax office of the fact of a change of residence address. If you do not do this on time, all notifications will be sent to the previous mailing address.

- Recalculation. If errors occur in the calculations, a notification may not be sent due to subsequent correction of incorrect information.

After the taxpayer has figured out why the transport tax is not sent, it is necessary to either make a payment or make sure that he has no debt to the tax office.

What to do

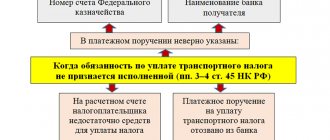

Failure to notify does not relieve the obligation to pay tax. If you still don’t have a receipt in early November, you should pay the toll yourself.

What to do if the tax on the car has not arrived and its amount is not known to the car owner? First of all, you should contact the territorial tax authority in order to find out the amount of the fee. There you can also clarify whether the letter was sent at all. In cases where the notice was sent, the payer is issued a receipt again. This is done at the request of the car owner. In order not to waste time, you should figure out in advance how to obtain a receipt for payment of transport tax.

If the inspection does not have a notice, the applicant fills out the payment document independently. To do this, you must request Form PD-4 from the bank selected for payment. And after filling it out, hand it over to the cashier along with the cash. You can also use the bank’s remote service and pay taxes online.

How to pay taxes?

Taxes are assessed by the Federal Tax Service based on data available in Rosreestr, the State Traffic Safety Inspectorate and other information systems that transmit information to tax authorities. A month before the deadline for paying taxes, the Federal Tax Service informs everyone by sending out tax notices indicating the amount of tax to be paid. The tax notice can be sent electronically or in printed form.

You can pay taxes in different ways:

- through the “Taxpayer Personal Account for Individuals” on the tax office website or in the “Taxes FL” mobile application;

- on the Gosuslugi website using the details specified in the tax notice;

- through a self-service banking terminal;

- at the post office;

- in the MFC;

- through online banking - in your personal account on the bank’s website or in the mobile application;

- in person at the bank - to do this you need to come to the bank with a tax notice.

Expand your capabilities using the Astral-ET electronic signature for individuals. Receive government services, log into the taxpayer’s personal account, work remotely, participate in auctions - this and much more can be done with an electronic signature. And from 2022, an electronic signature will be required for employees who submit reports or sign other legally significant company documents.

New deadlines for payment of transport and land taxes

From January 1, 2022, new deadlines for payment of transport and land taxes, as well as advance payments on these taxes, are introduced for organizations (clauses 68 and 77 of Article 2 of the Federal Law of September 29, 2019 No. 325-FZ).

Let us recall that previously the deadlines for paying taxes for organizations were established by legal acts of the constituent entities of the Russian Federation (for transport tax) and municipalities (for land tax). Moreover, the payment deadline could not be set earlier than the deadline for submitting tax returns, and the declarations themselves were submitted no later than February 1 of the next year.

According to the new rules, uniform deadlines for paying taxes and advance payments on them are established for all organizations. Now transport and land taxes are payable by organizations no later than March 1 of the year following the expired tax period.

In turn, advance payments for taxes must be paid no later than the last day of the month following the expired reporting period - quarter (clause 1 of Article 363 of the Tax Code of the Russian Federation, clause 1 of Article 397 of the Tax Code of the Russian Federation).

Thus, the following deadlines for payment of taxes and advance payments are set in 2022:

- March 1 – payment of taxes for 2022;

- April 30 – payment of advance payments of taxes for the first quarter of 2021;

- August 2 - payment of advance payments for taxes for the second quarter of 2021 (the deadline for payment of advances is postponed, since July 31 falls on a Saturday - a day off);

- November 1 - payment of advance payments for taxes for the third quarter of 2021 (the deadline for payment of advance payments is postponed, since October 31 falls on a Sunday - a day off).

Let us remind you that if advance payments for taxes are canceled by a regulatory legal act of a representative body of a constituent entity of the Russian Federation or a municipal entity, then organizations do not pay them during the year, but pay taxes only at the end of the year (clause 2 of Article 363 of the Tax Code of the Russian Federation, clause 2 of Art. 397 of the Tax Code of the Russian Federation).

Do I need to apply for benefits?

To receive a benefit, you can contact any tax office. You can submit an application through the taxpayer’s personal account, at the MFC, by letter, or by coming to the tax office in person.

