Kontur.Accounting - 14 days free! Friendly, simple and functional online service for small businesses. It's clear

Kontur.Accounting is a web service for small businesses! Quick establishment of primary accounts, automatic calculation of taxes, sending reports

In the realities of modern life, there are often situations in which a person performs work duties in two

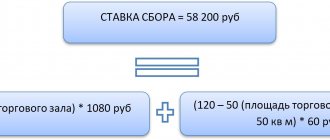

Example An organization (Moscow) owns land plots with cadastral value: in Moscow - 14

Types and conditions for providing financial assistance Current legislation does not prohibit an employer from providing its employees with financial assistance

The concept of loss in tax accounting The concept of loss is given in Art. 274 Tax Code of the Russian Federation. Lesion

Is it possible to make it backdated? When an employer may need to issue an order

How do we work and relax in Tatarstan in 2022? Find out now. Already on the site

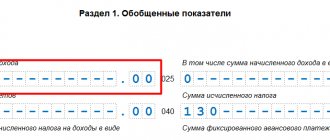

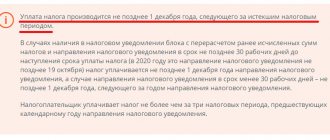

What is the liability for non-payment of taxes? The Tax Code of the Russian Federation stipulates that for prolonged non-payment

Drawing up and processing of cash receipts and debit orders Both PKO and RKO are cash orders