Some categories of citizens receive benefits without application. For example, pensioners, pre-retirees, disabled people, combat veterans, large families and owners of outbuildings with an area of up to 50 square meters. m may not contact the tax authorities on this issue: their benefits are taken into account automatically based on the data that tax authorities receive from the Pension Fund of Russia, Rosreestr, social protection authorities and other departments.

If you belong to preferential categories of citizens, but the benefit was not taken into account for you, you must independently declare it by contacting the Federal Tax Service.

Who can avoid paying transport tax?

In Russia there are currently a number of benefits for exemption from transport tax. Who may not pay transport tax:

- Owners of cars with power up to 70 hp.

- Disabled people who received cars through social security authorities.

- Heroes of the Soviet Union, labor veterans who suffered from radiation and exposure in connection with accidents or nuclear tests, as well as disabled people of the 1st and 2nd groups.

- In some regions, pensioners, single mothers and parents in large families are completely exempt from tax. In other regions, these categories may receive a significant discount

- Owners of stolen cars. This benefit begins to apply from the month the search for the car begins until the month it is returned to the driver.

- Depending on the region, owners of electric cars and gas-fueled vehicles may receive benefits.

- Police cars, ambulances and the Ministry of Emergency Situations.

What to do if there is no tax notice?

Those citizens who have a personal taxpayer account on the Federal Tax Service website receive tax notifications electronically. All their tax documents are posted in their personal account and are not duplicated by mail.

If the notification has not arrived either by mail or in your personal account, the Federal Tax Service recommends that you contact the tax office yourself:

- through the service website;

- through your personal account;

- by mail;

- through the MFC;

- in person at the branch.

The electronic signature is recorded on a protected physical medium - a token. In our store you can purchase JaCarta LT tokens, Rutoken EDS 2.0.2100, Rutoken Lite 64. They comply with legal requirements and have all the necessary certificates.

Tax officials remind you that they do not send notifications if the tax amount does not exceed 100 rubles or for objects for which you do not need to pay tax, for example, due to the application of a tax benefit, deduction, etc. In this case, you need to wait until the amount of taxes has accumulated over several years and exceeds 100 rubles - then a tax notice will arrive.

Subscribe to our newsletter

Success

Error

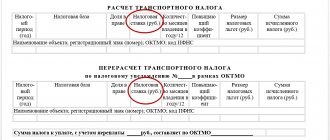

Distribution of tax notices on transport tax

Legal entities do not receive any notifications from the tax office regarding the payment of transport tax. They act in accordance with regional legislation, independently calculate the amount, submit a declaration and make payments one time or in four installments (advance payments). Accordingly, the problem of delayed tax notifications does not exist for them, and late payment of taxes is solely their own mistake.

The calculation of the amount of transport tax for individuals is carried out by the regional Federal Tax Service, which uses open registration databases of the State Traffic Safety Inspectorate. A private car owner can only receive a notification and pay the tax before December 1.

Typically, tax inspectors create calculations and begin sending out notifications about the need to pay transport tax at the end of summer. In the letter, the taxpayer receives the notification itself and a receipt for payment with the tax amount already indicated and the payer’s details.

The car owner can pay the tax in cash at the bank's cash desk, by card at an ATM or online - through online banking, the Federal Tax Service and State Services portals, electronic money services Yandex.Money and WebMoney.

Important! The deadline for receiving a tax notice is November 1, after which you will have exactly one month to make your tax payment.

However, sometimes the notification does not arrive, and car owners face a problem: how to pay the tax without a receipt? Is it possible not to pay without a payment document? What to do if the receipt did not arrive or is late?

What happens if you don't pay taxes on time?

If you are late in paying taxes, then, in addition to the tax itself, you will also have to pay a penalty - for each calendar day of delay at an interest rate equal to 1/300 of the current key rate of the Central Bank of Russia. Penalties will begin to accrue the next day, December 2.

If the total debt exceeds 10,000 rubles, the Federal Tax Service will collect the debt through the court. In this case, the debtor will have to pay all legal costs. Also, if there is a tax debt, an individual may face a ban on traveling abroad and seizure of bank accounts.

Consequences of non-payment

Refusal to pay the fee or late payment may result in:

- charging a fine of 20% of the tax amount;

- accrual of penalties for each day of delay;

- refusal of the insurance company to issue a compulsory motor liability insurance policy (on its initiative);

- ban on traveling outside the Russian Federation by car;

- seizure of a vehicle (only by court decision).

Read more about what happens if you don’t pay your transport tax on time.